David Ricardo, and comparative advantage

Economics theory for ag

David Ricardo, comparative advantage, & microservices model for agtech

💡Key takeaway: It will benefit the ag ecosystem, if more organizations incorporate comparative advantage principles, and follow a microsservices model for agtech.

In 2002, according to tech legend, a mandate was issued by Amazon founder Jeff Bezos.

It’s becomes legendary in the API/microservices space, as it formed the basis for much of the modern API design paradigm within the corporate view.

The principles could be grouped into four themes.

Theme 1: Data and Functionality Exposure

- All teams will henceforth expose their data and functionality through service interfaces.

Theme 2: Enforcing Communication Through Interfaces and Standardizing Data Interactions

- Teams must communicate with each other through these interfaces.

- There will be no other form of interprocess communication allowed.

Theme 3: Technology Agnosticism

- It doesn’t matter what technology they use

Theme 4: Externalization as a Paradigm

- All service interfaces must be designed from the ground up to be externalizable.

Bezos made the mandate for Amazon, and it played a significant role in Amazon’s success as a technology company, as it reinforced a customer mindset inside Amazon. Every team (other than your team) now suddenly became your customer, with expectations for service levels, customer support, and quality of your product/service.

My thesis is that a microservices model has a solid economic theory foundation as well, specifically David Ricardo’s theory of comparative advantage. Every person, team, or organization has some comparative advantage. It is important to understand your comparative advantage in relation to others comparative advantages. It is important to understand your opportunity costs to do an activity, vs. procuring it from someone else.

To find people’s comparative advantages, do not compare their absolute advantages. Compare their opportunity costs.

How does this apply to agtech and agriculture?

With the concentration in the industry, many players think they have to solve every problem, have to have all the data, and act as a major hub to which all the other players connect as spokes. It creates a series of mostly false narratives of the following kind:

- We have to build every product and service

- If we partner, we won’t own the service, and that is not a good outcome.

- We have to capture all the value.

It is my contention these false narratives will lead to suboptimal outcomes for the ecosystem, as different companies do not play to their comparative advantages. They incur significant opportunity costs in building capabilities that they should procure from others. The limited availability of a microservices type model in the agtech space, makes it harder to compare and contrast comparative advantages. It can create an environment of, “we have to solve this problem, though someone else is in a better position to solve it” or “if it is not made here, it is not good.”

Due to this, in the longer run, it might be beneficial to not have a small number of very large hubs, but an ecosystem of many small to medium sized hubs connected to multiple spokes in a mesh like network.

It is interesting to see partnerships like Bayer and Bushel try to break some of these false narratives, with a seemingly better understanding of David Ricardo’s comparative advantage principle.

Bayer and Bushel have launched Project Carbonview

A data-based carbon measurement tool aimed at helping farmers to better assess and report the carbon footprint of their produce across the supply chain. Built on AWS, the opt-in program uses Bayer’s Climate FieldView app to collate data taken from the farm alongside logistics and transportation data skimmed from close to 54,000 users of Bushel’s grain-trading software platform in order to determine the carbon impact of end products.

This collaboration is a good example of Bayer leaning into their on-farm data collection, and agronomic insights expertise, while relying on Bushel’s expertise on post-harvest data collection. The collaboration will stitch data between on-farm and post-harvest workflows, to provide better visibility, and analytics to measure on farm practices, carbon related processes etc.

Eligible US farmers can opt into the Project Carbonview program and be compensated for participating. The longer-term goal is to compensate growers based on their implementation of sustainable farming practices and to enable more farmers to gain access to the financial gains created by carbon markets.

Project Carbonview focused on the United States will initially enable U.S. ethanol producers (corn is a key ingredient in ethanol production) to track carbon emissions across the entire supply chain – from planting through production – and implement more sustainable business practices by providing the data needed to make more informed purchasing decisions and reduce their carbon emissions.

Image source: Bayer’s Media Center

Bayer has previously announced a strategic partnership with Microsoft. I covered the partnership and its potential implications in edition 83, “Picks and Shovels.” The technology infrastructure for the Bayer-Bushel partnership will use AWS (from Amazon). Based on this, it does seem that Bayer is following a multi-cloud strategy, which again speaks to comparative advantages (and risk mitigation).

