Xin Yi Lim: Costco meets Disney at Pinduoduo

Crazy growth in China

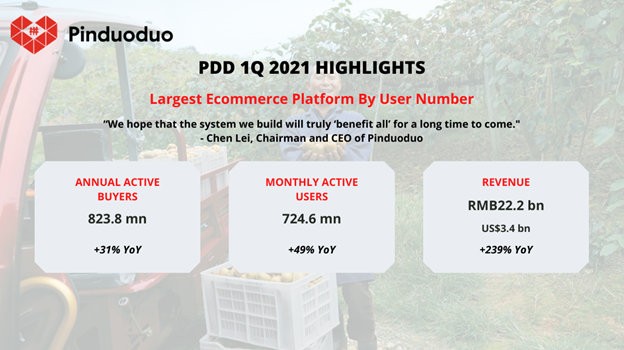

Today’s conversation features Xin Yi Lim, Executive Director, Sustainability and Agriculture Impact at Pinduoduo (PDD). Pinduoduo is an e-commerce retailer in China which focuses on agricultural products, and has shown a mind-boggling growth trajectory. PDD describes itself as “Costco meets Disney.” It was founded in 2015, IPO'd in 2018, and has 800 million (!!!) active customers in China as of Q1 2021.

Xin Yi and I had a conversation a few weeks ago. We touched on the origins of PDD, their experimentation with different business models, PDD’s laser focus on the consumer experience, how to create and manage two-sided networks, PDD’s impact on farming practices in China, and how it impacts sustainability. Towards the end of the conversation, we explore some of Xin Yi’s inspiration. This conversation also includes additional sources of information about PDD, their live streams, farmer training programs etc. PDD and Xin Yi’s work is a great example of how to be demand- and consumer-driven, and how to propagate preferences upstream.

Origins of PDD: Network effects and flywheels

Rhishi Pethe: You've lived and traveled all over the world. How did you end up with this role with PDD?

Xin Yi Lim: After university I worked in investments for the Singapore sovereign wealth fund (GIC). I covered a wide range of different industries, before landing at technology. I spent the longest time looking at the internet and media sectors while I was at GIC, with a focus on developed markets like the US and Europe.

I covered the Chinese giants, like Alibaba as well. I enjoy learning and connecting the dots across different companies, across different industries.

Working as a public equity analyst is to be behind the curve. By the time you hear it, somebody has already formulated a business plan to announce it to the public. I wanted to be closer to the action and get more upstream. I got to hear about Pinduoduo when they were listing. I thought I knew all about China e-commerce. Here was a brand new company, started in 2015 and going public in 2018. As I took a closer look, I wanted to immerse myself and see the situation on the ground. I was increasingly convinced that China had beat the US when it comes to the internet, for example the prevalence of mobile payments starting from 2016.

Rhishi Pethe: How would you describe PDD to someone who is not familiar with China?

Xin Yi Lim: We are the largest agriculture platform in China. Our goal is to become the world's largest agriculture and grocery platform. We are a third-party marketplace, similar to Amazon’s. We list products by different stores and merchants. Products are shipped directly from the merchant to the consumer.

We were founded when the mobile internet was taking off. It influenced how the platform was designed. We are mobile only. We saw the trend of everybody with a smartphone and anticipated that the offline and online world is going to be interwoven. The way people shop is going to be different.

It's no longer a PC era. When something triggers your fancy, you open an app and make the purchase on the spot. It has to be intuitive. It has to be seamless. It has to be interactive and fun. Even when you're not actively thinking about buying, you might open up the app to have a look. It ties into our vision of building an online Costco plus Disney.

We're the only major internet company with a mobile-only experience. On our platform, you can buy all categories of goods. Agriculture is a key focus area for us. In 2020, we sold about $42 billion (2019: $ 20 billion) worth of agricultural products. The total agriculture exposure is about 16% of our total gross merchandise value. You can buy directly from farmers and you get to enjoy more savings, while doing it in a fun and interactive manner.

