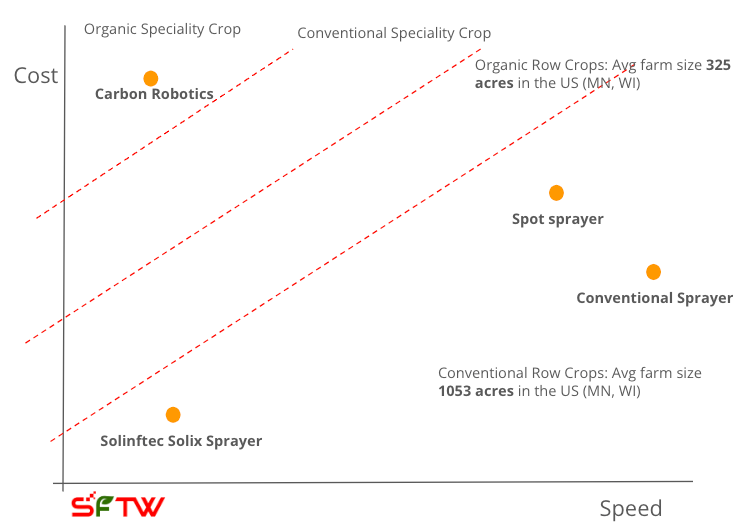

The cost and speed curve

Carbon Robotics announces new product lineup

This week’s edition looks at the latest product announcements from Carbon Robotics at the World Ag Expo in Tulare.

Announcements

- Most enterprise GenAI projects get stuck in proof-of-concept land. SFTW released a white paper on Wednesday, which provides a practical guide on how to break through the POC wall with case studies from four different organizations. You can get the free white paper here: “POC to OMG! The Realities of Deploying GenAI at the Farm Gate”

- AgTech Alchemy founding members Walt Duflock, Sachi Desai, and Rhishi Pethe appeared on Tim Hammerich’s Future of Agriculture podcast to discuss the inaugural AgTech Alchemy Quarterly. It was a fun conversation. You can download the AgTech Alchemy Quarterly from here.

- The AgTech Alchemy team is hosting another meetup in Salinas on February 27th. We already have 75 members signed up. Please register at the link, if you are going to be in the SF Bay Area and don’t want to miss out on the fun!

The cost and speed curve for operational and economic efficiency

Carbon Robotics released a new line of products in time for the World Ag Expo in Tulare, California. The new models are supposed to be faster, lighter, and modular, which is a good product iteration compared to the previous version of the product. The summary of the new models is presented below.

Based on all accounts, Carbon Robotics has done a great job on product development. They have stayed focused on the use case, and have consistently been able to iterate on it, as the latest product line shows. They got to market quickly with a solid niche product and did a great job on marketing it. Their direct sales channel is firing on all cylinders. This is proof that GTM and distribution are as important and hard to do as product development.

Carbon Robotics Laser Weeder. Image from September 2023 by Rhishi Pethe

(From the press release)

Specialty Vegetable Crops and Herb Models

LaserWeeder G2 200

Width: 6.6 feet (2.0 meters)

Weight: 4,250 pounds (1,928 kilograms)

Description: Ideal for smaller farms, its compact size makes it easier to transport.

LaserWeeder G2 400

Width: 13.3 feet (4.0 meters)

Weight: 6,000 pounds (2,722 kilograms)

Description: A versatile mid-size model capable of handling diverse crop types and field layouts.

LaserWeeder G2 600

Width: 20 feet (6.1 meters)

Weight: 7,200 pounds (3,266 kilograms)

Description: The next generation of Carbon Robotics’ industry-leading LaserWeeder, designed for a wide range of specialty vegetable and herb crops.

Broadacre Organic Corn and Soybean Models

LaserWeeder G2 1200

Width: 40 feet (12.2 meters)

Weight: 12,000 pounds (5,443 kilograms)

Description: Specifically designed for organic corn and soybean operations, this model introduces the first broadacre weeding solution that does not disturb crops or soil, significantly increasing yields.

LaserWeeder G2 1800

Width: 60 feet (18.3 meters)

Weight: 14,000 pounds (6,350 kilograms)

Description: Built for large-scale organic corn and soybean operations, it integrates seamlessly with farming operations standardized on 60-foot-wide farming equipment.

The most curious part of the release is the move towards broadacre organic corn and soybean models. Carbon has been focused on organic high value specialty crops so far, given the high price tag of their product.

