"Anna Karenina" LLM'ed! LOL!

Analysis of Land O'Lakes Oz, Syngenta's Open Platform, and a comparison of GenAI product positioning

Programming Note: SFTW will be off for the next two weeks for the US Thanksgiving break. SFTW will be back in your Inbox on Dec 3rd, with an SFTW Convo with Dr. Brad Zamft, CEO of Heritable Agriculture. Also, going forward, SFTW weekly edition will come to your Inbox on Monday mornings, Pacific time.

“Anna Karenina” LLM’ed. LOL!

The celebrated mega-novel, Anna Karenina, by Leo Tolstoy, was published in book form in 1878.

Described by William Faulkner as the best novel ever written and by Fyodor Dostoevsky as “flawless,” Anna Karenina tells of the doomed love affair between the sensuous and rebellious Anna and the dashing officer, Count Vronsky.

Anna Karenina is about 878 pages long.

Incidentally, Anna Karenina is almost the same length as the “Land O’Lakes Crop Protection guide, an 800-page agronomic resource built on 20 years of data and millions of data points.”

On November 12, Microsoft and Land O’Lakes announced that the two companies have co-developed an AI-powered agricultural science tool called Oz,” designed to help farmers and agricultural operations.

Historically, these retailers leveraged the Land O’Lakes Crop Protection guide, an 800-page agronomic resource built on 20 years of data and millions of data points, to make personalized product recommendations that address unique farm-level challenges. (By the way, Land O’Lakes should rename their Crop Protection Guide as “The Tolstoy of Agronomic Data”!)

Microsoft and Land O’Lakes used this data to develop a custom copilot called “Oz” that delivers fast, accurate, and mobile-friendly responses to agricultural questions top of mind for farmers and specific to their unique needs.

Land O’Lakes is a member-owned cooperative with industry-leading operations that span the spectrum from agricultural production to consumer foods.

Taking an Anna Karenina-length document, putting an LLM on top of it, and giving it to your agronomists is a good first step, but it can go much further beyond that.

What is in it for LoL?

What is most interesting to see is how it has been positioned to help farmers combat rising costs, shrinking margins, and land constraints. Rising agricultural input prices are a genuine concern in the United States. According to a speech given by Secretary of Agriculture, Brooke Rollins, in September 2025,

U.S. farm production inputs are significantly more costly than four years ago, putting pressure on farmers’ bottom line. Between 2020 and now, seed expenses have increased 18%, fuel and oil expenses increased 32%, fertilizer expenses increased 37%, and interest expenses increased by a whopping 73%. Labor costs increased 47% since 2020.

Oz is built on models from Microsoft Azure AI Foundry.

Oz is an ironic name to choose. Given the high prices of inputs, farmers now need to use oz (ounces) of inputs, instead of gallons, without sacrificing performance!

The models have been tuned using Land O'Lakes' proprietary agronomy corpus, along with their crop protection guide and digital agronomy data. LoL explicitly called out the use of AI to access “structured, high-quality, and standardized data from over the past 20 years.”

This is a smart and obvious first step to take with the latest GenAI technologies available today. Land O’Lakes and Microsoft began collaborating in 2020, with a joint announcement made by Beth Ford and Microsoft CEO Satya Nadella.

In terms of strategy, this is a good move to leverage the in-field expertise, a strong agronomy network, and the raw data from various programs, such as Answer Plots, to provide more usage and validation for their expertise. This could create a flywheel effect with a strong feedback loop, leading to better models, more informed decisions, and a more differentiated value proposition for their members.

Oz is designed for agronomists who already act as trusted advisors, and is not a direct-to-farmer application. Oz understands and respects the channel and upgrades the existing human expert, rather than trying to disintermediate the expert. Other Agribusinesses using LLMs (for example, Bayer’s E.L.Y.) are already seeing time savings for their front-line staff, faster response times to farmer queries, and higher confidence in product placement for their agronomists.

Oz doesn't replace the agronomist. It just makes the agronomist look like they’ve finally read a book and know what’s in it.

The strategy is to defend and deepen its human-expert moat. An agronomist can now use "Oz" on their phone in the field to instantly answer a farmer's complex question (e.g., "What's the most cost-effective fungicide for this specific blight, given my soil type and last year's crop?").

This converts a 100-year-old data asset (the 800-page guide) into a high-value, interactive service that solidifies the agronomist's value to the farmer.

Oz provides the commercialization support layer on top of the data, powered by existing relationships and human expertise.

