The tools are coming!

Thank you for being a supporter of SFTW! If you want to get access to all the paid content, I am offering a 15% discount for the annual subscription. The discount will expire by mid November.

I attended the FIRA USA 2024 in Woodland, California this year (though only for a couple of hours). For those of you who don’t know, FIRA is a premier agriculture robotics show. Given the significant labor challenges within the specialty crop segment, many of the agriculture robotics companies are targeting use cases in the specialty crop sector

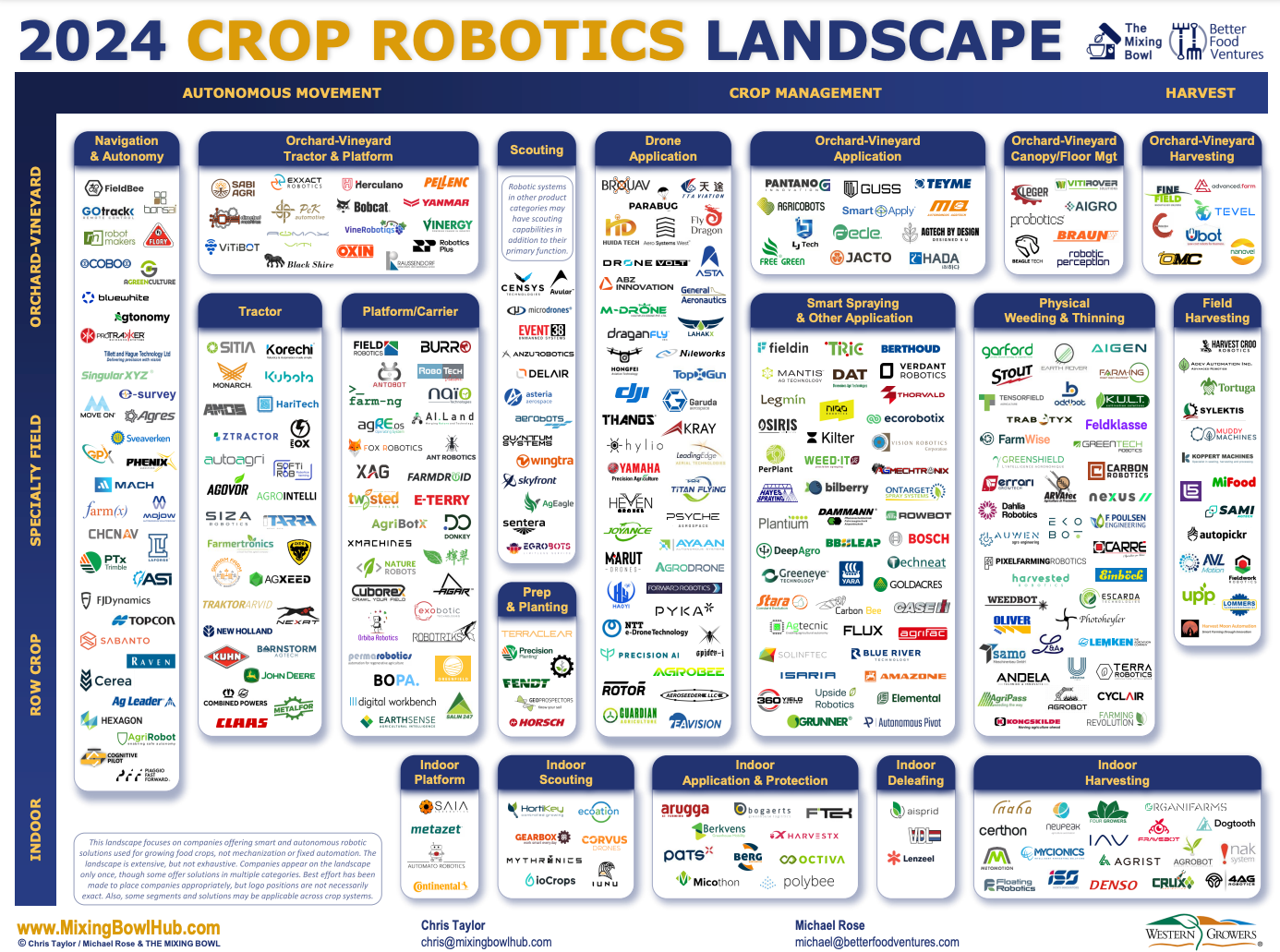

The number of crop robotics companies has increased by 40% from 2022 (250 companies) to 2024 (330 companies) based on the 2024 Crop Robotics Landscape published by The Mixing Bowl during FIRA 2024 in Woodland, California.

