The Retreat of Tech Giants (from AgTech)

Google, Microsoft, Amazon are scaling back their ambitions in agriculture

Tech giants engaging with agriculture

About 10 years ago, when AgTech was heating up, some of the tech giants like Amazon, Microsoft, and Google decided to pay more attention to agriculture. The push was driven by both financial and impact reasons, given the massive footprint of agriculture in terms of resource use (land, water), GDP size, and a source of employment for millions of people, especially in the global south.

Agriculture and food systems do have a large impact (both positive and negative) on climate change, and greenhouse gas emissions. The tech giants are motivated by a genuine desire to make an impact on these important issues.

Google launched its Google Earth Engine initiative in 2010 by putting “an unprecedented amount of satellite imagery and data—current and historical—online for the first time.” Google envisioned use cases built by others using the Earth Engine technology with the “initial use of Google Earth Engine to support development of systems to monitor, report and verify (MRV) efforts to stop global deforestation.”

Today, and over the last 10-15 years, Google Earth Engine is used by thousands of companies, researchers, and developers to build applications based on the data provided by GEE.

Microsoft announced their work in TV White Space in the middle of the last decade with their Farmbeats suite of capabilities, with the focus on IoT capabilities and data management. Both Satya Nadella and Bill Gates were excited about Farmbeats and it was launched on Azure (Microsoft’s Cloud Infrastructure) in 2019 and transitioned to Azure Data Manager in 2023.

Azure Data Manager was the cornerstone of the Microsoft and Bayer partnership, and today continues to “provide industry-specific capabilities to connect farm data, enabling organizations to leverage high-quality datasets and develop solutions that power agriculture insights.”

Amazon AWS formed its own agriculture industry group towards the end of the last decade with a team of commercial, product, technology, and data team members.

Tech Giants pulling back

The picture has changed a bit in the last 18 months. Tech giants have pulled back on some of their agriculture related efforts..

Mineral (an Alphabet company, focused on sustainable agriculture) wound down this year. (*Note: I was part of Alphabet X and Mineral from April 2020 to October 2023).

Last year, Amazon’s agriculture group within AWS was cut back by leaving only a few commercial members on the team. Microsoft has had partnerships with Bayer etc., but the partnership hasn’t had much to show over the last 3 years. (It was announced in 2021). I do know some of these initiatives do take time, but we haven’t seen major announcements over the last few years.

So what do you think is happening? Why are tech giants pulling back from some of these initiatives?

Return on investment is slow and maybe not as large

The changing interest rate environment, the continued dog fight over cloud market share and profitability, the massive CapEx requirements to build out GenAI and AI capabilities, has put additional pressure on tech giants to re-think their investment allocations across core and aspirational initiatives.

Each of these tech giants are multi-trillion dollar companies, with highly profitable business models.

For these companies to justify investments in building out specific end use cases, the end use cases need to have a path to a large revenue potential and market cap (and by large I mean literally billions of dollars!).

The adoption rates are slow in agriculture. If you are doing a marginally better product, then your revenue potential will not be commensurate with your investment level and your ambition. The opportunity cost for a large tech giant is very high, and so it creates its own investment allocation challenges.

The cost structure of these companies in terms of employees is very high given the compensation structure of these companies. The growth rates for giants over the last few decades has outpaced the growth rate for most agribusinesses out there. This has worked out quite well financially for these employees, though making career progression has become much harder at these tech giants.

When these employees are working on agriculture related projects, they come in with expectations of higher growth rate than is normally seen. This creates expectation mismatches between employees and the company. If they want to take a higher risk-reward ratio, they are better off working for a startup outside the company in some other area.

Another challenge for tech giants is that most of them are focused on digital capabilities. Digital capabilities are enablers for agribusiness, to help them sell a tractor, or seed or chemical, or establish a closer relationship with the customer. Over the last 10 years, most agribusinesses have struggled to make money from their bits only businesses, unless they are paired with an atoms business as well.

This is a big challenge for tech giants, who are working on a bits only business, and typically will not have atoms to sell. (Unless you are NVIDIA)

Don’t get me wrong, it is absolutely fantastic that large companies like Google, Microsoft, Amazon, NVIDIA, and others have initiatives which have an impact on agriculture, directly or indirectly.

