Android Strategy for Agriculture

Horizontal strategy - can it work?

Apple or Android strategy?

💡Key takeaway: How will the hardware and software stack be constructed for agriculture equipment? Will we see an Apple/iOS and Android model in agriculture equipment?

Aptiv is a auto parts supplier and it recently acquired Wind River, a provider of edge computing software and software-defined systems for the auto, defense, and telecom industries. This is non-agriculture related news, but the approach and strategy have direct implications to agriculture, especially the space of autonomy and robotics. Aptiv hopes to run Wind River software on their hardware. (It is an oversimplification, but directionally reasonable.)

In last week’s edition (88. Technology is people) I had talked about the tech, go-to-market and user experience of Deere’s 8R fully autonomous tractors. But how do autonomy products and services construct their tech stack?

Autonomous equipment (or any equipment in general) is a combination of hardware and software. How does one go about assembling the hardware and software together?

In the case of agricultural equipment, big companies like Deere seem to follow an iPhone strategy of building their own hardware and software (or acquiring it and running it under their brand). Through its App Store, Apple does allow you to download and run 3rd party apps, but developers have to use Apple SDK, and infrastructure to deploy their products. Apple is a premium product, with high profit margins but lower volumes compared to Android powered phones.

Another variation for agriculture equipment could be an Android variation. The hardware is inexpensive, and more of a commodity product, the “smarts” of the phone come through an operating system and applications. For example, you can buy a decent Android phone for less than $ 100, and it works quite well for billions of users.

Will we see a similar split in the agriculture equipment market?

Majors like Deere will follow an Apple approach with high end hardware, and software under their brand. They will service the high end large scale row crop farming in the developed world.

Is there space for a generic sub-$10K tractor, where the hardware is more or less a commodity, and the software on it is what makes it interesting and more useful? There are many types of operations depending on crop type, and so there might be different hardware configurations.

Could a Mahindra or a some South East Asian/Chinese manufacturer provide hardware in large volumes at low cost? Can a strong software and technology provider provide an equipment operating system, with room for application developers?

Could this strategy work in the developing smallholder space?

Are other configurations possible or feasible? What do you think?

Technology trends

Data driven regen-agriculture

💡Key takeaway: Investment in farmland, informed by high quality input, environmental and management practice data is a big opportunity. Regenerative agriculture practices can create interesting tranches for investors, and a unique opportunity for farmers, input and service providers.

On-farm data has the potential to enable new workflows, or improve workflows throughout the food and agriculture value chain. Common examples are around product performance, equipment performance, financial decisions around insurance and lending, decommodification through data provenance, and ecosystem credits.

The prevailing narrative in the public square is “row-crop farming is all the same (monoculture, high chemical, GMO).” There are many nuances due to agro-ecological conditions, crop types, and input differences. Due to this variation, it is often challenging to understand the correlation between the nuances and outcomes, whether it is yield, soil health, greenhouse gas emissions etc.

Running a large number of experiments under different conditions is a way to prove your thesis on the correlation between practices/inputs and outcomes.

EDF is now expanding the “study” in a partnership with Farmers Business Network with the launch of the Regenerative Agriculture Finance Fund (RAFF). It is a new financing program to reward US farmers if they meet certain benchmarks for soil health, and nitrogen efficiency, while using regenerative agriculture practices.

“Row crop agriculture contributes 5 percent of greenhouse gas emissions from the U.S., and is the largest emitter of nitrous oxide – a gas with 300 times more warming potential than carbon dioxide. However, scientists estimate that a 21 percent reduction in row crop emissions is a viable goal over the next 15 years through the optimization of current technologies – and a reduction of up to 71 percent is possible with new innovations.”

The fund will start with $ 25 million and enroll 30-40 row crops, mostly from FBN’s members. Growers borrowing less than a million dollars will receive instant approval (talk about small farmers!). EDF will provide the scientific and practice expertise, FBN will provide the tools to capture and manage data, and the program will provide underwriting and monitoring. Once the farmers complete the sustainability requirements, they get a 0.5% reduction rate ($ 5000 / year on a $ 1 million loan).

