Trapped value in agriculture

Geoffrey Moore's framework in agriculture

Can Geoffrey Moore’s (Crossing the Chasm author) “trapped value” framework be applied to agriculture? How are NFTs, and blockchain being used for carbon credits, and trading commodities?

“Trapped Value” in agriculture

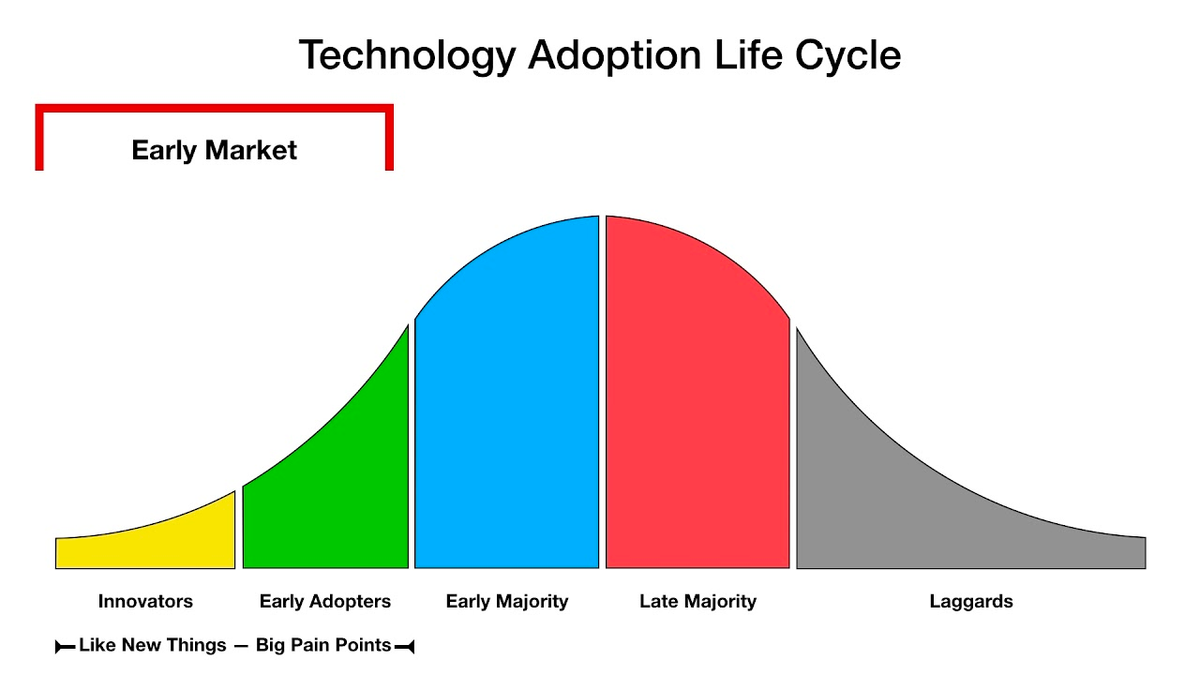

“Crossing the chasm” is a seminal book about technology, innovation, marketing, scaling, organizations, leadership, and business. Author Geoffrey Moore did a podcast with Patrick O’Shaughnessy (Invest like the Best) a few weeks ago, which explores the lifecycle of technology adoption. The conversation touched on many interesting ideas, and many of them are relevant to agriculture and agtech.

Image source: Crossing the chasm

Geoffrey Moore talks about “trapped value.” Trapped value exists in a given context, but either the technology and/or the business model to create the “trapped value” and capture is not available or mature. For example, (from the podcast)

“Who knew we had trapped value in the back seat of our car?” (Uber)

“Who knew we had trapped value in our bedroom?” (AirBnB)

These examples show the dispatch systems of taxi companies, and hotel reservation systems of hotels were trapping a huge amount of value which was unlocked by Uber and AirBnB.

According to Geoffrey Moore, trapped value has to be concentrated, and it can typically be enabled by use of appropriate tech, entrepreneurial spirit, and the right business model to go with it.

So what are some examples in agriculture?

Photo by Andres Haslinger on Unsplash

WTY? (What the yield?)

