This week’s edition includes the following

1 AGCO’s Precision AgTech Day Event Presentation

2 Rantizo’s approval to fly multiple drones without a visual observer, and at night

3 ADM partnership with Smuckers and Golden Peanut to expand support for regenerative agriculture

After the After-Market

AGCO held their Precision Technology Day Event last month with demos in Kansas. The event highlighted AGCO’s evolving go-to-market and product strategy, based on the recent Trimble acquisition and the format of the PTx group.

(For context, AGCO says globally it has 55,000 active users across 158,000 connected ag machines planting, spraying and harvesting across 84 million acres worldwide annually.)

When the deal was first announced last year, Shane Thomas did an analysis of the acquisition and the joint venture.

“AGCO is aiming to be a leader in precision ag, but they aren’t precise in who their target farmer is and why their customer should care.”

It’s more important to highlight the implications of retrofit offerings. Said another way, what does a retrofit solution enable for a farmer?

Flexibility. Control. Optionality. Autonomy (of decision making). Optimization.”

It was not surprising that AGCO is doubling down on a retro-fit and after-market approach. AGCO’s strategy has been evolving for the last couple of years with the acquisition of Precision Planting (2017), Trimble (2023), and the launch of the PTx brand in 204.

Channels and customers

AGCO has taken some lessons from Shane Thomas. The presentation was a bit more clear on their two go-to-market channels, and the type of customers they serve.

Full line retrofit dealers

- Customers using any make and vintage of machine

- Targeting customers who look to increase the capability of their equipment beyond OEM factor availability.

Aftermarket Retail Outlet Dealer

- Mostly focused on customers of the dealer’s affiliated OEM brand(s)

- Customers looking to increase the capability of their equipment up to what the OEM initially designed out of the factory

Image source: AGCO Precision Technology Day Event

According to Corey Buch, Senior Director at PTx Trimble,

“It’s about having one comprehensive solution across all brands. We see an opportunity, a missing piece in the market we think will help our farmers by helping them manage their operations in a mixed fleet environment, regardless of make, model or age of the machine.”

According to AGCO, there is a gap in the market for farmers who run mixed-fleet equipment (and in theory, maybe do not want to get locked down into a particular OEM’s ecosystem) to help them manage their operations.

Trimble (part of AGCO) and Raven (acquired by CNH) provide similar products and solutions

AGCO expects their revenue to split roughly 50-50 between their retrofit and OEM business

Retrofit Business (50% of sales)

- Grow farmer engagement together with our dealers

- Expand global Full-Line Retrofit dealer network

- Heavily focused on retaining and supporting existing Trimble customers

- Expanding coverage in all regions with asset-light, mobile fleet model

- Actively engaged with over 350 Fendt, Massey Ferguson, and Valtra dealers for PTx Trimble contracts

OEM Business (50% of sales)

- Mostly guidance & steering and implement control ECUs & software – challenged by weakened agriculture equipment industry

- All Fendt, Massey Ferguson, and Valtra professional agriculture machines come standard with PTx Trimble receiver

For example, AGCO has been working on an autonomous tractor-grain cart retrofit kit called “Outrun”. Initially it will operate with some Fendt tractor models, and John Deere’s 8R tractor going back to models from 2014.

AGCO is working on building autonomous retrofits compatible with other tractor brands. If a tractor model is supported for Outrun, then you can install the autonomous retrofit unit, and get additional functionality on your existing equipment.

This is no different than what Raven has been suggesting with its OmniDrive technology.

Another example is the Precision Planting Vision System. AGCO demonstrated the system working with a 2018 John Deere sprayer as a selective spraying “smart machine.” It is a green-on-brown after-market kit which is able to tell small weeds from corn or soybean plants at 25 mph. The system includes vision-based guidance to steer the sprayer by preventing running over the crop and providing significant reduction in operator fatigue, concurrent scouting, and weed identification, coupled with targeted spraying technology for targeted spraying.

