Monitored Autonomy

AutoTractor from Carbon Robotics

SFTW Plus is the paid version of “Software is Feeding the World” and includes all Sunday newsletters, SFTW Convos series, Scaling Innovation series, and access to the archives.

Today’s edition looks at Carbon Robotics' recent announcement of AutoTractor.

Full disclosure: I am NOT an investor in Carbon Robotics. The analysis is based on publicly available information only. This content is for informational purposes only and represents the opinions of the author. It is not meant as legal, tax, investment, financial, or other advice.

Monitored Autonomy

In edition 143 of the newsletter (Salinas we have a problem - Sept 2023), I had written about the concept of a network operations center for remote operation and monitoring of farm equipment. I had theorized this will be a future service offered to small and medium sized farms, who don’t have the resources to have a technology team of their own on the farm.

The operations center owns and operates a fleet of equipment, which includes autonomous planters, autonomous selective sprayers, semi to autonomous scouting and spraying drones, autonomous harvesters, which are supplied with inputs like seed & chemicals, biological products, from a regional distribution center.

Cameras mounted on equipment, stationary cameras in the field, and IoT devices provide a constant stream of information and intelligence back to the network operations center. Artificial Intelligence models, supported by large amounts of real data from the ground, constantly make real time decisions with minimal or no human intervention.

The network operations center monitors and manages operations across hundreds of small and medium sized farms. The farm owner gets a regular report on important events, and can hop on their smartphone to see real time operations in the field, while watching their kids Little League baseball game.

The operations are operated by a small crew of trained engineers, soil scientists, product experts, computer & data scientists, drone pilots, and autonomous equipment experts.

Carbon Robotics recently announced the availability of a new capability dubbed the AutoTractor. According to the Carbon Robotics website, the AutoTractor can be used in two different ways.

Seamlessly integrates with Carbon Robotics’ LaserWeeder automatically adjusting tractor speed to optimize weed control and increase coverage by up to 20%.

Autonomously handles tilling, cultivating, chisel plowing, discing, listing, mulching, and mowing - all without an on-site driver.

Before the announcement of the AutoTractor, Carbon Robotics main product in the market was the LaserWeeder. Based on publicly available information, and statements made by Carbon Robotics, and people associated with the company, they have sold close to 100 units of their more than a million dollar LaserWeeder units.

The LaserWeeder removes the need for hand weeding. It works well in organic specialty crops where the labor prices are high. It is better suited for high density crops, where it is challenging to get a human crew in to do weeding.

Based on the organic protocol, there are limitations on the type of chemicals which can be sprayed on a crop and so a non-chemical option like a laser, mechanical weeding, or hot oil (yes, hot oil) are good alternatives.

If you look at their current LaserWeeder product, it has to move at a speed of 2-3 miles per hour. It requires a driver in a tractor to work constantly at the slow speed. The operational time the LaserWeeder can work is limited by the availability of a driver and also puts pressure on how many acres can be covered by the LaserWeeder in a day.

No surprises - Labor is a big challenge

Labor is obviously a big challenge in the US. The policies of the new administration do not help and they are tail winds for any product, which can help you reduce your dependence on and cost of human labor.

The labor supply is decreasing in the US farming industry, and so it requires an increase in productivity on a per worker basis. Automation and Autonomy can help increase the labor productivity per farm worker if we measure it in terms of acres per worker per unit time.

Chart by Austin Lyons from edition 155. The Labor Dilemma

Providing autonomy capability for their LaserWeeder product improves the ROI calculation on their LaserWeeder product, though there is no information on pricing of the AutonomyTractor kit. According to Carbon, the AutoTractor increases the coverage by up to 20%.

As Austin Lyons wrote in edition 155,

Autonomy removes the operator from the cab entirely. Driverless systems help tackle labor shortages by enabling farmers to reallocate staff and boost the equipment-per-worker ratio.

Autonomy frees operators from the cab, allowing farms to reallocate employees to higher value tasks. For example, tillage autonomy enables customers to address grain hauling bottlenecks during harvest by reassigning operators from tillage tractors to semi trucks and letting the autonomous tractor handle tillage.

