Produce Marketplaces

Can marketplaces work in perishable products?

When I was in graduate school, I worked as a sous-chef for a few months. The owner and chef of the restaurant was friends with the produce manager at a local grocery store. Every few days, the chef would go to the back side of the grocery store, and buy produce which was near or past its best by date. (The produce manager was not supposed to do it, but he did). The produce was good if you used it up quickly. This produce normally would have gone to a land-fill, but it got repurposed with significant savings on buying produce for the chef.

Produce waste due to mismatch in supply and demand, or market conditions is very common. By some estimates, a quarter or more of the fresh produce gets wasted. Dr. Lisa K Johnson is one of the leading experts on food waste (I had the privilege to connect with her a few months back).

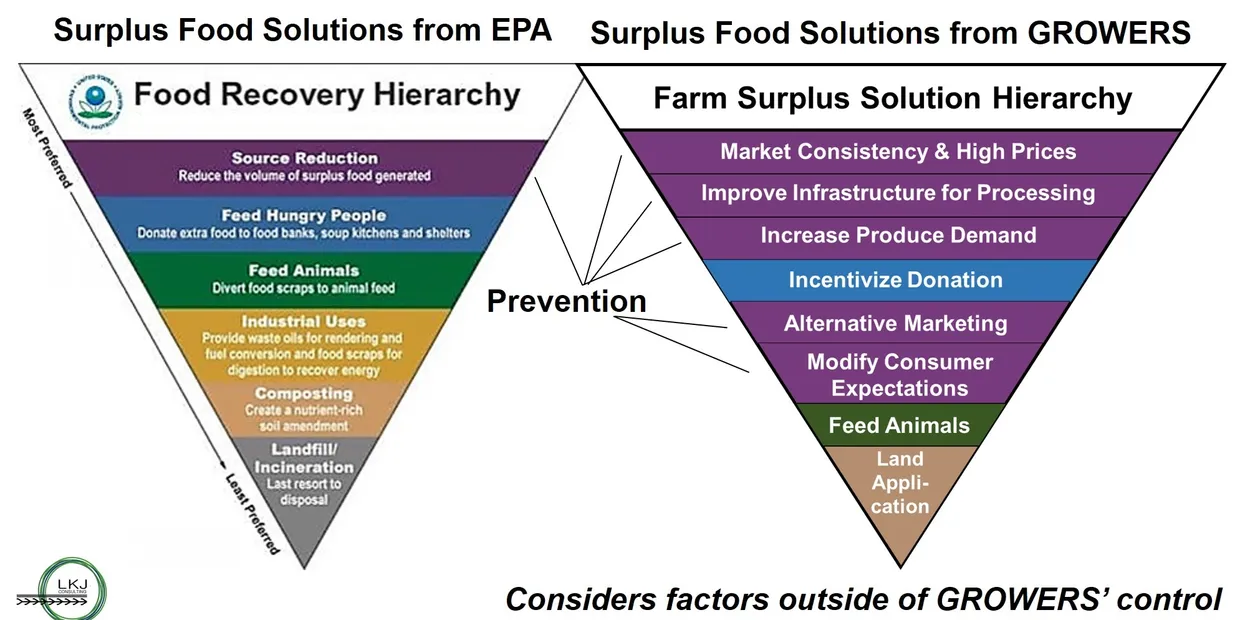

She has done interesting research on food waste on the supplier / grower side. If you look at her farm surplus solution hierarchy, it talks about market related topics like prices, demand, incentives, marketing and logistics issues like infrastructure etc.

Image source: Lisa K Johnson consulting

In a fragmented market like fresh produce, online marketplaces can try to do a better job to align supply and demand, allow for price discovery and consistency, smooth out some of the fluctuations, and can lead to better outcomes for most parties, including reduction of food waste.

Let us take a look at some marketplaces in agriculture.

Marketplaces in agriculture

In edition 117 and 118 (Narrow (thin) markets in commodity row crops (part 1 and 2)) of the newsletter, I had talked about the challenge of thin markets in commodity row crops in North America.

