This week’s edition includes three topics

1. Leaf Ag’s latest funding round, and its future business

2. More GenAI agents - what should input companies do?

3. Farmblox is a good example of clear line between product and value creation

Leaf: Legos for Agribusiness

We were up against a deadline. The insurance reporting season was fast approaching, and we still had a few kinks to iron out. The project required us to deliver planting and harvest summary files based on precision agriculture data within Climate FieldView to our partner Farmers Mutual Hail of Iowa. The quick, clean, and accurate transfer of data (based on grower permission) would streamline the process of acreage reporting required as part of the US Federal Crop Insurance program. It would make life easier for growers, insurance agents, and insurance companies like FMH.

The API replaced the manual process of creating summaries tediously by collecting all your files from multiple thumb drives, collating the data and then generating PDF reports to be delivered to your local RMA office.

I had spent a significant amount of time with smart software engineers, data scientists, analysts, and software architects to muddle through the details of precision agriculture data for boundaries, planting and harvest. We had debated and pored over the honeycomb nature of data, which built the overall picture, and issues with the accuracy and the quality of data. We had worked through issues of wrong crop types, drift, calibration issues, playing with and applying buffers of different widths to smooth the borders.

Our engineering team has ultimately come up with a process to summarize the mountain of planting and harvest data into a simple summary file which accurately represented the ground realities of boundaries, planting and harvest areas and met the requirements of the insurance reporting use cases.

Leaf Agriculture might say to organizations like Climate, “You don’t need to worry about all the minutiae of data management, accuracy and quality of data, converting the data in the right formats, and building the right pipes to share that information with organizations who need it (always with grower permission). You should focus on your core strengths and let us do the dirty work” (To be clear, these are my words, not Leaf’s)

Leaf’s latest funding round

Leaf Agriculture recently raised $ 11.3 million in their Series A funding round led by Spero Ventures, with investors from the previous round participating in the series A round.

“Crop insurance, seed & chemical, biotech, AgTech, cooperatives, and other companies all use farm data to improve their existing services and offer new products. Before Leaf, these companies attempted to build massive data infrastructure to manage and reconcile all of the weather, irrigation, imagery, tractor, and other data they were collecting. Not only did this process require a substantial investment, it also took hundreds of hours of ongoing engineering resources and development time to build, operate, and maintain. The team at Leaf identified this issue and created a single unified API where companies can easily access all of their data and focus on building new value with the data instead of building and maintaining messy integrations and data translation infrastructure.”

The round was led by Spero Ventures, which is invested in non-agriculture technology businesses. (Their only other Agtech investment is in Tortuga). Spero Ventures saw similar patterns emerge in agriculture with a confluence of farm equipment with digital logs (but crazy formats), plethora of sensors, ability to get data back to the cloud (though not immediately and many challenges remain), and the drop in prices for cloud infrastructure. Plaid, which powers many of the financial transactions between entities and apps like Venmo is a good analog for Leaf from FinTech. Another example is Nylas, which plays a role similar to Leaf, but in the calendar and meeting space.

What does Leaf do and what problems can be solved by Leaf?

Leaf products are used by the who’s who of the agriculture and food industry, which includes players like John Deere Ops Center, Climate FieldView, CNH, Planet, Raven, AgLeader etc.

Leaf provides APIs for field boundary management across multiple OEM brands, field operations data from proprietary formats converted into industry standard formats like JSON, get access to standardized and aggregated multispectral imagery from a variety of satellite and drone imagery providers, data translation across format, unified weather data, prescriptions for variable input applications for seed, chemical, and fertilizer to OEM platforms, access to retrieve asset data like serial numbers, fuel consumption, and provide validation services for user input product names etc.

Leaf abstracts out and encapsulates the complexity of dealing with messy, and complicated data into a simple interface for application builders to get access to the data and the infrastructure they need using a simple API.

As I wrote in edition 133 (“Convenience, network effects, and incentives”) and edition 134 (“Interoperability problems and causes with agriculture data”)

“Agtech providers want to focus on what they are good at - prescriptions, financial management, analysis, operational planning etc. Their customers and users want their data to move around to other systems, instead of having to enter it again and again.

Leaf provides the convenience of translating the different equipment formats, and then abstracting it out to a unified JSON (think of JSON as an easy to understand, open format which most software engineers understand). Now as a grower or an agronomist or an ag retail or OEM representative, you can seamlessly move data from one system to the other (obviously based on permissions from the data owner - typically the grower).