Packing: Image provided by Xinyi Lim

Rhishi Pethe: Why have you been so successful, when you had powerful and entrenched platforms like Alibaba. It is a two sided market with sellers and buyers. How did you get a network effect?

Xin Yi Lim: Our success comes from a singular focus on what users want. We work hard to solve problems in the best possible manner in the mobile era, with more savings and more fun. In 2015, no marketplace was focused on agricultural products. We focussed on agricultural products. The right idea at the right place at the right time, coupled with excellent execution were the key components to our success.

In China in 2015, e-commerce had been around for a while, with a decade of investments in logistics. It brought the price per parcel down. Along with improving physical connectivity, everyone who was an internet user had AliPay, WeChat Pay etc. People were connecting with their friends and family via social networks. It helped to spark the ease of sharing and communication.

Agricultural products are not being well served. The penetration rate is in mid-single digits versus 25-30% for the wider industry. Everybody consumes agricultural products. We estimate it's about a $1.2 trillion market in China alone.

We are in a new era of shopping experience for people who are connected by smartphones. They are connected to their social network by mobile apps. When they are on the go, they want easy access to products in a fast and interactive fashion. The user experience was designed as a recommendation feed, so it pushes products to people instead of you having to have a specific idea.

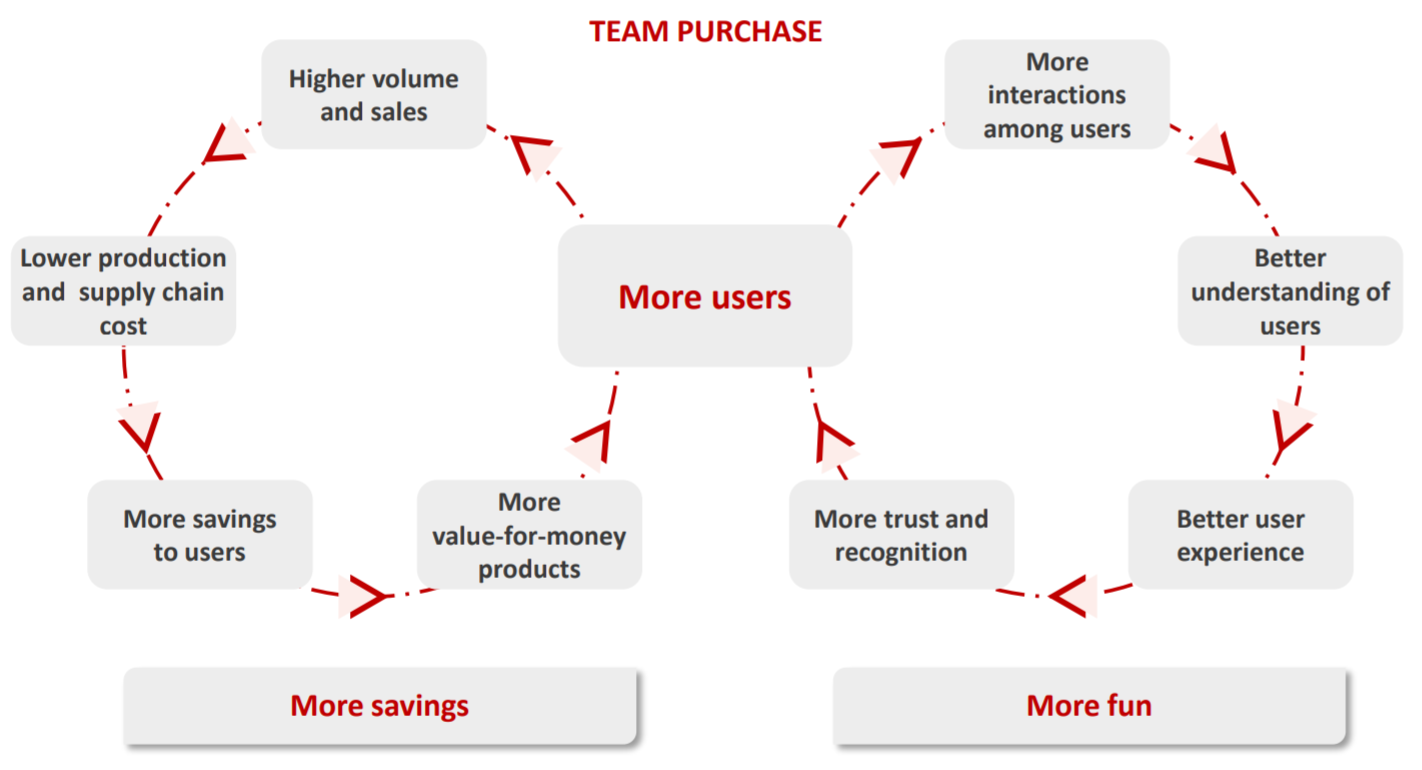

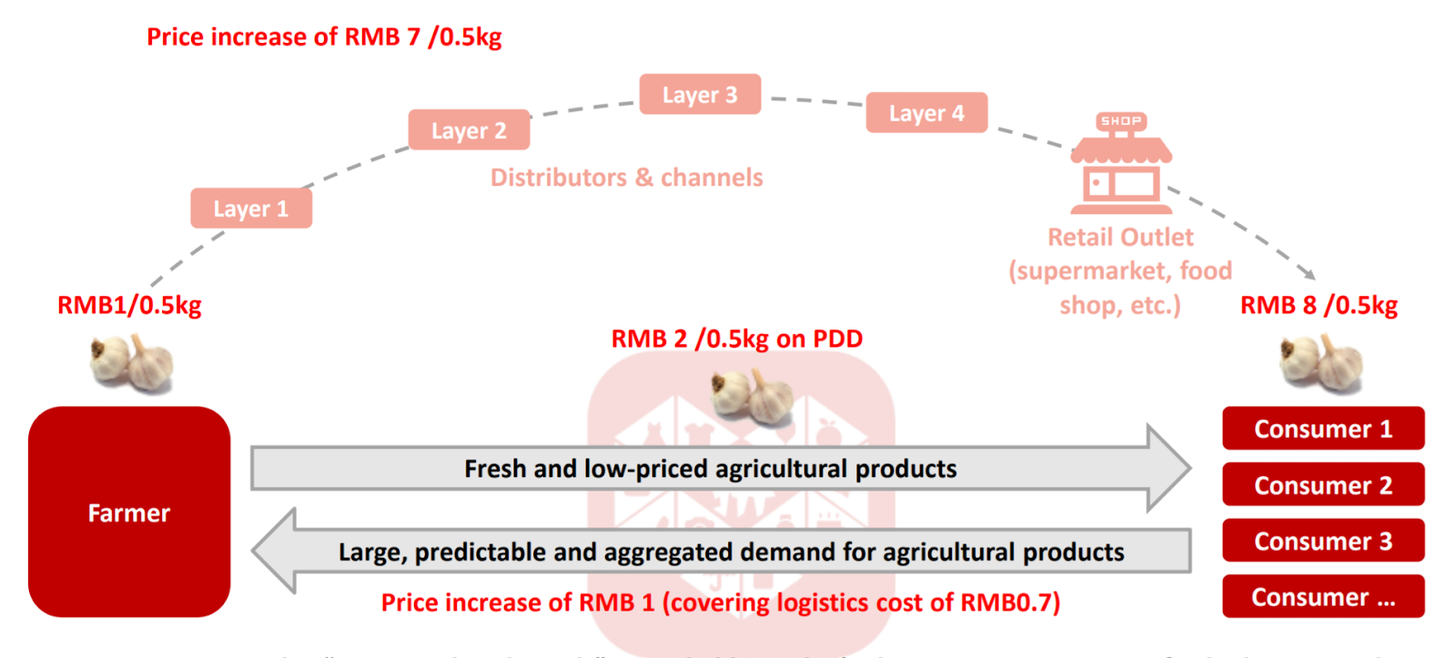

The team purchase is a critical piece of the puzzle. The team helps aggregate demand, which is especially important for agricultural products, because they are perishable. It is important for the farmer to have reassurance to move a large volume in a short period of time.

