Scaling Regenerative Agriculture

What is required to scale Regenerative Agriculture?

Scaling Innovation: Regenerative Agriculture

The essays in the “Scaling Innovation” series will go deeper on a particular topic, and understand the challenges and opportunities for scaling. This month’s edition looks into Regenerative Agriculture.

–

I am a fan of Tablas Creek wines in Paso Robles. Tablas Creek is a pioneer of California’s Rhone movement.

Our winemaking balances the traditions we inherit from the Rhone Valley with what we've learned in three decades in Paso Robles.

While their wines are really good, what is more interesting is that they are a regenerative organic certified operation!!

Say what, again??

There is a Regenerative Organic Alliance (ROC) which provides a regenerative organic certification. (highlights by me)

Regenerative Organic Certified® is a revolutionary new certification for food, fiber, and personal care ingredients that represents the highest standard for organic agriculture in the world, with stringent requirements for soil health, animal welfare, and social fairness. Regenerative Organic Certified® uses the USDA Certified Organic standard as a baseline. From there, it adds important criteria and benchmarks that incorporate the three major pillars of regenerative organic agriculture into one certification. (The three major pillars are soil health, animal welfare, and farm worker fairness.)

Given there are so many choices for wine in California, there might be a few consumers who might prefer Tablas Creek because they are ROC certified. (Full Disclosure: I am not one of them, I just like their wines!)

I. Regenerative agriculture and adoption barriers

What is regenerative agriculture?

There is not a very clear definition, though it is about soil health.

The methods of regenerative agriculture are meant to restore soil and ecosystem health, address inequity, and leave our land, waters, and climate in better shape for the future. (NRDC definition) There’s no strict rule book, but holistic principles

There are multiple definitions of regenerative agriculture. For example, input companies like Bayer, and Syngenta focus on outcomes, CPG companies like General Mills and Pepsico focus on principles and practices which lead to certain outcomes.

In spite of the excitement around regenerative agriculture some questions remain about its efficacy.

According to the 2023 EDF report “The Economics of Cover Crops on Minnesota Farms”, (highlights by me)

Farmers continue to have questions about the economic impacts of cover crops on their farming operations. Out of the farmers surveyed in the 2022-2023 National Cover Crop Survey who do not use cover crops, 83% identified “no measurable economic return” as a concern regarding planting cover crops with 60% considering it a major concern. For all regions and commodity crops analyzed, the average net return after accounting for labor and management of the cover crop and the following commodity crop was lower than the average net return of the same commodity grown without a cover crop.

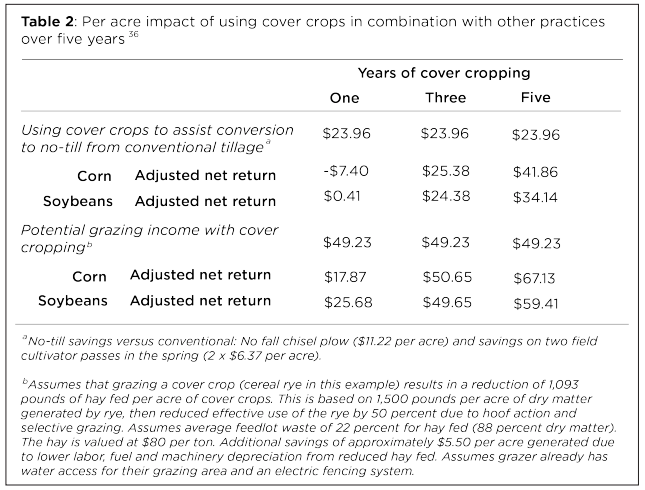

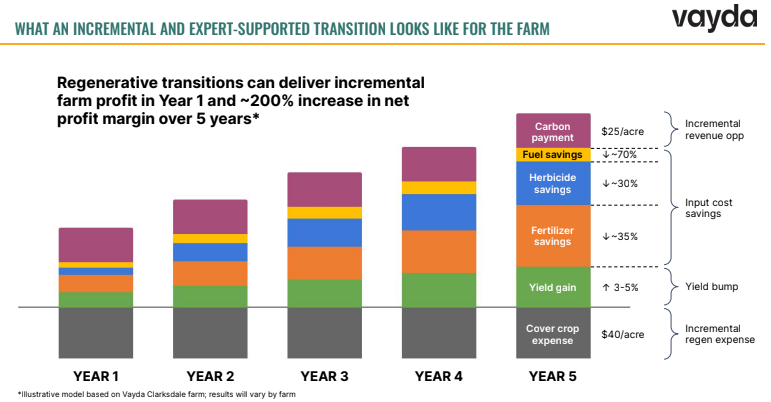

According to an August 2023 report titled “Encouraging Farmer Adoption of Regenerative Agriculture Practices in the United States” by The Chicago Council of Global Affairs, the per acre impact of using cover crops (considered a regenerative agriculture practice) in combination with other practices is positive over a five year time period. (depending on context).