By building a tool that directly addresses critical farming challenges (cost control, yield optimization), Land O'Lakes is creating a "pull" for digital adoption across its cooperative. This accelerates the broader digital transformation of its "Digital Ag Platform" and "Digital Dairy solution," all hosted on Microsoft Azure.

What’s in it for Microsoft?

Oz is a premier example of what Microsoft's "Azure AI Foundry" is built for. It proves that Microsoft's platform can securely ingest a partner's vast, private data (Land O'Lakes') and use it to create a custom, industry-specific LLM that delivers tangible business value.

The "Oz" program reinforces Microsoft's entire "copilot" narrative. It demonstrates that the concept is not just for office workers (Microsoft 365 Copilot) but can be tailored to empower frontline workers in any field, from a tractor cab to a dairy barn.

If Oz gains traction with agronomists and eventually farmers, that translates into steady AI compute and storage spending, making it much harder for Land O’Lakes to consider AWS or GCP for future AI efforts. It also gives Microsoft a marquee, real‑world GenAI reference in a sector where cloud penetration is still evolving.

Adoption questions

There are still certain risks associated with Oz. If Oz introduces friction in the field (such as latency, clunky UX, or poor offline behavior), agronomists will likely revert to their own heuristics and the physical guide.

Even though LoL has constrained the inputs to an 800-page guide, bad recommendations still have real financial implications. LoL will have to be transparent about data governance and any information asymmetry issues, given its size. However, this is less of a problem, as Oz does not create new information asymmetries, and the co-op structure does help.

Microsoft’s own research highlights connectivity and on‑edge LLM deployment as a key challenge in rural ag. It remains to be seen how far Oz pushes toward edge/hybrid workloads will matter.

Ecosystem Implications

Vertical, data‑bound copilots are now the default pattern in ag, as we have seen with Bayer’s E.L.Y., Cropwise Advisor, and Farmer.Chat from Digital Green, KissanAI, etc. Oz continues to raise the bar for other agribusiness majors, as well as mid-size input providers, OEMs, and retailers/co-ops.

Having a field decision assistant is rapidly becoming table stakes.

A partnership between a hyperscaler and an entity with agronomic expertise, trusted relationships, and a robust distribution network is one potential model to follow.

There are other models to follow as well, which can bring in domain expertise, strategy, and technology chops, execution capabilities, and change management expertise to build and push the adoption of these types of tools at scale.

It also shows that cloud vendors can compete more effectively by leveraging vertical depth in a specific domain.

In summary, Oz is a valuable network defense and augmentation tool, which transforms the Land O'Lakes' agronomy IP into a copilot for retail agronomists, strengthening the WinField United channel and keeping Azure at its core.

Syngenta’s Open Platform

Sygenta recently announced that they are making its Cropwise platform open to developers to build applications on top.

The core strategy is to accelerate adoption and become the central hub of digital innovation by inviting third-party developers, as well as competitors, to build upon its platform. This is a direct challenge to the more closed, machine-centric model of John Deere and the data-siloed approaches of its agrochemical rivals. (for example, FieldView from Bayer).