Technology trends

Is Market+ the same as Marketplace?

💡Key takeaway: Indigo has rebranded its marketplace as market+. It is not very clear how the new solution is different from a marketplace.

In edition 21 (“Five startups in one”, August 9, 2020),

It will be a challenge to do all five at the same time, when there are some differences between the five. It requires multiple DNAs to co-exist within the company culture.

The five were microbial, carbon, marketplace, agronomy, and transport. As of today, the website does not list agronomy as a solution, and the other four are still offered.

Last week, Indigo introduced a new merchandising solution, and has rebranded their marketplace solution as Market+.

Is this new solution different from the previous marketplace solution?

In 2020, the marketplace was defined with the following benefits.

Indigo Marketplace helps growers earn more for their grain, and helps buyers access high-quality, identity-preserved crops that meet their specifications. The marketplace is similar to a trading company, with an element of traceability and decommodification on top of it.

Indigo says,

By removing itself from the transaction flow, Indigo has expanded Market+ to directly connect a wider set of stakeholders across the agricultural supply chain with a suite of integrated and data-driven tools.

The Market+ website talks about a new suite of merchandising and marketing tools, and it sounds closer to Shopify than Amazon, though the value proposition for different value chain participants does not feel very different from the previous marketplace definition. The value for consumer brands is sustainably grown crops, direct grower connections, and better supply visibility. Does it mean they will have to be part of the transaction flow?

The value proposition for buyers, farmers, and shippers-carriers sounds very similar to a marketplace for grain, other commodities, carbon, and transportation capacity. This is a challenging proposition. According to Mark Johnson the grain marketplace in North America is dead, carbon marketplaces have potential but are challenging, and Indigo will be competing with the access that ABCDs (ADM, Bunge, Cargill, Dreyfus) have to efficient infrastructure.

It will be interesting to see if this is old wine in a new bottle, or a new kind of wine!

What is an Ag Retail Sales Platform?

Note: Shane Thomas (Upstream Ag Insights) is an expert on Ag Retail strategy, technology, and tools. You should definitely follow him, if you want to learn more about ag retail in North America.

It is surprising how difficult it is for ag retailers to get a comprehensive view of their customer operations, their transaction history, pricing & product lists, get intelligence, and seamlessly communicate with their customers.

Growers Rally was created to help ag retail stay relevant in today's competitive sales environment. Sellers can access a single view of the customer, forecast future sales, organize farm and product information, and make informed, meaningful recommendations.

There are many reasons for the relative lack of tools and infrastructure at ag retail.

Many of the retail organizations are a conglomeration of local entities coming together. The local entities have a lot of freedom in terms of their business needs, policies, and the adoption of technology solutions. Due to this, oftentimes there are large differences in the tools and technology solutions available to different retail branches. You see this in grocery retail as well, where national chains like Safeway, or Kroger are a conglomeration grown through acquisition of many regional brands. You see this phenomenon in co-ops as well.

The grower buying experience is evolving dramatically, and it is becoming omni-channel, with online being an important component of it. Farmers and growers are used to the seamless Amazon buying experience for consumer goods. Their expectations of ag inputs and services are going up.

For example, on the The Scoop Podcast: Bridge The Gap As A Trusted Adviser,

Customer segmentation has changed how we do what we do. It’s no longer a shotgun approach. As a seller, find out from your company who you are really trying to serve. It’s become critical for effectiveness of our dollar and for sales versus effectiveness of our time.

If you look at Farmjournal’s survey about online buying of crop inputs, it clearly highlights the considerations, which can be easier to meet and provide by having better ag retail systems.

Image source (The Daily Scoop): Has E-commerce In Agriculture Flatlined?

Agretail has often lacked basic tools like segmentation, CRM capabilities (big names on the Croplife 100 are definitely an exception). Solutions like Growers Rally will arm ag retailers with better tools to service their customers.

Haber & Bosch, hold my beer!

