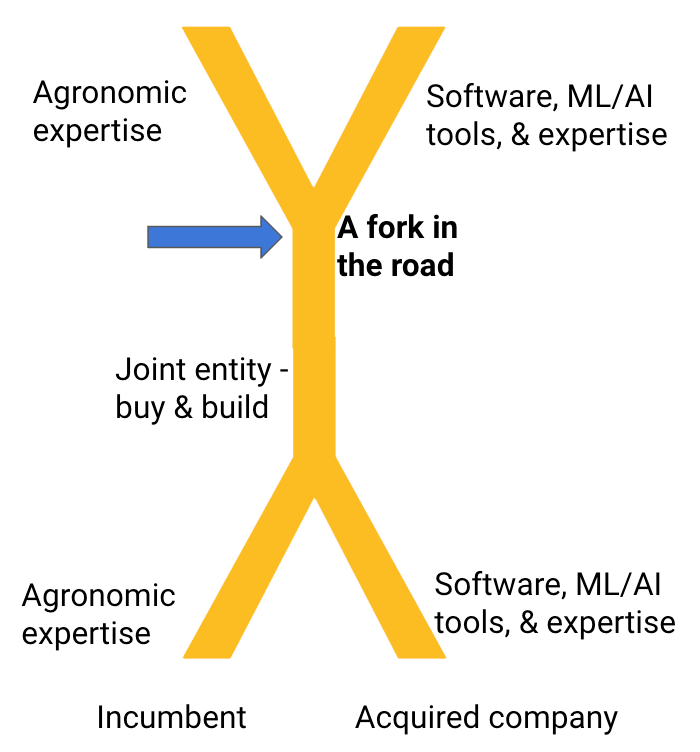

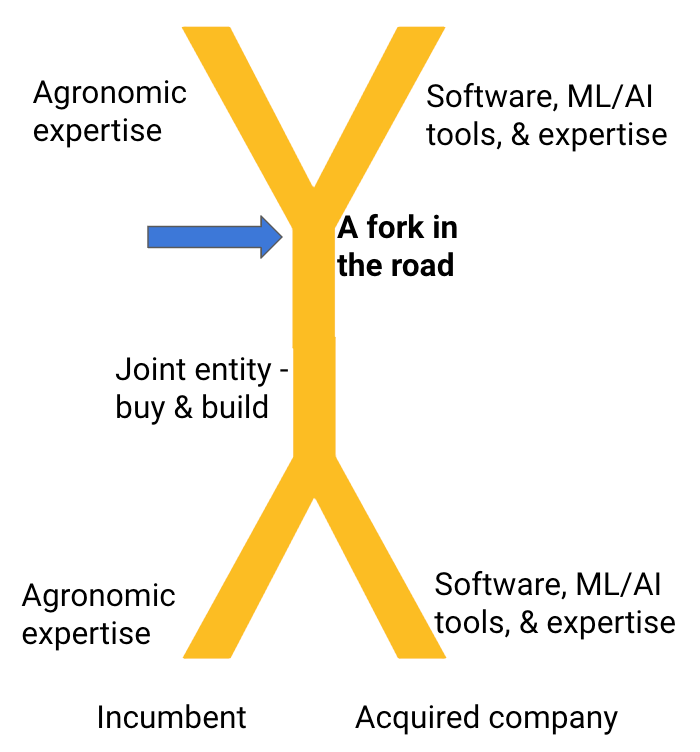

A fork in the road

What should incumbents do with their software stacks?

A fork in the road?

In his popular 2020 essay ”Look Back in Anger Or Disruption that Incumbents can love – AgTech in the 2010s”, Syngenta Ventures Managing Director, Shubhang Shankar bemoaned startups (labeled as incumbents) replicating incumbents.

The insurgents end up replicating the incumbents, subject to the same long commercialization cycles with heavy upfront investments – and limited value prospects at the end of it all.

No longer are startups talking about displacing the incumbent industry – most are now talking about co-existence or even more dramatic levels of dependency on incumbents. While trade sale is a legitimate route to exit for a startup, there is no fear of missing out on anything that is driving corporates to look at acquiring startups.

