Is Aggregation Theory Dead in Commodity Row Crops?

Can Ben Thompson's framework be applied to ag?

Commodity row crops and aggregation theory

I joined The Climate Corporation in 2017, to start the product team to build an agtech ecosystem of solutions around Climate FieldView. One of my assumptions was that Climate could easily create density of commodity row crop growers on the demand side, and density of agtech solution providers on the supply side. It is easier said than done for a few reasons, the primary reason being the structure of the industry itself, especially in the commodity row crop space.

On the supply side, in most verticals within agriculture, a few companies dominate. For example, seed & chemicals, equipment, off-take, etc. The incumbents have a strong hold on distribution and grower access. Many (or most) of the incumbents operate with a zero-sum game mentality.

It is difficult and expensive for an upstart to play the distribution and marketing game. Within agriculture, the answer to the question of whether a startup can reach distribution faster than an incumbent can reach innovation is mostly in the negative. (Shubhang Shankar wrote a provocative piece on this topic 2 years ago).

In the industrialized world, the number of commodity row crop farmers due to large landholding is a few hundred thousand farmers. The density of growers interested in a particular agtech solution might be limited, unless it is a truly horizontal capability.

When Grain Bridge was acquired by Bushel, then Grain Bridge CEO Mark Johnson, said grain marketplaces were dead. (The Day the Grain Marketplace Died - Oct 2021))

The primary reason was the lack of fragmentation on both the demand and supply side, making a marketplace less valuable.

- There are only so many possible buyers in a region, due to transportation costs.

- There are only so many farmers in a region and a grain buyer likely knows all of them.

