A needle in a haystack

Impact of AI on herbicide discovery

Over the last few years, I have spent a decent amount of time working on, and thinking through how tools like artificial intelligence are having, and can have a significant impact for on-farm operations. Today, I want to go upstream to see AI’s potential impact on product discovery and development processes for inputs like herbicides and pesticides.

Agrochemical companies spend a long time and a ton of money to bring herbicides and pesticides to market. It can take more than 10 years to bring a product to market.

I. Cost and time to develop herbicides

Herbicides are chemical substances used to control or eliminate unwanted plants (weeds). They are widely used in agriculture, forestry, and landscape management to improve crop yields, reduce labor costs, and manage invasive plant species. Herbicides can be classified into several types based on their mode of action, timing of application, and selectivity.

Mode of Action

There are two broad categories of herbicides based on how they work. Systemic herbicides are absorbed by the plant and translocated throughout its tissues, killing the entire plant, whereas contact herbicides kill only the parts of the plant they come into contact with.

Timing

Pre-emergent herbicides are applied before the weed seeds germinate, whereas post-emergent herbicides are applied after the weeds have emerged from the soil.

Selectivity

Selective herbicides target specific weed species while leaving the crop relatively unharmed, whereas non-selective herbicides kill all the plants they come into contact with.

The magic of glyphosate

The herbicide glyphosate was first discovered by Swiss chemist Henry Martin, and Monsanto chemist John E. Franz independently discovered its herbicidal properties in 1970. Glyphosate was introduced to the market by Monsanto under the trade name Roundup in 1974.

Glyphosate turned out to be the Michael Jordan of herbicides. Just like MJ, glyphosate was a once in a generation molecule.

It was extremely effective, and miles ahead of any other herbicides available at the time.

Glyphosate is a broad-spectrum systemic herbicide. It works by inhibiting the enzyme 5-enolpyruvylshikimate-3-phosphate synthase (EPSPS), which is involved in the synthesis of aromatic amino acids necessary for plant growth. Glyphosate became widely used due to its effectiveness in controlling a wide variety of weeds and its perceived low toxicity to humans and animals. The introduction of genetically modified (GM) crops, such as Roundup Ready soybeans and corn, which are resistant to glyphosate, significantly increased its use.

The overwhelming success of glyphosate and glyphosate-resistant crops led to a period of complacency in the herbicide industry, with fewer new herbicides being developed during its peak years.

The dominance of glyphosate reduced the perceived need for alternative herbicides, leading to a slowdown in innovation and investment in new herbicide research. There are now only five truly global corporations that operate herbicide discovery programs – BASF, Bayer, Corteva, FMC, Syngenta. The result of this industry consolidation has been far less herbicide discovery effort than existed in earlier decades.

The excessive (?) use of glyphosate and other herbicides has created the problem of herbicide resistant weeds, making some of the existing tools less effective and expensive to use, and thus making the search for newer herbicides even more important.