Funding for crop robotics companies has remained relatively stable in 2024 (H1 $ 399 million), compared to 2022 ($ 709 million) and 2023 ($ 751 million). Adoption has been slow but steady with rising labor costs, and the difficulty in finding skilled labor acting as tailwinds for the sector.

During my visit to FIRA USA 2025 in Woodland, California (albeit for a few hours only), I noticed some other signals which point to the relative strength of the agriculture robotics sector. My signals are related to companies providing tools and capabilities to other robotic companies to bring their solutions to market faster and at a lower cost.

Solinftec robot at FIRA 2024 in Woodland, CA (photo by Rhishi Pethe)

This week’s edition will talk about what those signals are, and what they mean.

But, let me first begin with my views on Carbon Robotics’ recent $ 70 million funding round.

Is there a risk of Carbon Robotics crowding out potential acquirers?

Carbon Robotics announced a $ 70 M raise to expand its laser weeding robot business at the beginning of the week at FIRA, with NVentures from NVIDIA re-upping their commitment from the last round. Laser application on weeds is a new mode of action, compared to using chemicals more efficiently or using mechanical weeding. As Walt Duflock concluded in his LinkedIn post, (highlights by me)

All of this is great news for Carbon Robotics – they continue to get investors attention and checkbooks by combining a strong leadership narrative in a hot space (AgTech automation) while delivering the results. It is also good news for other startups in the space, helping to prove the thesis that hardware appliances that do one thing really well are teeing up downstream revenue streams by leveraging all of the data to do that one function to help the grower do other things, some of which will create annual recurring revenue. And it is great news for the space if Carbon gets to an exit.

Agtonomy founder and CEO, Tim Bucher, talked about the importance of partnerships with OEMs for ag robotics startups. (highlights be me)

For autonomy to bring value to agriculture today, we must think about tractors and farm tools like farmers do. But we must do so collaboratively with the brands farmers already know and trust. This is how the entire industry can move together, faster, at the pace farmers need.

Speaking on behalf of farmers, we want on-farm robotics now. Speaking on behalf of startups, we can’t — and shouldn’t — go it alone.

It means one of the only ways for a robotics startup to exit is to get acquired by another larger OEM. (assuming an IPO is challenging in the next few years). A startup has to strike a fine balance between providing a use case with favorable economics for the customer, different partners, and you as a business, and how attractive does it make the startup to a potential acquirer.

You need to be able to find other use cases, and your technology needs to transfer easily to those new use cases. Otherwise, you will be limited in terms of how much you can grow your revenue to.

If Carbon Robotics is able to deliver on its growth, its valuation will continue to go up and it will be more and more difficult for an existing OEM to acquire them.

If you raise a ton of capital, an acquisition becomes challenging because the check size might get too big for an existing OEM. For example, Carbon Robotics' valuation is rumored to be around $ 300 million. You need to raise enough money to help you get to the next growth phase, but not so much that you become a difficult acquisition target for existing incumbents. This is especially true in agriculture, where there are only a handful of incumbents who can pull off hundreds of millions of dollars or a billion dollar acquisition.

If you look at the acquisition exits done by robotics companies over the last few years, there are only a handful of acquisitions which are north of a billion dollars.

In the year prior to our 2022 Landscape there were a number of M&A deals in the sector with John Deere buying Bear Flag Robotics and Case New Holland spending $2.1 billion for Raven Industries. Since that time AGCO and Trimble closed on their joint venture, PTx Trimble, that focuses on precision ag hardware and software and Kubota North America acquired Bloomfield Robotics for their AI-driven plant imaging technology targeting specialty crops.

Another consideration for an OEM is whether they should acquire a company doing chemical based (or mechanical) precision applications or look at a laser weeding company like Carbon Robotics. Will the acquisition bring in new customers, and new capabilities?

They will have to look for synergies for their manufacturing and supply chains, when it comes to the bill of materials for the said robotics company. Can they leverage their existing supply chains and manufacturing capabilities to do it efficiently and economically? A laser weeding robot might not fit very well with their existing manufacturing capacity and supply chains.

We are seeing this in the EV category for cars. EV supply chains are very different than ICE gas-powered vehicle supply chains. It is one of the reasons why European car manufacturers are struggling, given their supply chains are optimized for gas-powered cars, with supplier relationships which go back generations.

