Bayer & Microsoft bolster the last mile through E.L.Y.

Edition 176 discusses E.L.Y. and Bayer 3Q results

Today’s newsletter includes a discussion about Bayer’s new small language model for crop protection called E.L.Y, a discussion about Bayer quarter results, outlook for next year, and some tips for agribusiness employees navigating a tough economic outlook.

—-

It is a very dark and stormy night. There is a big house on the edge of the cliff, by the dark ocean. The dark and dangerous big waves crashing against the house, might bring down the house completely. The house might not survive the night.

There are three wings to the house. The structure of the three wings is barely supporting each other. It seems the house might be less precarious if the structure of the three wings was not connected with each other and each of them stood independently.

The original house used to be further away from the sea, but the current owners moved closer to the ocean.

There are a few lights visible inside the house, and some of them are bright. There are a handful of people walking around the house, trying to keep it from collapsing while uttering three letter acronyms.

A short distance down there is a big green house. The green house seems to be more modern and in a better condition, even though it has been there for a very long time. It is also feeling the impact of the wind and rain from the storm. The impact is more towards the south side of the house.

There are other houses down the street, most of them are in much worse shape, but have been around for a long time. Some (or many) of them will repair themselves, take on a different look, and probably be around for a long time.

If you look down on the beach, there is a lot of debris from many smaller and newer houses, which no longer stand on the cliff.

Bayer and Microsoft bolster the last mile through E.L.Y.

Almost 3 years ago, when Bayer and Microsoft announced their partnership, I wrote the following (“Picks and Shovels” Nov 2021)

It opens up a new revenue pool for Microsoft, as its Azure offering tries to move up the commodity offering of storage and compute in agriculture. It provides a revenue share opportunity for Bayer.

Bayer can potentially leverage many tools from Microsoft, which can do the heavy lifting of data processing, and provide tools for machine learning and artificial intelligence. This will help Bayer focus on agronomic expertise, grower understanding, input R&D, and access to distribution.

The partnership will allow other Agtech companies to build on the digital agriculture infrastructure, and accelerate their own innovation. It lets other organizations focus on their strength, while the heavy lifting of foundational capabilities like data management is done by the partnership.

It would be one more year till the first version of ChatGPT would be released in November 2022.

It has taken almost 3 years for something meaningful to come out of the Microsoft-Bayer partnership. Yes, Bayer did announce the Ag Data Manager and Ag Powered Services at World Agritech in San Francisco in March 2024. But, these efforts have been underwhelming at best.

For example, this is the current developer portal for Ag Powered Services.

It lists Growing Degree Days (which is a simple calculation), imagery insights based on Sentinel 2 data (which have been available for ages now, and it does not include any data fusion with other remote sensing sources), crop water use maps (which were developed by Bayer more than 5 years ago), crop ID (these are not simple, but not overly complicated models and Bayer has enough ground truth data to do a good job), smart boundary (doing great boundaries with Sentinel 2 data is very very difficult, but otherwise building a field boundary algorithm for large acreage commodity row crops is not extremely difficult), and historical weather (there are standard data sets available for this for quite some time).

So yes, underwhelming at best.

Maybe it is two large companies trying to figure out how to work together, or it is another example of Conway’s law.

I know Bayer can do more, and I hope they do.

Bayer releases E.L.Y (Expert Learning for You)

On the other hand, at least based on the publicly available information, Bayer and Microsoft’s launch of E.L.Y, a language model based on agronomic data (highlighted by me) seems more tangible and valuable than previous efforts from the partnership.

upskill agronomists and other farmer-facing employees, enabling them to quickly and accurately address questions related to agronomy, farm management, and Bayer agricultural products.

Before we jump into the details, let us define a few terms quickly.

LLM (Large Language Model): A large language model (LLM) is a type of artificial intelligence (AI) program that can recognize and generate text, among other tasks. LLMs are trained on huge sets of data — hence the name "large." LLMs are built on machine learning: specifically, a type of neural network called a transformer model.

RAG (Retrieval Augmented Generation): RAG helps companies retrieve and use their data from various internal sources for better generative AI results. Because the source material comes from your own trusted data, it helps reduce or even eliminate hallucinations and other incorrect outputs. Bottom line: You can trust the responses to be relevant and accurate.

SLM (Small Language Model): Small language models (SLMs) are machine learning algorithms that can process, understand, and generate human language. They are similar to large language models (LLMs), but have fewer parameters and a simpler architecture. SLMs are trained on smaller, more specific datasets, and are specialized for specific tasks.