There are many cross-industry learnings, skill-sets, and a new way to look at problems which are essential for any industry, and that is true for agriculture.

So how are and how should tech giants continue to play within agriculture, both for impact and for financial returns?

Investment options for big tech

Startup investments

The tech giants have continued to make investments into the food and agriculture sector, though the number of investments have been limited. It is understandable as investing into sector specific companies requires sector specific expertise and experience.

For example, Microsoft’s Venture Capital arm M12 has invested in Regrow.Ag, focused on measuring on-farm emissions. By their own account, Regrow’s growth has been slower than expected, the adoption of cover crops has been even slower, and the science for GHG and carbon measurements from natural systems like agriculture still needs a lot more advancement.

Google Ventures has invested in companies like AirProtein (fermentation based protein production), Bowery (vertical farming company), The Climate Corporation (since then acquired by Monsanto and Bayer), Agtonomy (a hybrid autonomy and tele-assist platform for agriculture), Cropin (agriculture analytics company), Strella Biotech (sensor technology to reduce produce food waste) and many others.

Amazon’s Innovation fund is focused on industrial innovation which is relevant to Amazon’s core business and so funds different robotics companies.

NVIDIA has been investing in companies like Carbon Robotics (Weed killing robots using lasers). On a long enough time-scale, automation and autonomy is a given in agriculture equipment. They have pushed their Jetson GPUs to Monarch and I know of many other agriculture robotics companies who either use or have considered using NVIDIA chips for real time, on-edge computations which require processing vast amounts of data in a power efficient manner.

NVIDIA does not go out and say, “solving this problem is a big challenge, let us spin up a business to build autonomous tractors”. Even though NVIDIA will never get into the business of making autonomous agriculture equipment, they definitely want a piece of the pie, as more and more farming operations adopt autonomous equipment.

My current guess is that these venture investments from NVIDIA are less for venture returns, but more to understand how their products can be used for specific use cases. This will give them the data to make sure their chips are designed to handle the specific needs of agriculture autonomy or precision farming, when those capabilities scale in the future.

Infrastructure plays

Tech giants are better suited to do infrastructure plays. An infrastructure play requires the tech company to abstract out the common capabilities needed across a variety of use cases in a given industry or across industries, build out those common capabilities, and sell them to the various industries at a lower cost and a higher quality, than any company could have done on its own.

Every company out there does not need to build remote sensing capabilities. They can just license them from Google Earth Engine.

Every company out there does not need to build the capabilities to do advanced analytics with geospatial raster and vector data. They can just buy SageMaker from AWS or Fabric from Microsoft.

Every company out there does not need to build its own LLM model from scratch. They can just license ChatGPT or Gemini from Google or any of the open source models and use them as a starting point to build their solution.

Infrastructure plays well for tech companies as they can address the needs of a larger number of customers, without having to build end user applications.