In edition 7, (April 26, 2020 “The Alchemy of Air”) on Bosch’s 80th death anniversary, I had written about the importance of the Haber-Bosch process.

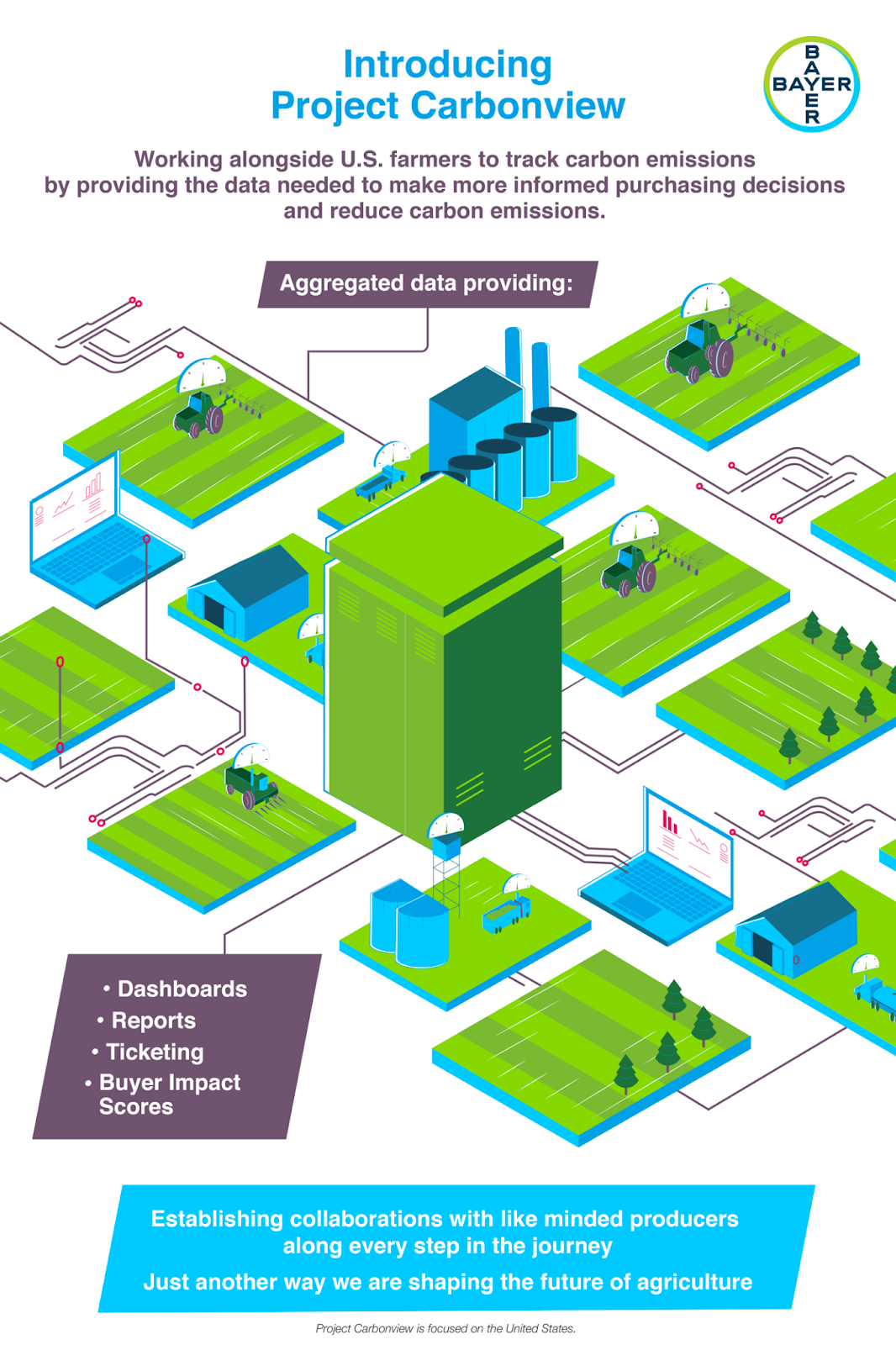

Without the Haber-Bosch process, about two to three billion people would starve to death.