Extended timelines and purse-strings

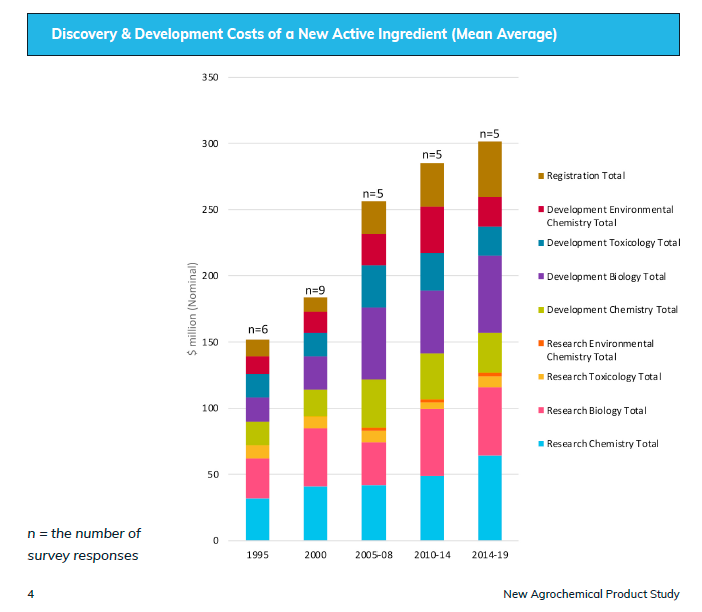

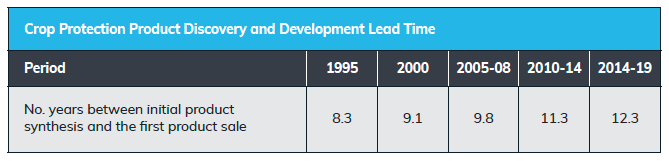

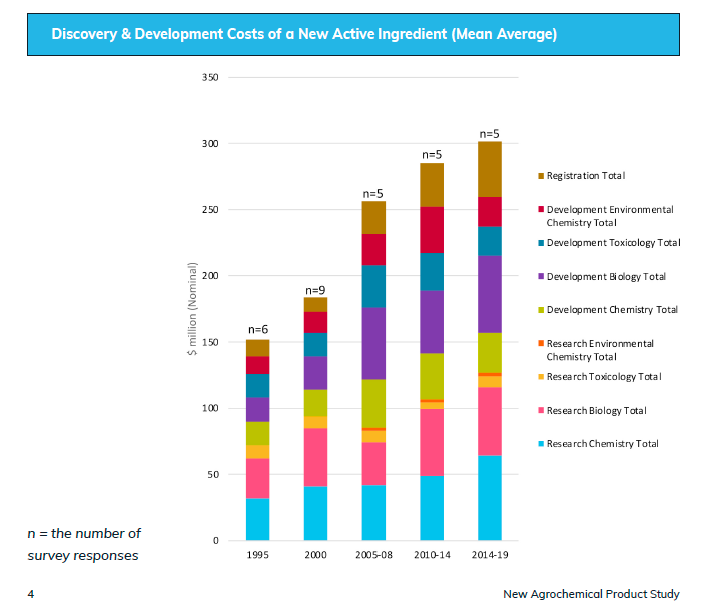

As you saw in the table above, the time to bring a new herbicide product has kept on increasing over the last few years, whereas the cost to bring these products to market have also ballooned.

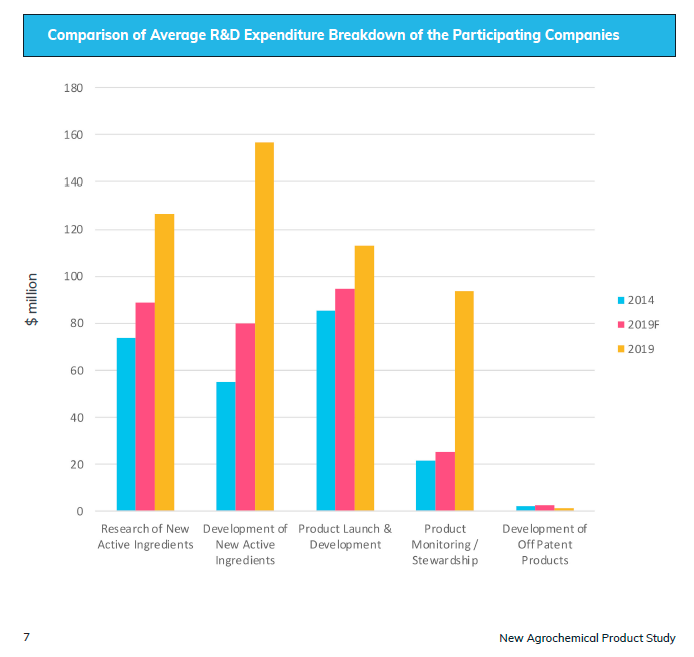

As you can see from the table above, the total cost to bring a product to market has doubled in 25 years, with major increases happening in costs during the research and development phase as can be seen from the chart below.

