SFTW Interview: Navigating the messy middle

A conversation with the Bushel CEO, Jake Joraanstad

The best way to learn something is to do it.

A close second is to have conversations with smart, and ambitious people, who are working on solving hard problems. SFTW has given me the privilege to have some of these conversations, and I want to bring them to you.

Today, I am excited to launch a new feature called SFTW Interviews. It will be a lightly edited transcript of my conversations with AgriFoodTech leaders.

This will be available for paid subscribers. Free subscribers will get a preview. I will occasionally publish some SFTW interviews to free subscribers, to give you a taste of SFTW Interviews. Or you can subscribe to get the full version.

What are “SFTW Interviews"?

What and how do agrifood leaders think? What issues and challenges keep them up at night? What trends are they looking towards? How are they positioning their organizations to take advantage of and create new opportunities? What role does technology play? How can you benefit from their experience, and wisdom? Can you take some of their learnings and apply them to your organization?

SFTW Interviews will give you a peek into the thought process of AgriFoodTech leaders.

The SFTW Interviews are meant to be informal. The text version lets you go back and re-read certain sections.

SFTW Interviews is launching with a conversation with Jake Joraanstad, CEO of Bushel. Jake is from Fargo, North Dakota and is a veteran agrifood leader and a technologist at heart. The interview went into some unexpected directions. Read on to learn more!