This makes it quite easy for users and customers to move their data, and it lets the AgTech provider focus on their priorities, instead of worrying about the underlying infrastructure of data movement and data translation.”

Leaf’s pricing model is straightforward and it depends on the number of physical acres. It provides an easy way for a customer to try Leaf out, keep their cost structure predictable, and provides a scalable way for Leaf to grow.

Leaf provides convenience.

For example, do you need a PDF report to be generated based on agronomy data in a format which is acceptable to the RMA (Risk Management Agency in the US)? Leaf can do it for you.

Do you need to export data out in a particular format for use in a different system? Leaf can do it for you.

Do you need to identify outliers in your data, and flag them or correct them? Leaf can do it for you.

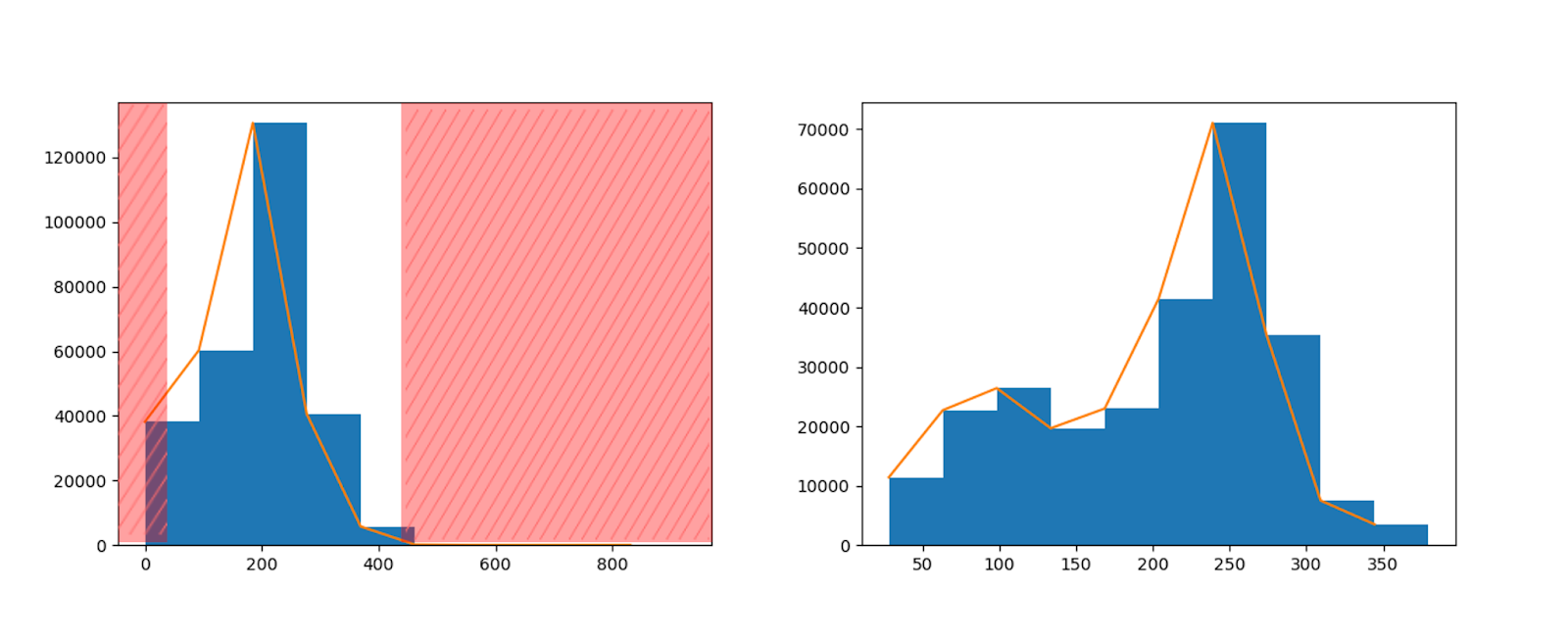

All points with the harvested volume value far 3 standard deviations from the mean will be excluded. Image from Leaf API documentation