The glyphosate and glyphosate-resistant crops business model revolutionized modern agriculture by providing a highly effective and efficient weed management solution. While it led to significant economic benefits and changes in farming practices, it also brought about environmental challenges, health concerns, and regulatory scrutiny. The long-term sustainability of this model depends on addressing the issues of herbicide resistance, environmental impact, and health safety, while continuing to innovate and adapt to evolving agricultural needs.

II. A needle in the haystack

So how does a herbicide discovery process work?

At a high level, the herbicide discovery process is a huge search based on certain constraints. It is very similar to drug discovery in the pharmaceutical industry, or the breeding process in seeds.

You start with a large set of potential chemical molecule candidates (assuming you are looking to find a chemical molecule to work as a herbicide). You continue to whittle down the list of candidates based on constraints, until you arrive at an option which satisfies all your constraints including registration and approval from government agencies.

- Is the herbicide effective in killing the weeds?

- Which kind of weeds can it kill? Will it and if so, how will it impact the crop? How will it interact with the weed to make it an effective solution?

- What is the delivery mechanism, and how does it work? Can it be stored, and transported safely?

- Can we manufacture it at a reasonable cost? Can we make a profitable business out of it?

- What is its impact on bees, other animals, plants, insects, and humans? Is it safe? How long does it stay before it disintegrates?

And many many many more questions.

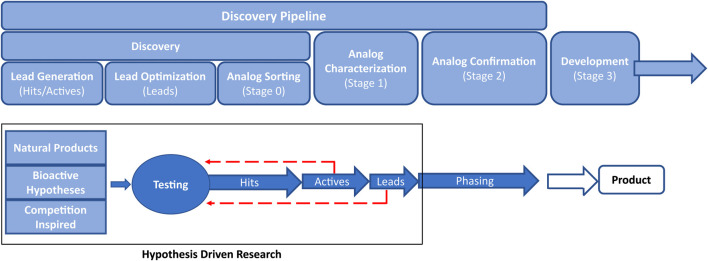

As you can see, the number of constraints is a large set, and due to this it takes a long time and a lot of money to bring a new product to market. At a high level, a typical process has three phases. Discovery, Development, and Registration.

The discovery process, from a chemical standpoint, starts with looking at a large number (>100,000 typically) candidates called hits, analyzing their properties, and whittling down the list to a few hundred candidates (called leads).

The diagram below shows a typical herbicide discovery pipeline process followed by most agrochemical companies.

Herbicide discovery pipeline process. Image source: Cheminformatics and artificial intelligence for accelerating agrochemical discovery. Research paper citation at the bottom.

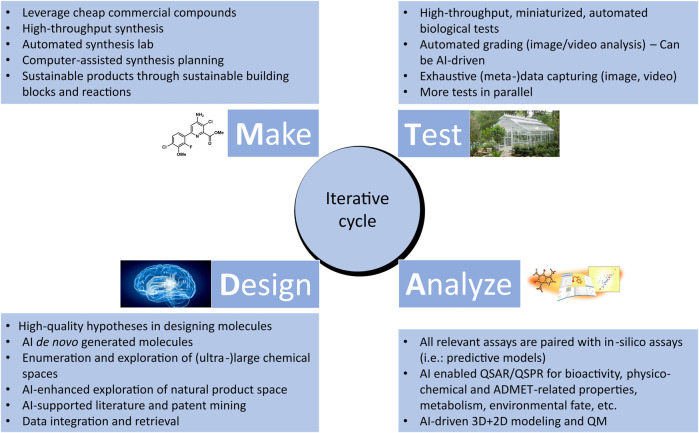

Once the pipeline has identified a smaller number of leads, the leads are typically analyzed through a circulate process called DMTA (Design Make Test Analyze). The DMTA process looks at various aspects of the discovery process, with the goal to further whittle down the list of leads to a much more manageable number. The DMTA process can take anywhere between 18 to 36 months.

It uses techniques like high throughput synthesis to understand chemical synthesis properties, biological tests to understand how the herbicide molecule will interact with the weed, the crop, and the environment, and methods like QSAR (Quantitative Structure Activity Relationship). QSAR is a way of mapping the way a molecule is linked with a process, such as biological activity or chemical reactivity.