This ability to flex employees to the highest value task across the farm is incredibly valuable, especially for operations with multiple businesses such as livestock or seed dealers. One farmer remarked “Our cows don’t care if it’s the busiest day of harvest – they are still going to give birth. With autonomy we can attend to our livestock and still keep the row crop business moving.

Compared to the LaserWeeder business, the AutoTractor is a more generalizable capability and potentially can help enlarge the future potential of the Carbon Robotics business.

The stated goal for Carbon Robotics is to get to $ 300 million in annual revenue, and then go for an IPO event. Large M&As in agriculture have been few and far between, and IPOs are even more rare in agriculture.

Carbon Robotics is very well funded by different venture capital firms. They have raised $ 157 million so far with a $ 70 million Series D round in October 2024.

Does Carbon Robotics fit the “AgTech VC Fantasy”?

Mikayla Mooney, VC with AgLaunch recently published a piece called “The $1B Lie: Why Agtech Doesn’t Fit the VC Fantasy”

When you look at startups and companies in general, they fall into one of three categories: Convenience, Change in Practice, or Category Creation. And only one of those really works with the “go big or go home” approach that fits the VC model.

Convenience: These tools make things easier, faster, or more efficient, but not fundamentally different. They’re modern takes on things that have always been done—getting info faster, automating a workflow, or layering in a new interface. They don’t change the information you get, just how you get it.

Change in Practice, Crucial but hard to scale: This is where the majority of Ag startups live. These are companies that solve real, often painful problems in the supply chain or production process and solve them with better tools, hardware, or services.

Category Creation – Rare, but Transformational: This is the VC dream and hardest to achieve. A company that doesn’t just solve a problem—it creates an entirely new way of thinking about the industry. A whole new behavior, market, or infrastructure layer.

Her thesis is that only Category Creator businesses fit the venture category, and there are very few category creating businesses in agriculture. As her article lays out, products which make things more efficient are good businesses, but do not drive fundamental change.

When it comes to change in practice, Carbon’s LaserWeeder falls in the Change in Practice category.

The issue is that ag isn’t one market—it’s thousands. It’s fragmented by crop, region, soil type, climate, and even personal preference. So a robotics company might build an amazing apple harvester—but that tech won’t work for corn, soybeans, or lettuce.

Let’s say your startup solves labor with a machine that replaces field crews. Huge problem and absolutely worth solving. But the machine only works on high-density orchard crops. Suddenly, you’re serving 2% of U.S. farms. That 2% might love you, but the market isn’t scalable in a traditional venture sense. The TAM was theoretical.

The problem can be even more severe than what Mikalya is laying out. The same crop can be grown differently in different parts of the country and can have different row widths, and unique operating conditions. If any robotic product can cross these boundaries of unique contexts easily and still be economically a good solution for the grower, it can lead to faster adoption.

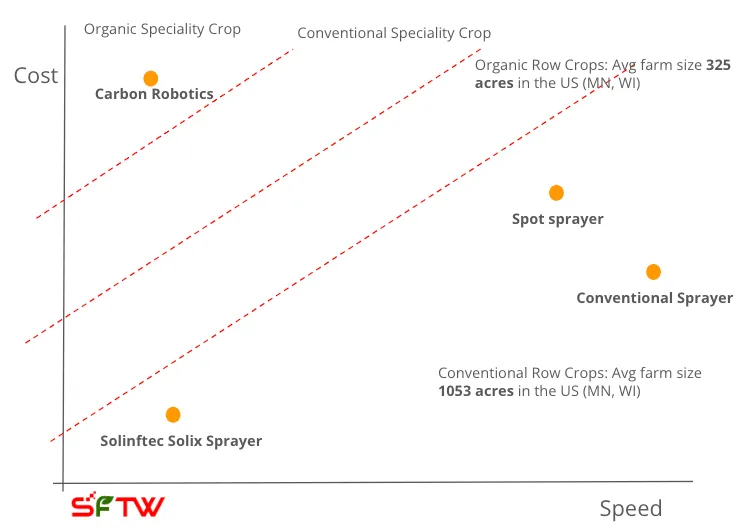

When Carbon announced an updated product line with G2, I had done an analysis of the economics of what a LaserWeeder can do, and where it makes it an appealing product. (“The cost and speed curve” - Feb 2025. Do read this piece as I go into a lot of detail on weeding costs by crop type and region, to see where Carbon Robotics LaserWeeder makes sense).

