Picks and Shovels

Bayer and Microsoft Announce Deal

💡Key takeaway: The Bayer and Microsoft partnership includes a thesis to create a digital agriculture platform for the industry. It can allow Bayer to provide tools instead of just applications and allow Microsoft to provide industry specific tools and applications, and thus capture more value. Time will tell if this strategy will work out.

Last week, Bayer and Microsoft announced a partnership around digital infrastructure. It didn’t provide a lot of details.

As part of the interview process with The Climate Corporation (part of Bayer), I had written a strategy memo for a platform play. (I recommend this written approach for everyone. It will not guarantee you a job, but It will guarantee you will stand out from other candidates.)

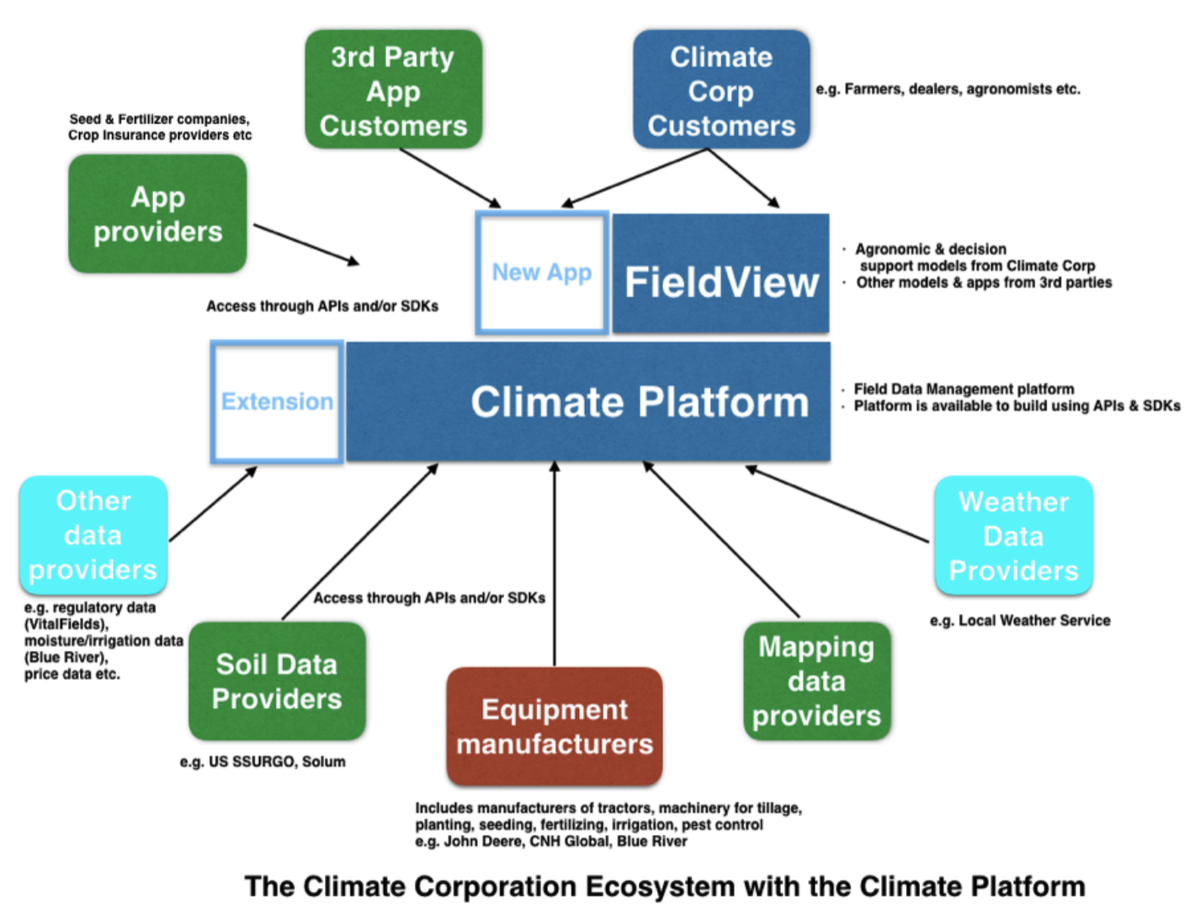

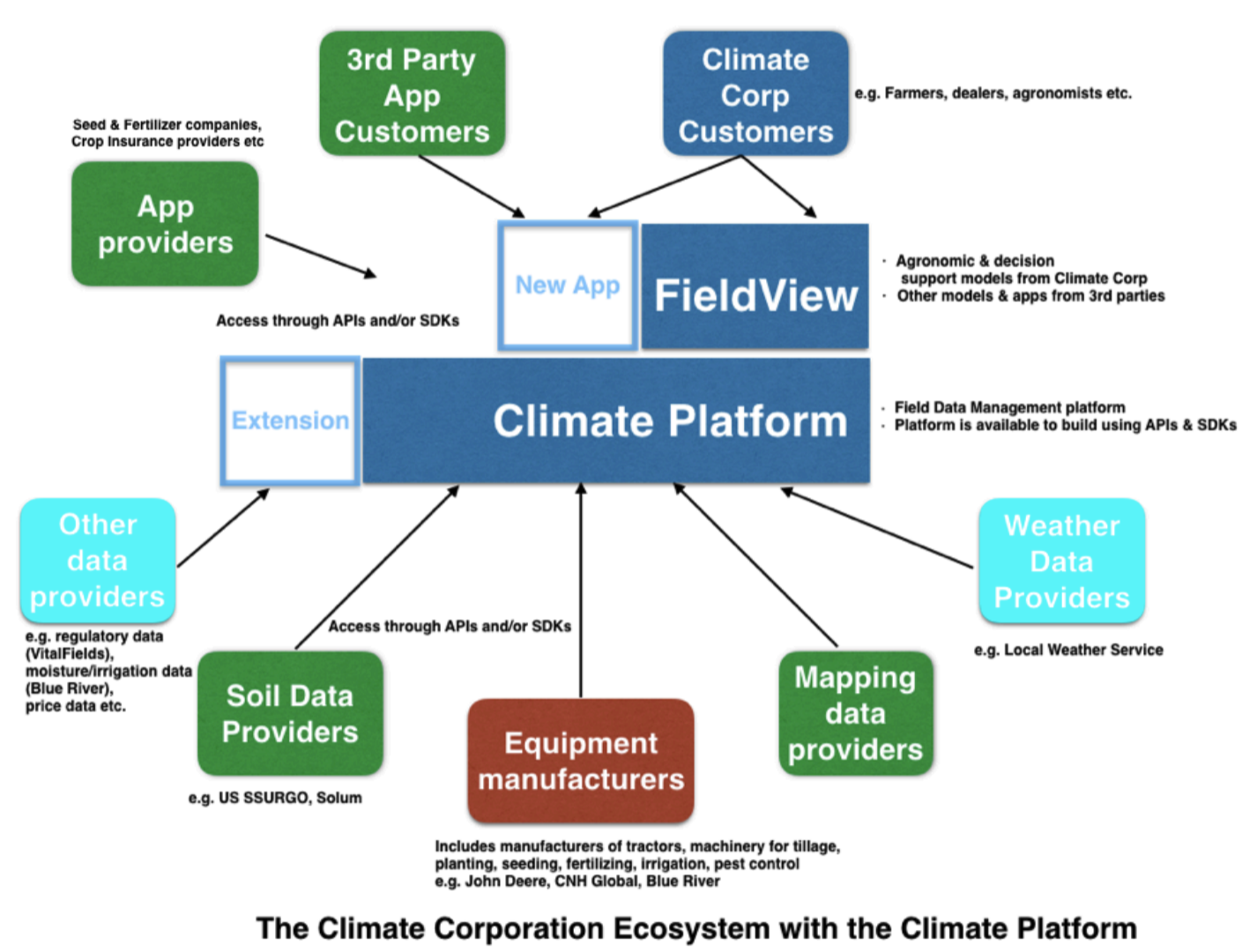

I won’t share the whole memo. I drew a platform architecture diagram in February 2017.. It recommended a platform approach for Climate, with the aim to build an agriculture ecosystem, and to accelerate innovation within the industry.

From Platform Strategy Memo (February 2017)

