Can a new breed of startups save AgTech?

Will AI-first startups have lower capital requirements?

Software is Feeding the World is entering a new phase with a paid tier.

Why am I doing this now?

I have been incredibly grateful to have your support over more than 170 editions, four years, 48 US states, and 74 countries. You have given me the privilege to be in your Inbox with in-depth analysis at the intersection of technology and agrifood.

You are agrifood professionals, investors, startup founders and employees, researchers, policy experts, students, and farmers. You want to be ahead of the curve by deeply understanding trends and innovations in the field.

We have discussed topics like markets and marketplaces, business models, investment and financing, sustainability, platforms, automation, AI, data management, scaling innovation, and many more.

As the AgriFood sector is going through rapid changes, it is even more important now to take a look at issues in depth from various perspectives, and evaluate how technology will make an impact. SFTW will be there to help you stay at the forefront of how the AgriFood industry is transforming, look at issues from different perspectives, evaluate business and investment opportunities, and make your organization more successful.

I will bring you the latest thoughtful analysis and valuable information that's timely and actionable.

Making these changes requires time and effort. Introducing a paid tier will help to take SFTW into this next phase. I hope you will continue to support SFTW in whichever way you can.

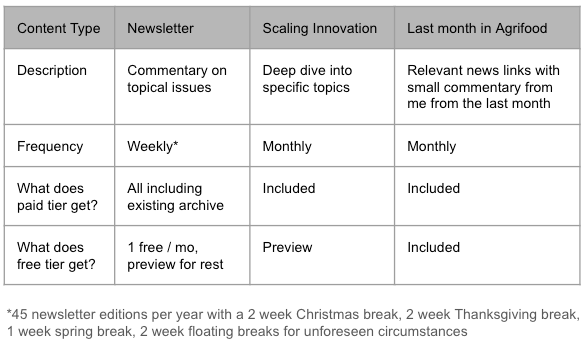

Here are a few additional details of what will be available in the free and paid tiers.

Pricing

Pricing

The pricing for the paid tier is $ 229 per year. For my early supporters, I'd like to thank you by offering a 15% discount for the next 30 days. The monthly subscription will be $ 23 per month.

Please reach out to me if you want a corporate discount for your company or are a current student.

I hope you will continue to support SFTW in the future, in whichever way you can.

A new breed of startups?

I was talking with a startup at the last AgTech Alchemy event in September.

The only engineer on their team gave me a demo. The startup (which has 3 employees) is building a tool for in field measurements targeted at researchers and field staff using a smartphone. It used the iPhone LIDAR sensor to get accurate size measurements. The application looked slick and well-done.

They built the application with just one engineer in a few weeks. The same application would have taken a team of 3-4 engineers working for a few months, if it was built 3-4 years ago.

This is the story now with AI for AI first startups.

The amount of capital needed to build initial technology solutions has reduced, due to advanced tooling for building ML models, vision based modeling capabilities using tools like Vertex AI from Google and others, and generative AI assistants like copilot to make writing code much more efficient. Writing code has become a lot more efficient. Good software engineering, systems design and architecture skills are still extremely important.

Due to this the initial capital required to build a technology product which requires coding has reduced.

Walt Duflock, Vice President for Innovation at the Western Grower’s Association made a similar point, at an annual event organized by Cal Poly’s BioResearch and Agriculture Engineering department. I am not repeating his exact words, but the gist of what he said.

Given how much more efficient it is to start a company focused on data and analytics, investors can put up smaller amounts of money in these startups, vs. putting larger sums of money in other areas in AgTech

{variable}-first companies

Everytime there is a big technology shift, companies started during the shift time-period take advantage and build products in a different way or create a new user experience.

In the last 15-20 years, we have seen three big shifts from a technology standpoint. Cloud, Mobile, and AI. There were companies which were cloud-first and took advantage of the ease of managing their technology infrastructure to reduce initial investments required to build products.

There were mobile-first companies, which took advantage of the mobile adoption to bring a different experience for users. Over the last few years, we have seen AI-first companies which are taking advantage of enhancements in AI and embedding AI in their products from day 1.

