Autonomous equipment: Subsidies & Labor

How subsidies, labor costs, and equipment utilization impacts ROI

What is the common thread between the anomalous increase in pandemic era wine consumption, the incoming US presidential administration, and climate policies in California?

Monarch Tractor just announced they are laying off 10% of their workforce, (35 out of about 350 people) (highlights by me)

as part of a restructuring that will see it prioritize non-agricultural customers, license its autonomous technology, and boost sales of its AI-powered farm management software.

Monarch Tractor is a provider of all electric autonomous tractors in the sub-100 hp range. Their primary customers are specialty crop growers in California. Monarch recently (in July) raised $ 133 million in July, bringing their total money raised to a whopping $ 220 million.

I have noticed this often where companies raise a round and then change their product portfolio, or go-to-market approach. It necessitates a restructuring of the company as slightly different skill sets are required, and you have to make room to make those additional investments.

(I have personal experience with this. In 2012, I joined a startup called HarvestMark. They had recently raised a $ 25 million round, and within a few months laid off a majority of the company as they pivoted to a different business model).

Crashing demand for wines and ag equipment

Monarch and the agriculture equipment space are facing certain headwinds. In the case of Monarch, their early and primary customers have been wine growers in the state of California. Wine grapes is a high value crop, and one of the prime targets for technology companies to go after. Wine is also a discretionary spending item, which people can dial up or down depending on how they are feeling about their finances.

During the pandemic, our family ended up becoming wine club members at multiple wineries in California. After spending many hours on video calls every day, drinking wine in the evening was a convenient way to unwind, for people who could afford it. Our wine consumption shot up.

But after the pandemic was over, and prices shot up due to inflation, we found ourselves not renewing many of our wine club memberships and being selective with ordering wine when we went out to eat.

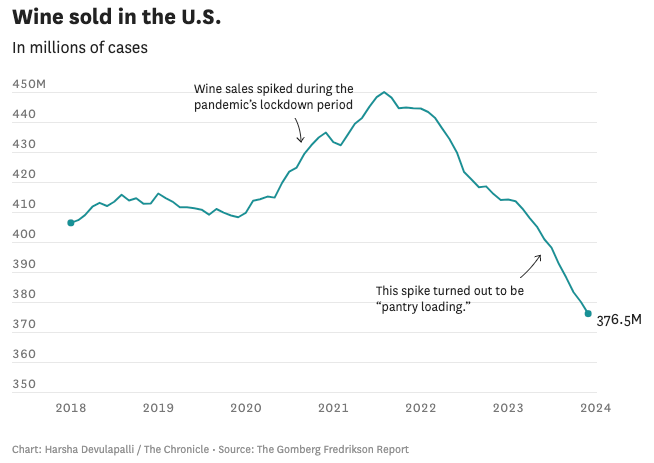

Our personal experience was reflected in the data as well. As the San Francisco Chronicle reported in an article, “California Wine is in Serious Trouble” during summer. Some wineries have seen sales drop for the first time in 2 decades.

Meanwhile, with fewer people going out to restaurants post-COVID, wineries saw a key sales channel wane. Rising interest rates drove distributors to reduce their inventories, buying less from wineries. Because there’s a yearslong lag between the time a wine is made and the time it’s sold, it took a while before wineries could notice these effects — let alone do anything about them.

When demand is cratering for your business, it does not take a genius to figure out that wine grape growers will try to cut down on expenses. Agriculture equipment has a long replacement cycle, and unless you really need that new tractor you are going to think really hard about getting a new one.

In the case of Monarch, the value prop is not just a new tractor. Monarch Tractors are electric, and autonomous and have the potential to save on energy and labor costs. Labor costs are a huge challenge in California, with additional requirements on the H2A programs.

Monarch Tractors can cost you up to $89,000 dollars. If you add in the cost of the software subscription for the premium membership tier, it adds another $ 8,400 per year. The massive subsidies available for buying electric tractors in California has helped Monarch sell close to 500 tractors.

For example, through the California CORE subsidy program, you can get a subsidy of up to $ 68,000 for a fully electric Monarch MK-V tractor. With the Carl Moyer subsidy program to fund cleaner engines and equipment in California, you can get a subsidy of 50-80% on the MK-V retail price. With the USDA EQIP program, you can get a subsidy of 50% on the MK-V retail price.

