Metal Dog Labs

As many of you know, I run an independent consulting business (Metal Dog Labs) focused on product and technology strategy for the agrifood sector. I work with startups, investors, and AgriFood businesses across the world. Here are a few examples of types of projects I have tackled over the last 8-9 months - product strategy for a food tech startup building a product for food scientists using GenAI, product strategy for a produce technology company, analysis of the impact of AI on agrochemical discovery for an investment firm, etc.

If you have a need to formulate or tweak your product strategy and go-to-market options, or want to get insights for investments, or kick-off a digital transformation project, you can reach out to me to have a conversation.

Now onto this week’s edition.

Survive till twenty-five

No, this is not a piece of advice for teenagers or folks in their early twenties on surviving high school or college. I am ill-positioned to provide meaningful advice on either of those topics.

—

I work with and have conversations with many startups every week. The conversations over the last 9-12 months have been sobering, as the funding environment has contracted. The vibe is very different compared to the zero interest rate environment from a few years ago.

Most VCs within AgTech, including corporate VCs of major agribusiness companies have held back their investments. By my count, corporate VCs made more than 10 investments a year before 2023, and now they are down to less than 2-3 investments per year.

There are multiple challenges for startups in the current environment.

If they last raised funding pre-2022, many startups managed to get very high valuations during the frothy zero-interest rate time period. When many (not all) of these startups have gone for their next funding round, they have been in for a rude awakening.

There has been a big gap between their new actual valuations, vs. their expected valuation based on the previous valuation and the progress they might have made since their last funding round.

Due to this, startups do not want to raise a lot of money, as they will have to hand over a big chunk of their company to VCs. On the flip side, VCs have also been leery to fund companies, and they have upped their diligence for smaller check sizes.

This is not a new phenomenon. We have seen this happen in the past as well. During tight funding environments, early stage (for example, seed) companies still get some funding. They are riskier, but have a larger upside potential, and so VCs have continued to invest in them. For later stage startups (Series C and beyond), the company has gone through a reasonable derisking process. If they can scale, then they can create big returns, and these companies can also get funded even in a downturn.

Series B Gap

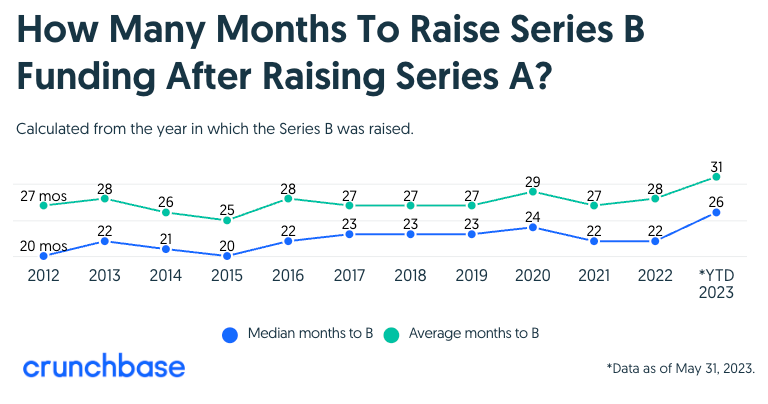

This is called the Series B gap. It is real and it might be impacting startups today. One of the first signs is the time between Series A and Series B raises for startups.

Startups that raise Series A rounds typically have only a short break before they’re fundraising again.

Among U.S. companies that go on to close Series B funding, the median is just under two years to do so, according to a Crunchbase analysis from 2012 to today. For the speediest quartile, the median is under 18 months.

But as venture funding contracts, the lag time between rounds gets longer. We saw evidence of delays last year,, with the average time lapse between Series A and Series B hitting 31 months — the longest span in at least 12 years.

Image source: https://news.crunchbase.com/venture/startups-raise-series-a-series-b/

Startups are taking different approaches depending on when they last money, and how mature they are on product-market fit, and commercial traction.