Many studies done by EDF in the past involved a handful of farmers, with agronomic and logistical support provided by EDF and the Soil Health Institute.

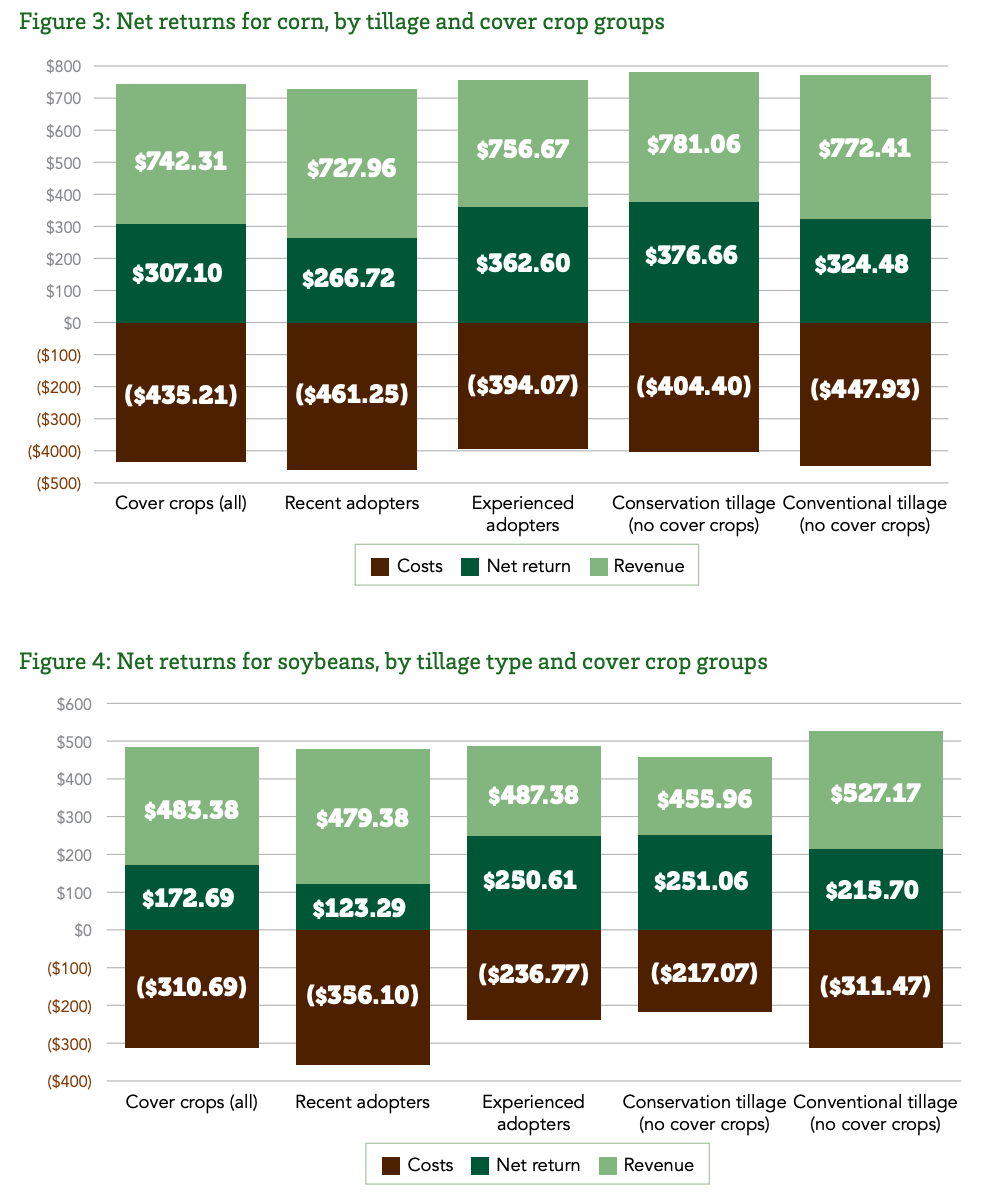

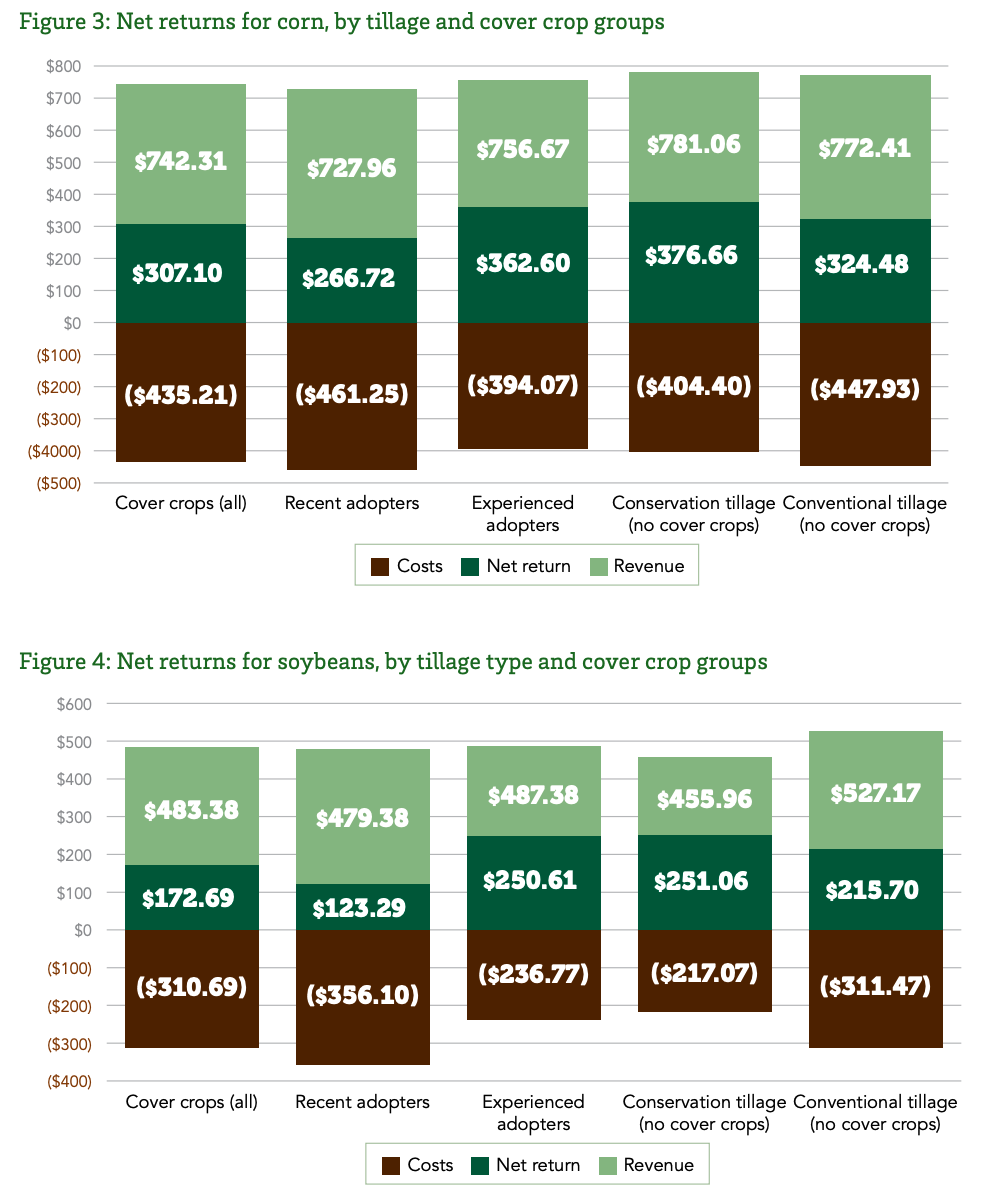

In edition 49, (What would Drake say?) I had highlighted a few studies done by the Environmental Defense Fund and the Soil Health Institute on the impact of regenerative/sustainable practices on outcomes. The study shows an increase in net returns for experienced adopters, with a slight dip in net returns in the short term.