Summary

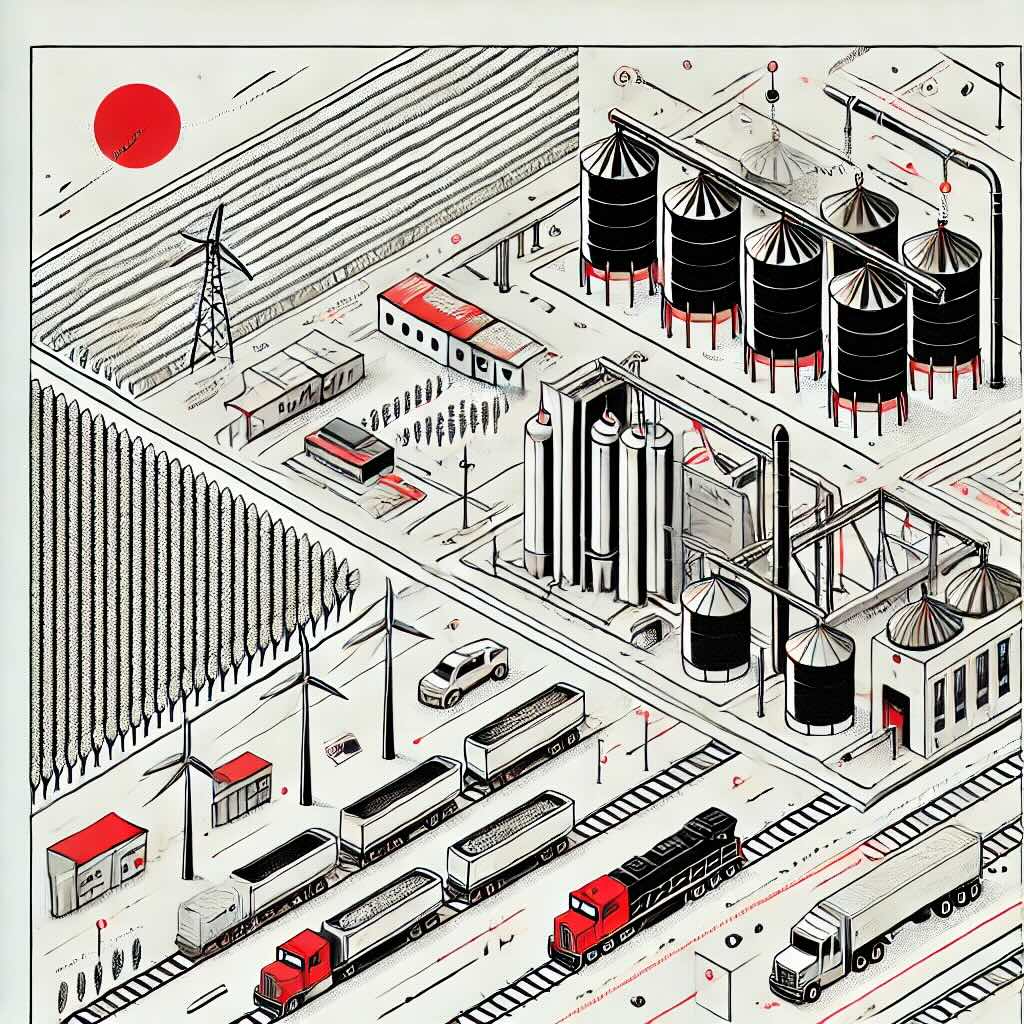

Bushel is an early pioneer in AgTech. Bushel has built products for managing the “messy middle” of agriculture, including some acquisitions over the years. Bushel recently released their “2024 State of the Farm” report based on a survey of US farmers. I wanted to connect with Jake about the report and get an update on the latest with Bushel.

Jake Joraanstad, CEO of Bushel (Image provided by Bushel Marketing team)

In this conversation, Jake from Bushel discusses the complexities of the agricultural sector, particularly the 'messy middle' that exists between farmers and the market. He emphasizes the importance of technology and incentives in improving efficiency and transparency in agricultural transactions.

The discussion touches on the evolving expectations of farmers, particularly younger ones, who are increasingly looking for digital solutions that mirror their consumer experiences.

Jake envisions the development of a super app for agriculture that consolidates various functionalities to streamline operations for farmers. He addresses the cyclical nature of agriculture and how it impacts business strategies, while highlighting the need for innovative solutions to support young farmers in managing cash flow and accessing resources. Looking ahead, Jake shares insights into Bushel's future initiatives aimed at enhancing the farmer experience and fostering stronger connections within the agricultural ecosystem.

Now onto the interview with Jake!

The messy middle in agriculture

RP: Jake, thanks for joining. You define your mission or vision as connecting the messy middle. What do you mean by the messy middle?

JJ: The messy middle is not very sexy and to some people it's not very interesting. I think a lot of people are enamored by the farmer and what they're doing and how they grow their crops and whether they're sustainable or not and whether they chop the forest down in the Amazon or not. But how do you go from the farm to get to food, feed for animals or fuel, that's the messy middle in between.

That's the grain companies and co-ops. That's an ag retailer who helps the farmer get enough fertilizer on the field. And that's the big processors that take these products and make ingredients that we put in our food, feed and fuel. So that's the middle.

Those are almost always our customers at Bushel. That's who we hone in on. And we actually think that's where a lot of the inefficiency around the engagement between them and their farmers and their customers is really happening in terms of where software could help.

RP: And what makes it messy? What are the barriers to make it less messy?

JJ: So first off, it's not messy in the sense that it's pretty efficient. Because it's usually in the commodity space, and that market has an inherent driver of efficiency because of price. And so there's a lot of efficiency around how we do it physically, moving these things. But what's not been invested in very much in the last 30 years is the digital complement to those.

For the farmer to be able to know what they're doing and take that result back to their operation. That's what we do on the customer portal, whether it's payments, which is still 70%+ paper check, which is wild. And to the idea that these companies still don't have real transparency even between relationships that they have with other commercials. And so there's this gap of information and that creates these sometimes volatile markets. That's the opportunity that exists there.

Data sharing and incentive problems

RP: When you talk about information sharing, what I've seen in different contexts is, yes, there is a technology component that needs to be solved, but oftentimes it's an issue of incentives and what is the right incentive for them to share information. And the technology can definitely help, but it's less of a tech problem, it's more of an incentive and alignment problem. Do you see that in the messy middle?

JJ: So I would say right now it's almost entirely an incentive problem. The idea that a farmer has access to what they've sold to you is a no-brainer, that's what we do at Bushel. The idea that there's transparency in what they're gonna get paid makes sense. But the idea that they would just freely hand over how they went about growing their crop for an unknown outcome of some credit for carbon or some variable math that they can't understand. That's part of the problem. There's a real issue there.

