AI for food product design and ingredient management

Use of AI and GenAI in the CPG food supply chain

Welcome to the June 8, 2025 edition of SFTW. We will continue the series of how AI is being used in the food and agriculture supply chain this week. This week’s examples come from CPG (Consumer Packaged Goods) companies. Some of the examples might not be directly relevant to you, but I hope you can see patterns, which apply to you.

Metal Dog Labs and AgTech Alchemy Happenings

- The second part of the GenAI in Agriculture white paper is available for free to all members

- I will be doing a keynote (“Is AgTech relevant in 2025?”) at the Plug n Play Center AgTech event in Sunnyvale, CA on June 11th. I hope to see some of you there and/or at the AgTech Alchemy event in Sunnyvale. I will publish the slides of my talk after the event

- AgTech Alchemy will host two events on the same day in California (wait list only, as the registration is closed) and in Fargo on June 12th

Scaling Regen Ag Starts with Better Data

Farmers Edge is building the digital backbone for regenerative agriculture—designed to simplify Scope 3 reporting and deliver credible results, fast. With Managed Technology Services built for agribusiness, Farmers Edge connects real-time field data to your sustainability goals across every acre and every grower in your network. From in-season tracking to end-of-year proof, Farmers Edge makes regen ag measurable and manageable. If you're serious about scaling impact and reporting, this is the infrastructure that makes it possible.

AI for food product design and ingredient management

Last week, I spoke about understanding the realities for GenAI at an event in St. Louis. My main takeaways for the audience (which included a bunch of seed dealers) were as follows:

- The cost of experimentation has gone down significantly and so they should be able to engage with GenAI and run some experiments.

- Depending on the use case, ROI can come in fairly quickly, and can fund future projects fairly quickly.

- Strategy and technology expertise is available and they don’t need to take on these projects on their own.

- The time to engage with GenAI is now and the biggest barrier is a necessary change in mindset.

I used Amara’s law to instill a sense of urgency with the audience. Amara’s law states the following:

We often overestimate the impact of technology in the short term, but grossly underestimate the impact of technology in the long term

It's like planting a tiny seed. You might not see a mighty oak tomorrow, but if you forget to plant it at all, you'll definitely never have shade.

Amara’s law teaches us to temper our expectations for the short term, but also exhorts us to engage with promising tools like GenAI so that the world suddenly does not change on us in the long term.

Which problems lend themselves to GenAI?

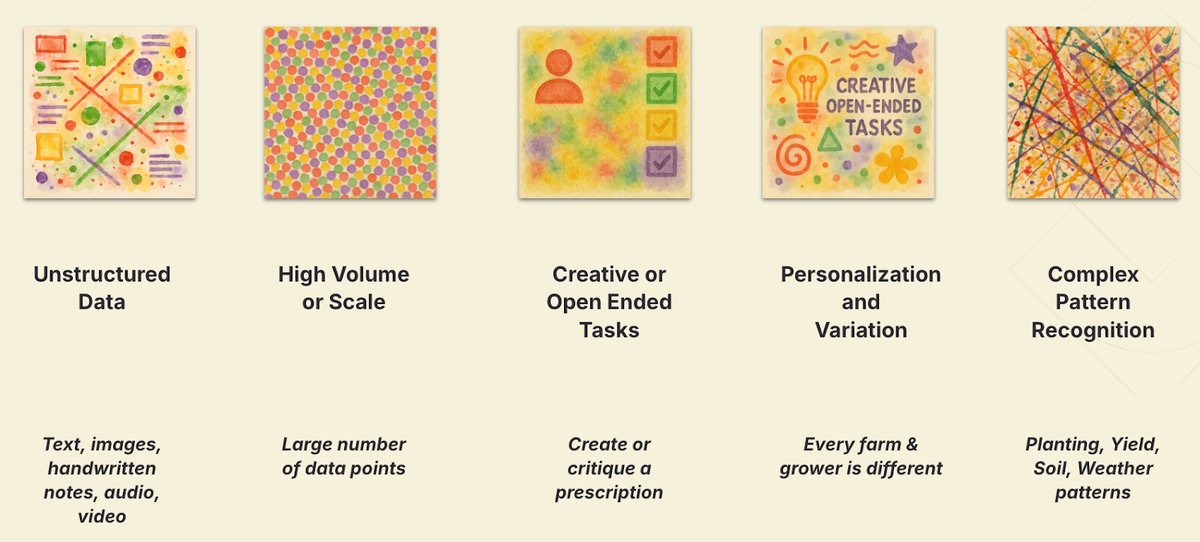

There are certain situations where GenAI could be a great tool to be used and I believe and know that the food and agriculture industry is ripe with these scenarios.