The farmer or the merchant can set the price themselves. There are two prices for a listing. Let's say the regular retail price for a box of apples is 15 RMB (1 USD is roughly between 6 and 7 RMB) and the farmer sets the team price of 12 RMB for the same box of apples. It is a meaningful discount. If you wish to form a team purchase, you have a 24 hour window to do it. You reach out to your friends, specifically those whom you think are more likely to convert. Now instead of two orders individually going to two merchants at different points at time, I have two orders going to one merchant. The merchant has visibility into how much volume is going to move. It gives merchants the leeway to price products at an attractive price.

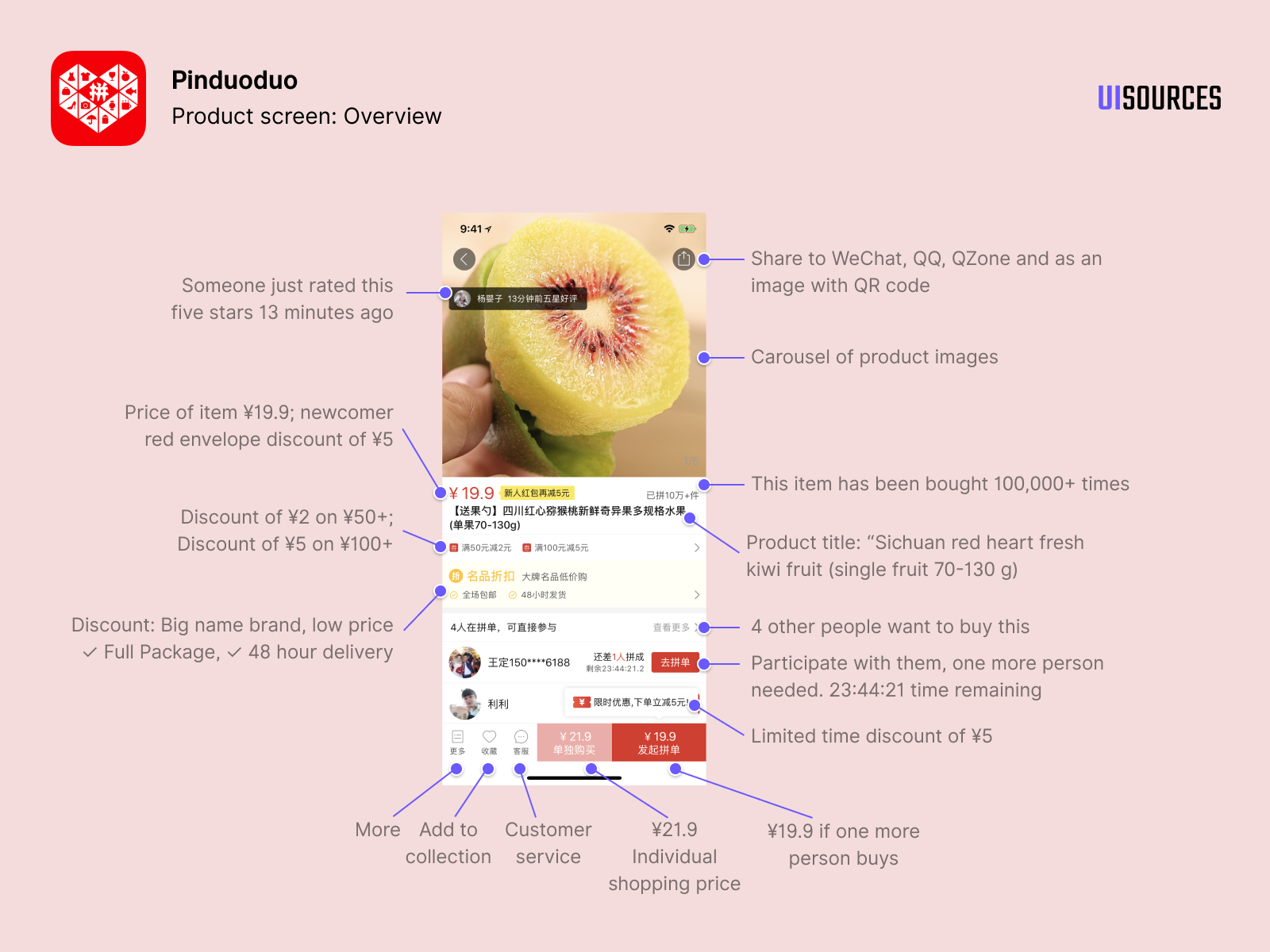

From UI sources

People will come and browse frequently. As they convert, it naturally drives more traffic, and more sales. More merchants want to sell or the existing merchants want to sell more on the platform.

We are driving a virtuous cycle. We have 824 million users, who bought something from us in the last 12 months. We have a very engaged user base, with the average monthly active user base at 90% ratio.

Rhishi Pethe: The timing for PDD was important. You didn’t have to spend any marketing dollars to educate people or build confidence in mobile commerce. China had the mobile payment infrastructure. Can someone start a company like this today?

Xin Yi Lim: We have seen other companies try to adopt the team purchase function. They thought “It worked for PDD. Let me put games in my app and it will be fun.” But there is a gap between just copying a feature and actually capturing the spirit. The Chinese internet industry is very competitive.

People are innovating around the form factor or the function. For instance, we launched an extension of our service in August last year with groceries. People come in on specific verticals or try to innovate on the model itself but we haven't seen a significant replication of a full service, general purpose, e-commerce platform.

Our peers in the e-commerce space have their value proposition. For instance, JD has electronics. Our focus from the get-go was, “Let's give consumers what they want.” It has led us down a different path.

First-Party or Third-Party model?