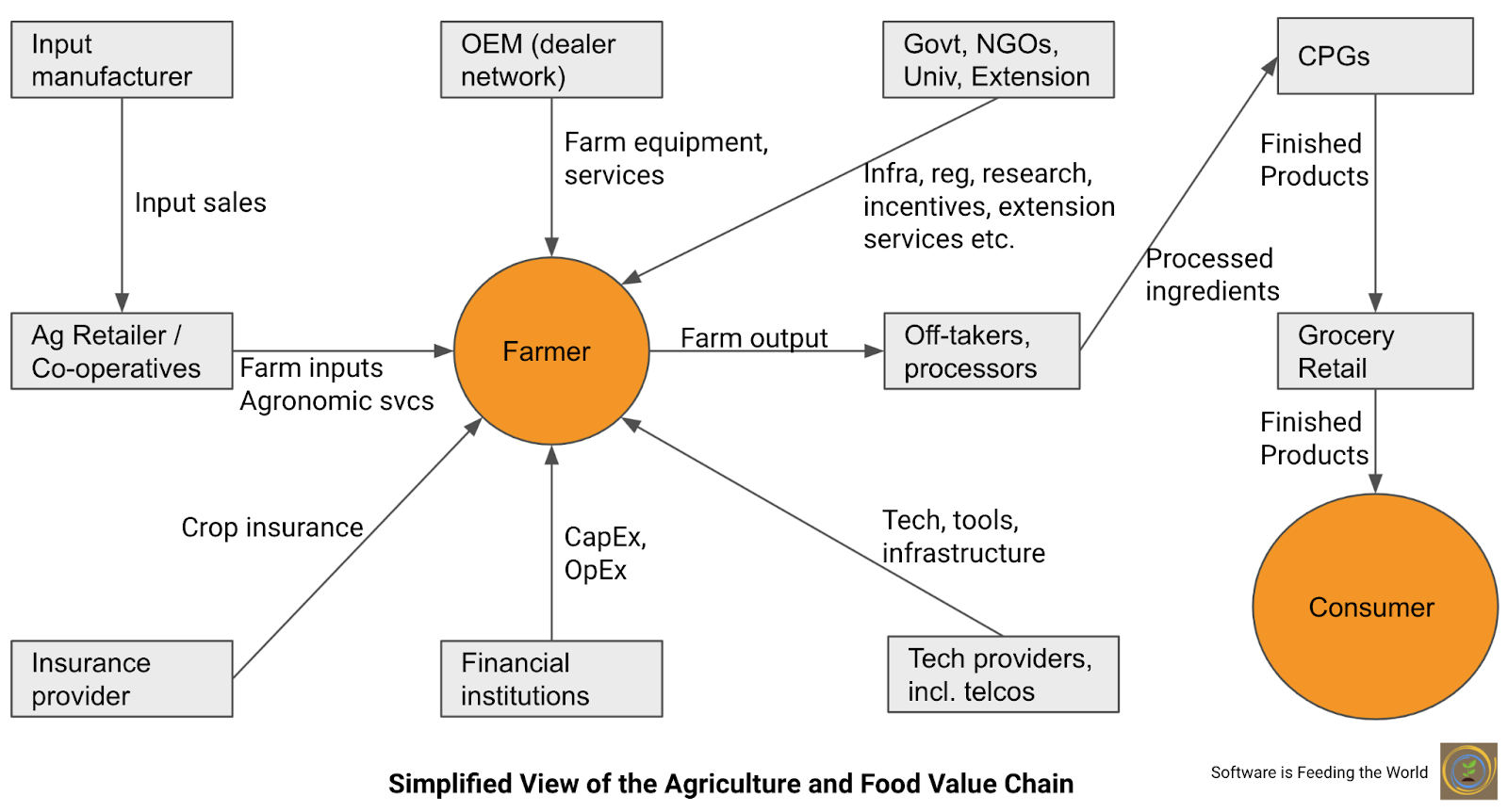

In any strategic partnership, it is important to evaluate the assets of each party.

Bayer (or any ag input major)

- Access to a large grower base, and farm level data. Bayer has access to 180 million acres of farm level grower data.

- A large pool of agronomic knowledge, experience, and expertise.

- Access to a large distribution network to reach growers, agronomists, etc.

- A well-recognized brand name, and a large R&D portfolio with significant investments.

A tech giant like Microsoft

- Significant chops in software, machine learning, and developer tools.

- Experience working with small and large technology organizations.

- Experience with the FarmBeats platform.

- A global sales force for cloud and technology services.

Even though my diagram is almost 5 years old, the thought process laid out by Jeremy Williams, CEO of The Climate Corporation is similar in principle, with some changes in brand names. (Highlights by me)

According to Williams, it’s much more than a case of Bayer white-labeling Microsoft Azure’s processing capabilities; the two organisations are going one-step further to create a cloud infrastructure that’s not just storage but provides “foundational” digital ag tools for clients to license. Combining “assets Microsoft and Bayer have individually” they’re building “from scratch” a platform that can save individual companies, developers, and entrepreneurs from reinventing the wheel.

The platform will include foundational data science capabilities such as ingesting and processing satellite imagery.

“What’s exciting is that this will be useful not just for bigger enterprises, but for agtech entrepreneurs too who, instead of investing in core digital capabilities, can focus on differentiating their products instead.”

“There’s a tremendous amount of data generated in agriculture and adjacent industries but it’s often disconnected, incomplete and with many errors; lots of work has to go into processing and harnessing it to turn it into useful information for customers,” said Williams. “We believe that not everyone needs to spend their resources doing that foundational work; we can allow companies large or small to focus on the things that are strategically important for them, while they rely on us for their core capabilities.”