Cloud-first

Cloud made it easier for small technology startups to get going. You could rent out compute and storage, you didn’t have to buy servers, and with sophisticated cloud management tools, you spent more time on your core business and capabilities. You could scale the underlying infrastructure very quickly and provision servers and storage at the click of a button.

It was about making startups more efficient and pooling your IT management with an Amazon, Microsoft, or Google cloud account.

As early as 2011, cloud was being hailed as the fuel for the next entrepreneurial boom.

There was a time when launching a serious startup required serious capital. Seed money was required for hiring talent, marketing and promotion, office space, and for technology to make it all happen. The technology portion of the equation is suddenly diminishing, dramatically. Thanks to cloud computing and social networking resources, it now costs virtually pennies to secure and get the infrastructure needed up and running to get a new venture off the ground.

Cloud computing had an impact on the venture capital world. Harvard Business School (2017) talked about how AWS (Amazon Web Services) changed the way VC’s fund startups. (highlights by me)

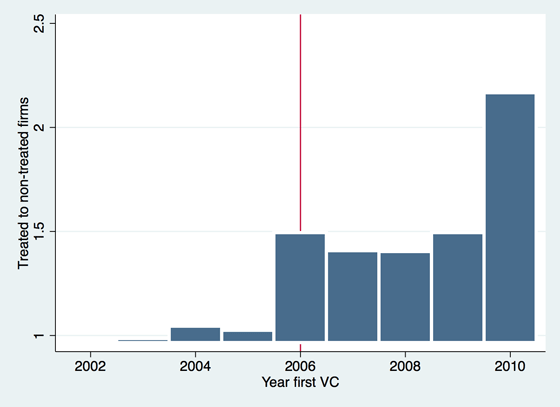

Starting companies is becoming so quick and cheap that venture capitalists have shifted strategy funding entrepreneurs. Now, more startups get backing—but they have to prove themselves in a hurry, according to research by Ramana Nanda and colleagues.

The researchers found that the number of startups receiving first-round funding increased substantially between 2006, when AWS was introduced, and 2010, especially for those firms that could most take advantage of cloud services. For the control group of companies in industries such as aerospace and medical devices, first-round funding increased from 350 to 450 firms, a rise of 30%. But for startups in the software and media industries that could make use of AWS, funding increased from 375 to 700 firms, a nearly 100% rise.

Image source: Ewens, Michael, Ramana Nanda, and Matthew Rhodes-Kropf. "Cost of Experimentation and the Evolution of Venture Capital." Harvard Business School Working Paper, No. 15-070, February 2015. (Revised March 2017, Forthcoming in the Journal of Financial Economics.)

Because VCs could write smaller checks, they funded a lot more startups, and the failure rate for those startups did go up, as the risk profile for those initial investments changed to be more risky. (highlights by me)

Of the firms that Nanda and his colleagues looked at over the period of 2002 to 2010, 43% failed before receiving a second round of funding. They found that failure rates increased after the introduction of cloud computing in 2006, implying that although money was being spread to more firms, many of them were failing before they received a second round of funding—a phenomenon that became known as the “Series A Crunch.”

In the past, you would be less likely to fund a long-shot bet because it would not be profitable. Now, because it’s so cheap to start companies, you can be willing to give more firms a try, and shut them down quickly if they don’t work out”

Mobile-first

The introduction of the iPhone and Android in the late 2000s, created a very different user experience. Consumers were on the go and the iPhone became the center of the computing universe for consumers, with your laptop, desktop, cars etc. becoming peripheral to your mobile device, with applications like ride-sharing, Amazon ordering, Netflix, and many more.

Image source: Breaking Smart by Venkatesh Rao

Before companies went mobile-first (or in some cases, mobile-only), they would build a web-experience and then after some time migrate it to mobile. Mobile-first (or mobile only) companies did not bother to build web-versions, as their user case was primarily or exclusively mobile.

For example, apps like Uber and WhatsApp made sense only for a mobile use case in the beginning, and so were launched as mobile only applications. Mobile-first or mobile-only companies could focus on the user experience, without having to spend the time and energy to build web applications.

AI-first

Over the last few years, more and more AI-first companies are coming into existence. With the advent of GenAI, many companies are trying to incorporate GenAI into their products, use it to improve internal efficiencies, and/or use GenAI to improve the efficiencies of building their technology product.