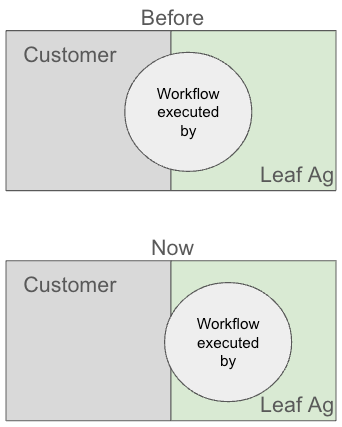

Over the last few years, the Leaf team has focused on the connections between systems. Many organizations have still continued to run their data infrastructure, cloud hosting, and data management through their own resources. If you think of the whole workflow post data acquisition of data storage, data management, cleansing, formatting, and ultimately transferring to another system as needed, Leaf was mostly focused on the last 2-3 aspects of the workflow, which was maybe 60% of the overall workflow.

Leaf and their customers realized that if almost the entire workflow could be transitioned to Leaf, including infrastructure and tools for cloud hosting and data management, at a lower total cost of ownership for the customer, it could be a win-win for everyone involved. Leaf can spread their costs of managing data and cloud infrastructure across multiple customers, and can provide a compelling price point for each individual customer.

Increased customer value as Leaf executes more of the data management workflow, including cloud infrastructure, configuration, and management (graphic by Rhishi Pethe, SFTW)

The customer is spending less time on the data management workflow and so has more time and resources to focus on its core competencies and strengths. The cost of using Leaf pays for itself in both lower initial development costs and reduced maintenance costs.

Leaf has expanded its product offering to provide a full end to end solution for data management, data cleansing, data security, data transformation, and transfer, including cloud services to their customers. This works well for small and medium sized businesses. They don’t have to worry about cloud providers, and to have staff to manage their data infrastructure. They can focus on what they are good at, depending on the type of business they are in. They can leverage Leaf’s expertise for all the data infrastructure and management.

Even before this change, Leaf’s net dollar retention on a per acre basis was quite high. These additional services will increase that number. It will create additional value propositions for new customers to sign up with Leaf. This includes agronomy services companies, agriculture retailers, other food and agriculture service providers, small to mid-sized input companies, and OEMs.

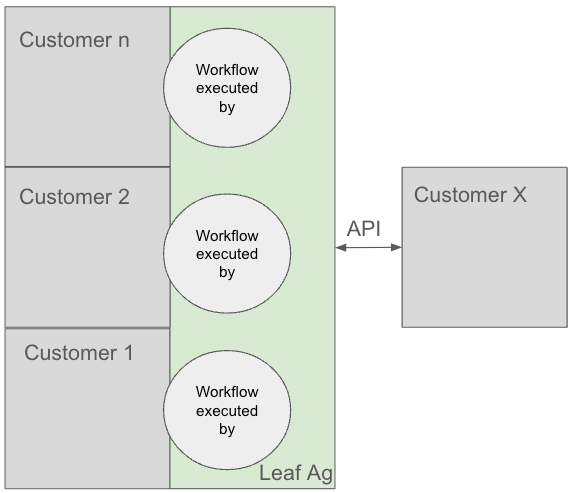

This approach strengthens the hub and spoke model practiced by Leaf Ag. (I had written about the Hub and Spoke model for Ag Data in Edition 95. Hub and Spoke model)

Graphic by Rhishi Pethe (SFTW)

In the graphic above, Customer X can connect to customers 1, through n by making one connection to Leaf. Similarly Customer 1 connects with Customers 2 through n, and Customer X, by having Leaf execute most of its data management workflow.

Future Growth for Leaf

Being able to provide more of the data management workflow, will hopefully help Leaf to increase the share of wallet with each customer, and also attract a new set of customers, who want to focus on their key strengths.

One of the most difficult parts of dealing with precision agriculture data is the quality of data.

Every organization which deals with precision agriculture data spends the time to clean the data so that it is useful for downstream analysis - whether it is writing a prescription, analyzing the performance of a particular recommendation, understanding productivity of different parts of your field, or using the data for financial decisions like lending or insurance.

If you are a crop insurance company like Farmers Mutual Hail of Iowa, your expertise is in insurance policies, actuarial risk assessment, customer service to growers, and understanding of the latest insurance policies from the government. Dealing with precision agriculture data, with all the weird hexagons, calibration errors etc. is not your strength. You should be more than happy to partner with someone to do it for you.