Spot spraying technology is in its early days, but most of the technology has matured beyond green-on-brown to green-on-green with more than 25 different companies providing this technology. (Guy Coleman summarized them in this LinkedIn post)

“Game-changing” option?

Given the long refresh cycles on most agricultural equipment, the retro-fit and after-market model makes sense, at least in the short to mid term. The financial outlay from a farmer will be much less for aftermarket or a retrofit option vs. buying a few hundred thousand dollars worth of new agriculture equipment.

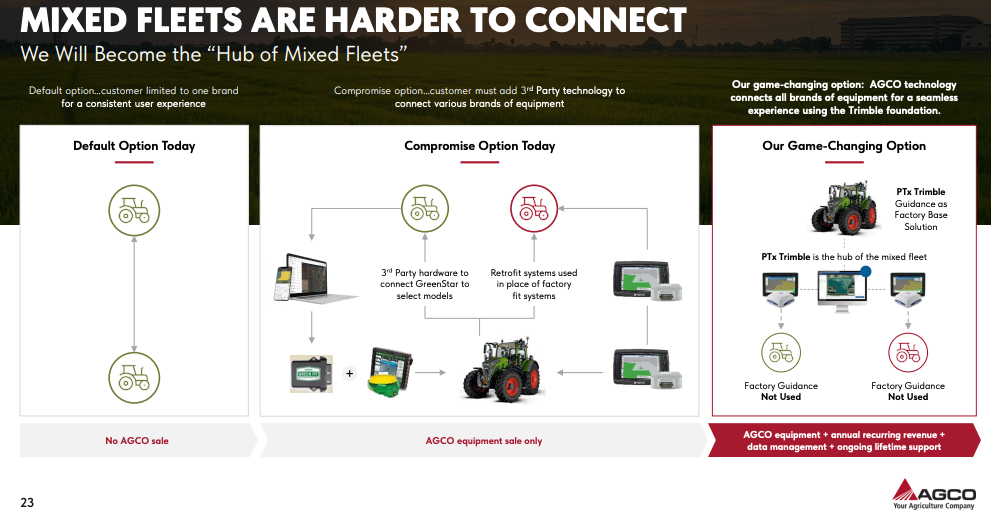

According to the presentation, most farmers are either using the default option of staying within the walls of a brand, or use a compromise solution which does not provide unification to connect across various brands of equipment.

AGCO’s self-proclaimed “game-changing option” is for AGCO technology to act as a glue for seamless connection across brands.

Image source: AGCO Precision Technology Day Event

Does the “game changing option” require customers to have a single data management software to login to?