The challenge with a laser weeder is that based on the dwell time needed for the laser to kill the weed, there is a natural limit on how fast the laser weeder can go, unless you can shoot multiple lasers on one weed at the same time (not even sure if the science works here). Compared to a laser weeder, see & spray type chemical sprayers can fly at speeds of 12 to 15 miles per hour in commodity row crop scenarios.

If the hand weeding + herbicide costs are $ 284 + $ 80 = $ 364 / acre for conventional romaine lettuce, then using a LaserWeeder which costs between $ 267 and $ 448 per acre (depending on crop type) might make the ROI calculation very challenging. The laser weeder is a great fit in highly dense crops for large operations.

Based on these publicly available data points, it might be challenging for a LaserWeeder to make a compelling economic case for conventional specialty crops and provide an ROI in a reasonable amount of time, unless the per acre laser weeding costs go down or the per acre hand weeding costs go up significantly.

This mean a LaserWeeder at > $ 1 million prices, which moves slowly can address the needs of organic specialty crops and only in production areas where the cost of labor is very high i.e. California.

I had made the same point about thin markets (small number of buyers and small number of sellers) in edition 117 (Sept 2022), edition 118 (Sept 2022), and again when I wrote about Farmwise winding down its operations. (Agriculture Robotics is difficult AF - March 2025)

Organic specialty crop sales were in a decline for the last 2-3 years but they have finally gone back to 2021 levels,

Organic fresh produce grew for a third consecutive quarter in 2024, reversing a stubborn two-year trend of volume decreases. While organics are now back to 2021 volume, growth is occurring at a slightly slower pace and the steady narrowing of the gap between organic and conventional produce prices paused this quarter.

Organic produce grew overall in dollars by 4.2% and volume by 4.6%, according to the 2024 Q3 Organic Produce Performance report developed by Category Partners, a strategic insights company focusing exclusively on fresh industries in the retail grocery channel.