Data on per acre impact of using cover crops in combination with other practices over five years. (Source: Chicago Council of Global Affairs report)

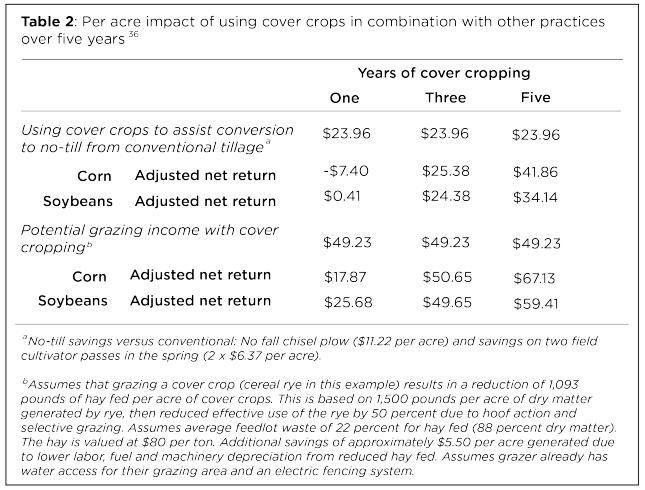

According to Bushel’s 2024 State of the Farm report, farmers consistently rate soil and benefits higher than profitability benefits when it comes to regenerative agriculture practices like cover crops, and tillage, though most of these practices rate high on profitability.

Image source: Bushel’s 2024 State of the Farm report

Despite the benefits described above from using regenerative farming practices, there are barriers that impede adoption. Top barriers are often interrelated and include:

- Financial concerns

- Access to necessary materials, equipment, and infrastructure

- Knowledge and education

- Time

- Land tenure

Sociocultural factors further compound these barriers, as there are generational divides to incorporating change and farmers are influenced by what is considered socially and culturally acceptable by their peers.

Let us look into a couple of approaches to solve the first four challenges mentioned above, with a focus on financial concerns.

II. Appeal to the consumer

One can try to market and sell the advantages and value of regeneratively grown crops and products to consumers, and use the higher willingness-to-pay by consumers to fund these transition programs for farmers.

It is a common impression that transition to regenerative agriculture operates according to the same logic as organic transition in terms of time-lines and profitability.

The transition to organic is supported by consumer’s willingness to pay higher prices for organic products. Organic products are marketed as cleaner products, and better for the consumer due to reduced / no use of chemicals, antibiotics (in the case of animal products). The perceived benefits of organic products are aligned with a certain segment of consumers.

If regenerative agriculture results in lower carbon intensity or lower GHG emissions, it has a better chance of a certain carbon / climate conscious consumer who might be willing to pay higher or prefer other alternatives.

In my opinion, marketing soil health benefits is a non-starter at scale from a consumer standpoint.

Having healthy soils is great, but it does not align with most consumer preferences like health, nutrition, feeling good about ethical treatment of animals and workers.

The reality is that intrinsic benefits like taste, nutrition, and price are more impactful on purchase interest in food and beverage.

Yes, some consumers do care about climate or other extrinsic motivations, but they care significantly more about taste, nutrition, and price.

III. Cost sharing programs

Funding the transition by using cost sharing government programs or through downstream companies (for example, CPG companies) who have made certain climate commitments to their shareholders, customers, and employees has been around for some time. This can include programs paying for lower carbon intensity production, insets, offsets etc.

Many CPG corporations are pushing for regenerative agriculture adoption for farmers within their supply shed based on their climate change commitments . These efforts are commendable as these organizations provide financial support, and access to knowledge and tools to farmers to help with the transition.

These programs allow food and agriculture companies to realize tangible returns on their decarbonization investments (ie, “credits” against their Scope 3 emissions). They stimulate longer-term adoption trends to drive down emissions over time.

These organizations try to pair partners within the supply chain with “insetting” initiatives to reduce and remove emissions, which is especially prevalent in the voluntary markets with commodity crops in the US.

These food and beverage companies partner with nonprofits (for example, ESMC) and 3rd party technology providers (for example, Habiterre) to provide remote monitoring and verification support through the use of satellite imagery and process based models.