With GenAI, the cost of building a startup is lower. You can get to a product fairly quickly, assuming you are doing data and analytics, and you can get it out at a much lower cost. The startup I mentioned at the beginning of this edition provides some anecdotal evidence.

The consulting house Bain has come up with some numbers on estimated productivity gains from generative AI.

Image source: Zero-Based Redesign: The Key to Realizing Gen AI’s Cost Savings Potential

The chart above estimates 15-30% improvement in employee productivity on software engineering, which is one of the biggest costs for a technology company. Many of the efficiency improvements come from amplifying human abilities using gen AI. Companies which can rethink their workflows and processes in light of Generative AI can get the most benefits.

For example, when I highlighted the AI-first company Traive Finance last year,

Traive’s artificial intelligence models and their credit reporting using generative AI (for example, ChatGPT) is able to operate in a data sparse environment, establish credit risk in a variety of scenarios, and present the credit analysis report back to the lender sliced along many different dimensions.

Traive has been able to rethink their credit scoring and credit reporting process by incorporating AI into their product and process from day 1. They are able to surgically apply AI and GenAI where it makes the most sense.

For example, you could use GenAI to take on the mundane tasks and automate them, while allowing subject matter human experts to focus on more value-added tasks.

The questions we (and startups and other organizations) need to ask are whether we have a clear perspective on how organizations will evolve as GenAI’s capabilities advance, and whether we can rethink how workflows and processes can be more efficient with GenAI?

Can AI-first solve AgTech’s problem?

Over the last 18-24 months, we have seen startup funding dry-up in food and agriculture.

According to AgFunder,

Agrifoodtech startups have raised $7 billion across 427 deals so far in 2024, according to preliminary data from AgFunderNews’ parent company AgFunder. This is down in both dollar amount and deal count compared to H1 2023, which saw $8 billion across 934 deals.

2024 has been down compared to 2023, which itself has seen some of the lowest activity in the last few years.

Image source: EMERGING TECH RESEARCH from Pitchbook, Agtech Report, VC trends and emerging opportunities, Q4 2023

As Walt Duflock pointed out at CalPoly, will these AI startups provide a different funding approach for investors?

Will it allow them to invest in companies which are much more efficient, and are going after specific albeit smaller use cases? Can they get exits which are in the $ 50-100 million range, vs. looking for unicorn exits, with hopefully one or two becoming much bigger?

As it happened at the beginning of the cloud computing era, the failure rate on these startups might be higher, but it will allow investors to take more shots on goal, with some of them coming out with reasonable outcomes on the other side.

With potentially smaller investments required at seed stage, it will open up other alternative forms of investment from grants, farmer organizations as has been seen done quite effectively by the strawberry commission in California, sector VCs, and maybe even corporate VCs!

Phillip Guthrie from Australia made a similar point within the context of Australian agriculture, though it holds for other localized contexts as well. According to his article Rethinking AgTech,

I’d like to see more discussion around an alternative model that focuses on supporting smaller, regional AgTech companies that deliver practical, locally grounded innovations without the distraction of chasing international scalability. The aim should be to support these companies to become revenue positive and self-sustaining as quickly as possible, so they can continue to innovate, evolve and then work with those that have the potential to scale, albeit considering the impacts on our own agriculture sector.

It is important to point out that AI-first companies will be able to build products faster, but they will still have to do the hard work of defining the right problem to solve for the right customer.

They will still have to find efficient ways for sales, marketing, and distribution, which are unfortunately controlled by a small number of very large companies within agriculture.

Key take-aways

AI-first strategies are now shaping the current era, where companies use artificial intelligence to automate processes, improve decision-making, and provide personalized experiences. Each era builds on the previous one, with cloud enabling mobile innovation and both cloud and mobile providing the foundation for AI breakthroughs.

I believe as the economic condition improves over the next 18-24 months (barring any major geopolitical issues), more and more investors (including VCs) will fund a larger number of AI-first efficient startups with smaller check sizes. This might increase the failure rate of some of these startups in the short term, but I believe we will see more ideas get funded in early stages even in the AgriFood sector.

As a rational techno-optimist, I believe this will improve the rate of funding of innovative founders and companies, and innovation itself.

I would love to know what the investors and entrepreneurs think.