Recall is risk tolerance

Precision and recall in spot spraying

Recall is risk tolerance & trade-offs with speed

Last week’s edition 137 got a significant response from readers as I delved into the calculations behind chemical saving’s, when using precision spot spraying.

Recall is a measure of your risk tolerance. The lower your risk tolerance for presence of weeds in your field, the higher should be the recall number.

The false positive rate is important as your machine learning model will recommend spraying, even though it is not a weed. In the case of precision spraying of weeds, the false positive indicates wasted chemicals as the model sprayed on plants which were not weeds.

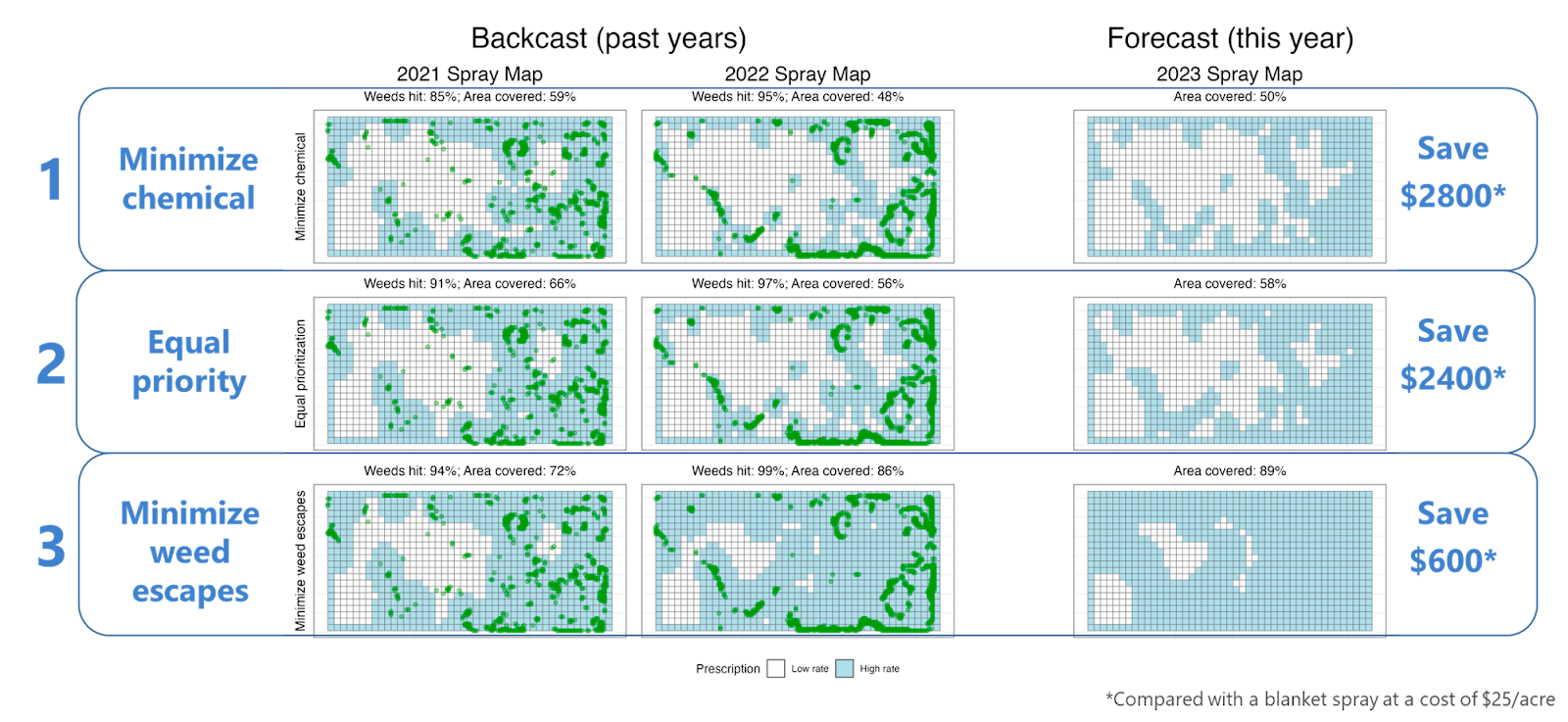

During last week’s edition, I went into some details on how chemical savings are dependent on weed density, recall rate, and false positive rate.