It will require a big effort on the distribution and service side in terms of training for sales and support staff, parts availability, and scaling of operations. An OEM will consider all of these questions, before they decide to sign a check worth hundreds of millions of dollars or more.

I am absolutely enthused about many of the crop robotics companies getting new funding and customer traction, because the farmers and growers, and the service providers need these technologies at an economically viable price.

Having said that, it is not clear if there is a danger of some of these companies becoming too big to be acquired due to the unique nature of the agriculture OEM market. What do you think?

The tools are coming

Discussion topic: What does the presence of “tools” companies means for the maturity of the crop robotics market?

The Mixing Bowl released their 2024 Crop Robotics landscape report titled “The Expanding 2024 Crop Robotics Landscape, Navigating To Commercialization”

According to the Mixing Bowl report,

While adoption seems to be happening incrementally, the Western Growers Association sees crop robotics starting to achieve product-market fit and provide value to customers in the specialty crop sector. In their second annual Specialty Crop Automation Report, upwards of 70% of growers surveyed said they had invested in automation (not only robotic) during 2022 with weeding being of particular focus.

In 2024, many agriculture robotics companies raised a decent amount of money. Monarch Tractor: $ 133 million, Carbon Robotics: $70 million, Bluewhite: $ 39 million, Burro: $24 million, and Greeneye: $ 20 million, among others.

Crop robotics companies are working on addressing a wide variety of use cases, cropping systems and crop types. At FIRA 2024 I did feel the technology has improved quite a bit compared to my experience at FIRA in Salinas in 2023.

Before we go into the tools discussion, I want to go back to what Walt Duflock (who played a significant role in creating the Mixing Bowl report) had written back in 2022 around standardization in crop robotics. (highlights by me)

Standardization in specialty crop AgTech automation is increasing, and that is good news for startups and growers.

The cost for an AgTech startup to build their initial product and get it into market are among the highest for any tech segment, and can frequently run $50–100M to get a 1.0 product completed and into market with partners or direct sales teams that can sell and support them so they can get to global scale. Roughly 2/3 of the eventual number is the initial product effort, including both early R&D and Product Development, and the other 1/3 is spent on getting the product into market and into customer fields, often in multiple markets (a requirement because many growers need multiple growing regions to support 12-month product availability).

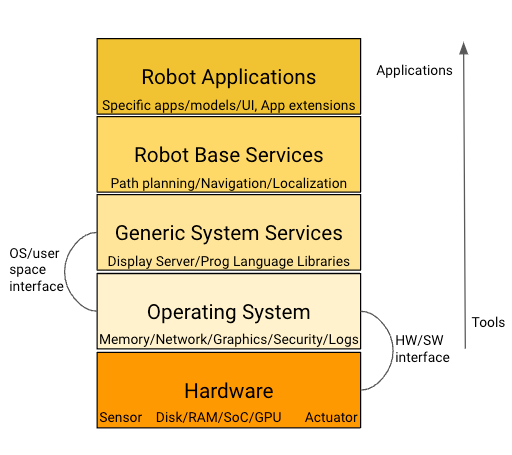

In edition 123. Let a thousand robots actuate (Oct 2022), I had focused on the technology stack of capabilities needed to deliver a valuable robotic solution to the end user. It is very challenging for one company to be able to build all the capabilities in the stack.

Agriculture Robot Technology Stack Layers. Image courtesy: Rhishi Pethe (Software is Feeding the World)

When companies come into a new sector, they have to build the entire stack to deliver a use case for their customer. Applications always come before tools and platforms. Exceptions to this rule happen when some of the lower down the stack capabilities have been built for other industries and then can translate relatively easily to a new application like agriculture robotics. (other notable examples are Windows OS, iOS, ChatGPT etc.)

For agriculture robotics, some of the lower level hardware is more easily available as robotics as a whole is a mature technology, when you think about other industries like manufacturing, and logistics. Right above are robotic operating systems (ROS), which are also fairly mature and most robotics companies in agriculture today can rely on standard libraries, security protocols logs etc.

The first robot specific layer is the robot base libraries & services layer, as it contains functionality independent from concrete robot applications. It provides generic capabilities like path planning, navigation, and localization. Once you go above that, agriculture specific capabilities become more important.

The top most layer is the most application specific. This is the layer that defines what the robot is actually doing, i.e. picking a strawberry or an apple.