CPG ingredient management

CPG companies (Consumer Packaged Goods) like Nestle, General Mills, Mars, and others often face ingredient availability issues. Ingredient availability issues come in different forms. For example, a particular ingredient (for example, some form of cocoa powder or corn starch) might see a spike in prices, or they might have a supply situation due to some supply chain issue. Ingredient availability and pricing are fairly common issues in the CPG industry.

An ingredient availability issue can trigger a whole chain of events, many of them are manual in nature. (By the way, I advised a startup last year to help them design a solution to help CPGs address some of the challenges with the ingredient substitution process)

One of the first steps is to involve food scientists who understand the product formulation and ask them to come up with potential substitute ingredients, without changing the product performance and ideally without having to change the ingredient on-package label. Changing the on-package label is a very expensive and time consuming process.

It is easier to get your Real ID done at the DMV than getting a label change on a package.

In this situation, food scientists will come up with a set of potential options for the substitution and then contact different ingredient suppliers for specs. The specs include nutritional information, other variables like viscosity, food safety, manufacturing attributes, availability and pricing.

The specs come back as PDF sheets, Word documents, or spreadsheets. Different companies might follow different formats and structures and how they present this data back to the CPG food scientists.

The CPG food scientist has to manually line up these specs and filter them based on the requirements of their product, and its impact on the manufacturing process. This process can take many iterations, is prone to errors and the output is very much dependent on the experience of the food scientist.

The food scientist has to often refer to other internal documentation or research papers to do a good job of whittling down the options to a manageable number. This process can take days or weeks, depending on the availability of information, and the experience of the food scientist.

If we compare the situation facing the food scientist to the five characteristics to apply GenAI, it checks at least 3 out of the 5 boxes. The data is available in a wide variety of formats and is fairly unstructured, there is a high volume of data, it requires personalization and there is variation across different ingredients.

We used an LLM to ingest different formats of unstructured data, and were able to get down the time for getting credible alternatives from weeks to days in most cases. It also allowed a junior scientist to work with the options with a higher degree of confidence, compared to if they didn’t have a tool to help them crunch through and make sense of the data.

The tool opened up the search funnel as it was more feasible of the LLM based tool to look at a larger number of ingredient options as potential candidates for substitution compared to a human food scientist doing it without the help of such a tool.

For example, ingredient substitution and product formulation company Agilitas is able to take proprietary data sets, other customer data, scientific literature, process and manufacturing documentation and provide additional capabilities to existing human food scientists.

Agriculture and food are ripe (pun intended) with unstructured data spread across PDFs, spreadsheets, emails, voice mails, text messages, standards documentation, contracts etc. These situations make it a perfect case for applying LLMs to uplevel teams, free up some of their time, and focus on higher value add activities.

The GenAI at the farm gate reports, make this point again and again, while presenting case studies from Bayer Crop Science, Digital Green, Kissan AI, and Traive Finance.

GenAI for product formulation

In the mid 2010s, I worked at a startup called ShopWell (which was acquired by another company called Innit). ShopWell came out of the IDEO design lab from the design school at Stanford.

At ShopWell, we had built a proprietary algorithm which would score packaged food products (score out of 100, with 100 being the best fit) based on their nutritional profile and ingredients. The score was personalized to each individual user based on their stated health goals and conditions or allergies.

For example, a product’s score with high sodium would be lower for a person with high blood pressure, compared to someone without a high blood pressure condition. A product with high added sugar would score lower for someone with type II diabetes, vs. a user who didn’t have type II diabetes.

We built a database of more than 350K food products, including private label products from companies like Walmart, Kroger, Safeway, and Trader Joe’s. (Trader Joe data was the most difficult to get and our coverage was quite poor for Trader Joe’s products).

Whenever a user scanned the bar code on a food product, the app would provide a score for the product personalized to the user based on their profile and recommend them a few products in the same category which were better for them. We did integration with shopping carts, receipts to help you score your entire basket as well.

One of the interesting capabilities we could offer to CPG companies was in product formulation. We could run a CPG company’s entire product portfolio in high priority categories, and then map the scores to different user personas based on their health profile and goals supported by our application.

This allowed us to identify gaps in the product portfolio, when it was compared against the types of user personas they wanted to service through their product portfolio. The tool could also be used during product formulation to see how the final product would score for different user personas and the food scientists could potentially tweak their formulation, if it made sense.

This was almost 10 years ago.

The tools and the technology available today for product development and formulation are like having a high speed wi-fi connection, compared to using carrier pigeons. The cultural window has also shifted, and there is an Overton window available at least in the US when it comes to designing healthier food products with the influence of the MAHA movement.

For example, Mars is using an internally developed GenAI tool called Brahma to come up with 50 new product ideas every day!