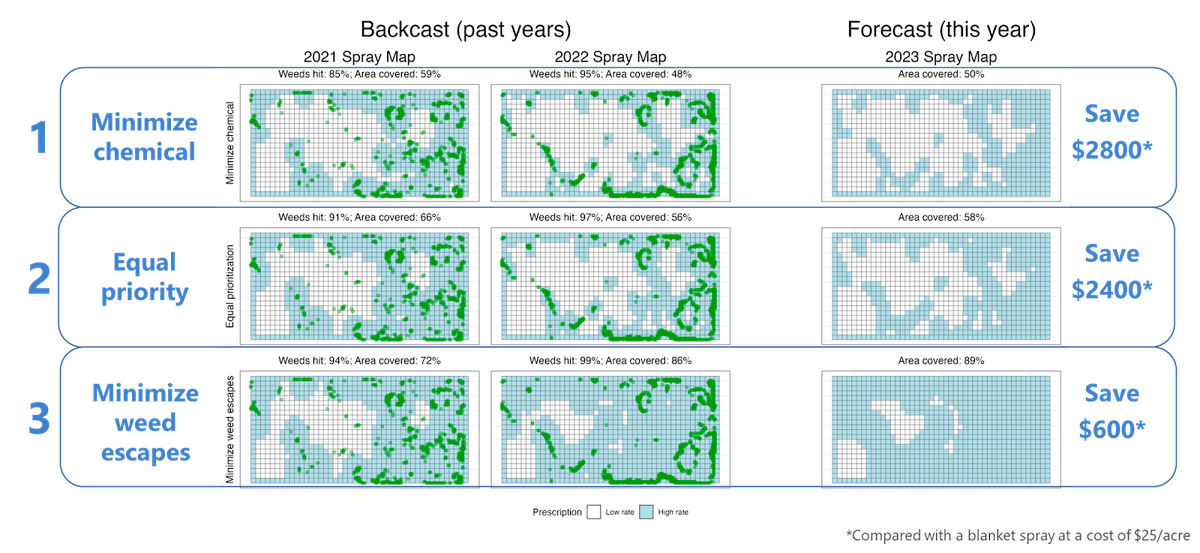

Let us dig into it a bit deeper and look into some examples. For example, a startup called Geco Engineering, focuses on predictive weed management, and provides 3 different options.This is a bit different than real time spot spraying decision making, but similar principles will apply in the case of predicting weed management. It is easy to relate to our concepts of weeding density, recall, and false positive rate.

Image source: Geco Engineering Website

The customer can choose from 3 options to minimize chemical usage, or minimize weed impact or find a balance between the two. How do these options relate to concepts from last week?

“Minimize chemical” usage requires a slightly lower value with a lower false positive rate. This will reduce the amount of chemical savings that is achieved. One will be closer to the blue and red lines in the chemical savings chart below.

“Minimize weed escapes” requires a high recall rate, and which in turn causes a higher false positive use. One will be closer to the yellow and green charts in the chemical savings chart above. As you can see, a higher recall rate results in lower chemical savings, and lower recall rate results in higher chemical savings, but increases the risk of weed escapes.

We are in very early stages of this technology and business model, but I anticipate it will get more sophisticated over a period of time. It will make the positioning and messaging for the opportunity complicated, which is especially a challenge as customers figure simple pricing models and business types.

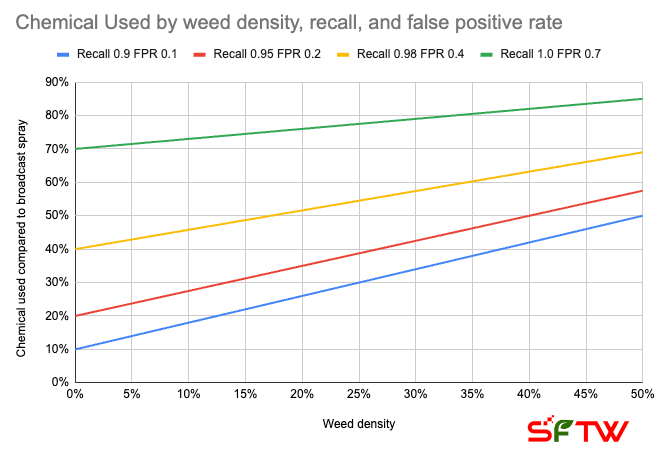

Another variable in the equation is speed of equipment travel, which has a direct impact on accuracy. Higher the speed of the equipment, the machine learning model has less time to capture an image, determine the class of the plant, and make a decision to spray or not to spray. It will lead to lower accuracy for the model.