Tools and capabilities

In edition 112. Agriculture Robotics is difficult AF, I had written about robotic platforms, which make building robotic applications a bit easier and cheaper.

Robot platforms provide generic robotic capabilities for hardware and software, without building application specific capabilities. Building robot platforms is equally hard, as your customer is not the end user of a particular application but the application developer for that application.

Platforms are incredibly powerful as they provide the tools to rapidly build other applications. Imagine how difficult (and inefficient) it would be, if to make accounting software, you had to design and build computer hardware, and an operating system to run on the hardware, before you got to building your accounting software.

During FIRA 2024, it was good to see many companies providing one or more layers on the technology capability stack for delivering a crop robotics application. These capability companies come along only if they believe they will have enough end-user robotics companies who will use their tools. These capability companies will get funded only if their investors believe there are other companies out there who will use the tool chains and capabilities to deliver an end-user use case.

The purpose of tools is to enable building applications at a faster pace and a lower cost, as the costs are amortized across multiple startups and organizations. The presence of tools companies is a good signal that there is enough potential demand from robotics companies. There will be enough robotics companies, if they believe they can solve a particular end user use case,

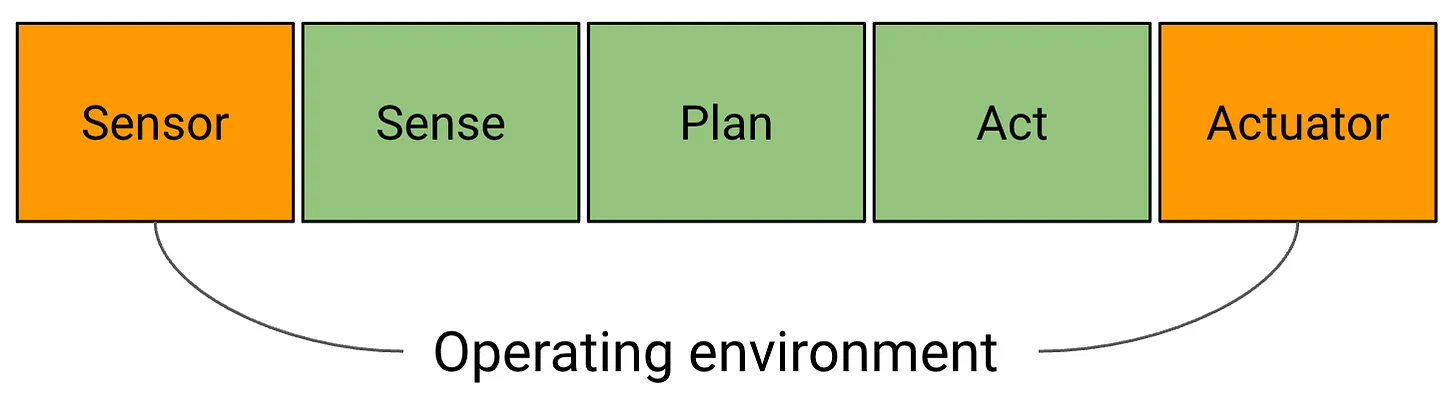

Let us look at what a robot does based on the task it needs to accomplish and what are the hardware and software components needed to accomplish those tasks.

Vision sensor packages

The sensor and the actuator are the hardware components of the robot, For reference, a sensor could be a camera or a vision system (in the strawberry and apple examples above). The actuator is the hardware component performing an action (in the strawberry example, it is the robotic arm with scissors to cut the stem of the strawberry).

Agriculture robot operating environment capabilities for end use product delivery in real time environments

For example, some robotics companies use generic off-the shelf cameras for vision systems for robots, for certain use cases. The operating environment of agriculture is a bit more challenging than a well defined environment in a manufacturing facility. In open agriculture, robots have to deal with dust, dirt, different lighting conditions, higher operating speeds in commodity row crops, and any vision based AI system has to capture good quality images to build high performing models.

Designing cameras which work for your use case is not trivial, as you have to worry about types of camera lens (rolling or global), power requirements for lights to give consistent lighting for good quality images, the right type of processor to run AI models on the edge etc.

You have to think about camera angles, allowable speeds, depth of view, speed of the equipment, accuracy and precision needed for your operation (weeding, picking, harvesting etc.)

Stereo Labs specializes in designing cameras for specific use cases based on the operating conditions and the performance needs. This is a specialized skill set, and it can help robotics companies get the right set of cameras to capture data, build models, and deploy them on their robots. A robotic company will have to work in close collaboration with an entity like Stereo Labs to get a camera designed for their set of use cases.