The statement by Shankar was true for many startups, and their acquiring incumbents. Here are a few examples,

- Monsanto acquired The Climate Corporation for $ 930 million in 2013

- Dupont Pioneer (aka Corteva) acquired Granular for $ 300 million in 2017

- John Deere acquired Blue River Technologies for $ 305 million in 2017

- CNH acquired Raven Industries for $ 2.1 billion in 2021

—

Build, buy, or partner is a critical decision most companies face, when looking at new capabilities, customers, brands, market access etc. In the examples above, the incumbents made a buy followed by build decisions. The incumbents have presumably spent millions of dollars post acquisition (CNH and Raven is too early to tell) to bring software, hardware design, data management, AI/ML skill sets in house through the acquisitions.

—-

In July 2022, Corteva announced the discontinuation of Granular Agronomy by August 31st, 2022. Based on multiple people I have talked with, Corteva might shut down Granular California offices in the next few months. During their July announcement, Corteva had said the following,

A critical factor in making this decision was the need to refocus our digital efforts to better enable our commercial teams to help unlock more value for customers with our core seed and crop protection products.

Corteva has reached a fork in the road. They have reached a conclusion that a software-as-a-service product does not work, and they need to refocus their digital efforts internally to enable their commercial teams with their seed and crop protection sales. Any ML/AI skill sets will be used to better understand the performance of their own seed and crop protection products. (For example, in June 2022, Corteva had about 500 open jobs in the midwest for AI/ML/technology skill sets.) This information will be used to arm their commercial teams to do a better job to position their seed and crop protection products.

Bayer is in the process of bringing the erstwhile Climate Corporation closer into its fold, with formation of Climate LLC. Bayer has dropped the price for FieldVIew from $ 999 per year to $ 99 per year, and they do have a free version too. Bayer has gone down a path of using FieldView as a loss leader to collect data, and use the information to improve their existing portfolio of seed and crop protection products.

—

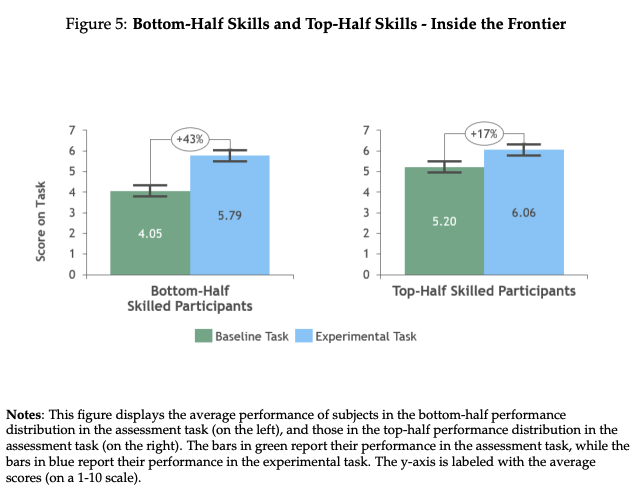

Last Friday, I caught up with a former senior executive at one of the leading input companies in the world. This executive had reached a similar conclusion a few years ago. They came to the conclusion that the world is getting bifurcated into teams good at agronomy and teams good at building AI/ML tools, and infrastructure at scale. This conclusion led the company down a path of partnerships with experts in software, data, AI/ML, while the incumbent focused on agronomic expertise.

—

ADM and Cargill had started a joint venture with GrainBridge, but decided it was not the right thing for them to work on and it was sold to Bushel.

Nutrient has made significant investments in digital capabilities and most of them are targeted to improve online purchasing, and e-commerce.

—-

The main reason for agriculture incumbents to rethink their digital strategy is that it is hard to go through a digital transformation, look at different business models enabled by technology, etc.