Microsoft said something similar.

We look forward to partnering with Bayer to accelerate their transformation and then offering those capabilities to customers, ISVs, startups, and enterprises in the agriculture industry and beyond. Microsoft has a well-established partner business model, and we will leverage a better-together co-selling approach with Bayer to reach companies on a global scale.

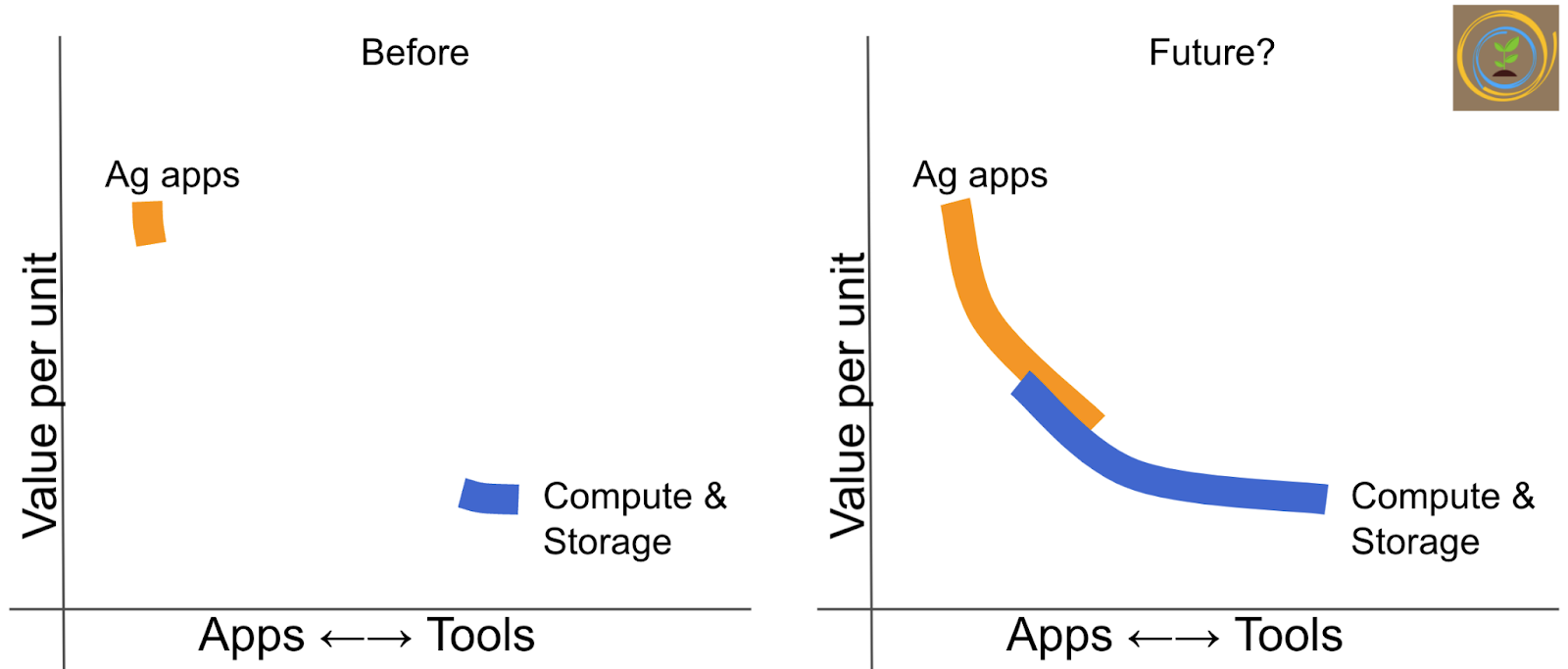

Applications and tools

Let us break it down with a framework of applications and tools. Applications solve a specific set of problems for a specific type of customer. Tools help you build a variety of applications in a given domain. Think of lego blocks (tools) vs. a Millenium Falcon made from lego blocks, or an e-commerce website or blog vs. the tools needed to build it (For example, Squarespace, Stripe, etc.)

Today, Bayer mostly sits on the application end, when it comes to digital agriculture through its tools like FieldView or FieldView Cab. Bayer does offer their data-as-a-service tools for more than 70 partners to connect with FieldView, but it is a small part of their business. Microsoft mostly stays on the tools end with compute, and storage cloud offerings, or some image processing capabilities. (Microsoft does have the Farmbeats program, but let us keep it aside for a moment.)