Rhishi Pethe: You mentioned your own personal philosophy of learning. In the context of PDD in the last 6 six years, you must have run experiments to see what works and what doesn’t. Can you talk about some examples, where PDD thought an idea might work but it didn’t?

Xin Yi Lim: We have experimented with a first-party model and a third-party business model.

The benefit of a first-party model is much tighter control over quality. We had a company called Pin Hao Huo. It was a first party business model. We didn't know how fast the business might grow or to anticipate surges in ordering.

The system was basic. One memorable summer we got overwhelmed by orders for lychees. We had a good promotion on it. It performed way better than we expected. We were overwhelmed by too many orders, and some of the shortfalls came into view. We were constrained by our own manpower. Your warehouse has limited capacity. if you can't do the packing in time, the product goes bad. It was a painful lesson. We realized the system doesn't scale. We thought a move to a third party marketplace system will allow us to scale better.

With a two-sided marketplace, you have to convince merchants of your scale, where it matters. In the fruit category and fresh produce, we got to scale in a short period of time. The merchants were willing to sell on the platform because we got a big user base.

More savings, more fun flywheel

We have designed checks and balances to ensure that not only are consumer rights protected, but the merchants also have a good selling experience.

We were surprised by how relevant team purchase was for agricultural products. Initially we thought of it as aggregating demand. It can help us get to scale in a short time. We were able to address over supply or imbalances, when we had the COVID-19 lockdowns. It was a good demonstration of how “team purchase” can move the needle. It can determine whether the farmer makes a complete loss or is able to sell some of his/her crops.

Rhishi Pethe: By definition, in a first-party model, you have more control over the quality of the product, and experience. How do you maintain the quality of your suppliers, as well as the logistics network? How do you ensure a good experience for your customer and enhance your brand promise?

