The retreat of CVC in agrifood

FMC Ventures has been shutdown abruptly

Welcome to another edition of Software is Feeding the World.

Before we get into this week’s edition, I want to let you know about an IRL event organized by the AgTech Alchemy team in the San Francisco Bay Area on Wednesday, January 22, 2025. If you are going to be in the area on Wednesday, it would be great to meet in person. You can register for the free event here.

The retreat of corporate venture capital

In August last year, I had written about the retreat of tech giants like Microsoft, Google, and Amazon from the AgTech space. I had pointed to factors like the magnitude of and time to return on investment and opportunity costs in AI wars as one of the main reasons for Google, Microsoft, Amazon to scale back their ambitions in agriculture.

Now we are seeing a similar phenomenon within corporate venture capital firms in the agrifood sector. AgFunder News announced that FMC ventures has restructured their venture operations, effectively shutting it down. The AgFunder article does not give us any more details, and so we are left reading between the lines.

If we look at the US Venture Capital industry as a whole, the VC industry has been a massive force multiplier for R&D spending, innovation, and value creation, according to research published a few years back. The AgTech industry needs to continue to figure out the types of problems which are most amenable to be solved and scaled using venture capital.

“Venture capital-backed companies account for 41% of total US market capitalization and 62% of US public companies’ R&D spending. Among public companies founded within the last fifty years, VC-backed companies account for half in number, three quarters by value, and more than 92% of R&D spending and patent value. The US did not spawn top public companies at a higher rate than other large, developed countries prior to 1970s ERISA reforms, but produced twice as many after it. Using those reforms as a natural experiment suggests that the US VC industry is causally responsible for the rise of one-fifth of the current largest 300 US public companies and that three-quarters of the largest US VC-backed companies would not have existed or achieved their current scale without an active VC industry.”

Gornall, Will and Strebulaev, Ilya A., The Economic Impact of Venture Capital: Evidence from Public Companies (June 2021). Available at SSRN: https://ssrn.com/abstract=2681841 or http://dx.doi.org/10.2139/ssrn.2681841

Venture in AgriFood

Venture capital has had a chequered history when it comes to the agrifood sector, because of some of the challenges I had laid out in my article about the retreat of tech giants. Post the pandemic venture capital has taken a big nose dive and its impact has been felt on the Agrifood sector as well.