At lower equipment speeds, you will spend more time in the cab (especially if you have a human driver), but your chemical costs are lower. This will lead to higher labor costs (assuming non-autonomous operations), potentially higher fuel costs, but better weed management and lower chemical costs. The right balance will depend on many factors, including the field and growers' unique needs.

This is a chart with made up numbers, but I have used it to highlight how different costs will factor into your total cost equation. (Ops costs includes labor + fuel costs)

For example, in 2022, the international container shipping line Maersk, decided to slow down their ships to reduce fuel costs. Maersk is doing a trade-off of lower fuel costs, with longer lead times, and higher risk due to longer time to hold onto the cargo.

This report from 2010 highlights some of the numbers behind Maersk’s thinking.

"The cost benefits are clear. When speed is reduced by 20%, fuel consumption is reduced by 40% per nautical mile. Slow steaming is here to stay. Its introduction has been the most important factor in reducing our CO2 emissions in recent years, and we have not yet realized the full potential

Similarly, if you are an Amazon Prime member (based on my experience in the US), Amazon provides you multiple options for shipping, some of which reduce the number of shipments but include a slower shipping time, or Amazon will offer you some money for digital items, if you agree to take an even slower shipment. This is a smart move, as it shapes the customer demand for items, packaging, and shipping speed, and prices them accordingly.

Other variables include the type of chemical mix used based on weed density and past experience, timing, and dosage applied. There are still many unknowns in the technology and business model for spot spraying.

The challenge for spot spray technology is to provide the flexibility of user choice, while being able to price and communicate the value prop in an easy to understand manner.

Deere’s unified experience

When I worked at Amazon Kindle in 2011-2012, Kindle hardware and sale of eBooks was going through a massive growth phase. During the year, Amazon launched Kindle content in more than 25 countries (if I remember correctly), with the Harry Potter launch of Kindle being a big event.

Kindle is a device dedicated to reading, with the promise to get any book in the world (has to be in its massive catalog) in less than 60 seconds. In the late 2000’s when Kindle launched, a customer could always use an available mobile network to download an ebook. Even though a cell service could deliver a book fast enough, Amazon didn’t want the Kindle to be tied to a phone contract, as it introduced another layer of friction for the customer. Instead, Amazon worked with Qualcomm, and developed Whispernet.

Every Kindle owner would have a free 3G connection to download books, no matter where they were. Given the dedicated Kindle device could only be used for reading books, the cost of the free plan was more than offset by the amount of content purchased through the device.

This is a great example of Amazon thinking about the customer experience, and abstracting away the underlying complexity and presenting it as one unified Amazon experience.