Crop insurance acreage reporting is an area of growth for Leaf. Leaf is uniquely positioned to take advantage of this opportunity, given their experience in dealing with precision agriculture data, the prevalence of crop insurance within the United States, and the current tedious and manual process of doing acreage reports for government agencies like the RMA

Leaf can provide a clean, accurate (strong requirement for insurance), and a timely report in an easy to use format for insurance companies. It creates value by saving time for the grower, the insurance agent working with the grower, and the insurance company which holds the grower’s policy.

Insurance companies have good intuition on the risk profile of a farming operation. With access to better quality precision data, insurance companies have the opportunity to validate their intuition and experience with actual high quality data. Precision data and associated models can unearth new and additional insights, which can help inform the actuarial process.

There is an opportunity for a Moneyball moment to appear in the world of crop insurance and agriculture lending as more and more high quality data becomes available.

Leaf will have to be careful to not lean too much into creating risk scores, or building models which are too close to the core business of insurance. Leaf should focus on creating a high quality data and model stream which can go as an input into a risk scoring model, without building a risk scoring model itself, at least in the US where the crop insurance space is heavily regulated. I do not have any inside information, but Leaf could potentially lean into this area outside of the US, especially when it comes to private insurance or parametric insurance.

Leaf has the opportunity to provide high quality data for downstream applications like MRV platforms for GHG & C reporting, data requirements for sustainable aviation fuel (which is neither sustainable or a good fuel!), or to prove provenance for a particular product by tracing it through the supply chain.

There are significant headwinds in each of these opportunities due to existing issues around rules, the science, and the right business models. I believe there is enough room to grow in the insurance space and an opportunity to become the defacto data processor for crop insurance, before it can move on to additional use cases.

Final Thoughts

I personally see Leaf as a way to build digital infrastructure for agriculture using APIs-as-a-service. Infrastructure work is not sexy, but a well built infrastructure can move the needle in meaningful ways.

As Spero investor Andrew Parker rightly points out, an API-as-a-service company allows them to explore bottom-up, emergent use cases. The complete end-to-end execution of data management workflows instead of doing API connectivity between two systems is a strong example of emergent use cases. Leaf pushes the discussion about data standards in the background, and instead helps organizations focus on value creation and value capture.

—

Here are some additional articles I have written about data interoperability in the past, beyond the ones I have already references in the edition today. Edition 105. Three fears of farm data, Edition 84. The Babel Fish of Agriculture, Edition 32: Connectivity and adoption curves, Edition 55: Outsiders and Interoperability.

You don’t have a Gen AI agent?

Not a week goes by before another organization releases their LLM powered assistant.

For example, last week Stratovision Group released AgriSearch Assistant which helps users quickly and efficiently find credible agriculture information. The assistant helps users aggregate data from trusted and disparate sources like the USDA, Economic Research Service (ERS), and National Agricultural Statistics Service (NASS). The “Assistant” simplifies getting access to data related to pressing agriculture issues.

AgVend, a leading provider of digital enablement solutions for retailers, announced the launch of “Goose”, an LLM based assistant. Goose is available to ag retail teams, for no additional cost. AgVend is using Goose to help ag retail teams automate insights and tedious tasks, and ask to automate tasks around information summary, communications, etc.

At this point, if you have access to some amount of proprietary information, what are you even doing if you don’t have an LLM?

Most of the examples of LLMs being used today in agriculture fall within two broad categories.

1. Help me learn - Stratovision’s assistant falls in this category.

2. Automate boring tasks - AgVend’s Goose falls in this category.

Final thoughts

If you have access to a reasonable amount of proprietary information, or if your information is spread across multiple locations and formats, you should think about which tasks are related to make learning more efficient, and which tasks can be automated. Both of these types of tasks are good candidates to put an LLM wrapper on top.

Right now, there is a lot of hype around GenAI, though most of the use cases are around improving the efficiency of an existing process (for example through automation) or making your teams more efficient (for example, by learning something new quickly and efficiently). There are few examples of GenAI which increase top line revenue directly.

When FBN’s Norm launched initially, it was panned by folks as almost all responses included “call our sales number” for further information.

For input companies and agriculture retailers, GenAI based assistants could potentially act as a way to position their products in the right context for the right opportunity. Due to this input companies should be careful in incorporating their product and trial data into 3rd party GenAI agents, as the GenAI agent could put their thumb on the scale in how products from certain brands are positioned to the end user.