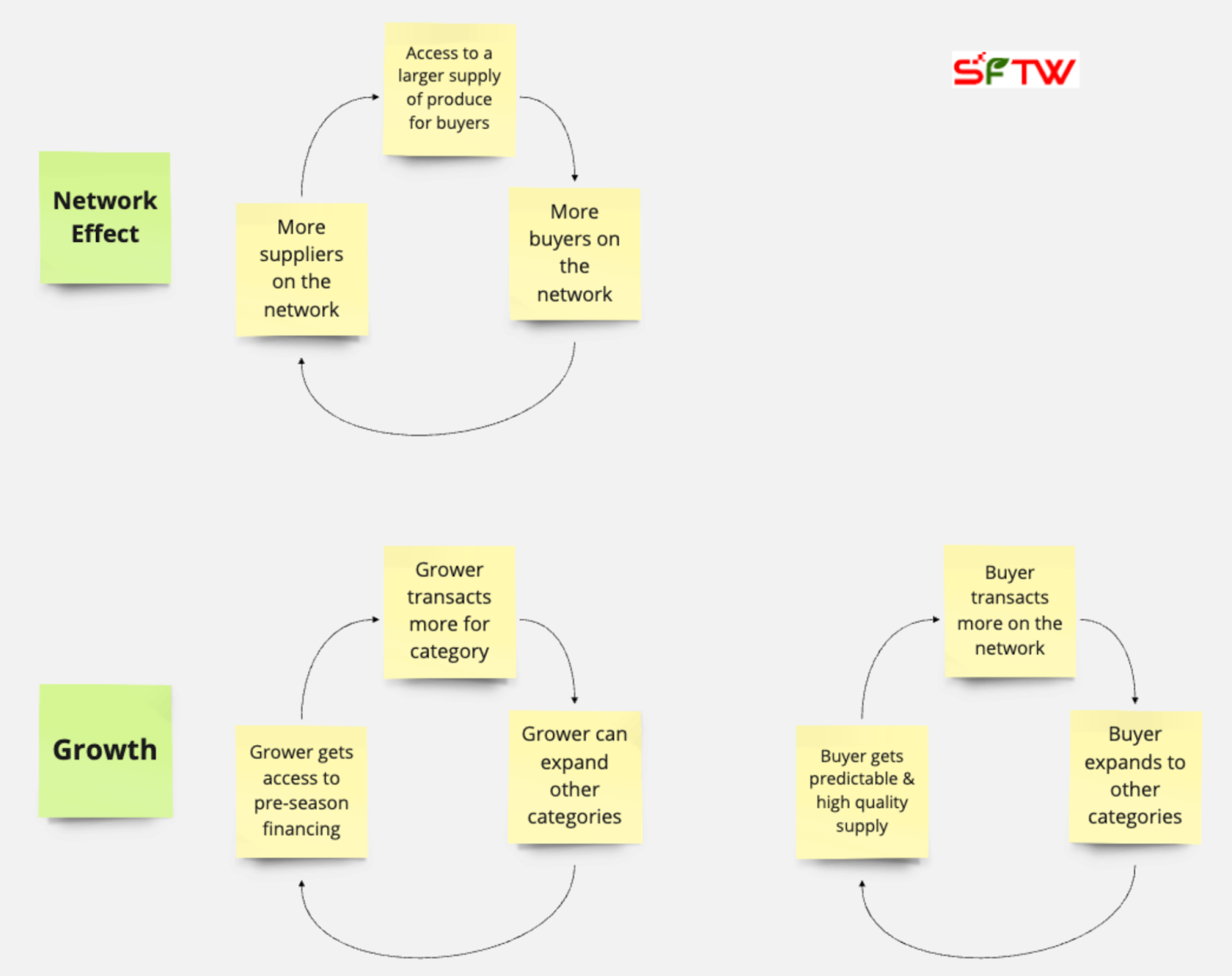

Marketplaces typically require certain conditions to exist within the market to work, with a large number of fragmented buyers and sellers being one of them to provide enough liquidity for transactions to happen. A marketplace should have network effects, where more sellers attract more buyers and vice versa.