Startups across sectors are taking steps to cut costs and extend runways.

Startups which have found some commercial traction are doubling down on sales staff to sell what they have and have cut back on very future looking products and technology. For example, I was about to sign a product strategy project with a startup to look at their longer term (> 2-3 years) product strategy.

Concurrently the startup was working on a fundraise, and they realized they would have to hand over a larger portion of their company (due to a lower valuation than what they expected) and so decided to put the project on the back burner and focus on the here and now.

One of my current startup clients was going through a fundraising process. They hired me to look at a future looking product strategy, but a few weeks into the project, pivoted the project to focus on some immediate product execution problems as they were able to raise less capital than what they had anticipated. Given they had decent product market fit, they went out and hired a few salespeople to generate some immediate revenue based on their already working solutions.

Both the decisions above are rational decisions by their CEOs to help extend their runway, and give them a chance to fight another day.

But it looks like there might be some silver lining on the horizon.

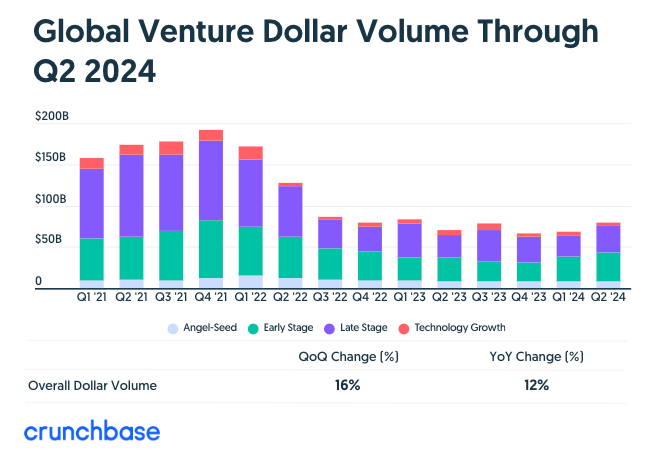

For example, CropLife recently said that the VC investment in AgTech for Q2 2024 is 15% higher than Q1 2024, even though the number of deals were the same. We are seeing this in the overall VC trends as well, as VC investments have ticked up in Q2 2024.

“190 AgTech startups raised a total of $1.6B. This represents a 15% increase in funding while the number of deals stayed flat from Q1 2024. There were six AgTech exits last quarter, all through M&A transactions.”

Given the number of deals are the same, more late stage companies are being funded, increasing the average check size. This is consistent with the Series B gap which I mentioned above.

So are we out of the woods already when it comes to funding or was the last quarter a blip? It is too early to say. Based on most CEOs and VCs I have talked with, folks are cautiously optimistic, but believe the market will be tight for another 12-18 months.

Hence the mantra from startup CEOs,

Survive till twenty five (2025)!

What are you hearing and seeing in your business? I would love to hear from you.

Monarch is half a unicorn

Well, right as I am talking about the tight funding environment, electronic and autonomous tractor maker Monarch Tractor, raised $ 133 million in funding in their Series C round.

“Belgian impact investor Astanor, which invests in early stage agritech innovations, and Taiwan-based HH-CTBC Partnership, co-led the $133 million Series C investment to further develop Monarch’s artificial intelligence and autonomous driving features and expand domestically, in Europe and Asia-Pacific. At One Ventures in San Francisco, Belgium’s PMV and The Welfare Fund in Brussels participated in the round, bringing the startup’s total funding to more than $220 million. Monarch calls the round the largest ever in agricultural robotics history”.

The series C funding round values the company at $ 518 million (half a unicorn).

“The Series C funds will support the further development of Monarch's cutting-edge AI product offering, expansion of their operational footprint domestically and globally, while enabling the company's path to profitability.”

But so far Monarch has not hit their initial revenue targets.