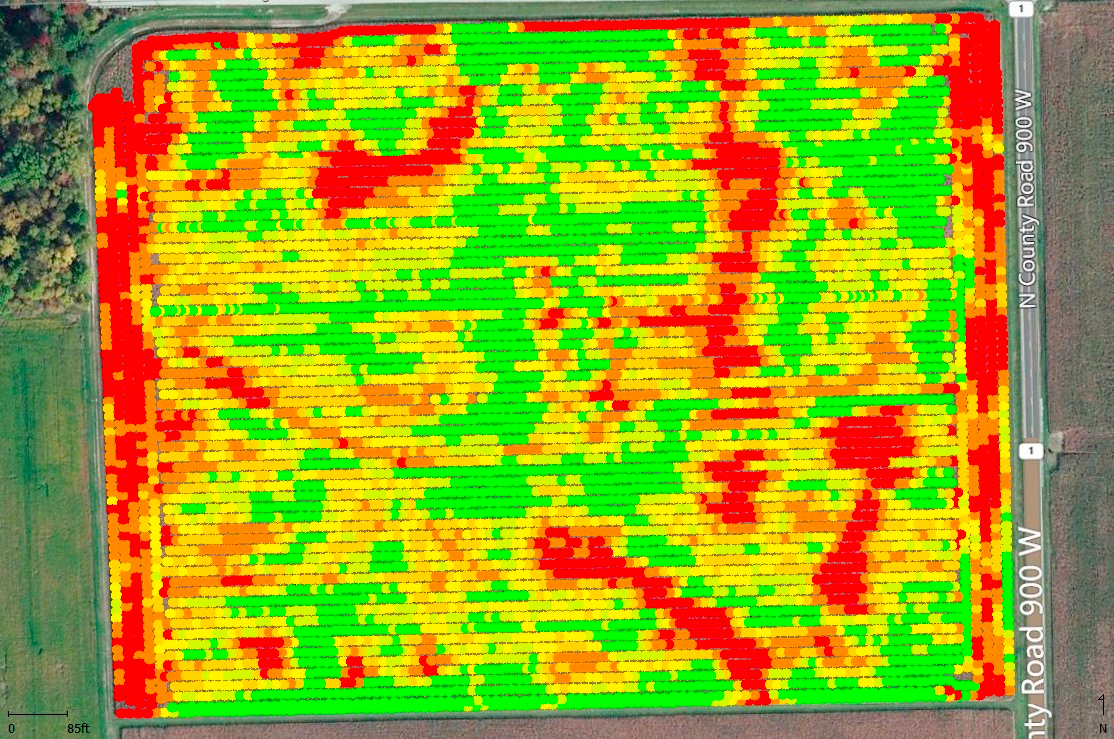

Typically for commodity row crops, one of the primary ways to generate revenue (value can be trapped in many places, not just the top line, as you will see more examples below) for many years is yield and the commodity price. The commodity price is not controlled by the farmer/operator of land. This leads to a huge push to capture the “trapped value” in yield potential. The first wave of precision ag data companies, went after the yield potential trapped value, with a thesis of better data and better models leading to better decisions. This in turn will lead to higher yields and higher profitability.

It is quite common to see presentations from AgTech companies which address the yield gap between the winner of the corn yield contest (> 550 bu/acre) and the average yield in the midwest (~ 200 bu / acre). The thesis is bad / insufficient data and insufficient models are the friction points.

Unfortunately, increasing yield is a combination of many small (or medium sized) decisions over a long period of time. The “trapped value” is not concentrated in a few decisions. It requires high quality data of a variety of parameters like soil, management practices, weather, past history, genetics, and many other factors.

Corrected Yield Map. Image source: Identify and Eliminate "Gremlins" From Yield Monitor Data

It speaks to the slow burn for agtech companies, and challenges many precision ag based platforms have faced to clearly show value to farmers*. (This is mostly true in the developed world, with operations hyper-optimized for yield. The situation is different in the developing countries, as access to better seeds, or mechanization can lead to bigger jumps in yield. The developing world has other challenges in terms of lack of infrastructure, financing challenges, and inconsistent access to markets.)

Ecosystem services

The excitement for carbon in farming can be explained by finding another source of “trapped value”, which already exists in farmland. There is (potentially) billions of dollars of value trapped in millions of acres of farmland, if we just consider carbon. Can the trapped value for carbon be released to farmers, and other entrepreneurs? What is holding back the “trapped value”?