SLMs require less memory and computational power, making them ideal for resource-constrained environments such as edge devices and mobile apps, or even for scenarios where AI inferencing—when a model generates a response to a user’s query—must be done offline without a data network.

To draw a parallel, an LLM is like using Google Search or ChatGPT to know which restaurant to eat at when you are traveling to a new place.

Using RAG is like asking a friend who has lived in the neighborhood, where you are planning to go to and knows about your food preferences, and someone you can trust.

An SLM is like a very smart kid, who does not know about many topics, but has gone deep into a particular topic you might be interested in. (For example, Warhammer 40,000).

So what is E.L.Y. and why is it an interesting development?

E.L.Y. is a small language model specifically targeted towards the use of crop protection products.

Continuously validated by Bayer agronomists, E.L.Y. is already enhancing productivity for over 1,500 frontline employees in the United States. These employees are leveraging the model to navigate complex agronomic information, delivering faster and more accurate results to farmers and other agricultural customers seeking insights about Bayer products and general agricultural practices. Focus group testing indicates that 90 percent of E.L.Y.'s users are willing to continue using it and recommend it to a colleague.

It has been trained on using Bayer data, agriculture extension data (which is oftentimes widely available but someone has to put it all together), open source data and any other data sets like product catalogs which include product usage information are included in the training set for E.L.Y.

Based on publicly available information, E.L.Y has information about pests, rates of usage (very important for crop protection products), and it also is able to consider product safety and liability information.

Bayer is using small language models, which are trained and based on large language models. The RAG process includes a lot of the proprietary and publicly available data, and is available to the small language model.

Microsoft is making a large library of different pre-trained models available to various industries. Microsoft is making these models available for agriculture, the automotive industry, industrial automation, regulatory compliance management in the financial sector, and a host of other industries.

This is a significant step for Microsoft as well, as it is able to partner with the leading companies in different industries, and leverage their domain expertise to provide relevant models for different industries.

With core competencies in the life science fields of healthcare and agriculture, will make E.L.Y. Crop Protection available in the Azure AI model catalog. A specialized SLM, it is designed to enhance crop protection, sustainable use, application, compliance and knowledge within the agriculture sector. Built on Bayer’s agricultural intelligence, and trained on thousands of real-world questions on Bayer crop protection labels, the model provides ag entities, their partners and developers a valuable tool to tailor solutions for specific food and agricultural needs. The model stands out due to its commitment to responsible AI standards, scalability to farm operations of all types and sizes and customization capabilities that allow organizations to adapt the model to regional and crop-specific requirements.

There are a few notable things to consider in this news release

- Microsoft and Bayer are deploying small language models. By the very nature of small language models, the hardware computing needs of small models are much smaller, and in theory can be deployed and run on a large number of edge devices. (for example, smartphones, headless units on equipment etc.)

- The models are pre-trained on a large number of publicly available data sources, Bayer expertise, and real-world information on Bayer crop protection labels.

- Microsoft provides customization tools and capabilities, so a 3rd party like a retailer can take the SLM provided by Microsoft/Bayer, and use their own curated data set using RAG capabilities to further fine tune the model for their own use. They can get general agriculture intelligence, and label information for product use out of the box for all the products used to train the SLM model.

Assisting the last mile

My hope and expectation is that small language models, which are trained with industry knowledge will drive a step change in the adoption of generative AI at the enterprise level. These models are specifically targeted towards agronomists and subject matter experts.

I believe the approach used by Microsoft and Bayer, reduces the challenges associated with pushing GenAI projects from concept to production. I had talked about this problem in edition 172. Precision and Structural Shifts (Oct 20, 2024), in relation to GenAI projects. (highlights by me)

In spite of this rapid progress, many GenAI projects have struggled to go past the concept or pilot phase in an enterprise context. (This is based on data presented during “The AI conference” in San Francisco in September 2024)

Some of the main reasons for the challenge with pushing GenAI projects from pilot to production are related to precision of GenAI models. This is especially true in a legacy industry like agriculture, where farmers and other stakeholders are used to having a human touch to most of the transactions - whether it is their agronomist, or their seed or fertilizer sales person, or their produce buyer from a grocery retailer.

For many of these businesses, there are considerations around policy, and liability, when it comes to advice or decision making done by a GenAI agent. It is harder to think through and incorporate issues around policy, liability, and bias in these types of models, while still having the trust and confidence needed for adoption.