This can be illustrated by using a simple schematic. As you go from left to right on the X-axis, the offering is more like a tool, rather than an application. As you go from bottom to top on the Y-axis, the value per unit (or customer) is higher, as you control the user experience and provide specific value, though the number of customers is lower.

You can sell pickaxes and shovels to a large number of people and it can be used in a wide variety of situations. The pickaxe and shovel version for Microsoft is storage and compute. Within agriculture, Microsoft is closer to selling pickaxes and shovels, though they have made significant progress with Farmbeats.

On the other end, you could sell a fancy drill to a limited number of people and it can be used in a limited number of use cases, but you can charge a lot more for it. Bayer’s digital tools are a version of the fancy drill, as their products can be used by row crop farmers who fit a particular profile.

What can Bayer do?

Bayer’s applications work for growers, agronomists etc. Microsoft’s tools work for anyone who wants to build any business or application using digital, e-commerce, etc. Microsoft has a limited set of tools for agriculture (outside of Farmbeats).

This agreement lets Bayer develop tools (by using Microsoft’s expertise) specific to agriculture, and thus attract a newer set of customers (for example, other agribusiness, startups, developers) on their digital platform. It can help Bayer to provide an additional set of applications to their existing customers, to improve retention, and lifetime value per customer.

Bayer has more than 70 businesses as partners on their digital platform, and it provides a way for current and new partners to accelerate their innovation process, improve customer onboarding, and user experience by using data from Bayer (while following privacy rules).

It will help Bayer use digital capabilities on 100% of its sales of its products and other offerings like outcome based pricing. By providing insights and transparency around how clients are using Bayer’s “physical products” (seeds, chemicals and inputs) and their farming operations, Bayer can better position and sell those products by making more relevant recommendations.

What can Microsoft do?

The agreement lets Microsoft develop agriculture specific tools (and maybe applications) by leveraging Bayer’s agronomic expertise. Microsoft can serve their existing agriculture customers better by providing industry specific toolkits, instead of just compute and storage. It can help them attract a new set of customers (for example other agribusiness, startups, developers) for their tools.

Bayer is used to a platform play on their seed business. Bayer (and other seed companies) routinely license their germplasm (private label it) to other companies. The other companies then take the germplasm, brand it differently, and package it as their own independent offering.

Better tools provide a better user experience for entrepreneurs and developers. They don’t need to sweat the details like creating an NDVI model from satellite data, ingesting imagery, visualizing soil sample results etc. The set of data, and tools will help accelerate innovation, by using the joint platform.

Bayer says the partnership is part of a strategic step toward the firm’s target of 100% digitally enabled sales in its crop science division by 2030. It’s also a way to accelerate its ability to deliver outcomes-based, digitally enabled solutions to customers.

- Accelerate Bayer’s and Microsoft’s ability to innovate within ag and across the entire food (fuel, fiber and feed) value chain.

- Create and commercialize off-the-shelf opportunities for other companies to enter and innovate directly in ag and other industries.

- Support farmers and other food industry customers with new innovation and continuous improvements to important digital and data science features used to manage their operations.