Monarch’s ambition continues to be the transformation of the farming industry through the replacement of fossil fuel powered machinery with autonomous electric tractors. Monarch’s tractors can be programmed for automated runs, guided remotely through fields and orchards to spray, disk, or harrow, or to follow workers as they move along a row of crops to carry supplies or to haul a harvest. Monarch believes AI and robotics could address pain points like overhead costs, farm labor shortages, worker safety, sustainability demands and data availability.

The tractors can be used by vineyards, orchards, dairy and livestock farms, airports and municipalities.

Operational Challenges & Savings

As I have said many times before, battery operated vehicles like drones, and electric tractors have operational issues in terms of battery size, operation time on a single charge, and time to charge the battery. The sustainability story is important but it is downstream to operational efficiencies and economics of an autonomous electric tractor.

Monarch tractors are in the low to mid range in terms of horsepower. Monarch is in the 75 HP range, which limits it to certain specialty crops. The battery can last up to 14 hours on a single 5.5 hour charge and has a lifespan of 15 to 25 years depending on the frequency of use. Monarch provides an optional cart for carrying a spare battery for quick, in-field swaps during power-intensive operations.

A key selling point for Monarch’s autonomous tractors is their ability to decrease operational costs, in terms of labor and energy, and the emissions savings due to the use of electric power.

Monarch first launched its MK-V tractor in December 2022. Since then they have deployed more than 400 MV-V’s resulting in 850 tonnes of CO2 emissions offset across 42,000 hours of tractor operations.

I am assuming all the 400 tractors didn’t deploy at the same time, so we can assume an average of 200 tractors being effectively deployed. With 42,000 hours of tractor operations, it comes to about 210 hours per tractor.

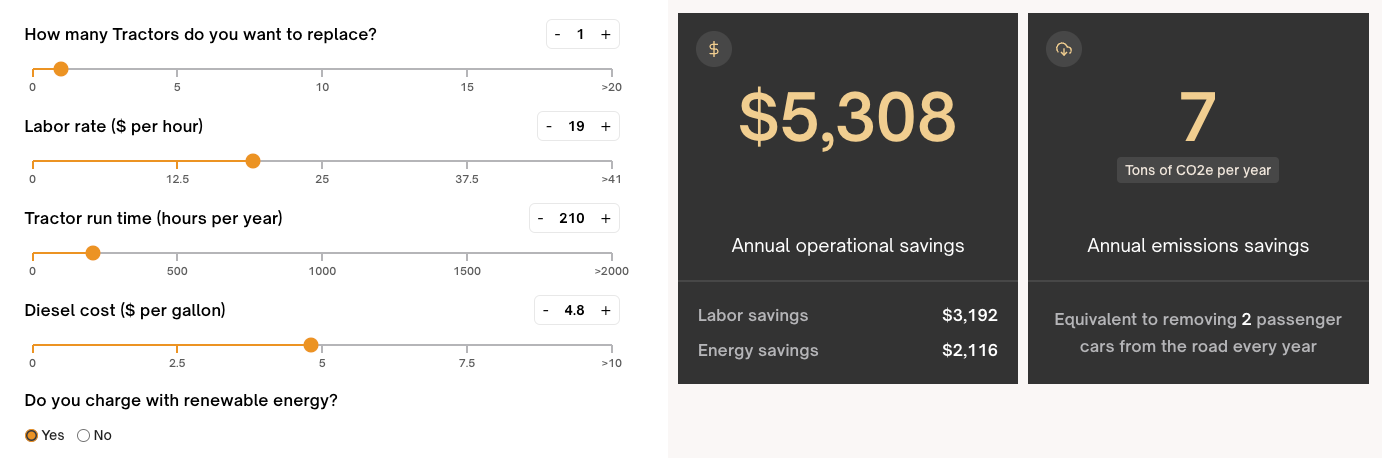

Monarch has a convenient annual operational savings calculator on its website. The calculator asks for inputs like the number of tractors you want to replace, labor rate for farm labor, tractor run time (hours per year), diesel costs (dollars per gallon), and whether you charge with renewable energy (for example, solar).