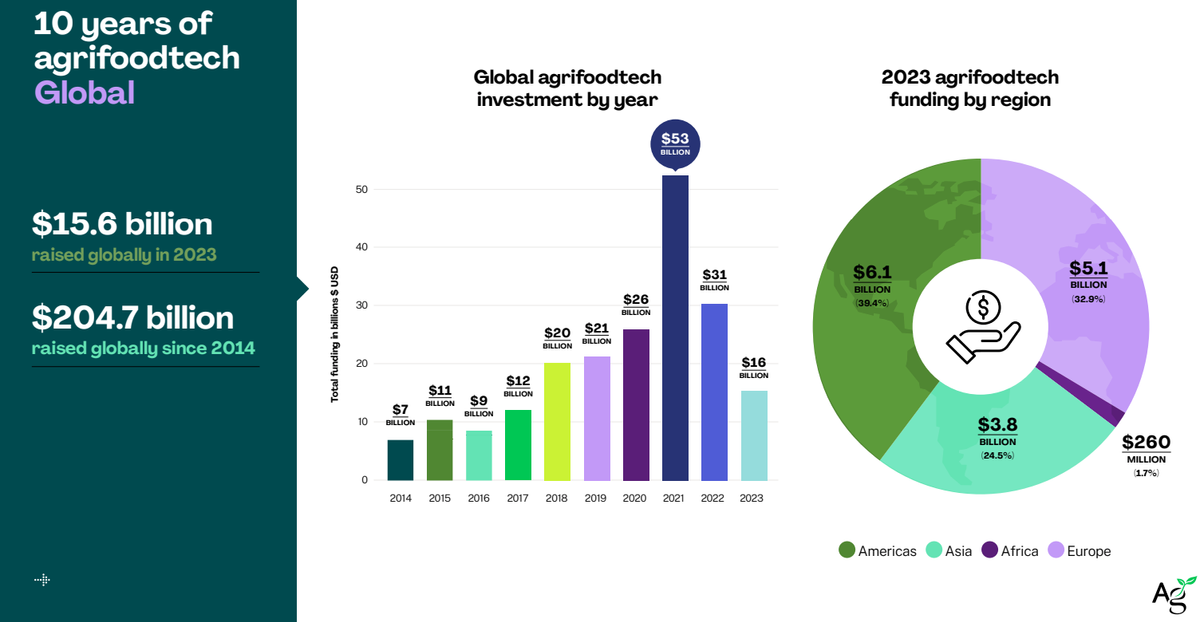

From 2021 to 2023, initial public offerings (IPOs) in all tech segments dropped 85% from 1,035 to 154 while venture capital has dropped 50% from $345B to $171B. AgriFoodTech venture capital has suffered a similar fate, dropping 70% from $53B in 2021 to $16B in 2023 (and 2024 looks no better – first half total was $7B).

Image from AgFunder’s AgriFoodTech Investment report (2024)

The emergence and slow down of corporate venture capital in agrifood

Corporate Venture Capital is a relatively new phenomenon in the agrifood sector, with FMC venture arms being started in 2020 (in the middle of pandemic and zero interest rate phenomenon). The old guard of BASF, Syngenta, and Bayer started their venture arms in 2001, 2009, and 2015 respectively.

FMC ventures was formed in 2020, and so they did not finish even a typical traditional VC lifecycle of 7 to 10 years.

If you look at other corporate venture firms in the space, Leaps by Bayer made only one new investment in 2024 in a company called Decibel (Decibel develops epigenetic technologies to alter crop traits without affecting DNA sequences). Syngenta Group Ventures made only one new investment last year in 2024 in Agrolend, an agrifintech platform from Brazil.

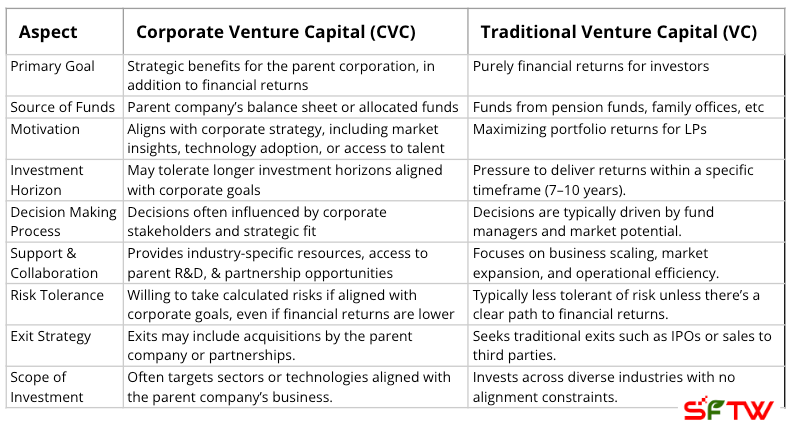

The story has been the same for other corporate VC firms over the last 12-18 months, though there are some key differences between corporate venture capital and traditional venture capital as I have highlighted in the table below.

Corporate venture capital in theory is supposed to be more patient compared to traditional VC, looks for strategic benefits for the parent corporation, and provides industry-specific resources.

FMC does not seem to have taken a more patient view with their venture arm.

It is quite ironic FMC made this decision, especially after FMC Ventures Managing Partner Mark Brooks had penned a guest article in AgFunder News about new capital models in AgTech. Mark Brooks specifically called out strategic patience , as it relates to corporate venture capital (highlights by me)

“Corporate venture capital (CVC): strategic patience.