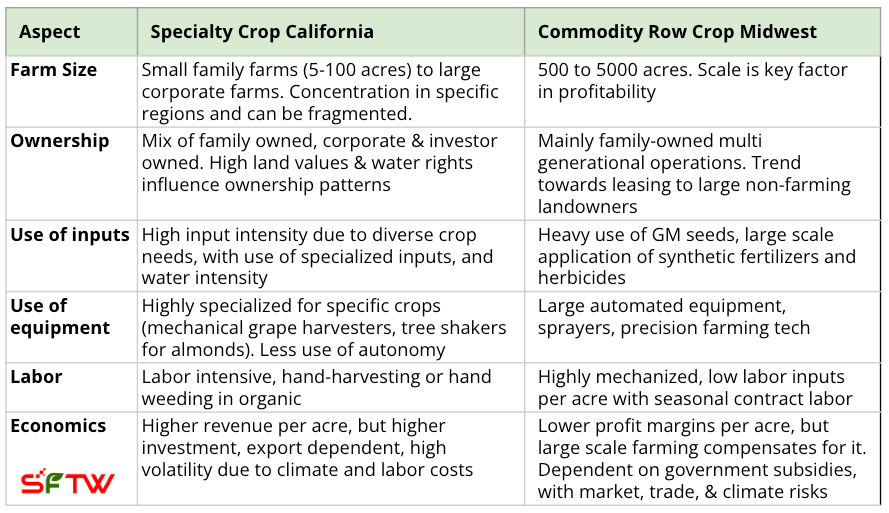

Before we get into whether Carbon’s product line can address the needs of broadacre crops or not, let us take a quick comparative look between farming operations of specialty crops in California and broadacre commodity crops like corn and soybeans. There are some stark differences along multiple key dimensions.

Specialty crop farming in California is like buying expensive groceries at Whole (Paycheck) Foods or your local farmers market, whereas commodity row crop farming in the Midwest is like buying from Walmart. Walmart operates on razor thin margins, which it makes up on scale and supply chain excellence.

Labor is a big part of specialty crop farming, whereas labor is a much smaller input on a per acre basis due to the highly mechanized nature of commodity row crop farming.

The two biggest differences between specialty crops and broadacre row crops is the high labor usage over a smaller number of acres for specialty crops vs. low labor usage over a larger number of acres for broadacre crops.

The large farm sizes in commodity row crops has led to the development of ever larger pieces of equipment like sprayers which can go very fast in a broadacre field, often at 15 miles per hour (roughly 25 kilometers per hour) to cover hundreds of acres in a given day.

Carbon Robotics focuses on weed management. In commodity row crops, weeds are typically managed by spraying herbicides multiple times during the year. Carbon Robotics reduces the need for herbicides as it can burn up weeds with its powerful lasers.

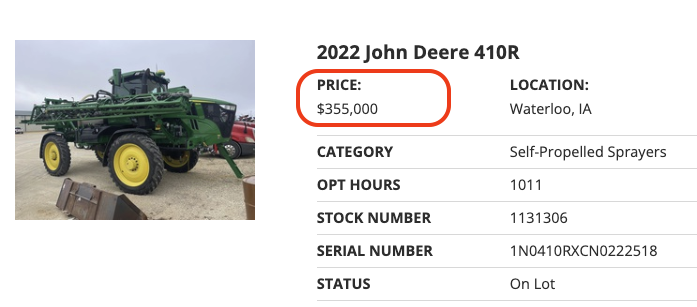

A typical sprayer for commodity row crops can cost anywhere between $ 150K to $ 550K. For example, a John Deere self-propelled sprayer is on sale for $ 355,000 on this website.

To understand the different options for weed management equipment, one could plot this on a graph with the speed of the equipment on the X-axis and the cost of the equipment on the Y-axis. The speed of the equipment is a proxy for how big of a field can be covered by the equipment in a given day. (I am using speed because it is easier to visualize a sprayer moving at 15 miles per hour and other equipment moving at 1-2 miles per hour, compared to a 1,000 acre farm vs. a 5 acre farm).

The sprayer from the image above can most probably scream through the field at 15 mph, and costs about $ 300K to $ 400K. A spot sprayer like John Deere’s See & Spray system, probably costs a bit more than the conventional sprayer, and as of now it moves slightly slower than the conventional broadcast sprayer.

On the top left of the chart is Carbon Robotics which moves fairly slowly in a specialty crop field, and costs more than $ 1.2 million. A sprayer like Solinftec’s Solix is in the bottom left corner as it is relatively inexpensive and moves very slowly (but it is autonomous).

Based on a simplistic cost vs. speed chart, an expensive sprayer which can cover a lot of ground makes sense for commodity row crops, and a very expensive laser weeder which moves very slowly but drastically reduces the need of a hand weeding crew makes sense in an organic specialty crop field.

The field sizes of conventional specialty crops and organic row crops are between the organic specialty crop and conventional row crop fields.