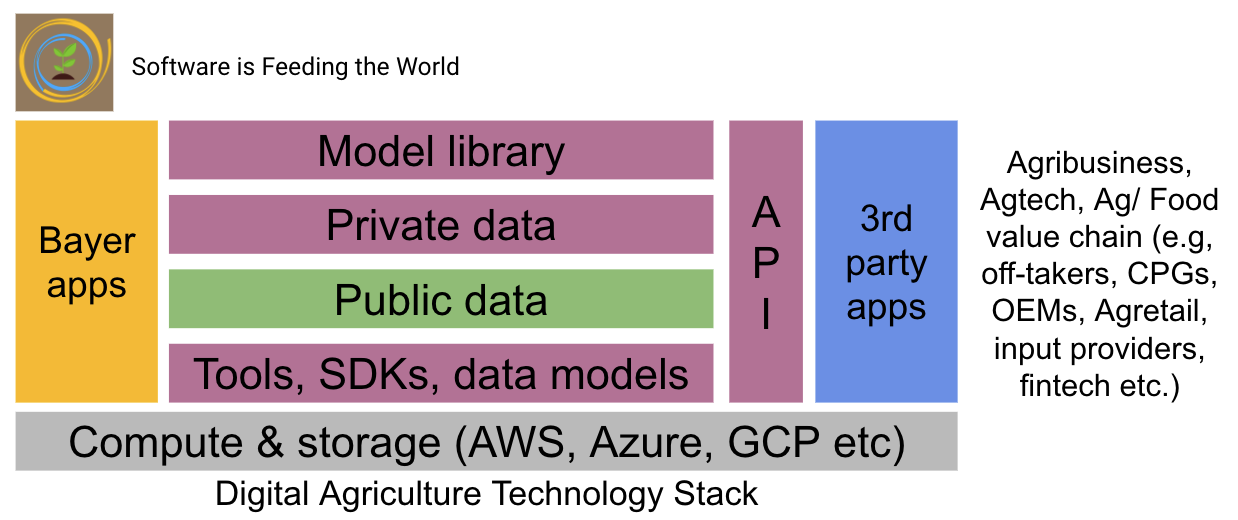

Digital agriculture technology stack

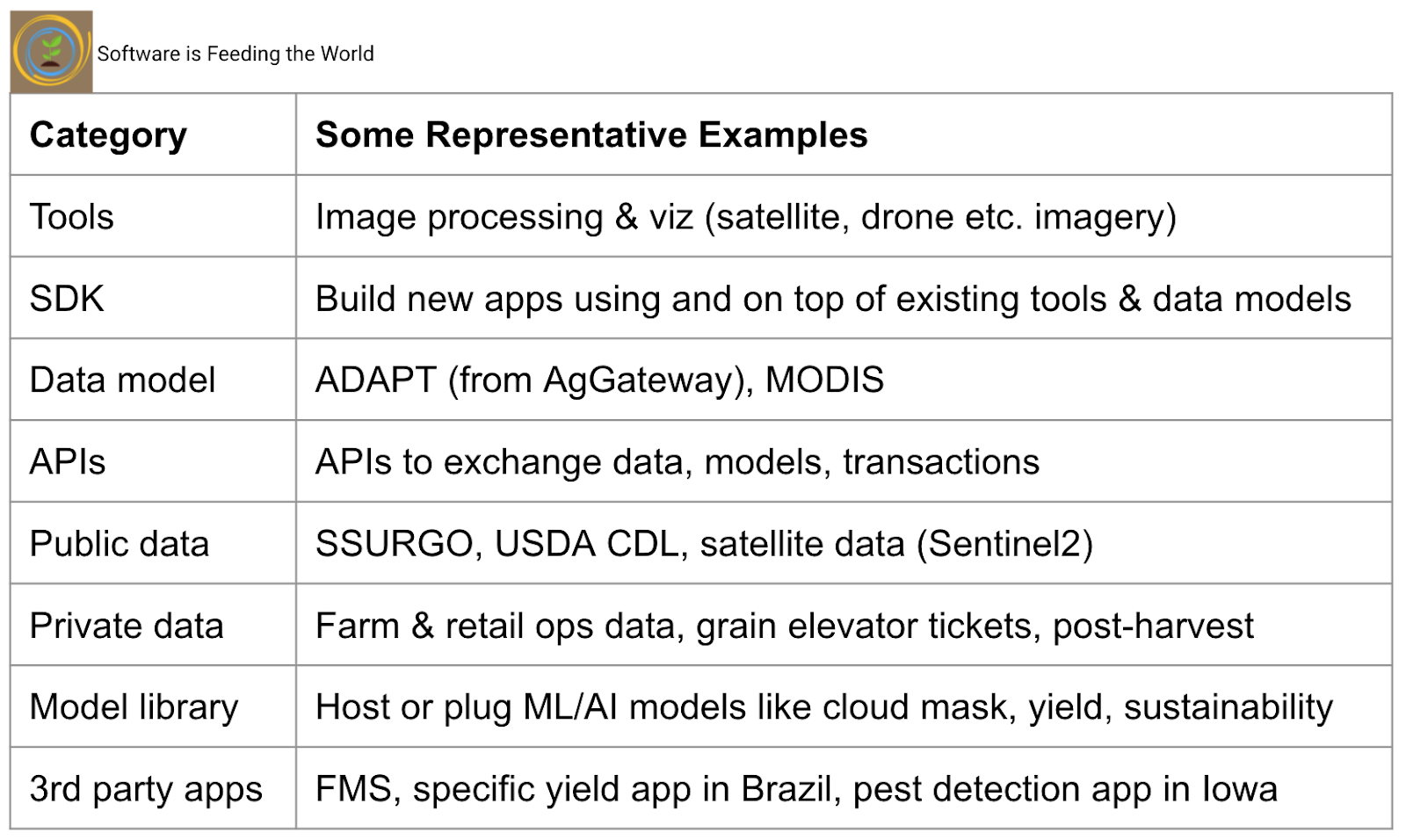

For digital infrastructure, it is helpful to look at a technology stack. I simplified my diagram from 5 years ago. (Similar to Seana Day’s soil health tech stack from September 2021)

- As you move higher on the technology stack, you move from tools to specific applications like FieldView or other 3rd party applications.