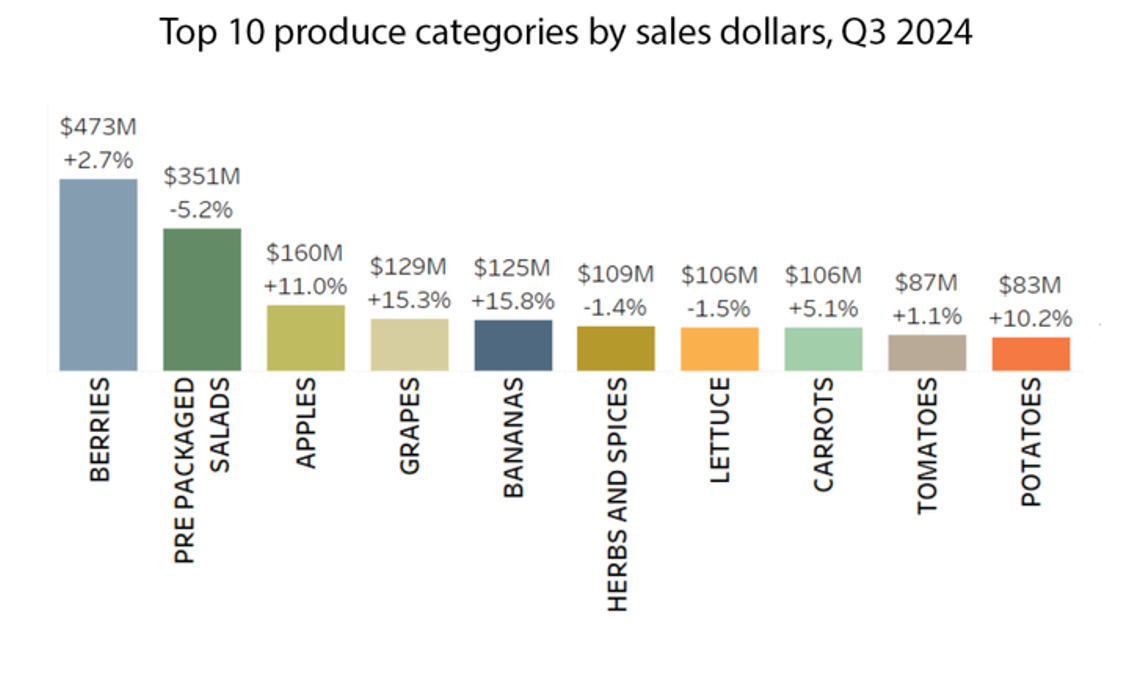

If the LaserWeeder can only operate in the organic specialty crops with high labor costs grown on the ground (so no nuts or tree crops, no berries), you are looking at what Mikayla called a “thousand markets.” If you dig into the top produce categories by sale and see if the LaserWeeder applies to the crop type or not, you can quickly see why Mikayla analysis is very relevant to this case.

Image source: Organic food sales returning (Jan 2025, Vegetable Grower News). Data for Organic Crops

Autotractor creates a complement for the LaserWeeder

So what about the AutoTractor capability? The AutoTractor capability introduces autonomy, paired with a remote operations center (as I laid out in the beginning of the piece).

The remote center provides “monitored autonomy” and will require great connectivity in the field. This is a solvable problem through a Starlink unit. It will still require boots-on-the-ground teams to respond if something goes wrong with the autonomous equipment and requires human intervention. Again, this is a potentially solvable problem.

The ability to run a remote monitoring center, and to have the link to local boots on the ground resources to dispatch is not really a technology problem, but an operational problem.

I don’t think Carbon has any special sauce when it comes to running an operational center compared to any of the other large players like Deere or any of the local, regional, or national agriculture dealers or retailers who are used to working with a large set of growers to provide services, though none of the current players are also used to running a remote operations center similar to one envisioned in the beginning of this edition.

But the AutoTractor capability seems like the right product move to make for Carbon Robotics.

It creates a complement.

According to Harvard Business School Online’s Business Strategy course,

A complement is a product or service that lifts a customer’s willingness to pay (WTP) for another product or service. For instance, a printer is useless without ink cartridges, so customers with printers are willing to pay more for ink. Razor blades are another example; razors need them to work properly. Since these products rely on each other to serve customers, they’re considered complements.

Complements can be extremely beneficial when leveraged properly and encourage companies to create businesses outside their core industries. The exclusivity decision, however, is particularly important for emerging industries and product categories.

The big question is whether AutoTractor will only work with Carbon Robotics implements in the back, like the laser weeder? If the product is exclusive, it increases the revenue per user, but it misses on the opportunity to get in the door with other growers, who are still not ready to use their Laser Weeder product.

Bull and Bear Case for Carbon Robotics

A bear and bull case is a standard artefact used to think about early stage companies and any startups which identify factors which are in favor of or against future success for the company.

To summarize, as of now, Carbon Robotics has two main products.

LaserWeeder

- How It Works: Combines computer vision, AI deep learning, and CO2 lasers to identify and zap weeds at the meristem with sub-millimeter accuracy. It processes 4.7 million images per hour using 24 NVIDIA GPUs, eliminating up to 5,000 weeds per minute.

- Performance: Covers 2 acres per hour, reduces weed control costs by up to 80%, and boosts crop yields (e.g., Triangle Farms reported a 50% yield increase in a Western Growers case study). It’s certified organic, avoiding chemicals and soil disruption.

- Evolution: The G2 model (2025) is modular (6.6 to 60 feet wide), lighter (starting at 4,700 lbs), and faster, with a dataset of 40 million+ labeled plants for adaptability across 100+ crops.

Carbon AutoTractor (New)

- Launch: Announced March 31, 2025.

- Details: Retrofits existing tractors with autonomy, offering real-time remote supervision by Carbon Robotics’ team. Powered by Carbon AI, it aims to maximize equipment use and address labor gaps. Specific performance metrics (e.g., speed, cost savings) aren’t yet detailed, suggesting it’s in early rollout.

- Significance: Expands Carbon’s portfolio beyond weeding into broader automation, potentially broadening its market.

Bull case for Carbon Robotics

Traction

CEO Paul Mikesell claimed 3x year-over-year revenue growth in 2023, with plans to sustain this trajectory, though exact figures remain private.