Source for farm sizes for commodity row crops. “MN-WI organic row crop producers managed 325 acres per farm on average and generated $324.24 per acre in median net farm income in 2020 and 2021. Conventional row crop farms, by comparison, were more than three times as large; averaging 1,053 acres per farm while netting $144.65 per acre in median farm income. “The 2020-2021 data are very promising for small-to-mid-size farms,” says Joleen Hadrich, professor in the Department of Applied Economics at the University of Minnesota (UMN). “

Solinftec is taking a completely different philosophical approach with their always-in-the-field sprayer, which is relatively inexpensive, is autonomous, and you can have a fleet of them always in your broad acre field.

Carbon Robotics value proposition is by the elimination of the need for hand labor, herbicides and mechanical weed control.

Carbon Robotics did a study with Western Growers Association last year to understand the ROI with Braga Fresh and Triangle Farms on crops like organic spinach, organic arugula, organic

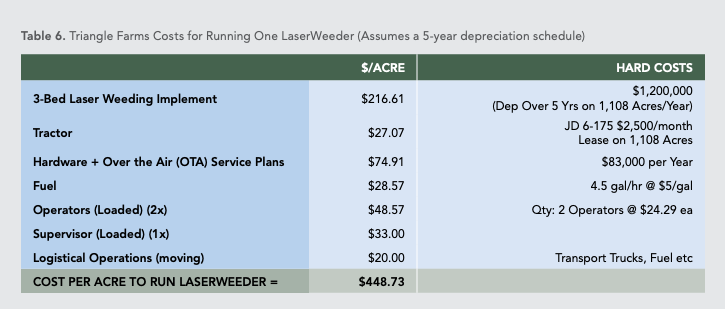

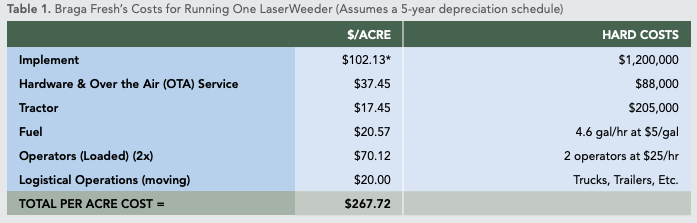

Costs of running a Carbon Robotics Laser Weeder at Triangle farms on a per acre basis

Costs of running a Carbon Robotics Laser Weeder at Triangle farms on a per acre basis

The extremely slow speed of a laser weeder is a big challenge to cover ground effectively even on a smaller organic commodity row crop field. Also, if you look at the per acre costs of running a Carbon Robotics laser weeder, they are in the $ 226 to $ 448 / acre range. If we look at the net farm income for organic and conventional row crops, there is just not enough margin to support an expensive Laser Weeder.

Organic vs. Conventional Specialty Crops

The labor costs in organic specialty crops are higher due to limitations on certain practices for organic production compared to conventional production methods. If we take the example of strawberries, the weed management based on the UC Davis studies on production costs for various crops,

Weeds and Runners. Weed management is especially challenging for organic strawberry production because soil fumigation and most herbicides are not allowed under organic regulations. For 10 months beginning in December and ending in September, weeds and runners are managed by hand. Hand weeding is estimated at 22 hours per acre per month for 10 months during the production season, and runner removal is estimated at 12.5 hours per acre per month for the same 10 months during the production season. The field is also cultivated three times during the season. Growers with different planting configurations and/or especially weedy fields may require a higher level of management and therefore higher costs.

For organic strawberries, the weed management by hand and runner costs come to about $ 8,300 per acre, whereas the same costs are roughly $ 4,200 per acre.

The chemical cost which can be cut is on herbicides, if a laser weeder is used.

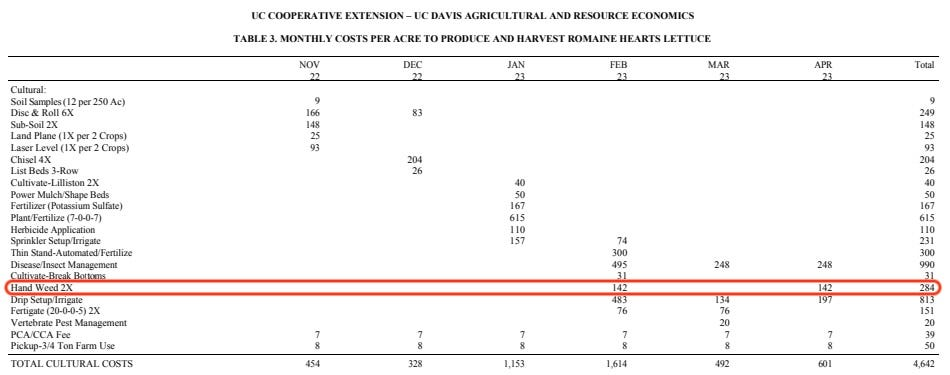

Let us take the example of lettuce. Again, according to the UC Davis data on lettuce, the hand weeding costs for romaine hearts lettuce was $ 284 per acre in 2023 and the cost for herbicides was $ 80 per acre (2023). The costs for broccoli are $ 211 per acre for hand weeding and $ 80 per acre for herbicides.