And then, another good example is things like speed. You might have the information and now the farmer knows that they're owed the money they've delivered on the contract. Why does the payment take a month to come to me as an example? And so those are things that create these friction points. Whether it's for the farmer on a trust and or incentive basis, I would largely argue that the farmer is less concerned about trust when they're working with partners that they consider their trusted advisors. It's really more of a, what is the incentive to do the work, to share the information, and do we know what the outcomes are.

Shifting consumer expectations in agriculture

RP: And you mentioned some crazy stats on how 70 % of the work is still done offline or through checks. And in your report, I read that there was a big improvement in people wanting to do more digital transactions compared to last year or the last 24 months. What is really driving that sudden improvement in sentiment that we want to do digital?

JJ: So one of the sentiments that came through clearly in the data was last year we asked the question, how many of you are using digital payment methods in your personal life? Whether it's a digital wallet like a Venmo or a PayPal or bill pay tools from your bank, whatever it might be. It went from something like 70% not interested, 65% not interested or not using to only about 25% or less still not doing it.

And so that's a 50 % jump just about in improvement. And so that is a consumer trend that almost always follows in business. It's just that in agriculture we're lagging. And actually B2B payment problems are always lagging consumers, but ag is especially lagging, another 20-30 % behind.

That data tells us that the farmer is starting to have an expectation that how they do their consumer work should not be so different in their farm business. And our job is to meet them where they're at. And so one of our partners we work with had this great perspective. She said farmers want to be able to do business with the farm businesses they work with, just like they do on the consumer with that little friction.

That's our marching orders. We're going to go figure that out.

RP: Right. And what does that mean for you from how you build products? Typically a B2B product, somebody buys it and somebody else uses it, which is a little bit different here in the case of a farmer, they are the buyer and the user. And user experience requirements have gone up, as you have said, because we are all used to using great experiences on the consumer side.

JJ: So agriculture is interesting. That messy middle is a true corporate agribusiness, we call them customers. They're sitting at the desk at their job. They're doing the business. They're used to email. They're used to portals to have to go to to do their work. We start there at Bushel. That's where he's built all of our tools. And then these tools trickle down to the farmer. Where the paradigm has shifted, is while we're providing these payment tools, we have things like direct deposit enrollment now for our wallet tool where it's just easy for the farmer to give them their account details to get set up for payments. That's all kind of a commercial mindset. Even though the farmer is a business, and it's usually a multimillion dollar business, frankly, most of them, their behavior is very consumer-like.

I mean, they even spend, sometimes using the same credit card, the personal credit card is the card they use for the farm, those kinds of things, right? And so that means that the way in which you deliver that technology can be more consumer-like. And that is a shift that we're excited about because we have held back on focusing on the farmer's version of payments, what it means for them. But with this shift finally coming where farmers are like, hey, I just want to make it easy for me. I want to do it like I do my regular personal life for the farm.

That's the clear indication we needed to say, what can we do to build? You can argue like the Venmo of Ag, but how do you make it so simple to transfer money to receive money? What are the benefits of holding money in an account? What kind of FDIC insurance do you have? How much interest can Bushel pay? Those are things that we can start to solve now that we know that this trend is truly happening for the farmer.

RP: You mentioned something interesting, which is the trends that you see on the consumer side. Maybe they are 20-30 % behind in B2B, maybe in ag. Are there other consumer trends that you're looking out for and say, hey, this is happening right now. Maybe next year or two years from now, this is something that you would think about. One example that I've used doesn't seem to work is we pay subscriptions for Netflix. Let's do subscription based software because farmers are used to doing that. Are there other examples like that?

JJ: Well, I can tell you a previous example that proved to be true, which was in 2017 when we launched, our customers didn't think that farmers would want to use their mobile app to do this business with them. The consumer trend was clear, mobile is the main interface in which we do our life. So why would that not follow in agriculture? And so we were right, and that's now where 80-90% of traffic comes from in these tools. And then another trend was, if we give the farmer the ability, will they take an actual action?

