Is the future of farm equipment smaller?

Will lower secondary market prices lead to different equipment form factors?

Welcome to the May 25, 2025 edition of SFTW. This week’s edition looks at equipment prices for secondary markets with some examples..

Happenings

- Earlier this week, Metal Dog Labs released part 2 of the GenAI in Ag report. The second part focused on Value Creation Frameworks, and provides a playbook on how to think about and execute on GenAI based projects. Both the reports are available for free to SFTW members. You can get your free copy here by Signing In (for existing subscribers) or by Signing Up (for new subscribers).

- Over the last few weeks, I have started offering corporate subscriptions to different organizations. A corporate subscription comes with a significant discount, full access to SFTW Plus and is paid for by your organization, typically through their training and education budgets. If you would like to sign up your organization for a corporate subscription program, just reply to this email.

- The SFTW Convo series will continue on Wednesday, with an SFTW Convo with Michele Lombardi, SVP Corporate Development and Venture Capital at CNH.

Secondary market prices

A 3 year-old million dollar combine, a 2023 Tesla Cybertruck and a 2023 $ 1.4 million Carbon Robotics Laser Weeder walk into a bar.

The bartender goes, "What is this? A tech demo or a clearance sale?"

Scaling Regen Ag Starts with Better Data

Farmers Edge is building the digital backbone for regenerative agriculture—designed to simplify Scope 3 reporting and deliver credible results, fast. With Managed Technology Services built for agribusiness, Farmers Edge connects real-time field data to your sustainability goals across every acre and every grower in your network. From in-season tracking to end-of-year proof, Farmers Edge makes regen ag measurable and manageable. If you're serious about scaling impact and reporting, this is the infrastructure that makes it possible.

Tesla Cybertruck

Tesla is offering just $65,000 for a $100,000 electric truck bought in 2024 with 10,000 kilometres (6,000 miles) on the odometer. The low trade-in value appeared to reflect a glut in supply of the vehicle, with Tesla's Cybertruck inventory reportedly reaching a record high of 10,000 units this month.

It represents a 35% drop in price in just 1 year and only after 6000 miles!

Carbon Robotics

Two weeks ago, it appeared as if a 2023 Carbon Robotics Laser Weeder sold for $ 389,000 at an auction in Washington state. The original sale price for the 2023 Carbon Robotics Laser Weeder was supposed to be $ 1.4 million. (I don’t know at what price did the potential seller buy it for originally, but my best guess is $ 1.4 million).

I dug into the issue a bit.

The seller was willing to accept a price as low as $ 800,000 for the 2023 machine. They did not get any offers which came up to that number and so they decided to take the unit off the market. They have a new Carbon Robotics machine working on their onion operation.The $ 800 K represents 57% of the original price in 2 years, though the desired price is not the same as actual price. This represents a 43% drop after 2 years with roughly 6 weeks and 7 weeks of use over the last 2 years.

According to the auction website, the machine had done 2775 hours and 3663 acres.

Onions are expensive to hand weed, especially for organic onions. (from 2022 report on Carbon Robotics machine)

The hand weeding costs $600 – $1,000 per acre in conventional onions and over $1,000 per acre in organics. While Johnson doesn’t expect the new machine to completely offset the labor expense immediately, he does estimate it will save at least $500 per acre.

If we assume a price drop of $ 600K after working on 3663 acres, they should have gotten an ROI of $ 163 per acre which given the very high hand weeding costs on onion does not seem crazy.

Or does it?

Combines

Ben Voss looked at this issue in detail with two LinkedIn posts a few weeks ago.

The difference in 2025 is that the farms buying new combines are just so much bigger and the gap between the 1st and 2nd buyer is expanding. It is a giant gap to the 3rd buyer. New buyers are buying multiple units (sometimes 10 or more combines), which means you need even more 2nd tier buyers to take on the used equipment. Add to the mix is the value of the equipment and the required depreciation to make the combine affordable to the 2nd buyer.