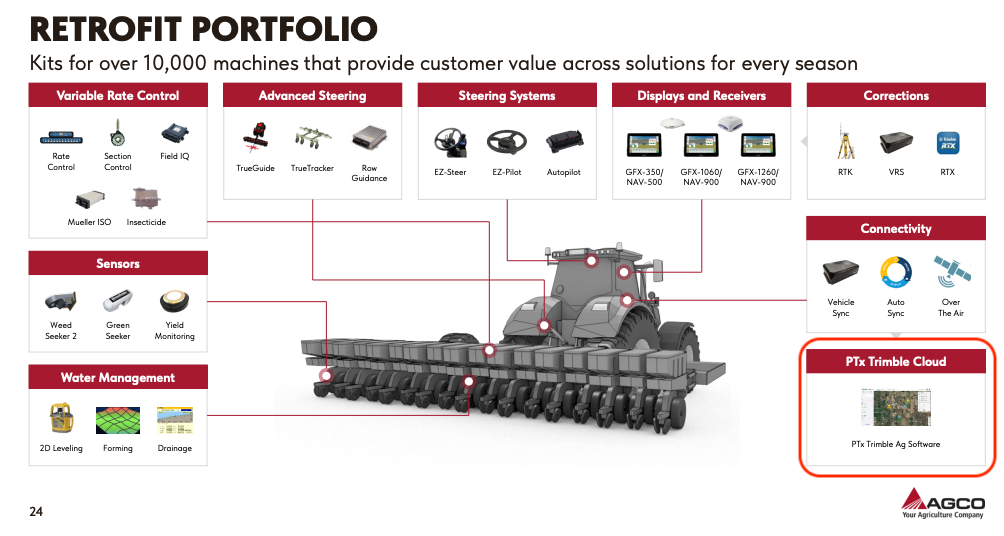

Between Trimble and Precision Planting, there are different pieces of software like the Panorama app, and Trimble software which could be brought together to provide a unified interface across a mixed-fleet of equipment. Based on the Retrofit portfolio slide, PTx is positioning PTx Trimble Ag software as a single data management software solution. (see bottom right)

Image source: AGCO Precision Technology Day Event

Having worked at The Climate Corp, I know how difficult it is to get adoption with farmer facing tools like Climate FieldView.

Given the proliferation of Deere’s Operations Center (available for free), any unified experience will have to compete with Ops Center, which clearly has a head start over any new unified offering from AGCO.

Given Deere has more than 50% market share in certain categories in North America, any “mixed-fleet” operation is highly likely to contain a Deere machine. This will be a very tough hill to climb for PTx.

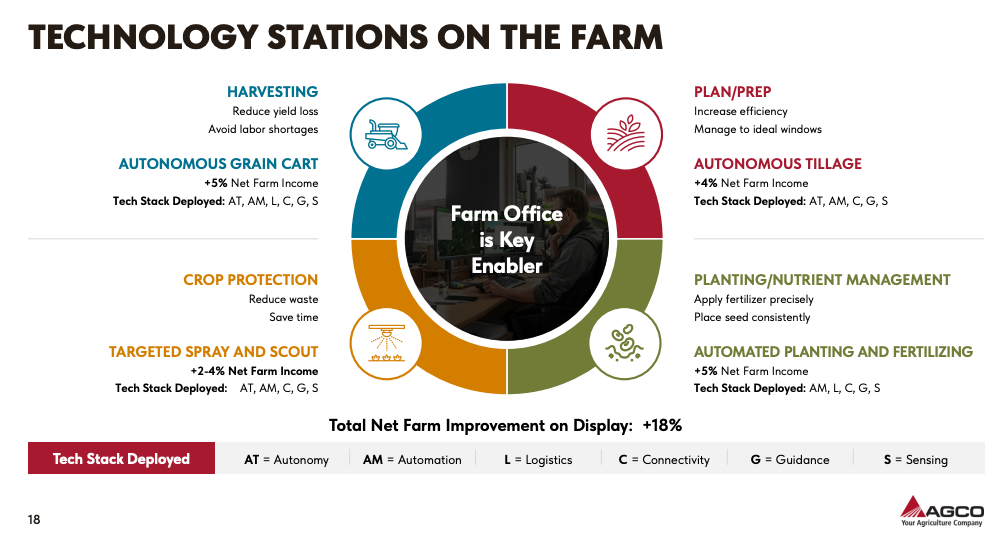

AGCO laid out increases in net farm income in the range of 2-5% for the adoption of different technology stacks on the farm across different operations like planning, harvesting, targeted spray and scout, and planting / nutrient management. Given farming operations are different, it will be interesting to see how much of the incremental net farm income is realized by customers to get them excited about these products.

Many of the capabilities mentioned below are and will become standard options for new equipment (for example reduce yield loss while harvesting, targeted see and spray, planting and nutrient management etc.)

Image source: AGCO Precision Technology Day Event

The technology stations listed on the slide above do signal the following, though AGCO does not call them out explicitly.

- Flexibility - “We are brand agnostic”

- Optionality - You can choose other brands for OEMs, and maybe even other brands (for example, Raven) for aftermarket / retrofit kits, but PTx is an option

- Optimization - The use of our technology stack will give you an incremental 2-5% net farm income.