Xin Yi Lim: We're a consumer focused platform. We have to protect the consumer experience. We have 8 million merchants and 800 million consumers on our platform. We have the right rules, and system in place. We were market leaders in terms of establishing a penalty system for counterfeits, defective products, or not meeting service standards. If there is a violation, we draw on merchant deposits or money sitting in their account with us to compensate the consumer.

From Pinduoduo 1Q 2021 earnings report

It is a process to align merchant incentives with ours, which is to protect the consumers and give them a good experience. Each merchant has a quality score. When a consumer receives a product, we often prompt them to leave a review. You can rate the merchant based on a couple of traits, for example, timeliness, product quality, customer service etc. You can write a review, you can take a video, you can take a photo.

The merchant quality score influences the visibility of that merchant's products or their store to consumers. If a lot of people leave bad reviews, the merchant has some quality control issues. If someone is looking for apples, it is not in PDD’s interest to show the lousy apple merchant. They will gradually get weeded out by the system.

Consumer before merchant

Rhishi Pethe: When I used to work at Amazon many years back, Amazon ranked suppliers based on their performance. They could extend working capital merchants, to help them expand their business, or provide additional help or training programs. Do you provide any support to your merchants?

Xin Yi Lim: We don’t do financing. We have a focus on training. On agricultural products, you are working with farmers who haven’t had the experience of selling produce online. We will continue to invest, and educate them on running an ecommerce business. We have live streaming and the curriculum is constantly evolving. The training is rich and is available online. We have offline courses, where we partner with local governments or other institutes. These courses will have an agronomic component. We work with China Academy of Engineering or agricultural universities. It helps farmers farm better.

When we look at the benefits to consumers, they enjoy the closer connection to farmers. A live stream from a farm gives them product quality assurance. They feel a bit more trustworthy. With smartphone penetration, and digital banking, there are many avenues for people to take out loans for their business.

We are focusing on questions like, “Can we deliver more value to our consumer? Can it be uniquely delivered by us?”

We work with local governments. We work with cooperatives to establish trial pilot farms. We test for responses to productivity based on inputs, for example irrigation. We give the farmer visibility to the end market.

Rhishi Pethe: PDD is a Cinderella story. Every business faces challenges. What keeps you up at night?

Xin Yi Lim: We worry about not being able to meet consumers' needs. Colin laid this out in his first shareholders letter.

“I hope our team wakes up feeling anxious every day. Never because of share price volatilities, but because of their constant fear of users departing, if we are unable to anticipate and meet users' changing needs.”

We don't spend a lot of time looking at our competitors. We focus on the consumer needs. The high engagement proves the user experience delivers more saving and more fun. They don’t find it elsewhere and so they want to keep coming back to PDD to shop. It is the ability to anticipate user demand, and be able to shift quickly.

Tea live stream: Image provided by Xinyi Lim

Rhishi Pethe: I want to know more about the company. What is the company culture of PDD like? Who are the people who work there, and how do they think about these problems?

Xin Yi Lim: We have over 6,000 employees. It's a young company (median age 27), with high performing, bright people. About two thirds of the employee base are engineers. We have a strong focus on technology and innovation at the company. We are guided by the three core principles.

They are 1. People first 2. More open 3. Benefit All

Putting people first comes down to focusing on the customer. It is about the spirit of never resting on our laurels. We are constantly thinking “What can we do to help people and how can we do it better?”

Let us take the example of grocery. We did a lot of research on it. When we finally decided to execute on it, we moved quickly, to roll it out to test, to get feedback from consumers, and to iterate and improve our product offering. Because we started in 2015, we always have a bit of a feeling of being an underdog, albeit a hungry underdog. We have committed to work with other partners, for example third party logistics players to learn from each other. At the end of the day, it translates to greater industry momentum.

If you left it to farmers, you wouldn’t get much of a result because they are too fragmented. If you try to push it entirely from the top, it doesn’t percolate all the way. You need to have a creative mix.