One of the challenges for a camera system design company is whether the ag robotics market is big enough or not. It was not clear how big this market would be a few years ago, but the entry of specialized camera design companies tells you they believe the camera market in agriculture (and by definition the robotics market in agriculture is going to be big).

Another Kiwi startup Cropsy, which has done many use cases in vineyards, designs a camera unit with lights integrated in it to enable different use cases, especially in indoor or slightly less challenging environments. Their unit looks like a shoe box with a vision camera in the middle, and multiple lights around it to give a consistent lighting environment to capture the best quality images possible. These shoe box units can be used in different environments to collect data for building and deploying models.

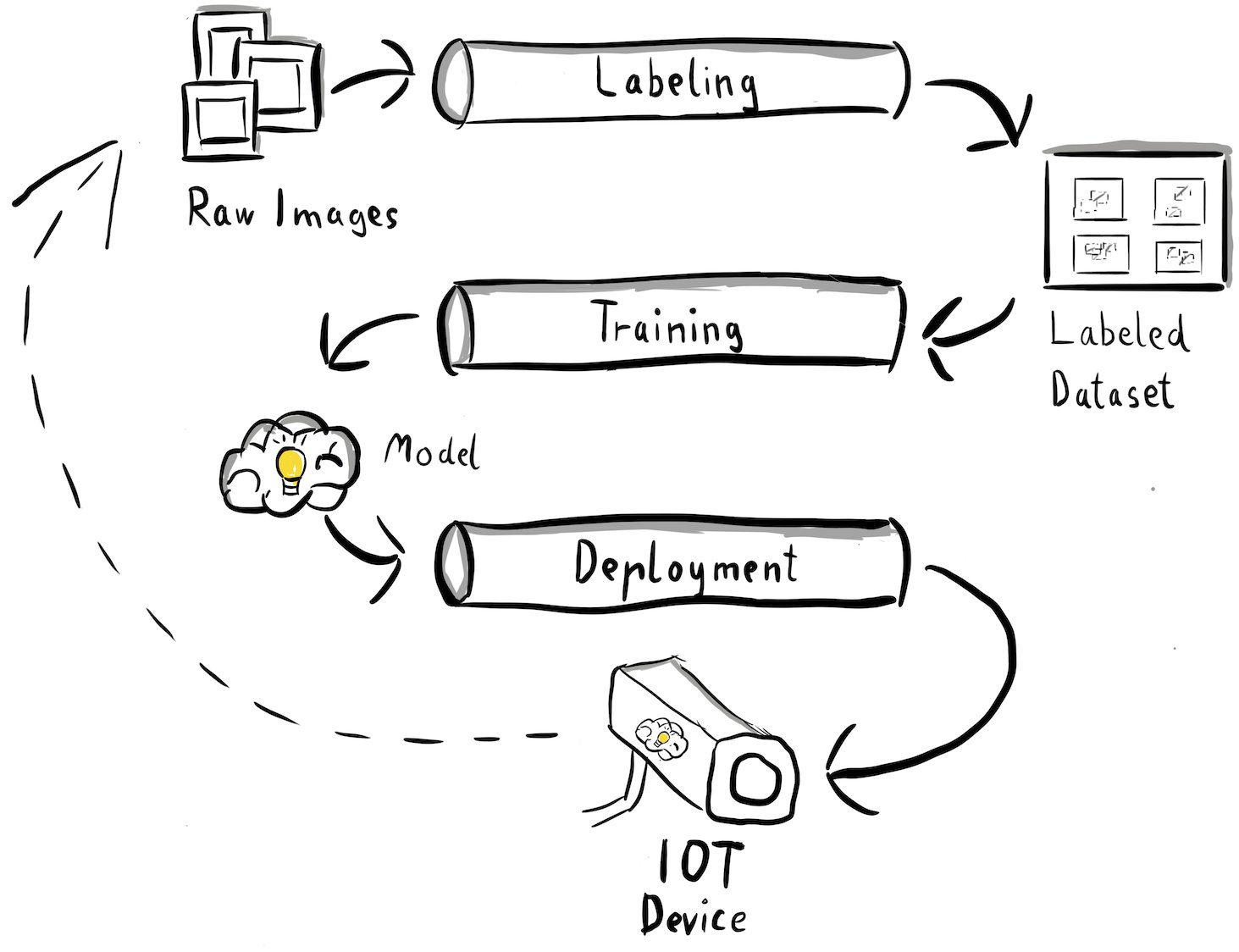

Vision model building and model deployment

Even if you had the right set of cameras and processors, building an AI model requires collection of high quality images, annotating them accurately, and building models which can work in a variety of relevant conditions.