Based on data from frontline employees like agronomists, and sales staff,

Bayer has achieved over a 40% improvement in answering questions accurately compared to initial testing with ChatGPT. Additionally, frontline employees report time savings of up to four hours per week, demonstrating how E.L.Y. has accelerated response times and improved customer interactions. To ensure high accuracy, the team has implemented automated processes to keep the system updated with the latest agricultural information.

Bayer and Microsoft realize and recognize the importance of the “last mile”, even though they do not explicitly call it out. The last mile problem is especially acute in genAI models.

Image generated by DALL-E with prompt “Last Mile in Agriculture”

The “last mile” is your intuition and it is often based on the data, which is not easily available to the model. For example, when buying a house or choosing an apartment, the last possibility is how does it feel when you walk around the neighborhood, how is the street noise, do you see moms jogging with their strollers?

In the case of a restaurant, the last mile is the general vibe of the place, how the crowd feels, is it dark or bright etc.

In the case of agronomy, it is how the grower feels about making certain decisions? Do they want their kid to come back to the farm, and so want to get them involved in the decision making process? Do they expect some water and irrigation issues this year, based on last year’s experience?

All of these last mile issues most probably are not available to the model, and so having an SLM which gets the agronomist 85-90% of the way, but then using the agronomist’s intuition and expertise to help make the “last mile” decisions in collaboration with the grower is a smart and safer approach.

E.L.Y. has the potential to help the “last mile” participant to be much more effective, and impactful for the grower.

Open questions and comments

I do have some open questions, followed by some key takeaways when it comes to adoption of tools like E.L.Y.

- Will potential enterprise users trust a model built by Bayer? Will they have a suspicion of bias? What is Bayer going to do to allay some of these fears? One option for Bayer is to spin out this group into a separate independent company to reduce the perception of bias. I don’t know if this is on the cards for Bayer or not, and whether Microsoft would prefer to work with a smaller independent organization, which is not part of Bayer?

- How will an agriculture retailer, which sells a portfolio of private label input products, and branded agrochemical inputs from companies like Bayer, Syngenta etc. be able to use E.L.Y. as a starting point? They will have to bring their own data set of products, and use E.L.Y. as a starting point, and then use a RAG mechanism to further fine tune their own model. This will hopefully be an easier conversation, as they will not have to share their proprietary data with anyone, especially a company like Bayer.

- What tools are available for a 3rd party to easily do a RAG system, and make their derived model more representative of their product portfolio and business? It is my understanding that Microsoft will be able to provide many of those tools.

- How will an ag retailer, who might not be as tech savvy as Microsoft, be able to make all different models like E.L.Y. work together? There will be a need for orchestration tools across these models and hopefully a tech expert like Microsoft will be able to provide those tools and/or services.

- What is the pricing for E.L.Y. and what is the right way to create and capture value? The productivity improvements for frontline staff are relatively easy to measure and price, but how will Bayer (and Microsoft) price the improved accuracy and efficiency of frontline staff?

Key takeaways

- If Bayer can address potential issues of perception of bias, find the right pricing model, and make an easy set of tools available for enterprise customers (in partnership with Microsoft), this could provide a very good onramp for adoption of GenAI tools for various enterprises within the industry. These could range from large retailers and dealers, co-ops, other seed and crop protection brands (though I doubt a Syngenta with their Cropwise AI or BASF or Corteva might use these tools), could potentially adopt these models.

- If these models are adopted at scale, it could raise the floor on the average advisor. They can focus on providing a higher level of service to growers. It will increase the value of advisors as they can focus on the last mile, and be much more effective and impactful.

Bayer changes outlook for 2025

The agriculture sector is facing significant headwinds. During last week’s newsletter, I had pointed to some of the drop in sales for Deere, CNH, AGCO, and the relative flatness for companies like Syngenta.

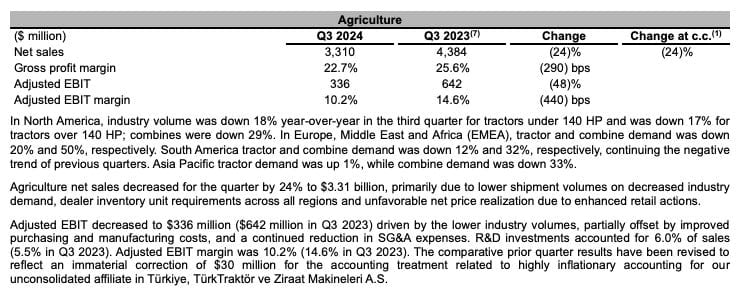

For example, the recent Q3 2024 results from CNH showed a 24% decline in net sales for their agriculture division, with industry volume down 18% year over year for tractors under 140 HP. The drop in combine demand in the EMEA region is as much as 50%.