It shows that Carbon is getting traction with large organic growers in specialty crops in high labor cost areas with their LaserWeeder product. With rising herbicide resistance, and a dwindling set of options for herbicides, any non-chemical weeding technology is in a good spot to take advantage of the secular trend.

Carbon has taken an approach of finding a profitable application for organic specialty crops, which gets their product in front of their customer. The LaserWeeder creates an opportunity to create more value (and potentially more revenue) by increasing the utilization and coverage of the LaserWeeder by addressing objections like, “I can’t find labor at night” or “I cannot find labor consistently during high season.”

It creates a nice complement for the existing laser weeder solution as I laid out before.

The EU’s Green Deal and sustainability requirements in California have been good tailwinds for sustainability focused startups, but with the latest economic and geopolitical environment, the Green Deal is faltering.

Within the laser based non-chemical weeding space, there are very few players and Carbon does have an advantage on mind-share due to their marketing and communications capabilities.

A new business model

So far, Carbon Robotics has found success with their direct-to-grower sales model. It works well for large growers who want to outright own the equipment to manage the risk of availability of equipment when they need it. The high price tag makes it challenging for small and medium sized growers to make a commitment to buy the more than a million dollar laser weeding system.

The AutoTractor enabled remote operations center model could potentially open up the doors for a robotics-as-a-service model for Carbon Robotics, especially targeted towards medium sized growers, as I laid out in my hypothetical scenario at the beginning of this edition.

The remote operations center model also could potentially bring in recurring revenue, which is always a hug plus for any company, both in terms of cash flows and valuation. Selling to smaller and mid-size growers is a challenge due to high sales and marketing costs. It could force Carbon to look beyond their current direct-to-grower model.

The remote monitoring network operations center model allows Carbon to offer a recurring revenue model on top of the direct sales model for the existing LaserWeeder product. My guess is the recurring revenue model is potentially higher margin than the direct sales model, though it does shift the operational burden on the Carbon team.

Strong team with execution with a focus on logistics

From the outside, Carbon has a strong experienced team with disciplined execution. They seem to have focused on a few things, and have executed well. Their marketing and positioning is disciplined, when it comes to their laser weeding approach for specialty crops.

They have published case studies through Western Growers Association. Even though a case study on its own does not convince a grower to buy their product, it is a very good artifact in their “portfolio of evidence” to convince growers to try and buy their product.

Even though ROI is a big factor for a specialty crop grower to choose a particular product, for large growers operational efficiency is paramount in terms of logistics, labor scheduling and availability, impact of weather on activities, training of staff, etc.

As one large grower told me recently, there is always something going wrong at the farm and every little thing which does not happen as expected is a tax on efficiency. If your product keeps the grower’s operational challenges the same, or ideally less egregious, then your product has a better chance of being adopted at the farm level.

Based on anecdotal information, Carbon Robotics laser weeder is relatively easy to use and provides flexibility.

When it comes to how broadly applicable their LaserWeeder technology is, they need to do a better job on figuring out the right message, medium, and messenger. I have heard claims of the potential of selling a large number of million plus dollar LaserWeeders to commodity row crop growers in the Midwest who farm a few thousand acres of corn and soy. This makes them sound and look not credible. To be fair, these claims are coming from people associated with the company, but who are not employees of the company.

Labor challenges rising in California

Farmers face labor shortages and rising costs, issues Carbon Robotics addresses by automating weed control. A single LaserWeeder can reportedly cover 2 acres per hour, slashing labor expenses and boosting yields, making it attractive to large-scale operations. Carbon’s LaserWeeder, covering 2 acres per hour and reducing labor costs by up to 80%, addresses this gap effectively.

The new immigration approach from the Trump administration is going to create challenges for labor availability, and with an aging farming population, and migration of young people to urban areas, autonomy is a very desirable solution for farmers.

The product expansion with the AutoTractor retro-fit capability with real-time remote supervision could tap into the broader tractor autonomy market, and potentially expand Carbon’s addressable market beyond weeding.

Large war chest to survive industry downturn

Backed by investors like BOND Capital and NVentures (NVIDIA’s venture arm), Carbon Robotics has raised significant funding (over $157 million). This capital supports R&D and market expansion, signaling confidence in its long-term potential.