Agrifood corporate VCs are stepping up to play a more critical role. The parent companies of CVCs have incredible market power via the channel, world class R&D capabilities, regulatory expertise, and a global footprint. For startups, CVCs offer something traditional VC cannot: strategic alignment and a clear bridge to commercialization. Corporates are keen to accelerate innovation for their pipelines and CVCs are one of the few tools at their command. This playbook is beginning to mirror pharma: outsource discovery to startups, then scale promising innovations internally. It’s a win-win for startups and corporates.”

It is quite clear the news was a surprise to the CVC team.

The overall industry has been in some trouble over the last couple of years due to overstuffed inventory, weak demand, and wacky commodity and input pricing. During last year’s earnings call the CEO of FMC said the following,

“FMC was behind some of the other competitors in adjusting pricing, causing us to lose market share. The lack of adjusting our pricing is forcing us to keep market share. We had to move fast on pricing adjustment to keep market share. FMC is focusing on restructuring and cost-saving measures, targeting $125 million to $150 million in adjusted EBITDA net benefit. Product innovation, particularly in fungicides and biologicals, is the go forward focus.”

Almost all companies in the sector are tightening their belts due to the current headwinds. The funding situation is very tight for startups. Many corporations (and startups) have gone through a round of restructuring and reduction in their work force (Bayer, Syngenta, Deere, and others).

FMC has made a few investments over the last few years, but nothing notable in 2024. If you read through their portfolio companies, it makes sense why FMC invested in them. The team has been able to find and build a strong portfolio, which aligns well with FMC’s core business and strategic initiatives.

FMC Ventures Investments (Source FMC Ventures Portfolio page)

I don’t have any inside information about FMC’s financial situation (other than what’s visible from their public investor and financial documents), but the shutting down of FMC ventures does have some implications.

Implications of shutting down FMC Ventures

- FMC is one of the lowest spenders in the input space based on the percentage of revenue spent on R&D. Generics has been putting significant pricing pressure on them, and so they need to innovate to be able to compete effectively with their competition.

- FMC can try to go through M&A activity to acquire innovative technologies, but it might be difficult to do so right now. They might be able to find attractive pricing as many startups are struggling, but it will be much harder to get the benefit of the acquisition due to integration challenges, and the effort to scale and distribute newer technologies in-house, when they are struggling financially.

- If FMC wants to restart their venture group in the future, it is going to have a very tough time engaging with startups. If I am a startup should I trust FMC with a venture arm in the future? How can I be sure they are going to be with me, when the bad times roll?

- FMC has already invested in up to 8 companies. These companies will need ongoing support and potentially future investment from their existing and new investors. The response from FMC does not make it clear if they will not do any follow on investments as well. Follow on investment from an existing investor is not guaranteed, but it does make the job of existing startups harder.

- There is a saying that In tough times, one should “tend to your wounded”. With the entire sector struggling, their existing portfolio companies need a lot more tending. With no staff left, it is not clear whether the corporate entity will have the bandwidth and the priority to tend to their existing portfolio.

- If you look at other corporate venture capital firms like Syngenta Group Ventures or Leaps by Bayer, even though they have slowed down on making new investments, from the outside they appear to be working with their existing portfolio companies. This is essential not only to protect their investments, but increase the chances of getting a strategic advantage through the innovations being pushed forward by their portfolio companies.

- As we have discussed many times before, there are very few outlets for a startup to exit in the agrifood sector. IPOs are a tough call (at least for now), and large agribusiness is one of the few options for M&A activity as an exit option. Given the concentrated nature of the agrifood industry, especially in sectors like inputs, and equipment, the reduction in presence by a player like FMC reduces the number of options available for a startup to validate, scale, and distribute their technology effectively.

- Other corporate venture capital firms will have to work harder to convince entrepreneurs and innovators about their desire to play the long game, and not blink at the first sign of headwinds.

FMC did not show “strategic patience”. If anything, they showed tactical impatience.