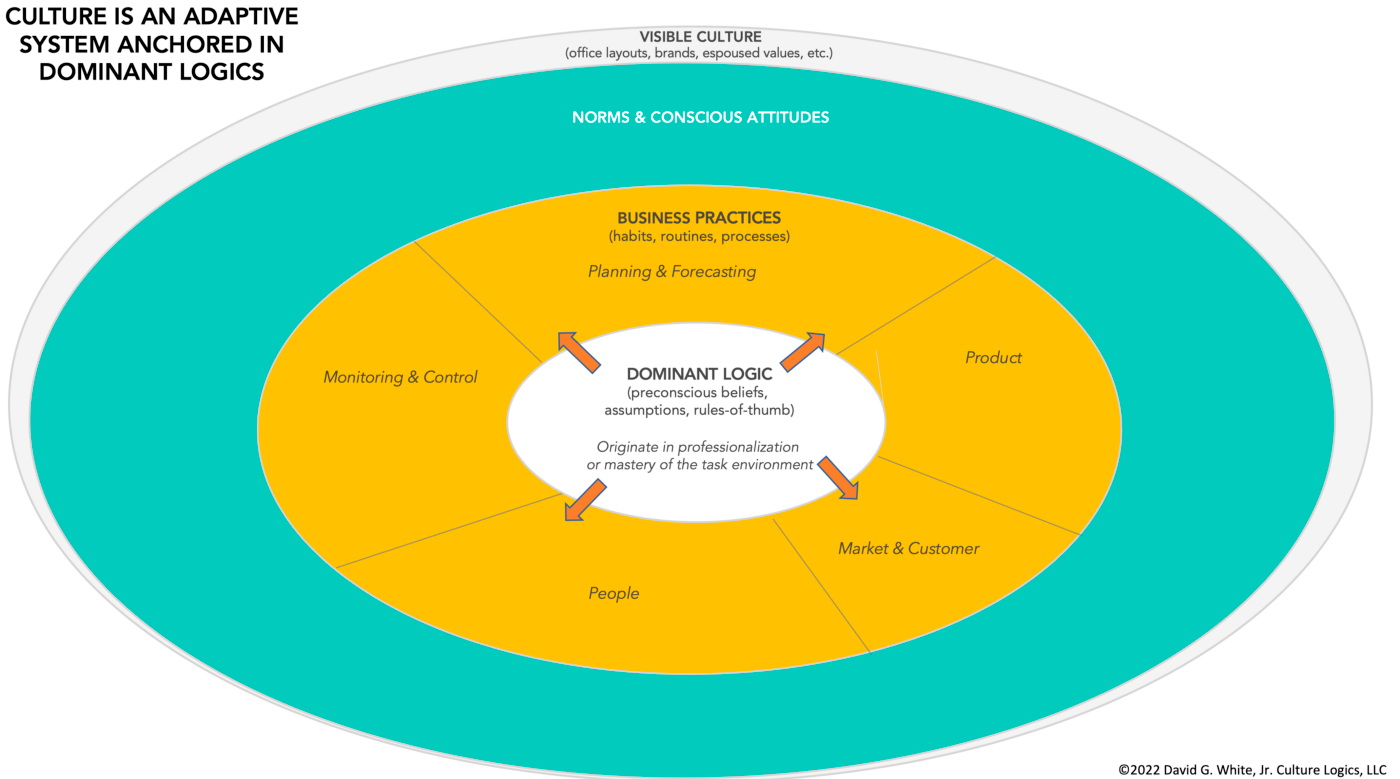

The primary reason is cultural.

For incumbents, financial performance always comes first, followed by certainty in all things, and rules to make the certainty more certain. In the short to medium term, digital transformation cannot guarantee any of these three to come true.

—

OEMs seem to be bucking the trend in this case, especially Deere. Deere has continued down the path of building a strong software, and data engineering team to drive their portfolio of next generation of products, which include Sense and Respond, Sense and Respond Ultimate etc. By some accounts Deere has more software engineers on staff, compared to mechanical or electrical engineers.

It has worked for equipment companies, for a couple of reasons. Deere continues to follow a software and hardware integrated technology stack for its brand, similar to Apple.

There is a clear difference between equipment and input companies, when it comes to software, ML/AI and data.

A piece of equipment like a planter, combine, or sprayer is quite expensive and can cost anyone from $ 200,000 to close to a $ 1,000,000. Equipment is priced much higher, has a longer life cycle, compared to seed or chemicals.

Farmers have different experiences with it, and software and technology can improve the product over a period of time.

But software and ML/AI is not limited to product development and design only. Software not only helps an OEM design a better hardware product, and also helps the equipment run efficiently and smoothly. There are many examples like auto-steer, setting A-B lines, path planning, automated grain carts, etc.

For seed and crop protection on the other hand, software, ML/AI, data, and digital tools are helpful to develop new products, but do not contribute during the operational processes for growing.

—-

So what should agriculture incumbents do? Should they buy and build, or partner with agtech and technology experts? There might be multiple good reasons for agriculture incumbents to partner with technology companies.

- Accelerate time to market

- Lower cost of development

- Cultural challenges

- Focus on core competencies and promote partnerships.

What do you think?