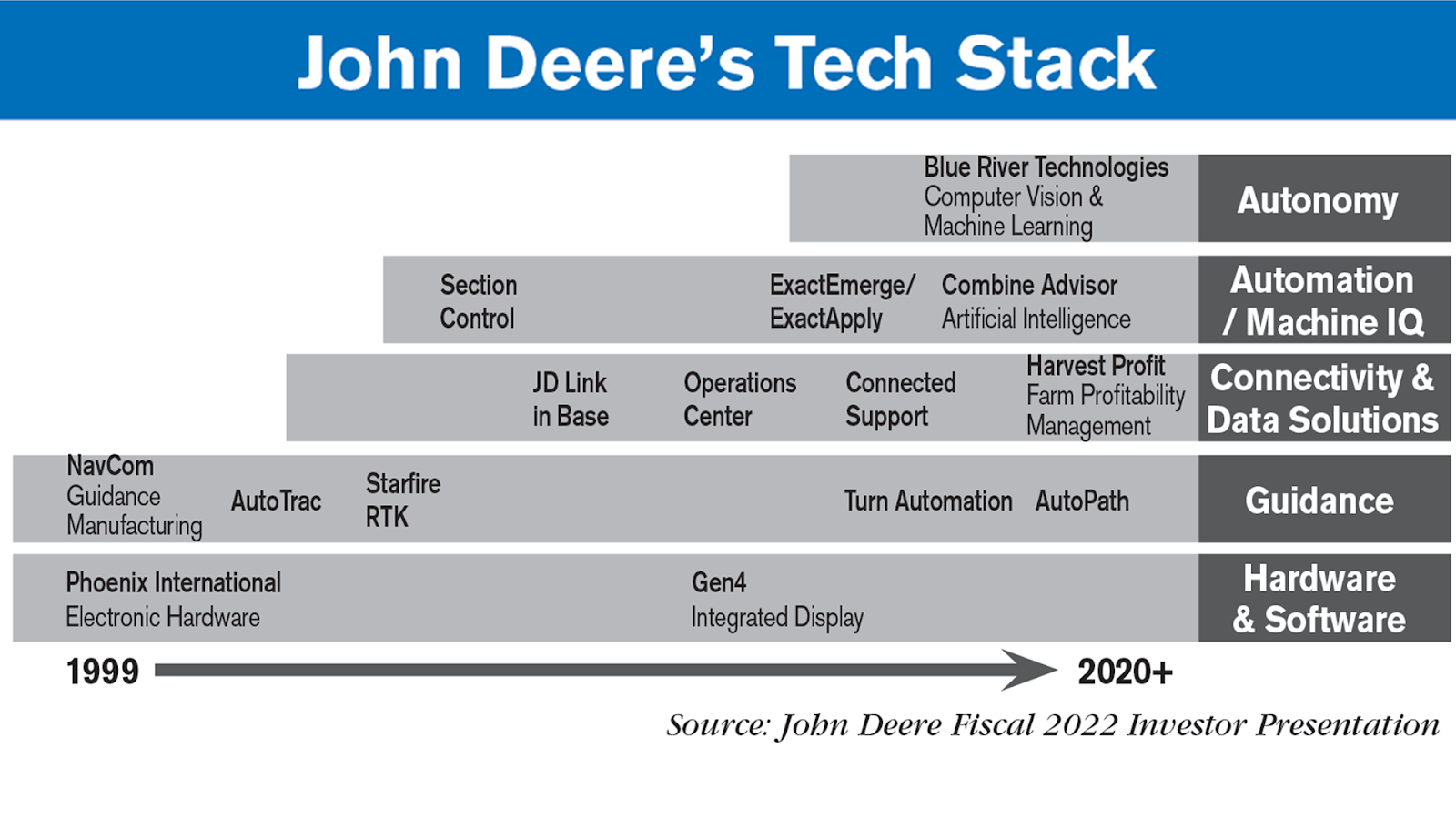

Deere’s stack

If you look at Deere’s tech stack, it many times follows a similar methodology.

If you look at the middle layer of connectivity and data solutions, customers engaged with a record 315 million acres globally using the John Deere Operations Center in 2021. Deere aims to have 500 million engaged acres by 2026, with 50% highly engaged, meaning multiple production steps are documented and digital tools are used to complete multiple activities over a 12-month period.

For Deere’s customers to get full value from Deere equipment, connectivity is crucial and which is often a challenge in farming regions. Deere offers connectivity while abstracting out the challenges with the “underlying wireless providers”, wherever available. (JDLink agreement). Deere is pushing into self-driving tractors and machines with autonomous features. Deere wants to use a combination of sensors, software, and analytics to provide precision farming tools to improve yields, and optimize operations.

Oftentimes, GPS is not enough, especially in large markets like Brazil where cellular connectivity is challenging in farming areas.

Due to this last fall (2022), Deere put out a request for proposal to,

the satellite communications industry to partner on space-based connectivity services. It hasn’t publicly disclosed the estimated value of the envisioned “SatComms” deal, but the space industry clearly sees dollar signs: roughly 40 companies have submitted bids, comprising the “who’s who of satellite connectivity across the globe.”

This is a smart move on Deere’s part and is akin to Kindle’s Whispernet move in the late 2000s and early 2010s. They know connectivity is critical and is a key part of their technology stack. It is a necessary component to increase the value a customer gets from Deere’s physical equipment. It allows Deere to stack on additional value of JD Ops Center, agronomy services, yield improvements, and connection into the Deere ecosystem.