The commodity row crop segment in the US is characterized by a smallish number of sellers and an even smaller number of buyers.

These market conditions make it very hard to establish a marketplace, as was very eloquently pointed out by my friend Mark Johnson in his 2021 essay, “The Day the Grain Marketplace Died”. Mark pointed out quite directly,

“Marketplaces don’t solve problems for the farmer or the grain buyer.”

Marketplaces do exist outside of commodity row crops in N. America. Dairy.com (not called Ever.Ag) is a good example of a marketplace for dairy and there are a few examples like Full Harvest, ProducePay (they don’t call themselves a marketplace, but they seem like one), etc in the produce segment.

Produce and Dairy are challenging marketplaces to try to build, even though it satisfies the constraint of a fragmented buyer and seller base. With produce every day the value of the produce reduces as the produce ages. (This is not exactly true for all produce categories, as initially the value post harvest increases till it reaches an optimal point, and then drops with age - for example, bananas, and avocados have to be explicitly ripened before they are ready for sale and consumption.)

For a produce or dairy marketplace, there is an urgency to find the right match between a buyer, and seller as a delay in finding a match reduces the quality of the product, and incurs additional cost with storage (cold chain etc.), and logistics.

The worst example of an expiring asset is airline and concert tickets. Any unsold tickets after the plane has left the gate is a complete waste. Due to this capacity utilization of the aircraft is a challenge which has been studied to the n’th degree.

Produce and dairy fall somewhere in the middle between grain and airline seats.

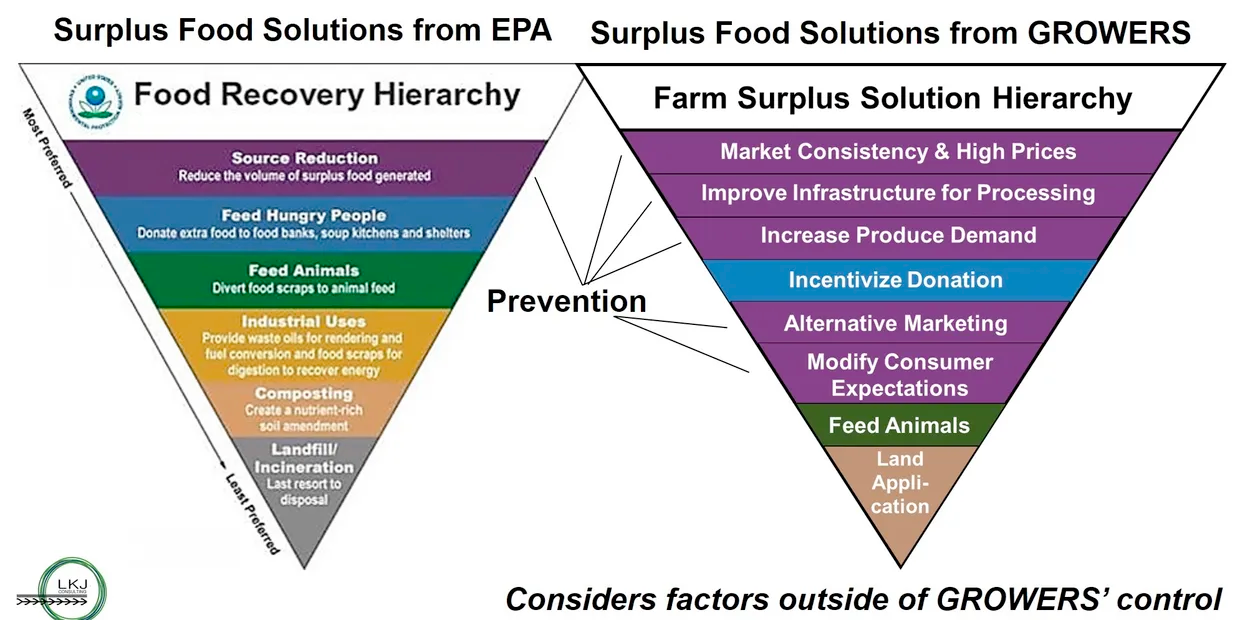

Many of the commodity row crop farms are larger in size, as you can see from the chart below, a majority of farms are on the smaller end of the spectrum.