If the hand weeding + herbicide costs are $ 284 + $ 80 = $ 364 / acre for conventional romaine lettuce, then using a LaserWeeder which costs between $ 267 and $ 448 per acre (depending on crop type) might make the ROI calculation very challenging.

Based on these publicly available data points, it might be challenging for a LaserWeeder to make a compelling economic case for conventional specialty crops and provide an ROI in a reasonable amount of time. A LaserWeeder might become compelling for conventional specialty crops, under the following conditions.

- The unit price of the Laser Weeder goes down significantly.

- Labor is simply unavailable or becomes too expensive. In this scenario, I would expect some of the acres to move from the US to other parts of the world like South America, where labor is about a tenth of the cost of labor in California.

Does this mean a LaserWeeder at > $ 1 million prices, which moves slowly can address the needs of organic specialty crops and only in production areas where the cost of labor is very high i.e. California?

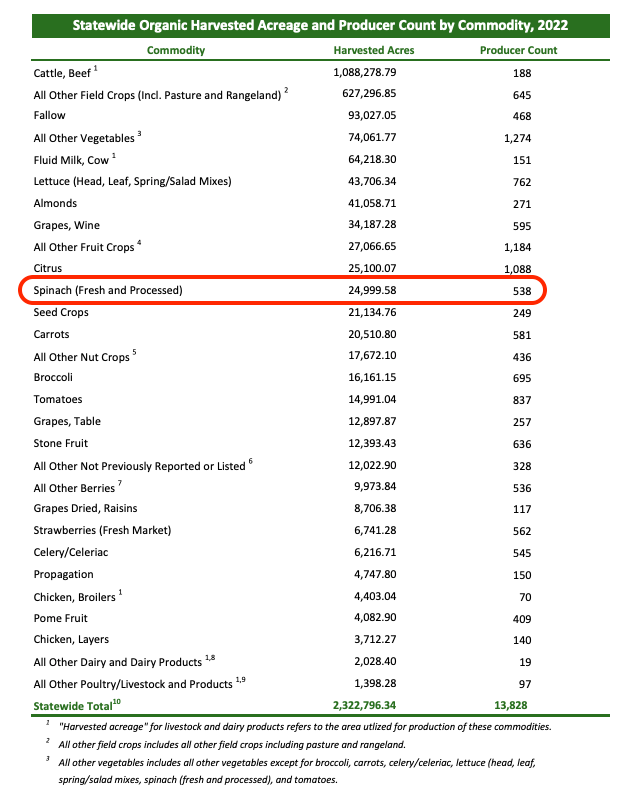

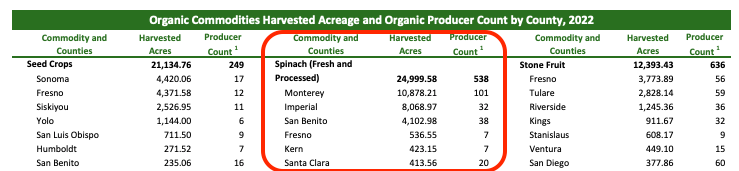

Let us take a look at how many acres are in the market for a Laser Weeding product.

How much organic specialty crop acreage is available in California? The California State Department of Food and Agriculture publishes the California Agricultural Organics Report with detailed statistics by county, crop type, number of farms, production etc.

For example, there are a total of about 25,000 Spinach acres in California. If you break down where those acres are about 23,000 acres are in just 3 counties, and has only 171 producers.

Based on the current assumptions, unless there is a huge drop in the LaserWeeder pricing or there is a massive labor problem in California, the LaserWeeder teams will have to execute flawlessly both on the technology and the commercial side, given the customer base and acres to sell into are limited.

The price of labor is a tricky situation as they don’t have any control over it (or limited control). If the price of labor increases to a level where it is still profitable to farm in California by using a LaserWeeder type of solution, then it will work in Carbon Robotics favor.

If the price of labor increases to a point, where acreage flees California (and which has been happening), the target customer base in California will further reduce.

It will be interesting to see what happens in the near to mid term future to labor costs and acres in California, and how robotics companies respond and adapt to it.

What do you think will happen in the future and how will the industry respond? Please reply to this email to let me know your thoughts.

(From an M&A perspective, I had covered the issue of limited acquirers in the agriculture OEM space and a potential high valuation for Carbon Robotics in the October 27, 2024 edition.)