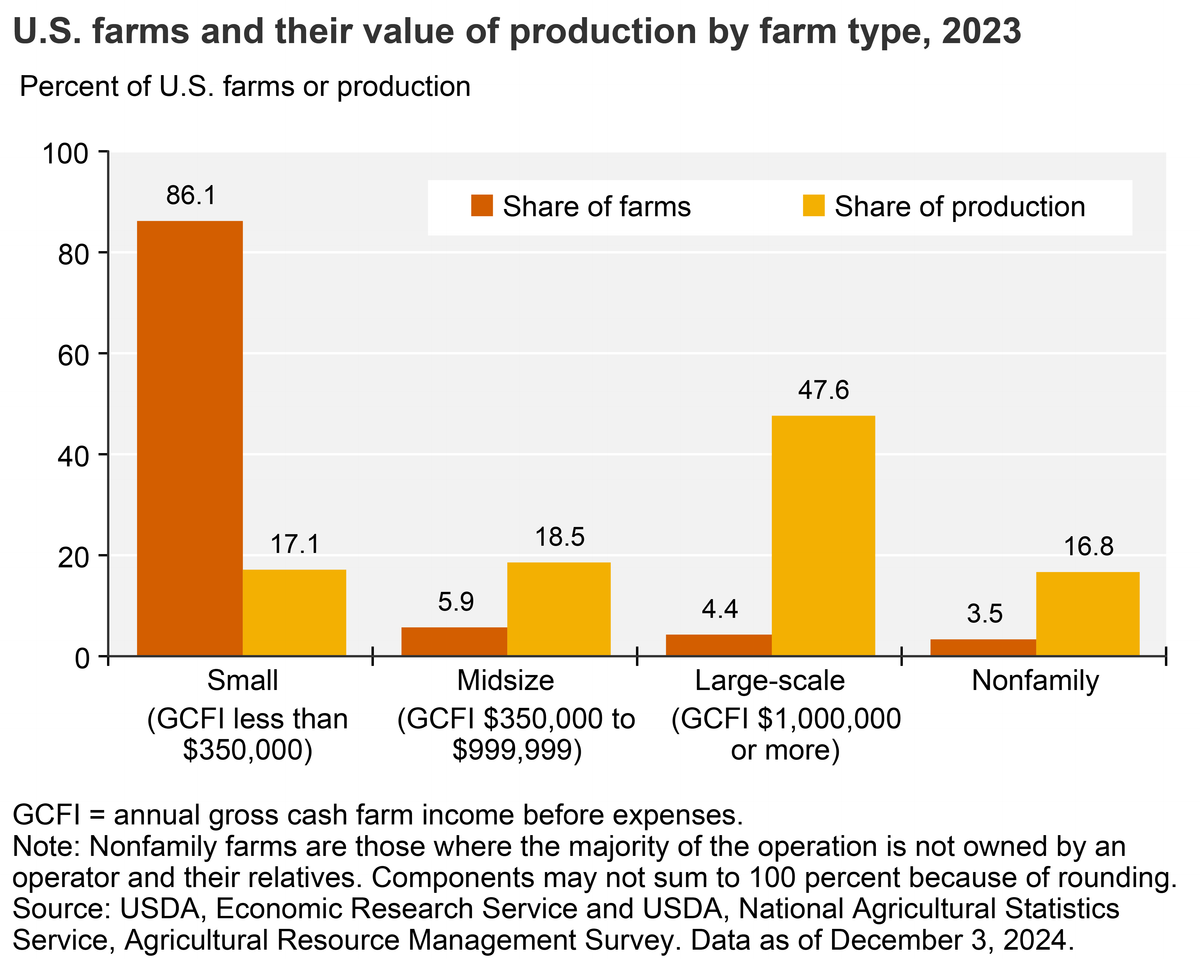

According to USDA data, 4.4% of large farms account for 47.6% of production in the US, and about 13.9% of the largest farms account for 82.9% of production.

While ag equipment sales have always been cyclical and gone through boom and bust, never before have we been in a situation where the new products sold today are so mismatched to the used market. There are several reasons why a farmer chooses to buy a new piece of equipment but probably in the top 3 reasons is resale value confidence.

A $1.1M combine now has to absorb much more depreciation than in the past. If the farmer buying this combine expects it to be worth 70% of MSRP after 3 seasons, they have to utilize $330,000 over 3 years or $110,000 per year. If they use the combine at its rated capacity, they might harvest 5,000 acres with that single combine which means it costs $22/acre for that period of time.

Lifecycle costs are calculated based on salvage value at the end of the period. If that value is no longer reliable, then we have to assume a lower value in our lifecycle calculations. The lower the resale value, the more cost has to be attributed to the machine’s useful period.

So, let’s assume there is weakness in the resale market (like we see happening today). If that combine drops its value by $200,000 and now only sells for $570,000 instead of $770,000 that means the farmer has to add back $13/acre of additional cost. Instead of $22/acre it is now $35/acre. In many cases, that is their margin.

Buying high priced combines can be a challenge even for large farms, as the salvage value is getting depressed for these big expensive machines, due to a lack of buyers in the secondary market.

High priced equipment in specialty crops

The situation is similar in specialty crops. Specialty crop agriculture is characterized by huge fragmentation across many different crops. There are a few crops which are billion dollar businesses with high per acre value and high per acre labor costs for weeding and harvesting.