The DMTA process is an iterative process, and at the end of it a few promising molecules are sent to the development stage to do additional field trials, understand scaling of production, costs, pricing power, efficacy, environmental impact, safety etc.

The DMTA is an expensive process as R&D scientists try to eliminate candidates which do not meet the necessary constraints, with bench testing and lab testing.

DMTA Cycle for herbicide discovery. Image source: Cheminformatics and artificial intelligence for accelerating agrochemical discovery. Research paper citation at the bottom.

The development process is a slow and expensive process as it involves real world trials with increasing degrees of complexity.

The cost and time of the process is in some sense directly proportional to the number of candidate molecules which go through the DMTA and the development phase.

R&D scientists are constantly trying to improve the search process so that they can send a smaller number of highly relevant candidates to the DMTA and development process. Artificial intelligence has been playing a role in finding a smaller number of but more relevant and effective molecules in the top part of the search process. (discovery)

III. AI to the rescue?

Artificial intelligence helps with the discovery process in a number of ways. Due to computational advances, AI can widen the top of the funnel and look at a much larger set of molecules to start the search process. Some companies can look through a few billion molecules very quickly to whittle down the list of potential candidates.

Expanding the funnel at the top might sound counterintuitive, but with the use of AI, it increases the chances of finding a candidate, which a less exhaustive search will miss. There are many principles used in drug discovery which are applicable to herbicide discovery. For example, the sophisticated protein modeling platform AlphaFold, can dramatically narrow the search space, by predicting the 3D structures of plant proteins which are involved in essential biological pathways in weeds.

Deep learning models trained on large datasets can help predict how well a molecule will bind to its target, how will the molecule design have an impact on selecting the right target and for safety, how can it potentially overcome resistance, and how will it interact with other variables through a data driven approach. The table below summarizes different ways in which different AI techniques helps narrow the search process efficiently, while increasing the quality of the constraint optimization to come up with more promising high quality candidates for the next stage beyond discovery.

IV. Can we find the needle easily?

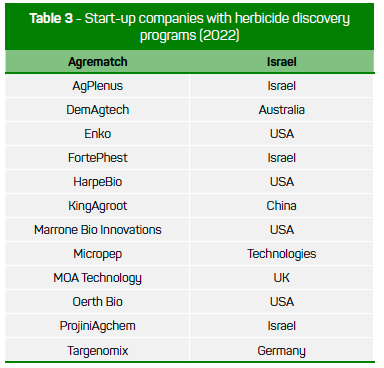

As discussed above, artificial intelligence has the potential to increase the speed of discovery and improve cost efficiencies of the discovery process. AI models can also help with improved efficacy and reduce the environmental impact through lower usage. There are many startups working to improve the discovery process. According to the 2022 study titled, “Herbicide discovery through innovation and diversity”, there are at least 20 startups working to improve the discovery process.

Image from report titled: “Herbicide Discovery through Innovation and Diversity”

The table below summarizes some of the claims made by startups on the impact of their technology powered by AI on the speed, cost, efficacy, and environmental impact.

Even though it is difficult to validate all the claims based on publicly available information, the state results sound very promising.

V. Is it real?

AI is already having an impact on drug discovery processes in terms of time and cost to market for new drugs. The agrochemical industry is learning from and bringing many of similar techniques to the agriculture sector. Given some of these techniques are still in development, it will be some time before we can really feel the impact of AI on agrochemical discovery in meaningful ways.

AI is also being used in the development of non-chemical based treatment options like bioherbicides, laser based weeding, mechanical weeding etc.

Based on the evidence so far, and the early success achieved in the drug discovery process, I am quite confident AI based tools will have a measurable and significant impact on the agrochemical discovery process.

Research article citation: Djoumbou-Feunang Y, Wilmot J, Kinney J, Chanda P, Yu P, Sader A, Sharifi M, Smith S, Ou J, Hu J, Shipp E, Tomandl D, Kumpatla SP. Cheminformatics and artificial intelligence for accelerating agrochemical discovery. Front Chem. 2023 Nov 29;11:1292027. doi: 10.3389/fchem.2023.1292027. PMID: 38093816; PMCID: PMC10716421.