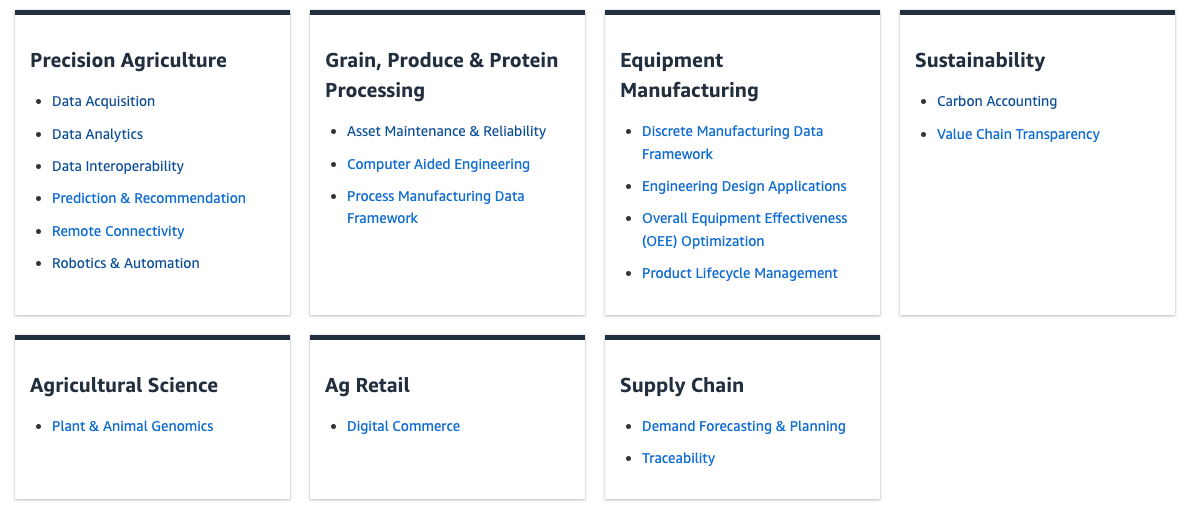

Amazon has launched industry specific capabilities as a solutions library across areas like precision agriculture, sustainability, ag retail, and supply chain among others. In the case of AWS though, the solutions library is from a sales and marketing standpoint, with Leaf Ag being one of the more prominent users of AWS capabilities.

My current guess is that AWS is not providing anything substantial which is tuned for agriculture, other than cloud computing infrastructure.

Image source: Solutions for Agriculture webpage from AWS

Google has helped companies like Unilever to build out some early versions of sustainability tracking and measurement within their supply chains (deforestation etc.), though I have not seen any data on how well it is working.

Building end user applications is a lot more challenging.

End application use cases

As one of these tech giants, if you are thinking of building out solutions for end user applications, it can be very challenging. You have to have a much deeper industry and domain knowledge, you need to have a strong understanding of go-to-market strategies which work within agriculture, and need to have the relationships to execute on your marketing, commercial and technology efforts.

Even if you are able to do it, the challenge of slower growth within the sector can make your return on investment calculation very challenging, when it is compared to other parts of your business.

So if you are thinking about going after end user specific use cases, you should think really hard and do it only and only if you can convince yourself that it will continue to open up newer and newer use cases at lower and lower R&D and GTM costs. This is a very hard calculus to make.

If these companies are going to think about making an existing use case marginally better, the ROI equation is very challenging.

If you are thinking about a slightly better model for weed detection, you should stay away from it.

If you are thinking about a slightly better model for crop identification using satellite imagery, you should stay away from it.

As my friend Dan Schulz always points out, it is better to define a new category than to try to make an existing product a little better.

For example, Google has invested billions of dollars in a new category called self-driving cars through Waymo. It leverages Google’s expertise in data collection, and machine learning to open up a new category of products. Having said that, the jury is still out on whether Waymo will be a large enough category defining business in the future or not.

Industry Partnerships

Industry partnerships is another way to showcase your capabilities and tap into large players for domain expertise, and access to a distribution network. Large agribusiness like Bayer and Land O’Lakes might be in a better position to move the needle on the end user application use cases.

Microsoft’s partnership with Bayer Crop Science and their Azure Data Manager capabilities is a good example of a tech + industry partnership to bring their unique strengths to the table.

Microsoft and Land O’Lakes announced a strategic alliance in 2020 with a focus on rural broadband, transforming ag with novel and emerging technologies, and the digitization of Land O’Lakes.

If these partnerships work well, they can be a great way for the tech companies to engage with large agribusinesses, get access to domain expertise, and build out infrastructure capabilities which are better attuned to the needs of the industry.

It might be easier for employees working on these initiatives to see the impact of their work, vs. working on infrastructure capabilities where you are one or more steps removed from the end user application.

So where can tech giants help?

The tech giants like Amazon, Microsoft, Google, and others do and can continue to provide a lot of value to the industry, through some of the approaches I have mentioned above - startup investments, infrastructure work, and industry partnerships.

The tech giants also help with innumerable programs around education, awareness, support for startup founders through accelerators, ventures studios, basic and applied research etc. There are other specific ways in which these companies can help.

For example, Amazon can help with supply chain and logistics expertise and tools, master data management, access to market data, especially in emerging economies, and internet connectivity in rural areas.

Microsoft can help with expanding their data sets and capabilities on Ag Data Manager, AI modeling tools and infrastructure, including for GenAI.

Google can help with payment infrastructure and access to Android, data processing and GenAI capabilities, and AI modeling infrastructure.

The economic variables, interest rate environment, and the agriculture industry business cycles might shift in the future, but I believe these principles will remain as long as these giants continue to be tech giants. What do you think?