The proprietary tool, built by the company’s One Demand Data & Analytics team and known internally as “Brahma,” uses data from consumer insights studies the CPG conducted last year involving 80,000 consumers and 800,000 consumption moments across 11 countries.

A recent workshop in North America using Brahma resulted in product innovation ideas that were shared with consumers at speeds that would have previously taken months

Almost 3 out of 4 CPG companies are using AI or GenAI, though obviously it is a bit early to understand the impact of GenAI without tangible use cases and data.

The benefits of Generative AI for CPG companies include the ability to automate labor-intensive tasks, generate new product ideas, analyze market data, optimize their supply chains, enable personalization on a massive scale, and much more. When implemented at scale, GenAI can help spur topline growth while slashing the cost of production. (highlights by me)

There are multiple examples from large CPG companies, including coming up with brand new formulations, which would have taken much longer to create, scale, and bring to market without AI and GenAI.

Food scientist Rachel Zemser used Tastewise IO and the TasteGPT tool to come up with some product ideas around gut health and other dietary needs of Generation Z consumers.

Zemser used her Tastewise findings to develop a few product ideas leveraging currently trending flavors and tastes, including a vegan aioli made with almond oil instead of eggs and an almond-chocolate candy bar. But the Almond Board’s favorite was an Almond Champurrado Mix (Mexican-style hot chocolate) based on super-fine almond powder from supplier Cache Creek Foods that the AI engine discovered.

Incumbents like Unilever and Coca-Coca have joined the party.

Unilever, for instance, has harnessed AI to launch new products, including Hellmann’s Plant-Based Mayo. Ocean Spray is using AI to plumb all the possible healthful effects of cranberries, including ones that may be influenced by various locations where they’re grown.

Coca-Cola used AI late last year to come up with a new limited-edition product it called Y3000 Zero Sugar, a flavor that had a tutti-frutti character to it

AI is not a panacea. It’s good at assisting researchers, but in the current format, it hasn’t eliminated the need for R&D. And while it can offer nuances, it’s not all the way there.

Obviously, using AI and GenAI is not straightforward, though the cost of experimentation has gone down. Companies should engage with the ecosystem to get started on the process to harness the full power of the new technology.

The new technology can provide an added boost, improve their product portfolio, and provide them a competitive advantage and differentiation compared to other food companies out there. (AgFunder did a nice review of this space in Sept 2023)

Additionally, companies have published some results which show the impact of AI and GenAI in their operations and product development process. (“Revolutionizing Product Innovation with Generative AI is Transforming the CPG Industry”, March 2025) (highlights by me)

AI-driven concept testing has also played a major role.

In reducing product failure rates by 40%, ensuring that new launches align with consumer expectations.

AI-powered inventory management has led to a 20% reduction in supply chain costs, improving operational efficiency.

Product development cycles have tripled in speed, meaning brands can bring innovations to market much faster than ever before.

GLP-1 overhang and AI

Food companies and grocery retailers are also looking at the impact of GLP-1. They will be looking to rebalance their product portfolios, as more and more consumers get on GLP-1 drugs like Ozempic, Wegovy, and Mounjaro. As the prices of these drugs drop, the impact of these drugs on consumer spending on food will have a massive ripple effect throughout the system which will come as a tsunami at the farm gate as well.

It's like the entire restaurant industry suddenly realized everyone's ordering half portions of salads, instead of the gnocchi. It is time to redesign the menu!

CPG companies will not only have to rebalance their product portfolios, but might have to reformulate many of their existing products in the product portfolio.

For example, according to a new report from IFF GLP-1 “Consumer Opportunity Outlook, Driving Empathy-Powered Innovation in Food and Beverage” (2025)

Food and beverage manufacturers need to think about the different needs of three consumer groups: active users of the medications, those transitioning off the drugs, and those seeking to sustain results after coming off the drugs.

(It does feel like IFF used an LLM to come up with these goofy alliteration laden persona names!!)

These different groups will have different needs when it comes to how they approach different meals like breakfast, and how they change their spending from one category to another. It will also change the type of ingredients, nutrition characteristics, packaging, and messaging needed to attract the three personas mentioned in the report.

Key takeaways

So what are the key takeaways for food and agriculture ecosystems?

- Your downstream customers are increasingly using AI and GenAI not only to improve their operational efficiencies but also in their R&D pipelines for product reformulations and new product development.

- The pace of change will continue to go up. If you overlay the impact of GLP-1 drugs, it will have a massive ripple effect throughout the food and agriculture system.

- Entities throughout the food and agriculture ecosystem will have to be ready and ideally a few steps ahead of these incoming changes.

- The cost of experimentation is going down, the pace of change is increasing, and the tools are getting better every day.

All it requires is a mindset shift to engage.

Are you ready?