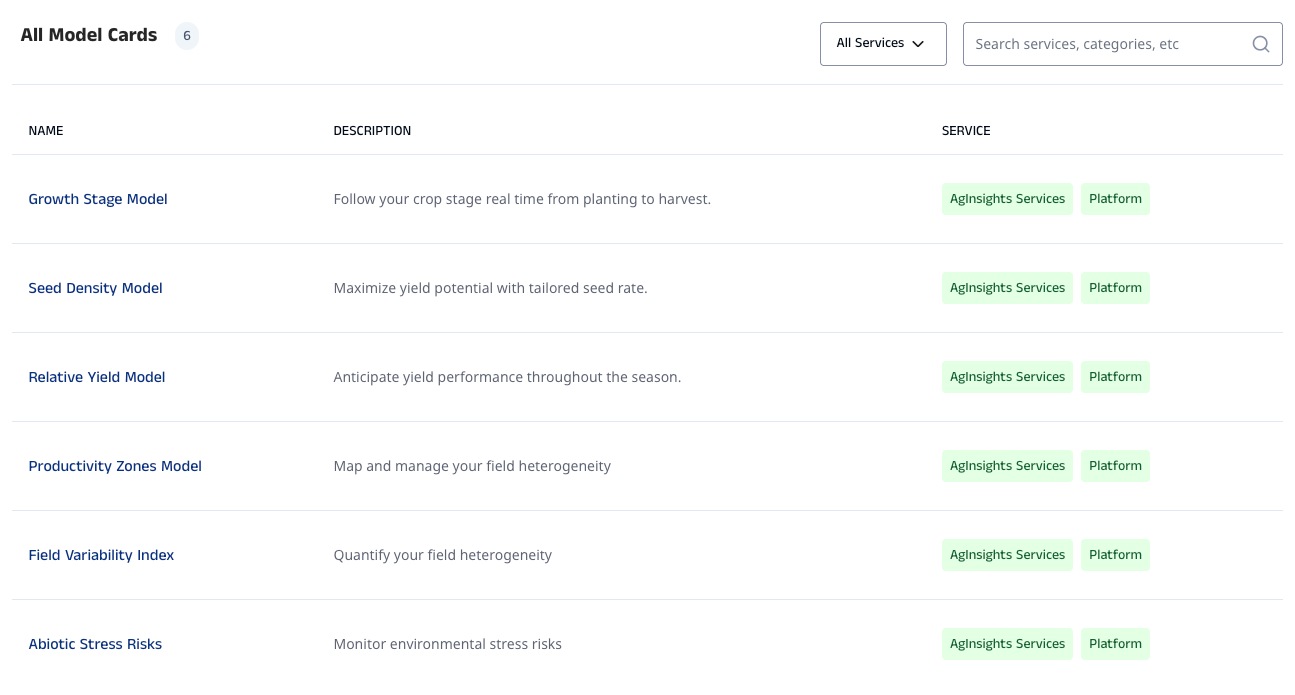

For example, Sygnenta’s Open Platform currently displays six model cards that can be utilized by developers.

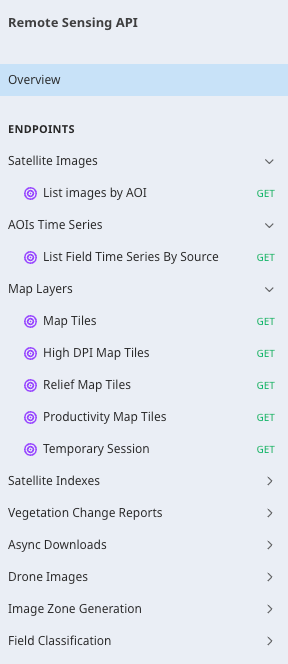

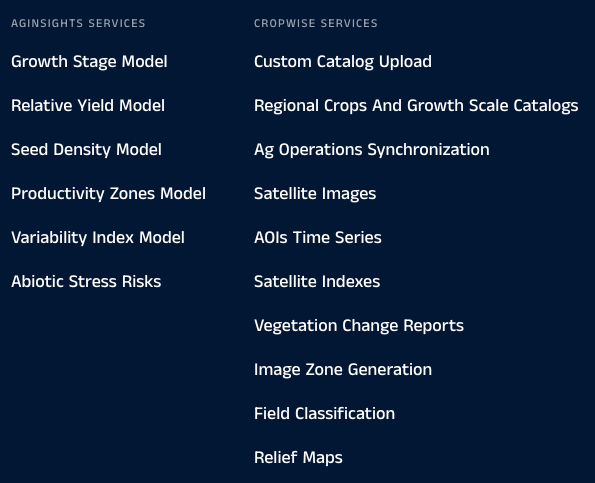

Cropwise also provides a set of APIs across core services, AgInsights, and remote sensing. (See example of remote sensing APIs and Cropwise Services offered on the Open Platform).

The Open Platform exposes the same class of models as generic APIs, allowing other apps to interact with these models directly instead of having to build and maintain their own.

For Syngenta, it amortizes the R&D cost of model development across multiple use cases, reducing duplication for developers. The Cropwise Open Platform offers a set of developer capabilities that reduce redundant investments in building the same models repeatedly.

The open platform could deepen its moat around agronomy IP and transition from being an internal asset to serving as a backbone for others’ tools.

It also provides an opportunity to distribute beyond Syngenta’s own go-to-market efforts through its open platform developer partners. In a sense, every integration is effectively an embedded distribution for Cropwise.

The open platform creates a stronger narrative around inclusion and sustainability, and positions itself as a player in opening AI to small and medium-sized farmers.

It could also counter any anti-China sentiment (ChemChina owns Syngenta), which is quite prevalent in the current “America First” political environment in the United States. For example, Kip Tom and Royce Hood wrote a white paper for the America First Policy Initiative in November 2025 (“National Security Threat of China-Dominated U.S. Agricultural Sectors”), which specifically called out companies like Smithfield, Syngenta, Chinese drone manufacturers, etc. as national security threats.