Figures from “Conservation’s Impact on the Farm Bottom Line” by the Soil Health Partnership, EDF, and K-Coe Isom

It will be interesting to see the following data based on the expanded study:

- How do net returns and profitability change over time and with adoption of regenerative practices? How does it impact variables like input costs, soil health, and GHG emissions?

- What are the investments and expenses necessary to start on a regenerative agriculture program?

- What are the educational and know-how requirements for farmers, and who is in the best position to provide it?

- What is the impact of regenerative practices on yield stability, and resilience to agro-ecological condition changes?

Building a corpus of evidence will take time, but if the thesis of regenerative practices impact on economic and environmental sustainability proves out in the long term, it can help reduce the friction to adoption.

Is the roof dirty or is there no roof?

💡Key takeaway: Even though remote sensing data from satellites is easily available at a low costs, there are still challenges to use it for analysis. Imagery providers need to do more to provide analysis ready datasets.

There is tons of writing advice online, and especially on Twitter. Dickie Bush has started the ship30for30 program, where he challenges folks to publish a piece online for 30 days in a row. It is a great exercise to unblock writing, and to build the confidence to write consistently and publish. The downside is a stream of generic thinkboi pieces. J Mathew Prior of Tenacious Ventures, is definitely bucking the trend, as he has been putting out some thoughtful pieces for the last few days.

Agriculture is an open system (not talking about CEA or vertical farming.) Sensors n the sky can capture a huge amount of data. Many of the farm activities are observable and can be modeled at a low cost and at scale, because as Matt says, “The factory has no roof.”

“Agriculture that is digitally native operates on the assumption that all required information is available at the highest possible spatial, temporal and spectral resolution. Decisions no longer need to be framed and constrained by the partitioning established around industrial-era infrastructure. Pervasive, inexpensive, high-resolution imagery is available for the entire plant, every day. Complex statistical and machine learning computer models can use this and many other massive data sets to build increasingly accurate models of the real world - the factory has no roof.

In this digitally native version of agriculture, there is no need to wait for infrequent, real-world events to know the true status of a crop or commodity. When we can know the health and potential of every crop, every day, and see in fine detail all the actions taken to manage it, we can redesign key aspects of the supply chain. The traditional concepts of ownership, insurance, risk, credit & finance, and sale blur into a continuum.”