Any OEM business requires a strong sales and after-market service channel. AGCO highlighted its FarmerCore program, which includes mobile and on-farm service fleets, smarter network coverage through alternative format outlets (for example, parts-only stores, and additional customer-facing digital tools to enhance customer support.

AGCO is leaning into Generative AI through their Fendt AI Chat application. Fendt AI Chat knows all manuals, service bulletins, and fault code guides, >18 million pages in 36 languages and currently is being tested with test dealers and AGCO customer support.

Fendt AI Chat should be able to provide a superior level of service, and arm Fendt customer service and support with relevant information.

AGCO mentions the democratization of generative AI capabilities, which sounds like a fancy name for giving access to GitHub Pilot for software engineers or allowing employees to use ChatGPT type tools at work.

Subscription fees

Deere offers an after-market solution with “See and Spray Premium” which uses cameras and machine learning to distinguish crops from weeds, spraying those only. It allows second and third generation equipment owners to have the latest and greatest features.

See & Spray Premium costs $ 25,000 for a 120-foot steel boom on 15-20 inch spacing, with a subscription fee of $ 4 per acre in soybeans and cotton, $ 3 per acre in corn, and $ 1 per acre for fallow. (The sprayer must have a factory-installed ExactApply system or Performance Upgrade Kit.)

In March 2024, AGCO talked about deploying software unlocks which can be purchased through the life of the hardware. It will allow customers to purchase AGCO software throughout the life of their hardware, irrespective of a new installation or used AGCO or competitive brands.

This will push AGCO towards a recurring revenue and subscription model based on software. It does present a new opportunity for AGCO to go back to customers year-after-year with incremental value for their customers and create a new margin opportunity for AGCO.

There has been pushback against subscription models within North America, but Deere is paving the way with subscription models for their advanced spot spraying technology.

The likes of AGCO, CNH, and others can ride Deere’s coattails to push for recurring revenue models, which could be in farmer’s best interest, if they are looking for optionality and flexibility.

For their autonomy stack, AGCO did talk about a metric called “active task hour” which measures when the actual autonomous capability is engaged and only charges farmers for that time. AGCO should experiment and explore other pricing options like “all-you-can-autonomy” subscription pricing to help with adoption etc.

Conclusions

AGCO is doubling down on its after-market and retro-fit business. Given its competitive position with respect to Deere and CNH, it makes sense for AGCO, though some of the new tech mentioned might be a bit behind compared to other OEMs out there.

AGCO needs to invest in its FarmerCore model as a high level of customer service will help them differentiate. (Think of how Best Buy has managed to compete with other players in consumer electronics retail, through superior service and knowledgeable staff).

AGCO should test out the subscription model. Deere is clearing the way for the industry, though AGCO will have to back up a subscription model with a clear value proposition and flexibility to suit their customer’s needs. Ultimately, how AGCO charges for these incremental value added capabilities is more important than how much they charge for it.

Multiple Drones without VO, and at night

Rantizo recently received FAA approval to fly without a visual observer and multiple drones at once (3 DJI T30 or two XAG P100 Pro drones), including night operations.

Rantizo has been one of the early pioneers in drone spraying. They have been able to push the envelope in terms of their freedom to operate with the FAA as can be seen below.

- Initial approval for single drone spraying operations from the FAA in July 2019.

- Approval to operate up to three autonomous drone sprayers by a single pilot and one visual observer in July 2020.

- Approval for drones heavier than 55 lbs in November 2021.

- Approval to fly without a visual observer and multiple drones at once, including night time operations in June 2024.

There are many benefits to flying without a visual observer, as it can reduce visual observer costs, boost human operator productivity, and allow operators to cover more acres.

The night time flying will allow the flexibility to spray during more favorable conditions, as there are fewer people in the fields at night, and there is less traffic. It reduces risks and allows for more efficiency. It allows for more flying time, which will result in more timely applications, and cover more acres per operator.