The biggest factors trapping value are the uncertainty in measurement of outcomes at scale, and the risk associated with getting to those outcomes, in terms of different management practices. In response to a question about barriers to regenerative agriculture, the following twitter responses were provided.

-regional knowledge of ecosystems

-outcome vs input standardizations

-greenwashing

-cost and time to transition conventional land

-appropriate size and access to slaughter facilities

-scale of supply chain and demand for whole animal

-vegan propaganda

-labor availability

-rising land costs

I don’t agree with all the topics mentioned above, but going back to Geoffrey Moore’s point, it begs the question if the value of carbon is diffused (similar to yield) as it will depend on a large number of many small (and maybe large) decisions.

The tweet reply from Connie Bowen, captured some of it in response to a question about regenerative farming (I don’t equate regenerative farming and carbon benefits as one and the same)

https://twitter.com/ConnieBowen_/status/1501640395435954181?s=20&t=S40fO_SpZ3WodXROHZlE7g

If technology (coupled with regulation, incentives, and business model changes) can consistently and reliably demonstrate the unlocking of this trapped value, it can accelerate the adoption of carbon farming.

Are there other aspects of value similarly trapped on land? The ecosystem services model includes reduction in greenhouse gas emissions, improvements in water quality, improvement in working conditions etc. The trapped value for some of the examples above is diffused, and also depends on regulation, technologies like automation, machine learning and data management. These technological solutions are not easy to scale, and again require you to understand the local context, which can be especially challenging.

Other “trapped value” on land?

Are there other sources of value which are trapped and could potentially be released? LandTrust (founded in 2019) tries to release other types of “trapped value” from farms and ranches. (I have no financial interest or financial relationship with LandTrust. Mark Young, COO of LandTrust was my manager, when he was the CTO & VP of Product Management at The Climate Corporation).

“We utilize a similar shared-economy platform that made Airbnb a global success and put it to work for you. You get paid for allowing hunters, fishermen, bird watchers, campers, photographers, and people looking for authentic farm and ranch experiences on working lands like yours.”

Based on LandTrust’s pitch to landowners, LandTrust has realized there is a trapped value of ‘authentic farm and ranch experiences' on farms and ranches. There are many layers to this recreational value, in terms of hunting, fishing, camping, photography etc. These values are not commodities, because the fishing experience on one farm will be different from another farm.

The lack of availability of high quality marketplaces for hunters, fishermen, photographers and others to transact with land owners is trapping this value. LandTrust hopes to “un-trap” this value, make it liquid, and available for transaction. If you want to take the framework of unbundling and bundling, they have unbundled AirBnB and created an AirBnB for recreational experiences. (Their marketing material says the same as highlighted by me above).

Relying on crop output as your sole revenue puts all your grain in the same bin. (sorry for a made up metaphor!). Releasing “trapped value” can diversify your revenue stream, and lead to a more resilient and sustainable operation in the long run.

LandTrust helps landowners realize their recreational income potential while keeping them 100% in control. We work together to identify opportunities to diversify revenue from the land across all seasons. LandTrust handles the demand marketing, participant vetting, insurance, bookings, and payments all on one easy-to-use platform.

Are there other streams of “trapped value” on farmland, which can be unlocked?

There are many other examples of trapped value in agriculture and agtech. This is not a comprehensive list by stretch of the imagination. Please feel free to send me any other examples.

- Horizontal use case of building similar tech infrastructure tools multiple times and in house, proliferates as a lack of productivity and creativity, slower innovation. (I covered it in my post called 83. Picks and Shovels). An open platform for 3rd parties can unlock this “trapped value.”

- Lack of automation for harvesting in specialty crops combined with bad policy has “trapped value” of human potential, social issues, and high cost on consumers to pay for nutritious fruits and vegetables.

- Biologicals, autonomy, see & spray, smartphone based scouting, etc. are all examples of ways to uncover and unblock “trapped value.”

Glyphosate, GMOs, autosteer, N-fertilizer were some examples of concentrated trapped value, and it led to massive adoption of those products extremely rapidly. But one common theme through many examples (not all) discussed today is the diffused nature of trapped value in agriculture. It makes rapid adoption, and scaling difficult, and it could be one of the reasons why we have seen few large exits in Agtech in the last decade.

How should startups and innovation teams think about “trapped value”, concentration of trapped value, and their investment allocations? I would love to hear from you!