- The lower you are on the stack, the tools have broad applicability, and tend to be a commodity. For example, compute and storage has become a commodity in the last 20 years, and the main computer and storage providers can sell it to any size company (and individuals) in any industry in the world.

- As you go higher, the tools as well as the applications become more specific to the agriculture industry, and so are applicable to a smaller set of customers, but you can create and capture more value per customer.

So what is included in the different levels of the technology stack above?

Implications

There are no major details provided by either player. At a very basic level, this could just be a cloud deal.

But if it is not just a cloud deal, I have laid out the following thesis (I have no insider information from either Bayer or Microsoft), based on public comments made by Bayer and Microsoft.

- It opens up a new revenue pool for Microsoft, as its Azure offering tries to move up the commodity offering of storage and compute in agriculture. It provides a revenue share opportunity for Bayer.

- Bayer can potentially leverage many tools from Microsoft, which can do the heavy lifting of data processing, and provide tools for machine learning and artificial intelligence. This will help Bayer focus on agronomic expertise, grower understanding, input R&D, and access to distribution.

- The partnership will allow other agtech companies to build on the digital agriculture infrastructure, and accelerate their own innovation. It lets other organizations focus on their strength, while the heavy lifting of foundational capabilities like data management is done by the partnership.

For example, almost every agtech startup in the developed world, spends time and resources to ingest and process satellite imagery, before they can focus on building their own special models.

If we take the example of data scientists at agtech and agribusiness companies, they spend a majority of their time wrangling with data, rather than actual data science. It slows down innovation, and uses up scarce resources in less value add activities.

Agtech (also known as graveyard of startups) startups create value through those models, and a digital agriculture infrastructure will help them focus on their strengths, and other customer-facing activities like marketing, relationship building etc.

- Additional products and services to existing customers.

- The infrastructure and the APIs enable adjacent industries and solutions which rely on farm data to plug in to the digital infrastructure.

For example, in 2018 The Climate Corporation launched an API based integration with Farmers Mutual Hail, a crop insurance provider. The integration improved the user experience for insurance customers. These customers got the service through Bayer’s FieldView offering, and improved their stickiness with FieldView and added an incentive to provide more data to Bayer.

Bayer has about 70 different partners, though most of them are based on the exchange of data through APIs. Carbon markets which have hooks both upstream and downstream are always hungry for more data

The partnership can explore if Microsoft can cover a larger area in the tools to applications spectrum, and if Bayer can cover a larger area in the applications to tool spectrum. Bayer has access to a large number of growers, and through more sophisticated tools, they can license those tools out to other entities. They can provide value through the data, and connect different 3rd party app providers with farmers through standard and open APIs. Some examples of tools include image processing, field boundary management, remote sensing layers, field level operations data etc.

Open Questions

The execution of this strategy is extremely challenging, both from a technology as well as a commercial standpoint.

- Will the market trust a technology platform backed by a seed & chemical company?

- How will any conflicts of interest between the inputs business and other businesses enabled by the platform be resolved?

- How will data privacy and security be guaranteed?

- Will the platform be open, extensible, modular, and scalable to support a variety of use cases?

- Will it support interoperability through standardized APIs?

Time will tell.

We definitely live in interesting times.

Technology trends

FBN and ABCDs

💡Key takeaway: Downstream organizations like off-takers, CPG companies, and grocery retailers continue to want to make stronger connections with on-farm stakeholders, especially growers. Access to a network of farmers is important for product testing & research, supply chain sustainability, and decommodification opportunities.

Farmers Business Network announced a big round of funding, with a capital raise of $ 300 million from Fidelity, and others including a minority investment by ADM ventures.

FBN started off 7 years ago with a goal to bring price transparency on ag inputs, and since then has grown their farmer network to more than 33,000 members over 82 million acres. They have access to 30 regional warehouses, and other partner organizations in the US, Canada, and Australia. Over the last few years, FBN has branched into privately branded genetics, acquired many seed and input companies, and has continued to shape the narrative of FBN being in the farmer’s corner.

FBN expanded its partnership with the A of ABCD of off-takers. The partnership with ADM will enable FBN members to sell grain to ADM’s extensive network of origination and logistics infrastructure, and track their transactions digitally.

This feels like a smart deal for ADM, as it gets access to a network of growers, which can help them market and sell ADM products such as fertilizer and animal nutrition products. The partnership will enable advancement in research to develop biologicals, seed traits, fertilizers, and crop protection products.