Unless your technology works across multiple crops, you have a problem similar to commodity row crops when it comes to selling very high priced equipment like the Carbon Robotics Laser Weeder. (You should read the Bull and Bear case analysis I did for Carbon Robotics in “Monitored Autonomy” April 6, 2025)

Carbon Robotics value proposition is by the reduction in the need for hand labor, and herbicides and mechanical weed control.

Carbon Robotics did a study with Western Growers Association last year to understand the ROI with Braga Fresh and Triangle Farms on crops like organic spinach, organic arugula, organic

The slow speed of a laser weeder is a big challenge to cover ground effectively even on a smaller organic commodity row crop field. Also, if you look at the per acre costs of running a Carbon Robotics laser weeder, they are in the $ 226 to $ 448 / acre range. If we look at the net farm income for organic and conventional row crops, there is just not enough margin to support an expensive Laser Weeder, except for very high labor cost for operations like weeding, deflowering and very high value crops.

To understand the different options for weed management equipment, one could plot this on a graph with the speed of the equipment on the X-axis and the cost of the equipment on the Y-axis. The speed of the equipment is a proxy for how big of a field can be covered by the equipment in a given day. (I am using speed because it is easier to visualize a sprayer moving at 15 miles per hour and other equipment moving at 1-2 miles per hour, compared to a 1,000 acre farm vs. a 5 acre farm).

A conventional sprayer can scream through the field at 15 mph in commodity row crops, and costs about $ 300K to $ 400K. A spot sprayer like John Deere’s See & Spray system, probably costs a bit more than the conventional sprayer, and as of now it moves slightly slower than the conventional broadcast sprayer.

On the top left of the chart is Carbon Robotics which moves fairly slowly in a specialty crop field, and costs more than $ 1.2 million. A sprayer like Solinftec’s Solix is in the bottom left corner as it is relatively inexpensive and moves very slowly (but it is autonomous).

Based on a simplistic cost vs. speed chart, an expensive sprayer which can cover a lot of ground makes sense for commodity row crops, and a very expensive laser weeder which moves very slowly but drastically reduces the need of a hand weeding crew makes sense in an organic specialty crop field.

The field sizes of conventional specialty crops and organic row crops are between the organic specialty crop and conventional row crop fields.

So, even though the conditions are different compared to commodity row crops, there is a very high probability that expensive equipment like Carbon Robotics could potentially suffer the same challenge of resale value currently seen in combines in commodity row crops, as there is not a large enough market of second tier buyers due to crop fragmentation and consolidation.

What does it mean?

There is a tight coupling between the cab operator (or the tractor driver) and the equipment itself, even for bigger and bigger machines. The cab operator was a binding constraint. The need for a cab operator was a significant driver in building bigger and faster equipment as farms got bigger and bigger.

But with autonomy on the horizon, the tight coupling between the machine and the operator can be potentially broken. Once the operator goes away as a constraint, it opens up a brand new set of options for designing, developing and deploying farm equipment. (I covered some of my thoughts on this topic in the edition “Second Order Effects” - April 20, 2025)

For example, Solinftec is taking a completely different philosophical approach with their always-in-the-field sprayer, which is relatively inexpensive, is autonomous, and you can have a fleet of them always in your broad acre field.

Autonomy tackles the challenge of finding operators for farm equipment, especially in the global north where only 1-5% of the population is in farming. Young people (if opportunities are available) want to move to the cities, and so it is a skill gap as well.

Autonomy addresses issues like human operator tiredness, and long working hours. Climate change is narrowing optimal operational windows, and autonomy is a great way to increase your chances of hitting narrow windows.

Autonomy decouples the equipment operator from your equipment and this is a profound change which could have far reaching effects.

Instead of buying a million dollar piece of equipment which requires a driver, would it be sufficient to buy 5 pieces of autonomous equipment which are smaller? What if they cost $ 100K each, and can do the same amount of work as a million dollar equipment with a driver, as they can work longer hours?

Doing more with less people does not have to mean bigger and faster equipment all the time in the future.

Could the second order effect of autonomy be smaller and smarter equipment? Could you do the same or more with a swarm of smaller equipment compared to one single piece of a massive expensive piece of equipment?

As the price of each autonomous and atomic (as in each of them can do the same job), the middle and lower end of the market becomes much more accessible to the second and third sale for that smaller piece of equipment. This will hold value better than a very large expensive piece of equipment which has a very limited set of buyers.

It will also require a different approach in building ag equipment and will require looser coupling between the hardware and software of the equipment, as the mechanical part of the equipment might last longer than the electronic components of the equipment. I had discussed this idea almost 3 years ago in the edition Android Strategy for Agriculture (Jan 16, 2022).

We have already seen a large number of companies focused on providing smaller and more nimble equipment like SwarmFarm Robotics, Greenfield Robotics, Barn Owl Precision Agriculture, Aigen, Solinftec etc.

Will the future of farm equipment be smaller?