When it comes to the societal impact, we encourage our staff to think about it as well. Every year we put out an agriculture report, to talk about how many farmers we have helped, how many are below the poverty line. In our day-to-day lives, we are heartened by how our work can improve people's lives. For our young staff especially, it is motivating to feel you can achieve impact early in your career.

How is PDD making agriculture more sustainable?

Rhishi Pethe: How are you making agriculture more sustainable?

Xin Yi Lim: What we have done in China within the agricultural sector, is unique. We are starting downstream, but we're not stopping there. When we first started with a warehouse and a first party model, we internalized how inefficient the agriculture sector was. We have been thinking about how we can improve the efficiency and productivity of the sector. If farming practices don’t change, and productivity is not improved, the declining workforce will cause a problem.

As we scale, we are able to feed what consumers want upstream. Now the producers have a better sense of the people buying their products, and the products they look for. It can influence what they decide to grow, or how they market products. It reduces wastage.

The other layer is around human capital development. You need to have people who can lead the farming community. We cannot be with every single farmer upstream. The new farmers we train are younger and local. We have trained about a hundred thousand. They've gone to work in big cities and understand e-commerce. They can get the trust of farmers and spread the information upstream. They can work with the farmers to help them make changes, or market their products differently. We are able to influence the mid-stream as well, for example, tell the logistics providers how to stage it.

We are working on some patents around cold-chain logistics, to reduce the time products spend in trucks. It helps us reduce our carbon footprint. We want to make better utilization of resources because the cold chain is not as developed. In China, the capacity is constrained so how can we make smarter use of this capacity?

We started a smart agri-competition last year, to demonstrate to farmers the potential impacts of technology and how it can benefit them in a tangible way. The AI /Machine Learning team growing the strawberries remotely were able to grow three times as many strawberries, by volume, compared to traditional methods. The ROI was 76% higher. It was so impactful that before the competition ended, one of the farming teams had already reached out to one of the AI teams to say, “I hear you are going to try and commercialize the technology. We want to work with you.”

We are in the midst of planning our competition for this year to see how we can have a wider impact. We can showcase technologies, how to implement them and adopt them.

Rhishi Pethe: What sustainability metrics do you track to measure impact?

Xin Yi Lim: For the pilot farms, we do measure inputs and outcomes, before and after the introduction of technology. By using irrigation controlled through a smartphone, farmers reduced pesticide and fertilizer usage by 15%. We have an annual agricultural report. We can see how farmers perform year over year after we do the training. We look to work with the local governments or other organizations to track progress on a wider scale.

Rhishi Pethe: You started in the humanities. Now you're working in a breakthrough tech company. Who are some of your inspirations?

Xin Yi Lim: I worked as a research analyst for many years. I have had a chance to follow a lot of companies. There's a lot to admire and learn from different leaders. I used to cover Microsoft both pre and post-Satya. The company performance has been fascinating, but it's the underlying change in the company culture. How do you take over a less ideal situation and make it inspiring?

Bezos’ thinking style is unique and it has generated tremendous results. Companies globally are trying to learn from Bezos and Amazon.

As I branch out and learn more into agri and food tech I'm getting inspiration from the world of science. There is a lot of research. which was not on my radar previously as a humanities student or as a research analyst covering tech. There are inspiring breakthroughs in synthetic biology. It is a potential revolution and a different mode of thinking to unlock new opportunities. People will be looking back on our generation and asking “Why did they do things that way in the past?”

Rhishi Pethe: Thank you for your great insights! Best of luck.

Conversation Notes

What is Pinduoduo?

How much do Onions really cost (explained by PDD merchants)

GGV Insights and crash course on Pinduoduo (video)

Building a More Resilient Food System with Technology, July 14th-15th, 2021.

Pinduoduo backs first of its kind study by Singapore researchers on health impact of plant-based meats

Turner Novak substack on Pinduoduo

E-commerce insights from China’s Pinduoduo

Xin Yi Lim on Tim Hammerich’s Future of Agriculture podcast