Last year ADM had announced sustainability goals to reduce absolute greenhouse gas emissions by 25%, energy intensity by 15%, reduce water intensity by 10%, and achieve a 90% landfill diversion rate by 2035 (2019 ADM corporate sustainability report). This partnership will provide better on farm visibility, and connect with their operations.

Building on the decommodification topic from last week, differentiated grain is one of ADM’s strategic growth platforms. The FBN relationship can help them find new ways to find incremental value through differentiated grain, and decommodification opportunities.

Bunge (The B in ABCD) has also promised to make changes to their global operations to promote decarbonization through regenerative farming practices, and improved logistics infrastructure.

“A substantial portion of the emissions reduction within its supply chains is expected to be driven by Bunge’s commitment to achieve deforestation-free supply chains by 2025.”

Bunge also laid out science based carbon emissions targets, which surprisingly don’t talk about soil health or water quality.

- An absolute reduction of Scope 1 & 2 GHG emissions of 25% by 2030 from a 2020 baseline year.

- An absolute reduction of Scope 3 GHG emissions of 12% by 2030, from a 2020 baseline year

Putting on weight

💡Key takeaway: Regulatory approval for heavier payloads on drones, will make the drones more and more competitive with a land based sprayer, both in terms of daily capacity, as well as efficacy of spray.

Drones provide a very good alternative to land based sprayers. They are smaller, cheaper, can reach difficult areas, and operate in a larger variety of conditions (unless when it is very windy). The challenges with drones are capacity, safety concerns, and training necessary to operate them.

Rantizo has been a leader in drone based spraying, and has been one of the first (maybe the first) companies to be approved by the FAA in the US. In July 2020, the company was approved for 3-drone swarming nationwide. Till now FAA regulation allowed the use of drones under 55 lbs only. FAA has now given exemptions to Rantizo to commercially operate their T-30 drone, with a capacity of 169 lbs.

The T-30 drone comes with a large tank that when fully loaded weighs up to 169 pounds. (Photo courtesy of Rantizo

Heavier drones combined with swarming (not sure if they are approved for swarming yet), will dramatically increase the capacity of what these drones can do. Rantizo follows an aircraft carrier model, with products like “Rantizo Load and Go Trailer”, which can hold and launch a variety of drones, to improve capacity, and service levels.

It will improve the safety of the drones, as more tech can be bundled into the drone with better avionics, control, and field management.

Rantizo knows its strengths and focuses on them. It sources drones from DJI. Rantizo continues to follow the McDonald’s model of working with retailers and custom applicators. I had written the following about Rantizo’s strategy in edition 37.

It offers a service (or franchise) model with labor provided by independent contractors. It includes equipment, licensing, technology, training, and certifications to operate their program. Rantizo is working on regulatory approvals, the largest roadblock to growth.

This is a smart business model to pursue for a service oriented business like drone based spraying. It helps Rantizo focus on the difficult aspects of drone spraying and regulatory hurdles. Access to distribution is one of the biggest challenges to scaling in ag and this model takes out some of the risk associated with it.

Autonomy at Midnight

💡Key takeaway: FieldIn’s acquisition of autonomous driving technology from Midnight Robotics helps it complete the observe, analyse, plan, and execute loop.

Fieldin is a smart farm operations management company for high-value crops. The company announced today that it has acquired agricultural autonomous driving company Midnight Robotics. The acquisition is to create a first-of-its-kind combination of a sensor-based operational farming platform with autonomous driving technologies to empower growers in the day-to-day management of their farms.

Fieldin has provided a smart farming SaaS platform that utilises sensor-based data to help growers worldwide improve production, operational transparency, and efficiency by monitoring field activities remotely and seamlessly integrating with existing technologies, equipment, and personnel to provide full visibility into day-to-day operations.

The company is the largest smart farm operations management company in the US, with 30% of US-based lettuce crops and 20% of the world’s almond crop run through their platform.

Midnight Robotics uses computer vision and AI to develop autonomous agricultural driving technology that offer a complement to Fieldin’s platform. The company’s core product is a retrofit kit that can transform any tractor to work autonomously using advanced LiDAR perception algorithms that enable a solution for autonomous operation and precise execution.

Midnight provides sub 5-cm localization without GPS and does not require expensive RTK devices. I am a bit surprised by the use of LiDAR, as LiDAR is much more expensive than computer vision with perception algorithms (though it is a harder problem to solve within software). For example, Tesla has stayed away from LiDAR, while other self-driving cars have stayed with LiDAR.

Midnight’s service model includes a few hours to a day of an on boarding process. In the early days of a company, this model makes complete sense, so that they can deliver a great experience and learn to improve their product and offering. It does limit their ability to scale quickly (if there is demand), and they will have to consider a dealer model in the future.