Incidentally, this was the same model that we had attempted to build at Mineral, and we were able to digitize approximately 400 million acres of farmland, planning to expose it through a set of APIs.

The challenge was with the business model, as selling access to these APIs was part of it. Syngenta has not outlined its business model for funding these open platform initiatives. However, Syngenta could keep it free, as it is accretive to their business model of selling seeds, inputs, and agronomy services.

Adoption questions

The quality of the actual developer experience will matter significantly for Sygnenta. Does Syngenta offer genuine SDKs, sandboxes, self-service sign-ups, and transparent pricing? How detailed and comprehensive are their models in terms of limitations, geographies, and crops?

Will Syngenta provide a proper marketplace or an application directory inside Cropwise with discovery and revenue sharing, or is it purely a B2B API gateway (which is what we did when I worked at Bayer)?

How hard will it be for a partner to leave or to multi-home across Deere, FieldView, Cropwise, etc.? One of the most important questions to answer will be around data. How is aggregated data used for Syngenta’s own commercial advantage vs improving the shared models? Who will be the flagship partners who signal that they take it seriously and help attract the next set of partners?

Missed opportunity for Bayer

Bayer’s FieldView platform, through its partnership with Microsoft, had the opportunity to do this 4-5 years ago, when they announced their strategic alliance (Nov 2021). In fact, Bayer had the chance to go deeper into this in the late 2010s, when they first launched their FieldView platform.

The FieldView platform was initially launched as a set of B2B APIs in 2016-17. Still, the longer-term vision was to convert it into an open platform that increased stickiness with FieldView and enhanced LTV (Lifetime Value) for existing customers. It reduced CAC (customer acquisition costs) for new customers.

Due to a lack of strategic vision, limited executive support, and team dynamics, Bayer has been unable to achieve this.

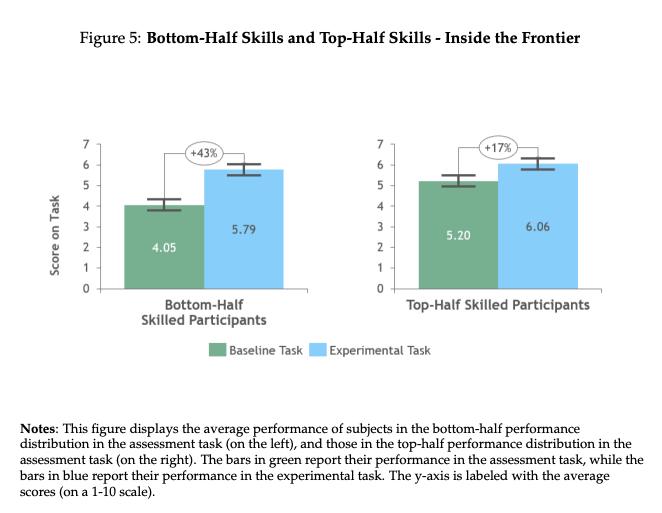

They have done quite well on building GenAI-based tools like E.L.Y., which has created significant value for their front-line staff (for example, agronomists). This was well documented in an SFTW report from early 2025.

Different approaches from Land O’ Lake, Bayer, and Syngenta

It is interesting to compare and contrast the different market positioning and the first set of problems these companies have addressed while using AI capabilities.

For an input manufacturer like Bayer, its GenAI product, E.L.Y., is focused on providing deeper proprietary insights into their own crop protection products and has a built-in bias towards their portfolio.

To be fair, Bayer has built the correct set of capabilities so that a model like Oz can use one of Bayer’s crop-protection portfolio-trained models and try to incorporate it within Oz. In that sense, E.L.Y. has started as a risk-mitigation and productivity tool to tackle the high-stakes domain of product compliance.

On the surface, Syngenta’s Cropwise open platform approach appears to be an aggressive and platform-centric tool. It aspires to utilize AI to become an indispensable, all-in-one digital hub for the entire agricultural ecosystem.

As I stated earlier, Land O’Lakes has decided to enhance one of its most valuable assets, its human-expert network. In that sense, Oz is a defensive and relationship-focused tool.

One key difference between AI advisors provided by input manufacturers like Bayer and Syngenta is that they will come with deeper, proprietary insights into their own product portfolios (or, in other words, they will be biased towards their own product portfolios).

A retailer or a co-op assistant, in principle, has to sit across different manufacturer portfolios (including private label products), but might struggle to match each manufacturer’s internal depth unless they ingest and normalize everyone’s data, which is non-trivial from both a technical and a contractual standpoint.