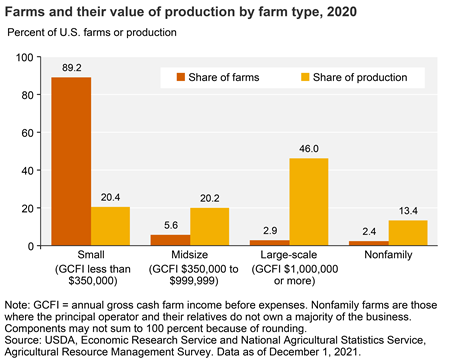

Nature of the produce supply chain

The fresh produce supply chain is fairly complicated. I have given a simplistic version of the produce supply chain as it exists today, with entities in light pink being sellers (or suppliers) and in gray being buyers. Some entities which sit in the middle are both buyers and sellers (for example, wholesalers).

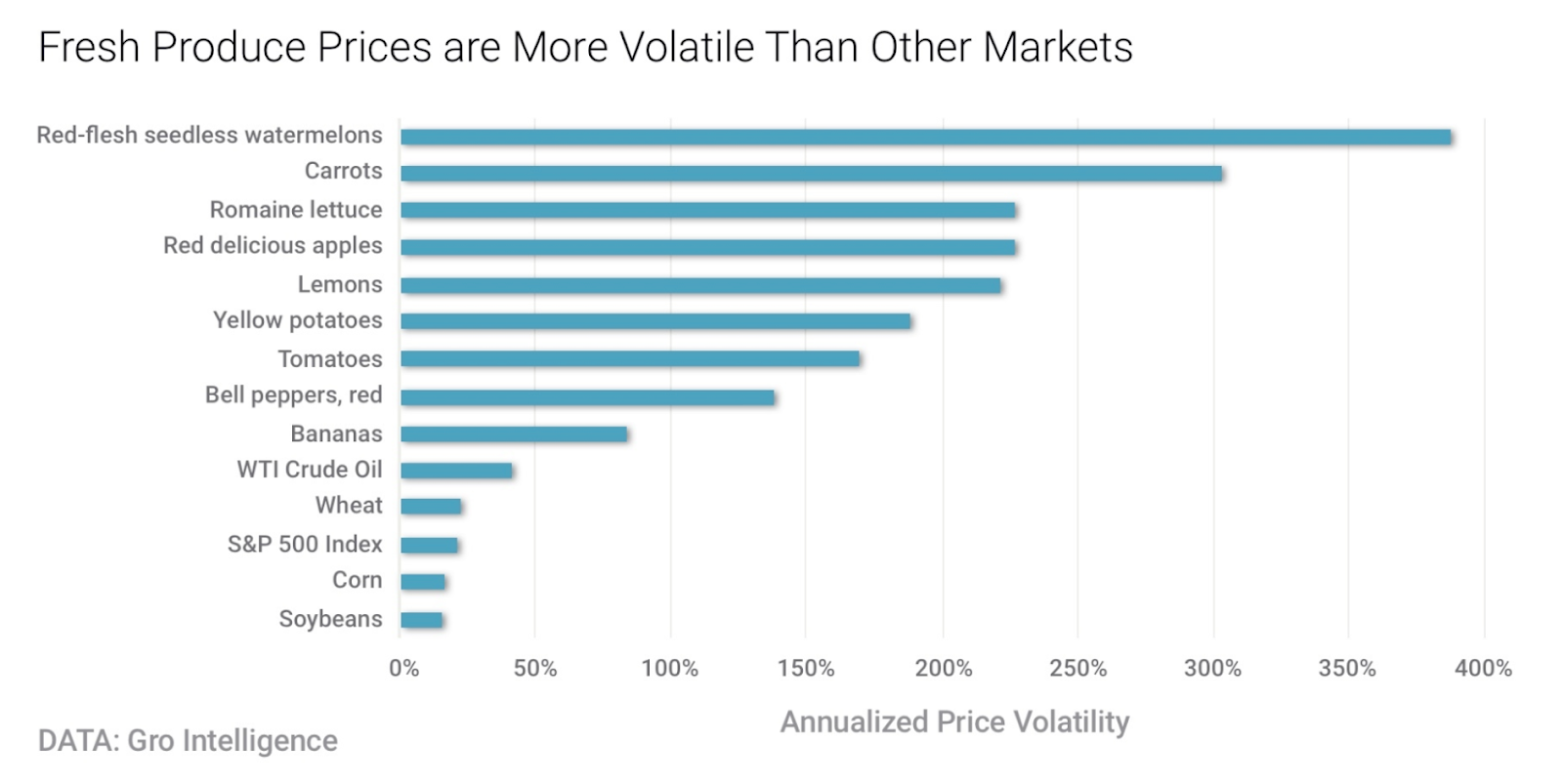

In the case of produce, the quality, consistency, and quantity of supply changes and can be very volatile depending on weather, supply chain / cold chain issues, and market conditions. For example, Gro Intelligence published data on price volatility in produce compared to soy and corn (this data is from 2020).

Source: Gro Intelligence

Given the fragmented nature of the produce industry, and in some cases a global supply chain, the produce market could be a good place for an online marketplace to connect sellers and buyers to provide more liquidity, price discovery, and trust. Another difference between commodity row crops and produce is the frequent nature of buying and selling of a slightly different product which happens throughout the year. (It might be the same commodity, but the quality and consistency changes throughout the year).

Online marketplaces like ProducePay, and Full Harvest connect buyers and sellers and create a marketplace for trading, though ProducePay and Full Harvest come at it from different angles.

If you want to look at an extreme example of a produce marketplace, which connects farmers / suppliers directly to end consumers (not grocery retailers or processors), you should look at PinDuoDuo, which has close to a billion users in China. I covered PinDuoDuo in detail in edition 60, during my conversation with Xin Yi Lin.

Predictable Commerce

ProducePay recently raised a Series D $ 38 million round.