The tools and infrastructure needed to do this efficiently and correctly are not trivial. You need technology expertise to run different data and machine learning pipelines, you need the domain expertise to accurately label a representative set of images, and you need the tools to continuously update your models to make them work correctly.

There are few companies who can do this well, with Farmwise being a good example of having spent a lot of time on building an MLOps team and infrastructure which allows them to add new crops and use cases relatively easily.

Robovision, which was present at FIRA 2024, has been around for 10 years. They have enabled use cases in different industries, including horticulture. They have built significant expertise in tulip farming and as part of the process have built expertise and tools to help a 3rd party to build and deploy vision based AI models efficiently.

They recently raised $ 42 million from a variety of EU and US based investors to push for expansion in the US market. Their tool chain provides labeling tools for annotation of images, annotator rating and quality control, segmentation and objection detection, which benefits from their experience of having worked with different types of crops over the years.

A robotics company can use their tools to build and deploy vision based models efficiently, without having to build all those tools and workflows in house. The robotics company has to provide the high quality correctly captured images to build those models, which is again not trivial.

The challenge for companies like Robovision is that vision based machine learning tools have matured significantly. Tech giants like Google, Amazon, and Microsoft provide these tools, along with a whole range of other capabilities for startups. These tech giants obviously do not have the agriculture expertise needed to build those models.

For example, Google’s Vision AI suite of tools provides many of these services, so does AWS with special tools needed to deploy models on the edge. But overall it is great that companies like Robovision exist, and are willing to provide the tools required by other robotics companies to build against specific use cases.

Image source: AWS website to build MLOps tools for vision based systems

Data collection and autonomy

There is a strong need to collect vision data in ag robotics. The data collection process to build robust AI models is a big challenge. Companies often struggle to get the right quality and quantify data to help them build AI models in a consistent fashion. We have already looked at sensor package companies like Stereo Labs and sensor package solutions like Cropsy. But the sensor package needs to be mounted on a piece of equipment to traverse the field and collect data under the right conditions.

For example, the camera has to be maintained at a certain height and angle, while the equipment travels at or below a certain speed. A company like farm-ng can provide inexpensive and autonomous form factors to collect data with confidence, and reliability. Today many companies like Farmwise, and others use farm-ng robots for consistent and high quality data collection for building their vision models.

Existing equipment integration

If you are going to integrate with an existing piece of equipment, it is the interface with the existing hardware (Go back to Tim Bucher, Agronomy’s comments). Given the wide variety of different equipment types, brands, and interface types, it is not trivial to interface with other equipment manufacturers.

For example, if you have designed a vision system to detect weeds in real time and then actuate a sprayer in real time to spray weeds only, your system has to send signals to the spraying hardware to turn it on and off at the right moment.

These interfaces are varied and not trivial, though the industry has fared well over the last few years with standardization like ISO11783, J1939 etc that allow systems to integrate plus higher level formats like TIM and CANBUS that people can develop against. There are proprietary system integrations which can be challenging and are custom projects.

Hexagon has been around for quite some time, and they have spent time making it easy to interface with different equipment providers. If you are a robotics startup, which needs to interface with an existing piece of equipment, you can use the services of a Hexagon to do so.

Autonomy kits and fleet management software

There are other examples like Sabanto, which has been around for some time. Sabanto provides an aftermarket autonomy toolkit which can make an existing piece of non-autonomous equipment to be autonomous. Agtonomy provides fleet management software for your agriculture vehicle fleets.

There are many such examples of technology companies, which provide a slice of the overall technology stack needed to deliver a full crop robotics solution.

These technology companies are making a bet that there are a large enough number of crop robotics companies who will need their expertise and help, and they can get it from the technology company at a lower cost compared to building it on its own.

Key takeaways

- There are many ways to track the growth and health of a particular industry segment, for example crop robotics.

- Venture capital funding and customer traction are very strong indicators of revenue growth potential and confidence.

- The presence of tools companies help startups and other agribusinesses build, deploy, and go-to-market cheaper and faster. This is a very good signal of the potential health of the industry, as the tools company has a hypothesis about providing horizontal tools to other companies and making it a viable business.