Really sell their grain digitally without talking to a human. And again, the resistance was, no, they need to talk to us. Maybe we don't even want to let them do this. But for all of our customers that have turned this on, we're talking 40-50 % increase. It's almost all becoming a digital transaction. That's why we're moving towards the payments trend as well. We're following those same actions.

What I think is interesting, I think a trend that's going to be happening is what is agriculture's super app? There is not a super app for agriculture. There is one, there's a few different ones for consumers, right? We've got payments built into our messaging products. We have the ability to communicate, conduct business and all that in WhatsApp, for example, that's done everywhere. What is it in agriculture? What's the farmer's super app that every farmer pretty much has and needs to have, particularly in the US?

That's going to be a trend that has happened in consumers in all these different parts of the consumer industry. I think agriculture is going to have a moment like that too. The question is how far are we from it.

A super-app for agriculture?

RP: Yeah. And if I theorize a bit, what would be the elements in a super app for Ag? I know it doesn't exist today, but what are the basic things you would need and what other things could go in?

JJ: I think it's just like consumers and again, at Bushel it will be our job to figure out the answer to this question. Maybe we can be the answer, but the question is, how do you take what I do every day, which is thinking about my farm and my fields, thinking about my spending, cash management or how I get paid and have to pay on those bills and also the markets, which is what I care about as a farmer. How do I, where can I go to get all of that information in one place?

What's the tool that I'm going to pull up every day and get my content and get my information about the markets and get my own information about my operation? That's the question that I think because that's what the consumer did. it's even the idea of what subscriptions do I pay? I pay a service to tell me what subscriptions I'm paying for so I can remove some. I mean, we're way past, right? I've got the Operations Center and I've got QuickBooks for accounting. And then I have three different bank portals I have to go to and my grain company has this product and my retailer has this one and what do I do? And so it's the same problem.

RP: Right. So we do have elements of these things, there is QuickBooks, there is Op Center, there are banking apps, and each of them exists in a silo, or maybe there's some connectivity, but there's nothing today, there's no super app, which I can use. Maybe it's a thin layer on top of all these. I don't know how this will be built, but that could be potentially an option. We see that in WeChat in China, or WhatsApp does a lot of these things today.

So is that something that you guys think about for the longer term? What actions, if any, have you taken to say, let's make that a reality?

JJ: One of the ways that a super app can come about is when you have enough network effect. So you have to have a user base that's doing something. You have to have information that's not so easy to get to. You have to have a community of sorts sometimes in the consumer case, maybe not so much in agriculture. And you have to have integration, right? You have to be a place where these things can connect. I would argue that we're going to be there at Bushel in the coming years if we do our job right the next few years, because we have trust with the agribusiness.

And we have a hundred thousand farms monthly that use our offering to do something. And if we can introduce to them the evolution of what becomes a super app, I think the thing that's missing is managing your finances alongside your operation. And we're working on that. And I think if we're right and the incentives are aligned to our point earlier, I think you'll see sometime in 2025 from us, at least the first case for the super app, we're gonna make that case.

Changing nature of relationships in agriculture

RP: All right, I'm excited about it. If you go back to the survey results, this is relevant to our discussion earlier. people say that agriculture is a relationship business. But then your data for farmers under 40 are showing less emphasis on relationship with staff with only 12% responding as a key factor in selling to a grain company compared to 21% overall.

Do you anticipate that to happen? I mean, this is more downstream, but you mentioned all the farmers, I buy inputs, I buy insurance, I buy equipment. Do you see the importance of this relationship going down because of technology or how will that evolve, based on this data point here?

JJ: I think it's really simple. I have this saying at Bushel. So the average farmer age right now is 58, 59 years old.

The grandpa's generation was a handshake business. The current generation that's kind of finishing out the farm work right now is maybe they know them, maybe they'll take a phone call. The current generation that's taking over the operations and are really gonna be running the businesses in the future, text me. Let's agree, Snapchat is somehow a place where contracts get completed sometimes.