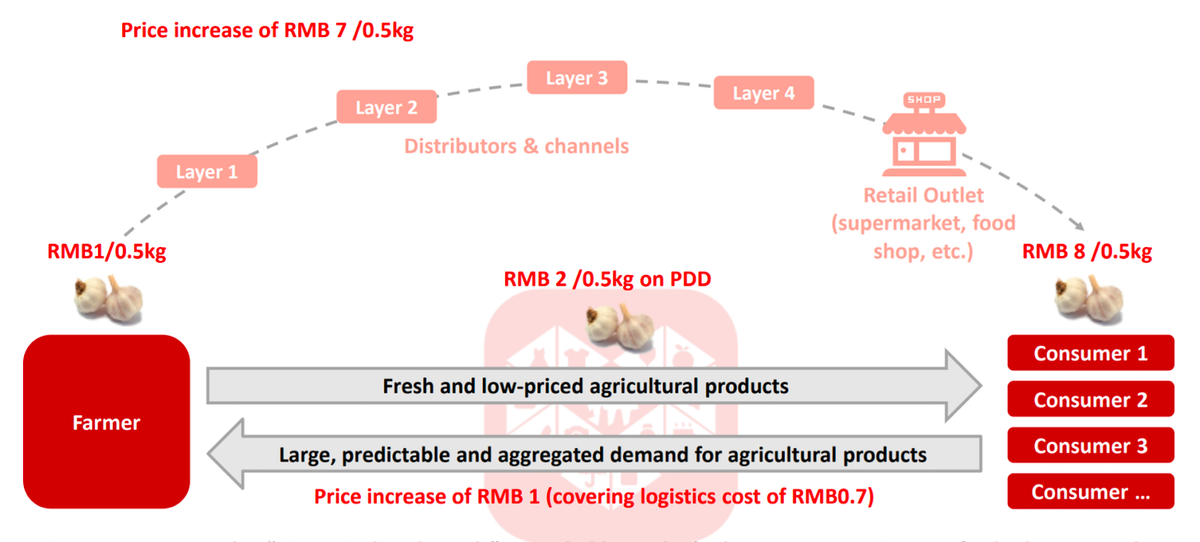

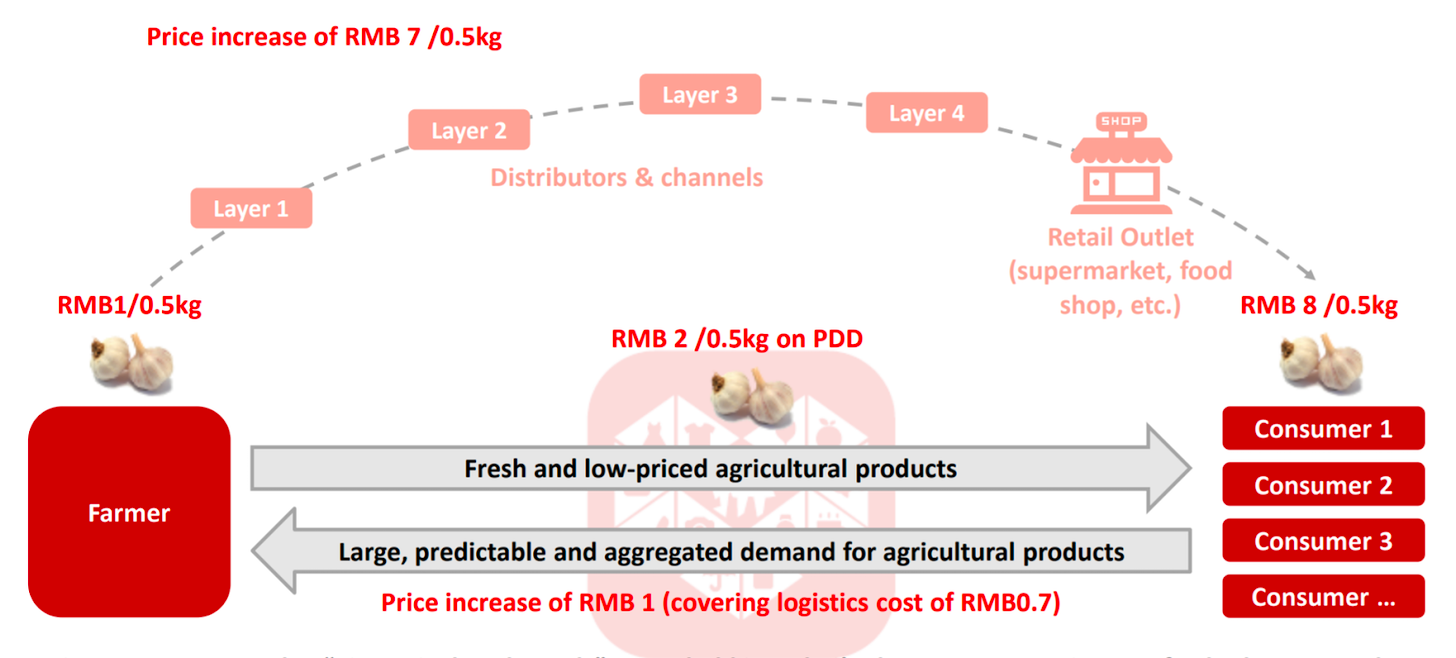

Mark Johnson’s thesis has been validated beautifully by the Chinese juggernaut PinDuoDuo. They have tapped into a very large and fragmented base of farmers (supply side) in China, growing perishable items (not commodity row crops) and an even larger base of consumers (demand side) looking for fresh, high quality, and nutritious products. You can read my conversation with Xin Yi Lin of PinDuoDuo here.

Direct connection to farmer (PinDuoDuo based on Turner Novak’s analysis)

Are these markets “too thin” for aggregation theory (popularized by Ben Thompson of Stratechery) to work effectively?

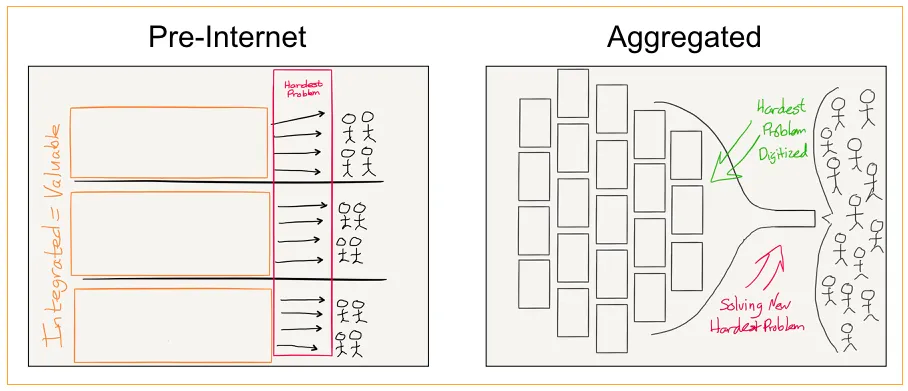

“The value chain for any given consumer market is divided into three parts: suppliers, distributors, and consumers/users. The best way to make outsize profits in any of these markets is to either gain a horizontal monopoly in one of the three parts or to integrate two of the parts such that you have a competitive advantage in delivering a vertical solution. In the pre-Internet era the latter depended on controlling distribution.”

Aggregation Theory will be the proper framework to both understand opportunities for startups as well as threats for incumbents:

- What is the critical differentiator for incumbents, and can some aspect of that differentiator be digitized?

- If that differentiator is digitized, competition shifts to the user experience, which gives a significant advantage to new entrants built around the proper incentives

- Companies that win the user experience can generate a virtuous cycle where their ownership of consumers/users attracts suppliers which improves the user experience

Does this mean aggregation theory (as popularized by Ben Thompson of Stratechery) is very hard in commodity row crops with a concentrated base of suppliers, and not a large number of customers? In this scenario, how can new value be created for farmers and solution providers?

Collaboration is the key

One potential answer is increased collaboration within the ecosystem. Increased collaboration is only possible without a zero sum game mentality. As more of the industry participants collaborate within the space, it creates new opportunities for incremental value creation within the different parts of the food and agriculture value chain.

Do ecosystem services like carbon, and water quality act as a forcing function for added collaboration, given the scope, and difficulty of these problems?

First and foremost, it requires a non-zero-sum thinking within the ecosystem. It requires to focus on a few use cases to begin with (application before platform?), and then use them as an anchor point to collaborate with other entities within the ecosystem. Daniel Schultz of Agtech Marketing Insights covered this topic in “The Cat, The Fox, and the Unfocused Value Proposition.”

To take another queue from screenwriters and novelists, we should begin crafting our value proposition by answering these questions:

- What is the most painful challenge I can help my customer overcome?

- As the result of using my product or service, what change is brought into my customer’s life and the lives of those they care about?

- What is the risk or negative impact of not using my product or service?

Make something different. Make people care. Make fans, not followers.

What do you think? I would love to get your feedback, and I will explore these topics in more detail in the coming weeks.

H/T to Sachi Desai for starting this conversation.