Will these GenAI agents “prefer” certain brands, if the brand has paid a “advertising and training fee” for their data? (Do you remember the kerfuffle when the entire world felt that Google was putting a thumb on the scale with their Gemini model?). The data rights around which data can be and is used for training are still a bit murky, so they should proceed with caution, though GenAI agents present a unique opportunity for product placement and positioning.

Farmblox

I don’t know much about maple syrup farming. The closest I have come to maple syrup hobby farming is through a Canadian friend, who gifted me a bottle of maple syrup from their orchard, along with pictures of their orchard.

Maple trees are tapped to collect maple sap, which is then processed into maple syrup.

New AgTech startup Farmblox recently raised $ 2.5 million as a seed round. It is starting with addressing issues faced during maple production - namely loss of yield due to leaks, maintenance of proper pressure, and the human labor requirement to go monitor taps for leaks, pressure changes for taps etc.

Farmblox has designed a relatively inexpensive solar powered monitor box, which can plug into any IoT sensor to transfer data from the IoT device to the monitor box. The monitor box is connected to a LoRaWAN gateway, which can then backhaul the data to the cloud. The same information highway can be used for data and decisions to go from the cloud to the IoT device. In essence, the Farmblox monitor connected with the LoRaWAN network as a “physical API” with information about sap leaks, sap pressure etc.

Farmblox’s monitor box connects with many different types of IoT devices like water moisture sensors, tank level monitor, vacuum monitoring (used to monitor maple line vacuum levels), flowmeters, level sensors, soil sensors, tank level, vacuum sensors, pressure, etc.

Farmblox provides an application layer based on the data coming from different sensors to get a view of what’s happening at the farm level based on the sensors.

Many IoT devices have to build a connectivity solution to send data from the device to another location. For example, earlier versions of the FieldView Drive would use bluetooth connectivity to bring the data to a local iPad, which would then sync to the cloud. Arable’s Mach 3 sensor captures a myriad of data through different sensor types, and then it uses a cellular connection to send data to the cloud. Swan Systems from Australia has spent many years building APIs with more than 100 different types of sensor systems and IoT devices.Farmblox’s monitor solution decouples the IoT sensor and the connectivity required to send data upstream.

Farmblox is taking a different approach by decoupling the IoT sensors from the connectivity tools required to backhaul the data. Farmblox’s message to IoT device manufacturers is clear - do not worry about your connectivity solution, as we will help you get a seamless connection to get your data from the farm to the cloud.

In the case of a maple orchard, Farmblox can protech yields through the use of the monitor with pressure sensors to detect leaks etc.

According to the North America Maple Syrup Producers manual,

“Research has demonstrated that an appropriately configured and effectively working vacuum pump attached to a tubing system can increase sap yield by 100 percent or more. The higher the vacuum level is, the greater the yield of sap. In general, a 5–7% increase in sap yield is found for each 1"Hg vacuum in the tubing system at the taphole.”

Leaks can cause changes in pressure resulting in lower yields. There is a significant labor cost to constantly have people go look for leaks and try to fix them. An IoT network connected with Farmblox monitor devices can automate the “go look for leaks” part, and thus reduce the amount of labor required to go-look-for-leaks.

Farmblox’s model is simple with a clear value proposition. Farmblox sells monitors and LoraWAN gateways at a subsidized one time price to the grower. The grower owns the data generated on the farm and has to pay a monthly subscription fee for access to data and insights on Farmblox. There is a clear link between the Farmblox product, and value creation (reduce labor requirement, higher yields). It makes value capture relatively easy.

Final thoughts

Even though Farmblox is a very early stage company, it provides some good learnings on the links between their product and value creation. They have successfully broken down the problem into small steps, and are clear about which steps will have the most impact. It will help it capture a larger share of value.

When you are thinking about bringing a new innovation to market, try to see if you can draw a clear line between your solution and value creation for your customer. This has been one of the biggest challenges within AgTech, as companies have struggled to show direct attribution to value creation based on their product, and due to this they have struggled with value capture.

What do you think?

If you don’t mind answering 3 questions anonymously (2 are optional), I would love to get your feedback.

This newsletter is a product of Metal Dog Labs, LLC, a Product and Technology Strategy consulting firm for the Agrifood industry.

Start writing today. Use the button below to create a Substack of your own