That's the trend that we're going and that's the same trend that happens in the consumer world. So I don't think that the relationships aren't important, but how you engage in the relationship has shifted significantly in consumer trends. And it's going to happen here. Just ask yourself how close you are to your bank. Farmers are probably some of the last people who have a close relationship with their banker and for good reason, but there's not a lot of consumer folks that have a tight relationship with an individual banker. It's not a thing.

RP: Yeah, absolutely. When I set up my own company, I had to go to the bank to set up my business account. And I haven't gone after that. They keep calling me to say, is everything okay? Do you need anything else? But that's about it. I manage everything online. I know the person there because she keeps calling me, but that's about it.

JJ: So here's what we did at Bushel that blows people's minds. We let you set up a business bank account, FDIC Insured, through our wallet offering in less than five minutes, usually less than three if you don't have a complicated ownership structure, all in a single experience, either online or in the app. And within literally three minutes, you have an FDIC Insured account that you can transfer money into or transfer money out of. And so you don't even have to go in to be part of the banking network we're building here at Bushel.

And so the things that are missing are incentives to keep your money there, interest, bill pay, places so you can have a single operating account, call it, and the ability to put money in that account, which for most farmers, you have to drive to the town and deposit the check. And remote checks deposit, this mobile deposit idea, $6,000 is the limit. The average check size to the farmer is $110,000.

We can change the requirements, all of a sudden you'll have the ability to scan a $150,000 check, put it into your bank and get paid interest on it. That's the kind of thing that moves the needle, I think, in agriculture.

Supporting young farmers in a digital age

RP: You're talking about these young farmers under 40 and there's another interesting nugget here (in Bushel’s report), maybe not surprising that cost is an issue for younger producers, right? Because they're starting out, they need the cashflow, that's why they go for these faster payment cycles. And you had a question in there, can alternative business models help producers access resources so that you can provide them some help on the cost side. What are some of the things that Bushel is thinking about or the industry should think about to help young farmers feel more comfortable?

JJ: There's two angles. There's access to capital and lending, which we believe Farm Credit is in the lead position in the US. Any farm credit organization has a cost of capital, basically they're the most competitive. And so partnering with them is pretty important in aligning with the Farm Credit system. We believe that lending to those farmers is going to be more more done by the Farm Credit system as things shake out.

And then, if you're an agribusiness, you've got to make a digital option for payment. You have to make a digital option for getting paid. And frankly, if you can give an option to your customer to get paid sooner, the younger generation is going to be moving in adopting that quickly. The 70-year-old doesn't care. The 58-year-old doesn't care because they own their land. They don't have to operate every year on an operating line with the 6, 7, 8, 9, 10% interest rate.

But the young guy who's trying to build their farm business or is taking over for the farm and is paying rent for the first time ever, it's a different conversation. So I think there's some opportunity in lending to do that better and just make it accessible digitally. The other one is the opportunity to make payments faster, even if at a small fee, it makes sense. If I sell my grain to you, and it's gonna get delivered, what's the gap? Well, by the time I planted it, that gap was six months. So what can we do about that?

RP: And I think those are obviously very important cash flow considerations. So anything you can do to help improve that cash flow would work. You guys acquired a farm management system three years ago. And as you said earlier, that creates a stronger connection with the growers. have 100,000 monthly active growers on it. Whereas other companies out there, whether it's Granular or a bunch of other farm management systems have really struggled. What are your views on that? Could somebody run a farm management system on its own or be part of a seed company? And how is it different for you because you have those downstream connections with the buyers?

JJ: I think doing farm management software completely independent of any other business models has been really clearly challenged. I mean, it's not even debatable. We have the largest paying subscription base, not only the probably the largest user base, but even paying subscriptions, we have the largest. And still it would not be a very good standalone business inside of Bushel. And because it's inside of Bushel, it works.

I think that the unique difference between us and others is that we don't have anything to sell you. We don't have a bias towards who you do business with. And our motivations are probably aligned in that we want to make it easier for you to access information you need to make decisions. Some people say, well, why do you charge the farmer? Well, if we don't charge the farmer, then we have to sell your information. So why would we want to do that? And the only other path to a free model or a cheap model is through banking services to make it easier for them to use their money, to move their money. There's a lot of margin in that opportunity. And so that's the other path to deliver these kinds of capabilities. And I think we've been building the foundation for that for a long time.