The recent hurdles with Farmwise, Tortuga AgTech, and others tells you how important it is to have deep pockets and a large war chest, to continue to fight another day, though nothing beats it like customer traction.

What is the bear case?

High cost limits use case to certain organic crops, and high labor cost areas

I have already laid out the bear case for LaserWeeding and its limitation to only certain organic specialty crops in high labor cost areas. When it comes to autonomy, it does expand the potential application of Carbon’s offering through AutoTractor. Given the weight of the LaserWeeder, it cannot work in wet conditions or soft soil and the farmer will have to resort to other methods when that happens.

The question remains whether there is more value in automation at the back of the tractor, or eliminating the human driver in the tractor through autonomy, though the AutoTractor gives it a nice complement to increase the revenue from an existing LaserWeeder customer.

When I interviewed Curtis Garner, the co-founder of Verdant Robotics in Episode 391 of the Future of Agriculture podcast (I was the guest host) he talked about the principle of “autonomy last”,

Here at Verdant we have a slogan called 'autonomy last.' So even though our co-founders and early employees all were foundational in the birth of that (autonomous vehicle) industry, it's the last thing that we're going to do. The majority of the value that we're going to provide the grower is automating the machine on the back. That's actually where the value is being provided.

Single operation type and competition

Carbon Robotics’ niche focus on laser weeding has to compete with other non-chemical approaches like mechanical weeding, other laser weeders, hot-oil based weeding (e.g. Tensile Robotics), and with chemical spray companies in the non-organic space and organic space.

When it comes to autonomy, Carbon is not the first player in the space to provide a retrofit autonomy kit. My guess is that large players like Deere, CNH (and Bluewhite), AGCO, etc. have built or are building their own autonomy and after-market kits.

This takes out a majority of the equipment players as customers for the autonomy and remote monitoring kit for Carbon. Carbon’s competitive edge is its technology and products.

There is a long tail of small and medium sized equipment manufacturers, who might not have the technical capabilities and resources to build their own autonomy and remote monitoring solutions, and they could be potential customers for Carbon AutoTractor.

Carbon will have to compete with the likes of Sabanto, Kingman Ag, Agtonomy, Mojow Robotics and others to win the business of this long tail of potential customers. It would require a different go-to-market and pricing model compared to its current direct-to-grower business.

Slow growth in organics & regulations on chemical herbicides

A recession could squeeze farm budgets (Happy Liberation Day!!) delaying purchases of non-essential equipment. The slow growth in organics, and the flight of some of the specialty crop farming to places like Peru with much lower labor costs, could pose challenges for Carbon LaserWeeder growth.

If regulations don’t tighten on chemical herbicides as expected, the urgency for alternatives like the LaserWeeder diminishes, weakening its value proposition.

Market adoption hurdle

Farmers are notoriously slow to adopt new tech, especially capital-intensive solutions. Cultural resistance, lack of training, or skepticism about laser efficacy versus herbicides could cap penetration, particularly outside tech-savvy regions like the U.S. West Coast. Given Carbon has sold almost a 100 units of the $ 1 million robots, this might be less of an issue with large farms in California.

People speaking on behalf of Carbon Robotics have very clearly stated that Carbon Robotics is a direct-to-grower business. I don’t know the cost of an autonomy kit for AutoTractor, but I am assuming the price is much lower than a million dollar LaserWeeder.

This will create sales and marketing challenges, when it comes to selling smaller ticket items directly to growers, as opposed to going through a dealer or channel partner.

Final Thoughts

Carbon Robotics has moved past the technical challenges of making a LaserWeeder work, though given its operational parameters and costs, it limits the potential to a small set of large organic certain specialty highly dense crops only growers who operate in the high wage environment of California. Carbon does have robust funding, with a clearly measurable value proposition on saved labor and chemical costs. The 3x revenue growth hints at strong traction. Carbon has a strong team, which is execution focused with very tight marketing and messaging. (mostly).

The AutoTractor broadens its appeal by offering a complement, though significant challenges remain in its direct to grower go-to-market approach, strong competitive environment from majors on autonomy and from smaller autonomy kit providers. The high costs, narrow focus, and competition from non-chemical and chemical based precision methods will pose a serious challenge.