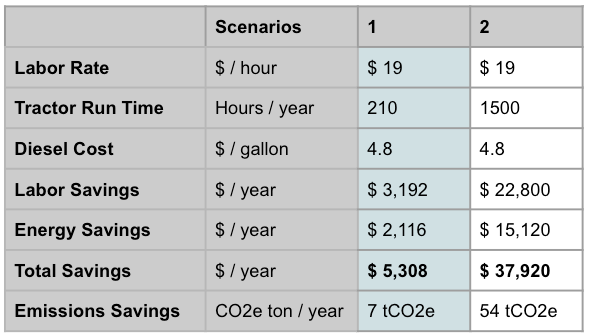

By taking an assumption of 210 hours per tractor, the average farm labor rate of $ 19 / hour in California, and the current diesel price of $ 4.80 per gallon, the calculator gives operational savings of $ 5,308 per year. If diesel and labor are cheaper, then then the business case for Monarch becomes weaker.

The savings are not trivial, but with a sticker price of $ 89,000 per tractor, savings of $ 5,300 / year will be tough to sell.

At 210 hours per year, it will result in annual emissions savings of 7 tons of CO2e per year, which is equivalent to removing less than 2 passengers cars from the road every year. (According to the EPA, an average passenger car which drives 11,500 miles per year, has a fuel economy of 22.2 miles per gallon, emits about 4.6 tons of CO2e per year)

If we use the default assumption of tractor run time of 1500 hours per year, the operational savings jump to $ 37,920 per year. (see column 2 in table below).

The actual operational savings will depend on the crop type, type of operations being done, terrain, soil, and weather conditions, energy prices etc, and so I would assume the operational savings as the best case scenario. (It would be great to get a peek into the assumptions behind the calculations)

Chart by Rhishi Pethe, SFTW

Investment from the buyer

The upfront price of the tractor is not the only financial outlay for a buyer. Monarch provides a proprietary WingspanAI application. The application provides remote management of up to 8 tractors, and real time visibility into operations.

The application’s capabilities fall into four categories of automation (autonomous operations), awareness (plan, review & visualize tractor operations), metrics (operational metrics like distance traveled, hours of operation, acres covered etc.), and maintenance (track tractor health, error codes etc).

The continual development of product solutions, including the introduction of new AI capabilities, will be the driving force in closing the industry's profit gap.

The subscription for the base version of the app is $ 199 / month / tractor and for the premium version is $ 699 / month / tractor (or $ 8,400 per year per tractor), which is significant for a single tractor. If you have a fleet of Monarch tractors, the additional spend every year will be equivalent to buying another tractor every year!

In the assumptions on the ROI calculator, I had chosen the option to charge with renewable energy, which would require access to solar charging infrastructure, which would incur additional costs for the solar infrastructure. Monarch has partnered with Paired Power, which provides a popup solar canopy (called PairTree) and can be installed in a day.

Paired Power also provides solutions for charging fleets by configuring their PairTree solution into a permanent structure. Paired Power can use off-grid solar powered Direct Current Fast Chargers to charge a swappable Monarch MK-V tractor battery for fleet operations.

The drop in prices in solar power infrastructure as well as government subsidies has made it more accessible, but it is an added expense at the farm level.