“ProducePay will use the latest capital to accelerate its global expansion to Europe, Asia, Africa and Australia; as well as advance the development of best-in-class technology and services, including comprehensive Predictable Commerce Programs in partnership with leaders and innovators across the global fresh produce industry. To date, the company has supported more than $4.5 billion in fresh produce transactions globally.”

ProducePay has marketed the term “predictable commerce.”

“Reducing volatility through unprecedented access to capital, a global trading network, data insights and supply chain visibility.”

This involves offering three key solutions:

- Capital: They provide pre-season and quick-pay financing to growers, addressing their cash flow challenges and enabling them to invest in their operations.

- Trading: They offer a platform for connecting growers with buyers, promoting market access and facilitating efficient transactions.

- Insights: They provide data-driven insights to both growers and buyers, helping them make informed decisions based on market trends and crop performance.

ProducePay provides access to pre-season financing, quick-payment to reduce time to cash, and access to a trading network. ProducePay helps growers and farmers get access to pre-season financing, without having to put up their land as collateral and is willing to work with them where traditional lenders might be hesitant to work with them.

This is similar to what TrAIve is doing for small and medium sized farmers. I had covered TrAIve in more detail in a previous edition last year. (SFTW Startup Spotlight (S3): TrAIve)

TrAIve is providing better credit scoring to financial institutions for small and medium sized farmers in Brazil whereas ProducePay originates and provides financing to farmers directly. It is not clear if ProducePay is taking on the financial risk or do they have other financial institutions in the mix. Given ProducePay provides financing up to $ 30 million (from their website), it would be safe to assume that they have other financial institutions involved in the process.