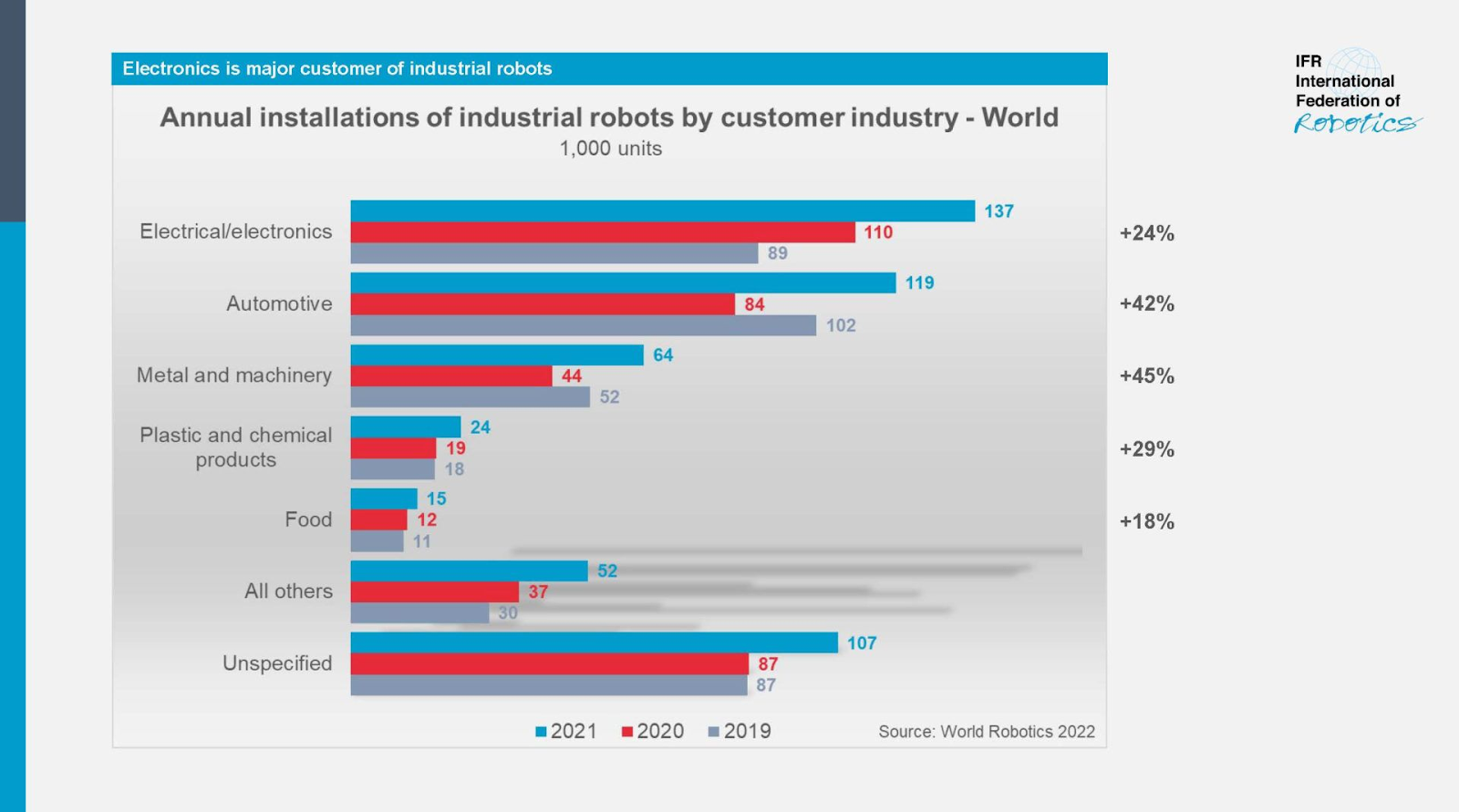

Trends driving automation and robotics

I have written quite a bit about automation, robotics, computer vision, AI etc. over the last 12-18 months in this newsletter. In fact, I had some folks unsubscribe due to the excessive focus on technology, but this newsletter is focused on the intersection of technology and agriculture. So what will drive adoption of robotics and automation? Some of the factors below are obvious according to AgFunder News.

Image source: AgFunder News

1. Economics is a no brainer. If the cost of using robots is higher, farm operators will not accept the solution. If the robot solution is being offered as a replacement for humans, the economics will matter quite a bit. This is easy to measure and make a decision on.