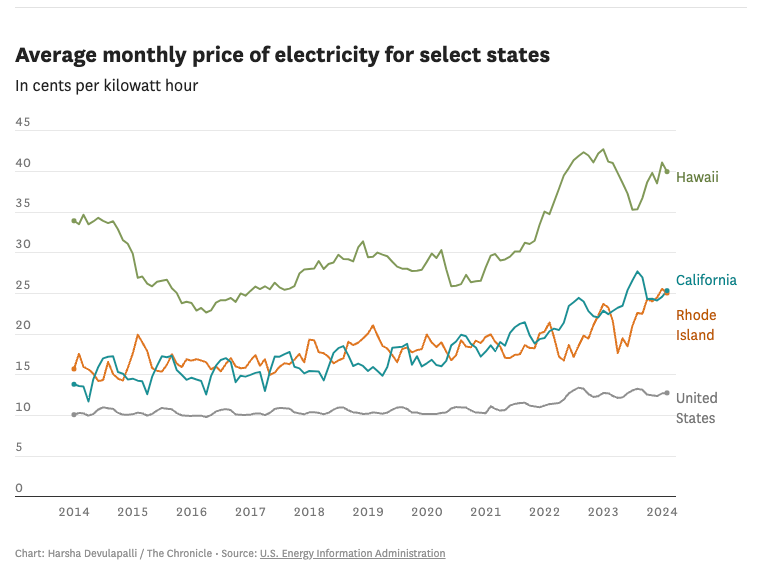

If solar is not an option, farms need access to electrical charging infrastructure. This is challenging as many agricultural sites are located at the end of grid distribution lines. This can create an unstable supply of electricity to charge EVs. The upgrading of power lines is a costly and long process, which requires permits, utility approvals, etc. For example, here in California, electricity prices have almost doubled in the last 10 years.

Business Model and OEM involvement

The business model for Monarch is challenging. The high investment has to pay off for VCs, OEMs like Monarch, service providers, and end users - farmers. As I discussed during the FarmWise Scaling Innovation edition, many robotics companies have switched to selling their equipment to farmers instead of providing it as a service for critical and expensive pieces of equipment with a price tag of $ 1.4 million.

Given Monarch’s price tag is lower, Monarch should experiment with different models like leasing, tractor-as-a-service, and different financing options through their partnership with CNH Industrial Capital.

Last year, Monarch and CNH had signed an agreement to reach new farms across different geographies. Monarch planned to leverage CNH Industrial Capital’s expertise in the agricultural equipment financing sector within the CNH Industrial dealer network.

The goal of OEMs is to continue innovation in field operations. OEMs want to offer a diverse portfolio of precision ag solutions for direct productivity gains in each stage of the production lifecycle.

CNH was not mentioned in the Series C announcement, which is not surprising. Through its existing partnership with Monarch, CNH is participating through production, and financing of Monarch tractors. Very soon Monarch might become a pretty big acquisition for CNH whose previous biggest acquisition was Raven for $ 2.1 Billion dollars, when Monarch is already at $ 518 million valuation.

Final Thoughts

- Autonomous machines have the potential to dramatically change farming and field operations. My contention is it will not change field operations overnight. It will take time to gain market acceptance among users. Autonomy features are developing incrementally on a task-by-task basis, which ultimately will have to come together to provide farmers the choice to choose their own set of autonomous capabilities based on their unique context

- Electric capabilities will be key from a future perspective, though we are not getting rid of all our fossil fuel vehicles any time soon.

- The goal of OEMs is to continue innovation in field operations. OEMs want to offer a diverse portfolio of precision ag solutions for direct productivity gains in each stage of the production lifecycle. Monarch should continue to focus on operational savings, productivity gains, and how it changes the nature of farming to its OEM partners, and customers.

- Agtech service providers offer an effective distribution channel. Distributors of various digital services have the expertise and the experience to manage robot software and hardware. The service providers will also have access to a network of innovative farmers. For example, agriculture retail organizations or co-operatives can play an important role for adoption of Monarch tractors.

- Monarch needs to be able to manufacture a multi-purpose tractor at a much lower cost than today.

- Monarch should experiment with different business models, which can make adoption faster and create additional revenue streams downstream, including investments in the WingSpanAI software for additional data collection, analysis, and compliance reporting.

- Given the sustainability story for Monarch, it makes sense to get more investment from European partners. Many of the EU co-ops have challenging goals for sustainability and have access to a large member network.

- Monarch exit might be an IPO in the next 3-5 years, or an acquisition by a larger OEM.