Managing through business cycles

RP: Yeah, well, that makes sense. Just like we talked about how there is a saying that I have a relationship business, which is true. And then you're seeing some evidence that people are looking for other ways to get their money faster. Similarly, agriculture is a cyclical business. And right now, depending on who you ask, maybe it's in the downturn, input prices high, whatever.

So when the going gets tough, people delay some of their big capital purchases like equipment. What is the impact of the cyclical nature on your business? And are you changing anything in your approach, your marketing, your messaging, or how you prioritize your roadmap because of the cyclical nature and where we are in that cycle?

JJ: Yeah, so if you're in software and agriculture, you do have to know the cycles and you have to pay attention. When we launched, we were on the bottom of the market in 2017 and we were able to go up. We're on the next down cycle right now. The next few years will be tough. Farmers, depending on your crop rotation, you may not even make money next year and some may debate whether they should even plant a lot. And so this is because the crop prices are down, input prices are still high.

It does affect the agribusiness, although as long as the crop is grown, the grain buyers generally make a margin, although it's tighter because the farmer is feeling it. And the retailers right now, their challenges, their prices are high for what the price of the crop is getting. And so you have to react to that. I think the agribusiness is a bit more steady than if you were doing just farmer facing offerings.

Again, I can't imagine fighting through a decision with a farmer right now around spending some thousands of dollars with your offering versus maybe not doing it. Those are challenging conversations. And so it does affect our thinking. I mean, our approach to the market next year we'll see, but we don't expect the farmer to wake up tomorrow and start paying more for software. So that's not the approach we're taking. I think you'll see that happen. It is just part of building software and agriculture. And I always tell our team, we got to be around long enough to be successful in agriculture. You've to be around long enough. And because these cycles are three to five years, and if you have a five-year mentality and that's it, you're probably going to be done and dead in the downswing.

What’s coming next for Bushel?

RP: That makes sense. You have to be in it for the long term, otherwise you might bail out when it goes down and then you don't get the benefit of when it's going up.

Last question, what are some of the next big initiatives? Anything that you can talk about publicly that you're working on for 2025? Maybe it's the super app that you talked about?

JJ: It's going to be on the farmer-facing side of our tools. It's going to be the inklings of a super app. We acquired Farm Logs in 2021. It's Bushel Farm today. It has a great user base, but there's a lot that we can bring to the table when you bring in what we've been working on across other parts of our business. In particular, when I say financing and banking, I don't mean Bushel is going to come out and give loans to farmers. That's not interesting.

There's players that do that and we want to maybe give that facilitation. But I'm talking about cash management, making it easy for the farmer to understand their transactions, categorize them. The P&L starts to be really important in the next few years. That's where the super app and the combination of what you know about the farmer from Bushel, because they do business with our grain elevator to their retail purchases on their invoices and putting that in one place for the farmer. I think that's a meaningful shift for us.

And I think our customers, the grain companies and co-ops and retailers will be excited if we can bring something to the table that helps their farmers. And so we always view them as part of a partner in the process. And I think we'll see a lot of that in 2025.

RP: Thanks Jake for your time today!

Key Takeaways from this SFTW Interview

- The 'messy middle' in agriculture involves inefficiencies between farmers and market players.

- Incentives play a crucial role in information sharing among agricultural stakeholders.

- Farmers are increasingly expecting digital solutions similar to their consumer experiences.

- The concept of an agricultural super app could revolutionize how farmers manage their operations.

- Younger farmers prioritize cash flow and digital payment options.

- Relationships in agriculture are evolving with technology, moving towards more digital interactions.

- Bushel aims to simplify banking and financial management for farmers.

- Understanding market cycles is essential for software companies in agriculture.

- The future of agriculture may involve more integrated digital solutions for farmers.

- Bushel is focused on creating tools that enhance the farmer's experience and streamline operations.