One of the challenges with insetting programs is that they are structured around highly conservative assumptions of the GHG impact of practice changes. This makes sense and is intellectually honest due to the large error bars on the process models used to estimate outcomes.

It does create challenges with incentive levels, when it comes to adoption of these practices. Oftentimes, these programs provide limited incentives for continuous improvement and individual performance is not rewarded.

Within the US, the USDA and recently the Inflation Reduction Act has made available hundreds of millions of dollars in incentives to farmers and ranchers to transition to “climate smart agriculture.” (emphasis by me)

The IRA funding includes an additional $8.45 billion for EQIP, $4.95 billion for RCPP, $3.25 billion for CSP, and $1.4 billion for ACEP. These funds will expand access to financial and technical assistance for producers to advance conservation on their farm, ranch or forest land through practices like cover cropping, conservation tillage, wetland restoration, prescribed grazing, nutrient management, tree planting and more. To ensure we can quantify the benefits of these IRA investments, NRCS is working to support Department-wide work on Measurement, Monitoring, Reporting and Verification (MMRV). The IRA provided targeted funding to support this effort. In administering the Inflation Reduction Act climate investments, USDA will also support other environmental co-benefits, including – among other things – water conservation, wildlife habitat improvements, and reducing runoff.

From a public investment perspective, different government agencies are providing financial and technical assistance to help with the transition to regenerative agriculture. These agencies are also working on MMRV processes to make sure benefits are quantified in a standardized and a non-biased fashion.

One argument for these government incentive programs is the Tesla theory of consumer adoption.

In the early days of electrical vehicle adoption, the federal government invested billions of dollars in charging infrastructure, consumer incentives, policy making, with a hypothesis that it will help with the lowering of the cost curve for EV vehicles, and will ultimately lead to larger adoption in the future.

This theory does not apply for regenerative agriculture, at least on the consumer side, because consumers might not care about the benefits of regenerative agriculture in the long term.

IV. Profitability through regenerative agriculture

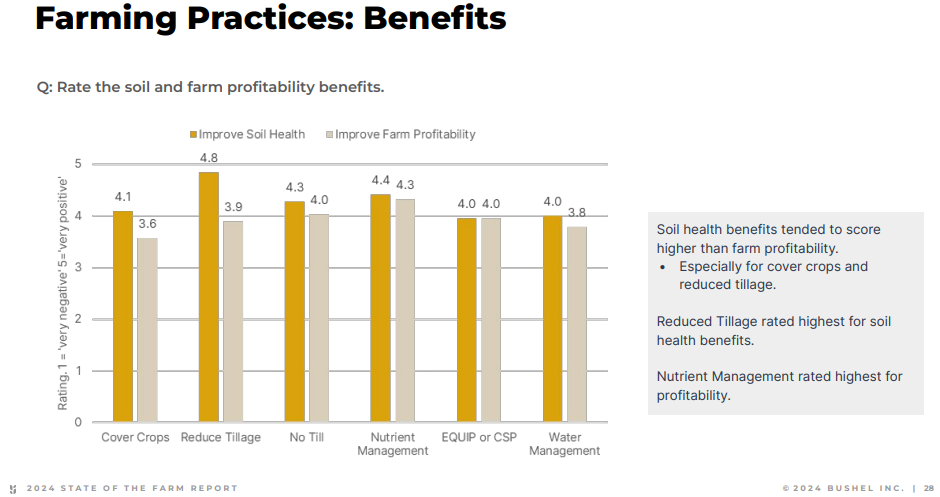

For regenerative agriculture programs to be sustainable, at a bare minimum they have to be profitable, along with other auxiliary benefits. For example, according to regenerative agriculture services provider Vayda,

The only successful regenerative agriculture program is the one that keeps your farm thriving and profitable. That’s our singular vision and purpose at Vayda.

Vayda is an independent services provider and does not sell fertilizers, biologicals or any other inputs. Their focus is on the farmers' business. The goal of their program is to help farmers increase productivity and profitability by using a data, technology, and evidence based approach to regenerative agriculture.

The program includes data from regenerative agriculture practices from a local farm which has a similar context to the farmer, precision agriculture tools, agronomy and analytics support, and connection to other financing sources mentioned above. (incentives through government programs, CPG programs etc.)

Source: Vayda Marketing Material

Regenerative agriculture is fundamentally about using alternate, nature-based management practices to effectively manage soil fertility and water, as well as to protect crops, with far fewer inputs. While change is highly complex to manage, the end result is a much more profitable, climate resilient and valuable farm.