So what else can push the envelope on drone spraying and make it more competitive with ground-based sprayers? The changes could be grouped into regulatory and technology changes.

Regulatory

- Clearer guidance on licensing and training requirements by state and jurisdiction.

- Clearer guidelines on chemical use and safety protocols.

Technological

- Longer battery life with quick charge drones will increase the number of acres covered in one charge and reduce downtime between flights. For example, a startup out of the UK has shown the ability to charge a 35kWh battery in less than 5 minutes. (For reference, the battery in a typical American EV is 85kWh.) “The area per hour efficiency of the Hylio AG-272 is dependent on the dosage you are applying at. At a 2 gallon/acre (18.7 liters/hectare) rate, you can typically cover up to 50 acres (20.2 hectares) per hour; this rate includes downtime between flights.”

- Increase payload capacity through more powerful motors, and lighter drone construction material.

- Better integration with GPS powered by AI capabilities for better route planning and autonomous navigation to ensure safe, accurate and efficient spraying.

- Improved obstacle detection and avoidance on drones to ensure safe and uninterrupted operations.

- Improved IoT connectivity, which is a challenge in agricultural areas.

- Software and regulatory changes to be able to manage multiple drones at the same time.

- Continuous operations with teamed pilots, with automated fast recharging and refilling.

Regenerative Peanuts

ADM recently announced a partnership to bring regenerative agriculture to the US peanut supply chain. Regenerative practices covered by the program will include continuous living roots (cover crops), improved fertilizer and pesticide efficiency and use of reduced tillage practices.

Emissions benefits will be calculated using Field to Market methodologies and removals will be calculated using COMET Planner.

The 3 year agreement spans 2024-26 and covers 20K peanut acres per year. For reference, there are 1.45 million acres of peanut crop in the US (2022) number and so ADM’s program represents 1.38% of 2022 acres, which is a very strong start.

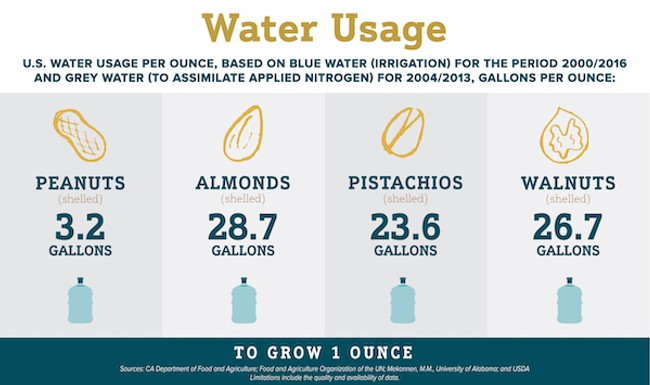

Peanuts are a great source of nutrients, with a smaller environmental footprint compared to other nut crops. Peanuts are resilient on both high and low amounts of water.

https://nationalpeanutboard.org/news/peanuts-and-sustainability-faqs/

ADM has continued to work on the carbon footprint of its value chain, with an outcome based approach for soil health, biodiversity, climate, and water resources. They have enrolled about 2.8 million acres in regenerative programs in 2023.

The program incentivizes farmers to manage inputs relative to a carbon intensity score using ISCC’s certification structure coupled with education and financial support, with a reduction in N, P, K fertilizer usage, lime, pesticides, and fuel/energy without sacrificing yield.

One of the hardest parts of any regenerative agriculture program is to build trust with farmers, and it requires significant investment in terms of project management, field days, information sessions, and extension services.

ADM and its partners have supported farmers across North America through 100s of meetings, consultations, and a $ 25 / per acre incentive to adopt regenerative agriculture practices. ADM can act as a good partner for CPG companies, which might be one step removed from growers (unless you are someone like Pepsico and might contract directly with potato growers).

Within food and agriculture, I am a big supporter of insets compared to offsets, and it is great to see companies like ADM putting resources behind their commitments across different crop supply chains.