2. Robots and automation can often deliver value which is unique to robots, and that value cannot be generated with human labor. For example, a robot can make use of GNSS (Global Navigation Satellite System), and record data like planting or harvest at a much higher fidelity (sub-field level).

One of the challenges with adoption is that many robotics startups have not yet fully demonstrated sufficient reliability to sell their products. They often resort to a Robot as a Service model or a leasing model (mentioned in edition 137 of the newsletter), which is attractive for customers as it converts their CapEx to OpEx. It does challenge startups because even if they are ready to scale, it’s not easy for startups with limited capital to own a large number of robots.

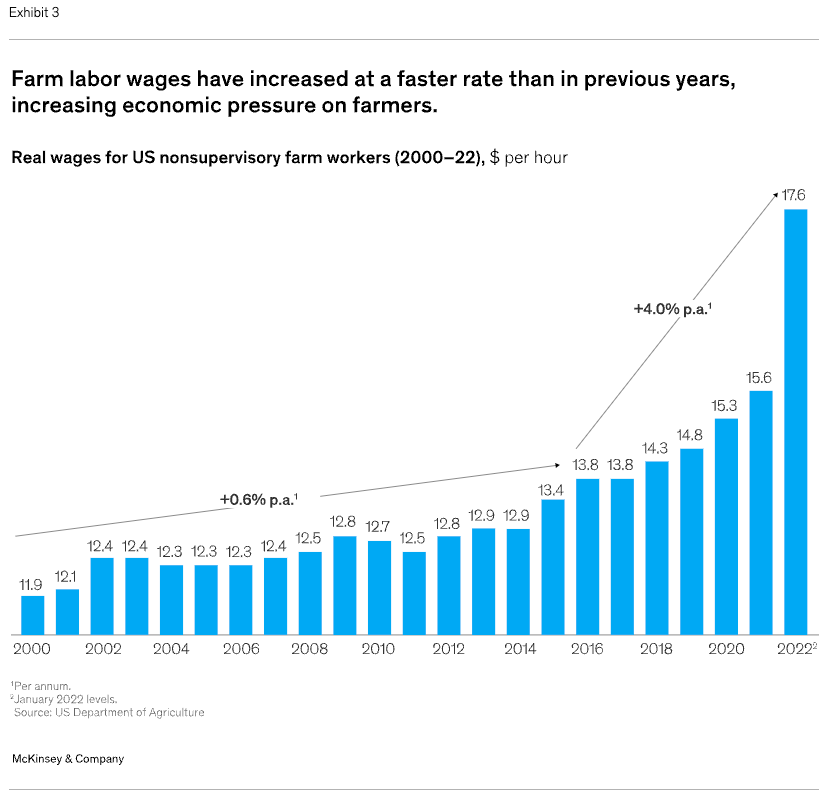

McKinsey recently published a report documenting the trends which are driving automation on the farm.

“Automation represents a significant lever for meeting these requirements. By using automated precision-spraying equipment combined with automated weeding or mowing solutions, farmers can dramatically reduce their use of pesticides and fertilizers or potentially eliminate them altogether.”

Based on the chart below, farm labor wages have increased at a faster rate than in previous years. The increasing labor costs (especially in specialty crops) make robotics a bit more competitive, when robotics is considered as a way to reduce reliance on human labor.

At the end of the day, it comes down to economics. Can robotics and automation help me become economically more sustainable and resilient to changes in farm dynamics. There are few things robotic technology providers, and startups can do to help with adoption. Here are a few suggestions to startups and robotics/automation companies based on the McKinsey article.

1. Clearly communicate the ROI and value drivers to your customers, buyers, and users. My discussion on spot spraying goes into details of a particular use case, but the same principles apply to automation and robotics in general.

2. Constantly challenge and reimagine the farming experience, with a combination of software and services. It is not just the robot which will drive change. The accompanying data, software, and tools will help with measuring, tracking, and optimizing operations and value.

3. Collaborate with other players in the industry, and find pie-expanding win-win situations within the ecosystem.

4. Continue to evolve, and experiment with business models, like subscription models, price to adopt, etc.

Most importantly, it is important to remember, it is a long road ahead, and customers will demand value at each intermediate step.