The lower purchase price because of the subsidies on the Monarch Tractor makes the ROI calculation for a grower a lot easier. The subsidies are trending downwards. If and when these subsidies wind down, the math for Monarch Tractor purchases becomes much harder, if the price of the tractor does not go down. (More on the ROI later)

These subsidies are available only in California as of today, though Colorado and Oregon have tried some pilot subsidy programs for off-road electric vehicles

Based on the recent quarterly earnings from some of the OEM giants like Deere, and CNH, the demand for agriculture equipment is following a downcycle in the agriculture markets.

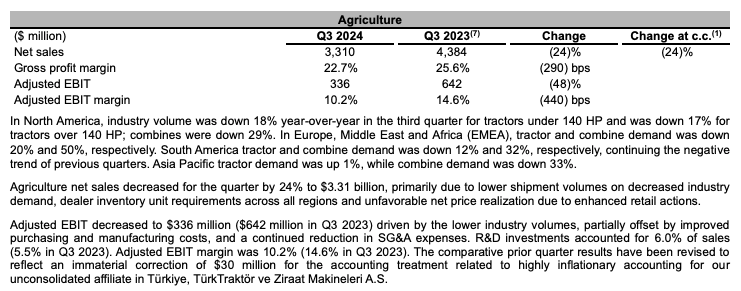

For example, the recent Q3 2024 results from CNH showed a 24% decline in net sales for their agriculture division, with industry volume down 18% year over year for tractors under 140 HP. The drop in combine demand in the EMEA region is as much as 50%.

Image from CNH quarterly results

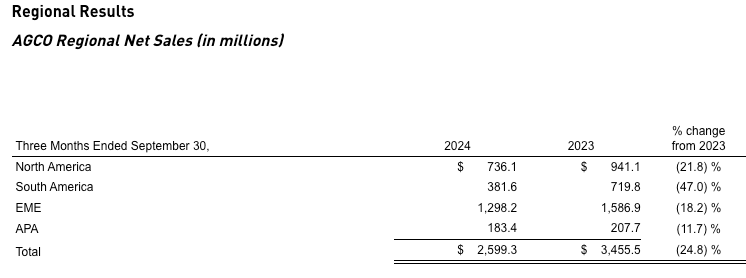

The other non-Deere big OEM player AGCO, had very similar results with a 25% decline from the same quarter from the previous year. (results released on Nov 5, 2024)

Image from AGCO quarterly results

The decline in ag equipment purchase is a reflection of what’s happening at the farm level. (highlights by me). The downturn in ag and the consolidation at the farm level has made a permanent dent in the sub-100 HP size tractors! (As of August 2024)

Income for corn producers was down about 33.3% during that period and soybean producers saw their incomes drop by about 19.3% during this period of time, also. Grain producers represent a very large percentage of purchasers of tractors in the 40 – 100 HP tractor segment and reduced income will result in reduced tractor purchases.

It is our opinion that many of these tractor sales have been lost for good. The most impactful factor is the reduction in the number of farms that will utilize tractors in the Under 40 HP and the 40 to 100 HP size and those farms are very unlikely to return. As stated earlier, each time a farm is lost, a potential buyer for this class of tractor is eliminated.

Large electric tractors are still not feasible due to the limitations of batteries in terms of operational time and the very large size needed which could create soil compaction and safety issues. The scenario described below is not feasible for electric tractors today, though Monarch claims their tractors can work 14 hour days.

Reliability is critical when it comes to heavy machinery. Tractors are expected to last long days out in distant fields and currently, gas-powered machines can do just that. Bringing extra fuel along is commonplace if a tractor runs out miles away from the operation or a gas station.

Increasing labor cost is a tailwind for autonomy

If the Trump administration follows through with some of their campaign promises, it will put upward pressure on farm labor availability and labor prices. California has the H2A program, which is getting expensive by the year. For example, based on the analysis done by Walt Duflock,

My analysis shows that CA growers are paying $16.3B for 850M hours per year ($19/hour) and with the rapid growth of H-2A workers in CA and the additional housing, transportation, and meal costs that H-2A requires and a $19.75 AEWR rate most of the growth is coming at something close to $30/hour and going up 5-6% a year in AEWR rate changes alone.