As you can see from the chart above, incremental regen expenses have to stay below the incremental value generated for the program to be sustainable. It is often the upfront regen expenses, combined with the uncertainty on the upside, which creates resistance to adoption of regen practices.

Today, the state and federal governments are providing both financial and technical assistance to farmers and ranchers to help with the regenerative agriculture transition (in the US).

My personal opinion is that the governments should provide technical assistance, know-how, independent and objective data and information around the benefits and challenges of regenerative agriculture. It will help farmers understand the risks and rewards within their context. It should look to other funding mechanisms and the profitability of the practice itself, to help with the transition process.

It requires a deep understanding of the context of the farmer, to design regenerative agriculture transition plans which are net positive from a financial, soil, and water perspective.

V. Context is king (or queen)

Context is everything in agriculture and especially so in regenerative agriculture.

Cover cropping is not possible everywhere.

Biologicals might not work the same everywhere.

To scale regenerative agriculture, we need the infrastructure which shows the value of regenerative agriculture practices in terms of profitability (most essential), resilience, and sustainability, better soil health, water capacity etc.

Most input companies, and agriculture retailers have set up test farms, which are similar in context in terms of soil types, crops, weather conditions, and practices. Farmers need the necessary expertise, tools, and education for transition to regenerative agriculture.

They need agronomists, and other experts to work closely with them to understand their unique needs. They need tailored approaches to reduce costs and increase efficiency.

Similar to organic transition plans, farmers need a regen transition plan based on the needs of their operations and the resources like equipment the farmer has access to. The transition plans need to be sustainable and profitable, and can include recommendations around cover crop, tillage, fertility, with an eye towards future productivity and profitability.

Unlike organic transition plans, the lack of rigid standards for regenerative agriculture could be a feature instead of a bug, especially if you are not going down the “consumer will pay” route.

If the transition plan is targeting financial and environment outcomes, as opposed to rigid protocols, it provides the flexibility to design plans tailored to the context, but which are still profitable and have soil, water and other benefits.

If one wants to follow this approach, one needs an objective and unbiased advisor to help design the regenerative agriculture plans. This creates a challenge for input companies or a retailer trying to sell the farmer more stuff from their brand or product portfolio. For example, Bayer has gone all-in on rebranding itself through the lens of regenerative agriculture.

The program from Bayer (For Ground) is portrayed as a systems solution, which it should be, but it gives them an opportunity to push their seeds & traits, and crop protection products. I am not singling out Bayer here, as it is true for almost all companies who are in the business of selling agrochemical products to farmers.

VI. Scaling Innovation

As I said, context is super important in agriculture and especially so in regenerative agriculture.

Understanding context requires access to data around historical practices, soil conditions, weather information, expertise and experience level of the farmer, equipment, support infrastructure in terms of agronomists, and analysts, and financing to help with transition.

I am not even sure if we can call regenerative agriculture a new innovation, as most of the practices have been around for some time now.

(George Washington Carver was one of the earliest people to talk about regenerative agriculture.)

But there is often power in bringing different elements together, and creating a better offering. Uber is a great case in point.

Innovation is required to bring all of these different aspects between financing to expertise to outcomes together, and how do you do it at scale.

What are the right business models, what is the right marketing message, what kind of tools and technologies are needed, what kind of expert network infrastructure is needed, what kind of financing tools are needed, and most importantly, how can these approaches adapt to the context of the farmer in question.

Each of these elements is difficult on its own, and bringing them all together is exponentially harder.

It will require collaboration across different participants, easy and economic access to data collection, and analysis, and the scaling of tools, knowledge and expertise within the ecosystem.

Technology can definitely help.

- Precision agriculture equipment, better mobile tools, sensors, IoT devices, and conversational tools can help with data collection.

- Techniques like soil analysis, sampling optimization routines, and clustering of agro ecological zones can help with figuring out the right fields for regenerative transition, and transfer learnings across fields with similar agroecological characteristics.

- Artificial Intelligence can help with analytics at scale, generative AI can help with up-skilling of agronomists, and extension agents.

Even if we are able to solve all these problems, it still requires collaboration, marketing, communication, and financial support to work through the transition, and most importantly making a positive ROI case in the long term for the context in which the farmer is operating in.

We should use a combination of incentives through public-private partnerships to reduce the risk of transition.

Public institutions should continue to build out an infrastructure of knowledge, training, and support, which is objective and independent. They should focus on helping create standards of measurement & reporting and leave the financing to other actors (private, philanthropic, and practitioners) in the industry.