Image from CNH quarterly results

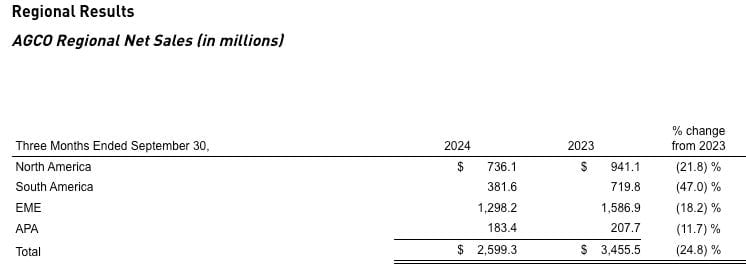

The other non-Deere big OEM player AGCO, had very similar results with a 25% decline from the same quarter from the previous year. (results released on Nov 5, 2024)

Image from AGCO quarterly results

The decline in ag equipment purchase is a reflection of what’s happening at the farm level. (highlights by me). The downturn in ag and the consolidation at the farm level has made a permanent dent in the sub-100 HP size tractors! (As of August 2024)

Income for corn producers was down about 33.3% during that period and soybean producers saw their incomes drop by about 19.3% during this period of time, also. Grain producers represent a very large percentage of purchasers of tractors in the 40 – 100 HP tractor segment and reduced income will result in reduced tractor purchases.

Syngenta also had some challenging results recen

tly. (Please refer to Syngenta investor website for results)

Bayer announced their 3Q results, and updated their guidance for the next year. Due to this, Bayer stock was down almost 12% and was at its lowest level in almost 20 years. Bayer shares have lost almost three-quarters of their value since their June 2018 acquisition of Monsanto.

Bayer indicated a loss of almost 4 million acres in North America for the Bayer corn business. With a total of 90 million acres of corn in the US, a loss of 4 million acres is significant. Bayer also saw a much bigger drop than expected in Argentina and Brazil.

Bayer indicated that weak farmer demand will translate into lower earnings next year. I listened to the Bayer Investor call and the Q&A with Bayer executives. Bayer Crop Science listed the following challenges for 2025.

- Lower corn acreage in Argentina and Brazil

- Intensified crop protection pricing pressure

- Prolonged soft commodity price levels

Bayer’s CEO Bill Anderson is publicly confident about their turnaround efforts, though investors are putting significant pressure to speed up the efforts, boost efficiency and drug development, and to restore confidence.

Bayer Crop Science executive Rodrigo Santos indicated some positive developments in terms of lower COGS for both the seed and crop protection business in the coming year, which should alleviate some pressure on profitability.

Most of the questions during the investor call were directed towards Rodrigo Santos of Bayer Crop Science, which is not surprising given all the challenges faced by the Crop division with drop in sales, and pending glyphosate litigation.

Bayer’s stock currently trades at roughly 3.9 times estimated forward earnings over the next 12 months. BASF is at 11.5 and Corteva at 18.8.

This might make the Bayer stock seem to be more attractive to buy, but analysts are not providing a buy recommendation, as earnings could further depress and some of the glyphosate related legal challenges could go against Bayer.

Some investors like hedge fund D.E. Shaw is taking the other side of the bet, when it comes to Bayer. They took a $ 108 million short bet against Bayer.

What should agribusiness employees do?

The current environment is tough for farmers, and the agribusiness ecosystem as well. Many companies are going through restructuring, including Bayer and Deere.

This creates significant anxiety for agribusiness employees. What should you do if you work at an AgTech startup or an agribusiness like a seed company or an agriculture retailer?

- It is natural to feel anxious. Continue to work on strengthening your network. Have as many conversations you can both within and outside your organization. This will be a great learning opportunity as well.

- Continue to spend time on polishing existing skills and learning new skills.

- Start writing online and putting your opinions out there. You have an interesting point of view, and let others hear about it. It will help you stay curious, learn, and put your thoughts out for others to engage with.

- Stay calm, and go for a walk.