Any actions taken by the Trump administration will make the ROI calculator in favor of autonomy technology like Monarch.

If a crackdown does happen, Sayre said California’s labor force would be decimated. He also predicted large expansions in the H-2A program. The program has never been widely used by California farmers, in part, because of the cost of having to provide housing and transportation. Sayre estimated that about 5% of California’s farm labor force are H-2A workers.

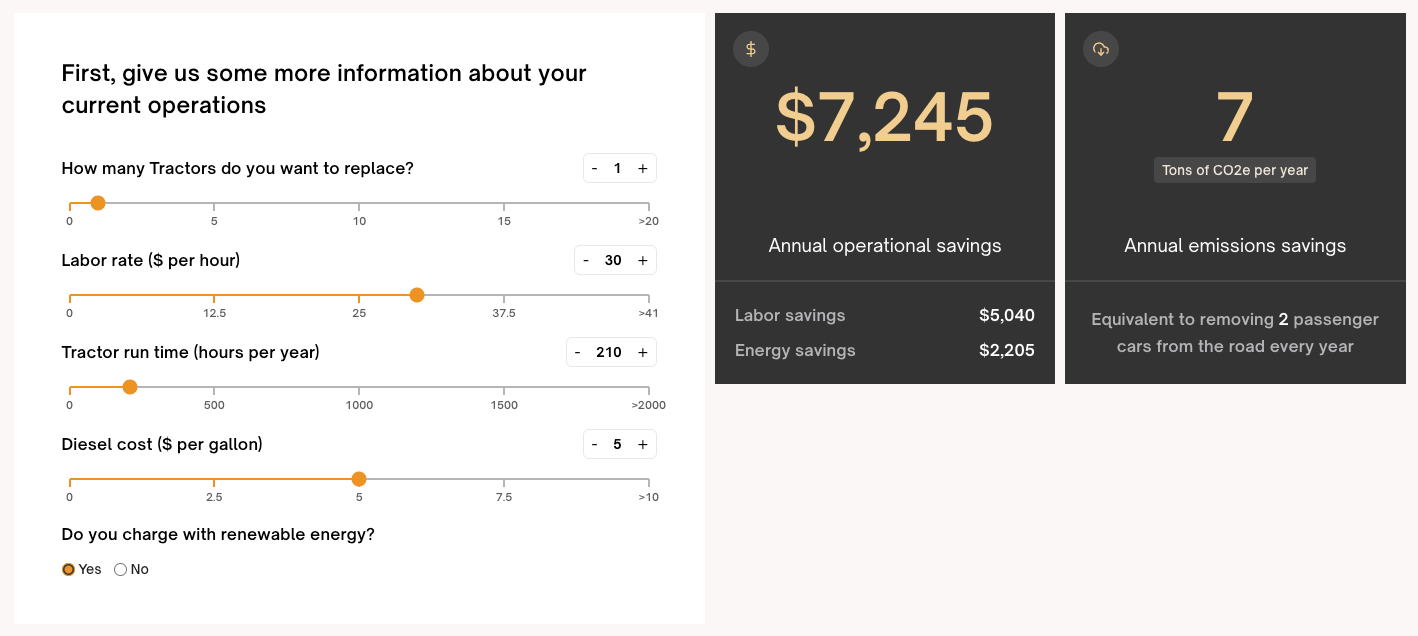

If we assume a rate of $ 30 per hour, and the tractor is operating for 500 hours per year. (Based on the Monarch data from a few months ago, and my back of the envelope calculations, their tractors are operating at close to 210 hours per year), and diesel price at $ 5 per gallon, you get operational savings of $ 7,245 per year.

This is not a bad calculation with the steep subsidies, though my guess is that actual savings might be lower due to different operating environments etc. At a low utilization rate of 210 hours per year, every 1 dollar increase in labor cost increases your savings by about $ 160-$170 per tractor, which is not a huge number at lower utilization rates.