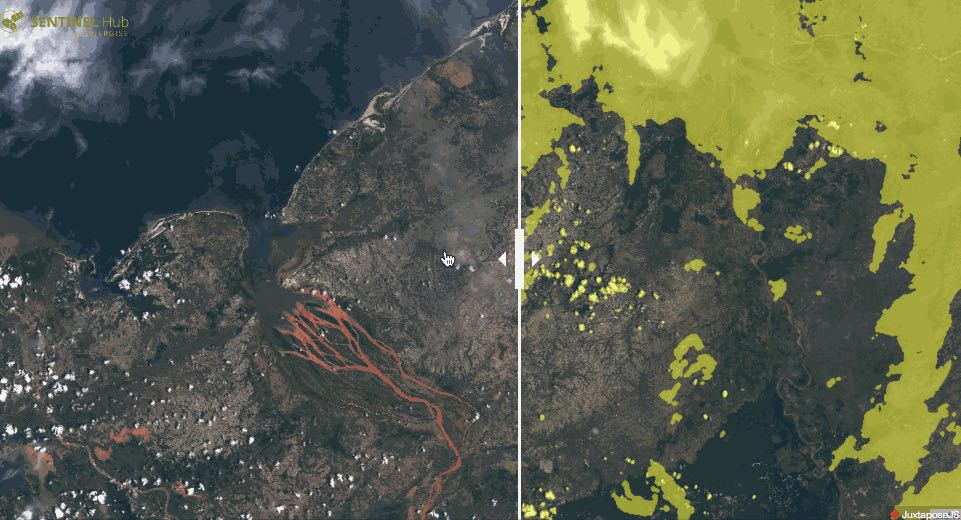

There is a large amount of remote sensing data available from satellites, weather data, etc. to assess crop health, and run different models like cover crop & tillage presence, field boundaries etc. Even though this data is easily available and fairly inexpensively at scale, the data still has many challenges. There are multiple bands, clouds create issues, presence of water vapor, revisit rates, and limitations on resolution create challenges for analysis. It requires a significant amount of preprocessing, with specialized skill sets and experience to get the data ready for analysis.

Downstream consumers of the data want Analysis Ready Data. They want to focus their time on building interesting models, and drawing insights. Instead, they spend their time doing operations like image clipping, data masks, atmospheric corrections, pixel & sensor alignment, to make the data more usable.

“Analysis Ready Data are time-series stacks of overhead imagery that are prepared for a user to analyze without having to pre-process the imagery themselves.”

Sentinel Cloud Mask by Sinergise, from their post on cloud detection with ML

It is as if the factory has a glass roof you can see through, but the glass is smeared with smoke, bird poop, and leaves, making it difficult to see what’s happening under it.

Bored Ape Corn

💡Key takeaway: 2021 was the year of the Bored Ape. Bore Ape clubs and NFTs (Non-fungible tokens) exploded in 2021. Are there applications of NFTs and blockchain in agriculture? Geora thinks so.

What is an NFT?: NFTs are non-fungible tokens. “Non-fungible” means it’s unique and can’t be replaced with something else. NFTs are used for digital assets like digital art, music, original content, and can also be used for a packet of reliable and trustworthy data.

Are there applications of NFTs or Blockchain in food and agriculture systems? Agtech/Fintech startup Geora definitely thinks so. Geora raised a seed round from Tenacious Ventures and others to scale their blockchain platform in agriculture to link traceability data with financing solutions. Geora provides tools to certify, regulate, and enhance the value of agricultural products.

According to Geora co-founder, Bridie Ohlsson, to meet global sustainable development goals investment along supply chains must increase by at least $2.1 trillion per annum.

Image source: From UN’s sustainable development and finance strategy

The Geora certificate registry allows certificate issuers to create and manage certifications for farmers and other industry participants. Once certified and invited to the system, primary producers record assets and enrich them with valuable data from all stages of the supply chain.

Users can have confidence in the immutability and traceability of their data, and protect themselves and their industries from fraud and adulteration.

Information from the farm and along the supply chain is aggregated to a single asset record, stored as Non-Fungible Tokens (NFTs) on the Geora platform, a permissioned Ethereum-based blockchain.

Geora models assets which represent a real world entity in the supply chain with unique data and history. Some common examples of assets tracked by Geora are commodity, silo (tracking inventory movements), finance agreements (lending terms between growers and financiers), or a package of data (which can be transacted with others).

Geora uses new token standards like the ERC-1155, which is a multi-token standard. It combines multiple ERC-20 (fungible) and ERC-721 (non-fungible) tokens into a single smart contract. The grouping mechanism of the ERC-1155 standard provides a unifying structure for different asset contracts to be modeled in a single contract.

This is a good structure as any smart contract has standard and unique terms, linked to a variety of assets. The combination of fungible and non-fungible token provides a framework to represent contracts more effectively and efficiently.

The asset data is stored on the IPFS (inter planetary file system) in a standard way. It allows any application which supports ERC-1155 to view and benefit from it (assuming it has the right permissions).

It is fitting that a company working on distributed and decentralized concepts like the blockchain and NFTs, has a remote and distributed team.