Figure from Erisman et al article “How a century of ammonia synthesis changed the world” (2008)

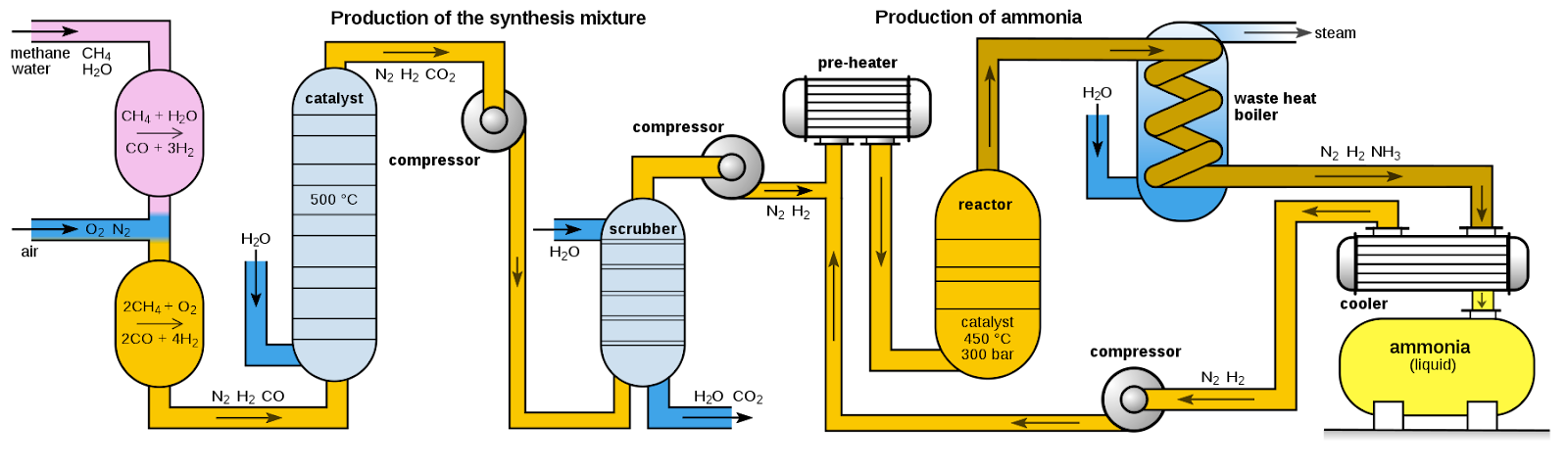

The Haber-Bosch process has been optimized many times over the last 100 years. It still requires fairly high pressure and temperature to manufacture nitrogen based fertilizers. Due to this, it requires large manufacturing facilities, with high capital investments, and so are not easily accessible to many countries.

The reaction, which runs at temperatures around 500 °C and at pressures up to about 20 MPa, sucks up about 1% of the world’s total energy production. It belched up to about 451 million t of CO2 in 2010, according to the Institute for Industrial Productivity. That total accounts for roughly 1% of global annual CO2 emissions, more than any other industrial chemical-making reaction.

Image source: Wikipedia

Research has been ongoing for many years to reduce the energy, and pressure requirements for N-fertilizer manufacturing. Here are some examples of existing research using “Molybdenum-catalysed ammonia production with samarium diiodide and alcohols or water”, a low-pressure, low-temperature Haber-Bosch process, and many more.

Now venture capital is also getting into the game, with the funding of startups focused on alleviating some of the problems of the Haber-Bosch process, namely high temperature, high pressure, industrial scale production, and relatively high energy requirements, and GHG footprint.

Tenacious Ventures is backing Jupiter Ionics, which uses an electromechanical process to manufacture small amounts of ammonia, closer to final use. The lower pressure and temperature requirements open up the possibility of using renewable sources of energy like solar and wind, in the manufacturing process. Jupiter Ionics’ NRR tech requires only water, air, and electricity as inputs – offering the potential for ‘net-zero’ ammonia production.