What happens if subsidies are reduced or taken away, which is possible with budgetary constraints and pressure from the Trump administration. The business case for buying an autonomous electric tractor becomes tenuous if you reduce subsidies, though increasing labor costs are your friend if you are Monarch. My best case guess at this point is that Monarch would see fewer sales, if they didn’t have the subsidies as the price point and the ROI are not very attractive.

When I worked at Mineral, we got a massively discounted rate on using Google Cloud infrastructure (storage and compute) compared to what is available outside, as we were part of Alphabet. Though when you did the financial analysis, you had to use the market rate not internal rate to calculate unit economics.

You could not use the discounted rate as it would not be true reflection on how you would compete as a standalone company. You had to be able to compete and provide value based on how an outside entity would compete and provide value in the space. Subsidies can help you get going but you have to question if they will last for ever.

Non-ag use cases, software and retrofits

Based on the latest news report about Monarch’s layoffs, Monarch is looking at use cases outside of agriculture. According to the California CORE program, there are many other use cases which are eligible for subsidies.

This includes forklifts, airport ground support, construction etc. The safety and reliability requirements for these use cases will be different compared to agriculture, and it will not be straightforward to repurpose the existing technology to those use cases.

Monarch is also trying to see if they license their autonomy kit, and their WingSpan software (used for control and management of Monarch tractors) to other OEMs. The customers for these businesses will be very different from growers as it is a B2B sales cycle. They will also have to adapt their technology so that it integrates easily with existing equipment from a different manufacturer, which is not a trivial challenge.

By definition the software business is a higher margin business than hardware, and the upfront costs for software will be much lower than buying a tractor. It can help Monarch increase their margins, have reduced customer service costs, and service a wider range of customers. This switch sounds easy in theory but it could take a few years.

The retrofit route is quite attractive during tough economic cycles, when growers are delaying their capital purchases, but still need access to technology due to labor and profitability challenges.

For example, Eric Hansotia, AGCO CEO, in the recent earnings call for AGCO emphasized AGCO’s focus on their precision technology after-market retrofit kits and software through their PTx division.

reiterate that AGCO's unique retrofit strategy allows us to offer an industry-leading suite of advanced technology solutions for farmers around the world looking to save on inputs or increase yields, regardless of their brand of equipment. This is especially impactful in a year when farm income is down, and we can help farmers with new technology at a lower price than a brand new piece of equipment

and

AGCO's mixed fleet retrofit solutions typically offer a one to two-year payback and are available at a significantly lower cost compared to buying a new machine.

AGCO is also using its AgRevolution partnership to provide better service to AGCO customers, and improve uptime for AGCO equipment. For example, AgRevolution recently opened 5 new dealership locations along with AGCO’s FarmerCore on-farm mobile service vehicles (similar to Best Buy’s Geek Squad).

For business critical products like agriculture equipment, enhanced service can go a long way in driving customer engagement, loyalty, and pricing.

Lower demand for a discretionary spend product during a tough economy, a tougher immigration policy, and a change in subsidy structure will have a big impact on the demand and ROI for many agriculture products.

Summary and Key Takeaways

- It is important to know what drives the unit economics for your business, and what is the sensitivity analysis. If your unit economics depends on getting a subsidy, you need to map out scenarios on what would happen if the nature of the subsidy changes, especially when as a startup you will not have much control over how and when the subsidy will be active.

- Higher labor costs are beneficial for the business case of autonomous equipment. Higher utilization of your autonomous equipment makes the business case stronger.

- If the demand for your product is dependent on the demand for a discretionary spend product (in this case wine), tough economic conditions will have a bigger negative impact on the demand for your product.

The news report announcing the 10% layoffs and restructuring at Monarch, includes the following line about Monarch’s CEO.

Penmetsa said he was uncertain if employees were let go without severance, but that the company has been trying to help out laid-off workers on a case-by-case basis.

This is not a great look for the CEO or for Monarch. It is not legally binding for a company to provide severance to their employees, but the CEO not being aware if their employees got severance or not, does not give you a good feeling about how the company is being run, especially for a company the size of Monarch tractor.

The California Wine Industry downturn report has the following line, about one of the winery owners getting a tasting room permit.

After a failed inspection and a year and a half of waiting, the tasting room’s permit finally came through in December.

Why does it take a year and half to get a permit for a tasting room?