ProducePay provides a trading platform to connect growers with buyers to provide more liquidity to create network effects, and additional value added insights to both buyers and sellers to help them make more informed decisions.

ProducePay published some results of their program with Four Star Grapes, which is one of the largest grape growers and suppliers in the United States. It resulted in improvements in cold-chain, logistics, quality & freshness. (Quality and time post harvest are inversely related for produce, i.e. the older a grape is the lower is its quality.)

- Time spent in transit was reduced by 31%.

- Number of stops in the delivery process was reduced by 50%.

- Volume rejection upon retail arrival was reduced by 80%, to less than 1%.

- Cold storage days cut by 41%.

ProducePay can be considered as a marketplace, as it brings more liquidity by facilitating transactions, connects the two sides of a transaction (buyers and sellers), and provides value for both sides.

Network effects

Many of the social networks figured out that once a user got to a certain number of minimum friends, they would continue to use the network and tell more friends about it. Early on, most social networks did their best to get you to that magical number of friends.

You also need to understand the “hard side” of the network. Andrew Chen explains the “hard side” in his famous book, “The Cold Start Problem: How to start and scale network effects.”

“There is a minority of users that create disproportionate value and as a result, have disproportionate power. This is the “hard side” of your network. They do more work and contribute more to your network, but are that much harder to acquire and retain.”

Is signing up food processors or grocery retailers the hard side, or is getting anchor commodity sellers the hard side? My guess is it is the demand side, which is the hard side.

One also needs to look at loops which bolster the network. Let us look at a few hypothesis loops. There are additional hypotheses for loops around growth, and reengagement, but the diagram below shows only a sample. (I am not sure if these are the right or the most important ones, but one needs to think through the loops for your network.)

With this hypothesis, one can test which loops actually work, and what is the strength of each loop in terms of outcomes compared to any investment requirements. One should then double down on reinforcing those high leverage loops.

Companies can run different experiments to test hypotheses on these loops and the strength of those loops.

In the case of ProducePay, with a strong emphasis on creating a two (or multi) sided network, technology solutions, and financing approaches, it could potentially lead to a strong network.

Can artificial intelligence be applied?

Given the recent emphasis on artificial intelligence, let us look at a few hypotheses on whether a tool like artificial intelligence could help strengthen some loops, increase the trust and transparency in the network, and provide more liquidity.

- Demand Forecasting: Analyze historical sales data, weather patterns, and other demand variables, and make these forecasts available to suppliers and growers to help them manage their production, reduce waste, and improve profitability.

- Dynamic Pricing: Analyze real-time data on supply, demand, quality, and other pricing variables to provide dynamic pricing signals to pricing to suggest dynamic pricing strategies for both growers and buyers to aid with price discovery.

- Compute vision based quality management: Computer vision models can analyze images of produce to detect defects, ripeness levels, and potential disease issues. It can improve consistency of measurement, increase trust, raise the quality standard throughout the supply chain, and help with logistics, pricing, and inventory management.

- ChatBots: LLM (for example, ChatGPT) powered chatbots can handle routine inquiries, schedule appointments, and provide updates on order status.

Ultimately as I have said it many times, and will say it again, artificial intelligence is a tool in your toolbox, and ultimately some of the problems which need to be solved are:

- Cash flow challenges for growers associated with agricultural cycles.

- Reduce market inefficiencies by providing transparency, reducing transaction costs, and improving market access.

- Reduce food waste with market access, and quality and freshness of produce.

Marketplaces can work if the right market conditions exist, and if the right loops are incentivized. Artificial Intelligence models have and will play an even larger role in the future. (I will be looking at Full Harvest and Dairy.com aka Ever.ag in a future edition of the newsletter).